Odds are growing for an financial downturn within the subsequent yr or two. Here is what occurs throughout a recession — and what you are able to do to be ready.

Recession dangers are on the rise.

Impending commerce wars, accelerating layoffs, declining client confidence, and a inventory market correction have People understandably skittish. In line with Google Traits, searches on the time period “recession” are on the third-highest degree of the previous 10 years.

These considerations are mirrored in current headlines. A sampling:

- “A Recession Might Be Coming. It is Not Too Late to Put together” — USA At this time

- “Shopper Confidence Drops Additional, Key Measure Flags Recession Threat” — The Wall Road Journal

- “Recession Is Coming Earlier than Finish of 2025, Usually ‘Pessimistic’ Company CFOs Say” — CNBC

- “Shares Fall Sharply; Bonds, Gold Buoyed as Tariffs Stoke Recession Fears” — Reuters

To make certain, many elements of the economic system are buzzing alongside simply effective. A recession over the subsequent yr or two isn’t a certainty. Goldman Sachs lately estimated the percentages of a recession over the subsequent 12 months at 35%.

However a recession finally is assured, as a result of we’ve not but found out get rid of the boom-and-bust cycles of the economic system.

The historical past of recessions

It is generally believed {that a} recession is outlined as two consecutive quarters of declining GDP. Whereas that is positively an indication of bother, a recession has occurred solely when the oldsters on the Nationwide Bureau of Financial Analysis say so. The NBER is a personal, nonprofit analysis group made up of greater than 1,800 economists, and so they formally designate when recessions start and finish.

Here is one definition supplied by the NBER: “A recession is a major decline in financial exercise unfold throughout the economic system, lasting quite a lot of months, usually seen in actual [i.e., inflation-adjusted] GDP, actual revenue, employment, industrial manufacturing, and wholesale-retail gross sales.” As you may inform from the definition, the downturn must be pervasive all through the economic system to be a recession.

The NBER supplies knowledge on recessions way back to 1854. Since then, the U.S. has skilled 34 recessions — thus, on common, a recession roughly each 5 years. Nonetheless, there was greater than a decade between two of the final three recessions. And the final growth, which is the time period economists use to explain the time when the economic system is rising in between recessions, lasted from 2008 to 2020 — which was the longest growth on file. In actual fact, the 2010s was the one decade through which a recession did not happen.

The common recession has lasted 17 months; since 1945, the common has been simply 10 months. The final two downturns had been on reverse ends of the length spectrum. The 2007–2009 recession lasted 18 months, the longest financial contraction because the Nice Despair. However the recession attributable to the Pandemic Panic of February 2020 was simply two months — the shortest recession ever.

What goes up or down throughout a recession?

Recessions can have an effect on most elements of your funds — and never all in dangerous methods. Here is usually what rises and falls throughout a recession.

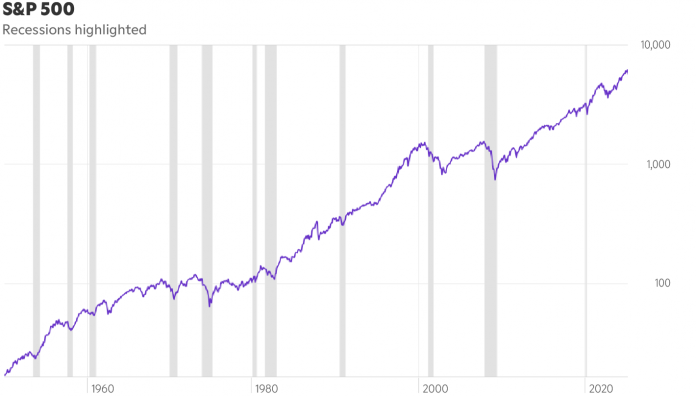

Shares: Down

The inventory market is taken into account a number one financial indicator, so it tends to drop a number of months earlier than the recession formally begins. Additionally, shares often (however not all the time) rebound earlier than the recession ends. Buyers who attempt to time the market by ready on the sidelines till the economic system recovers typically miss among the best-performing days. In line with Truist Co-Chief Funding Officer Keith Lerner, the median recession-associated decline within the S&P 500 (^GSPC -0.96%) since 1948 was 24%.

Supply: YCharts.

Rates of interest: Down … often

The bond market and the Federal Reserve each react to recessions by driving down rates of interest. Nonetheless, if inflation stays excessive or will increase throughout the financial downturn (what is called stagflation), rates of interest may very well go up, as occurred throughout the 1973-1974 recession.

Supply: YCharts.

Bonds: Up … relying on the bonds

Bond costs transfer inversely to rates of interest, so if charges go down, bonds often go up. Plus there’s typically a flight to security throughout a recession, which implies individuals promote shares and purchase bonds, which drives up bond costs.

But it surely does rely upon the standard of the bonds. Treasuries maintain up effectively. Nonetheless, investment-grade company bonds, traditionally, have been a combined bag. Riskier corporates, akin to high-yield junk bonds, go down together with shares throughout a recession, although often not fairly as a lot.

For cash you need to maintain up throughout a downturn, stick to FDIC-insured money and Treasuries, with maybe a complement of diversified bond funds which can be a mixture of government-issued debt and investment-grade corporates.

Supply: YCharts.

House costs: Up … often

House costs declined in simply two of the six recessions since 1980, and a kind of was a decline of lower than 1%. Analysis from Mark Hulbert of MarketWatch discovered that from 1952 to 2018, residence costs, on common, truly rose extra throughout bear markets in shares than throughout bull markets.

Most of us keep in mind the 2007-2009 recession, when each shares and residential costs plummeted. However traditionally talking, that was an outlier.

Supply: YCharts.

Unemployment price: Up

On common, the unemployment price rises by roughly 3 share factors throughout a recession. However throughout the 2007-2009 recession, it doubled from 5% to 10%, and folks had been out of labor for nearly half a yr. And throughout the pandemic, unemployment skyrocketed from 3.5% to 14.8%.

Supply: YCharts.

Office advantages: Down or at the least flat

Employees who’re lucky sufficient to maintain their jobs might nonetheless expertise a discount of their total compensation packages throughout a recession. Raises and bonuses are more durable to come back by, and firms which can be actually struggling scale back different advantages. For instance, round 10% of firms decreased or eradicated the 401(okay) match throughout the pandemic, and that determine was nearer to twenty% of firms throughout the 2007-2009 recession.

Inflation: Down … we hope

If there’s an upside to a downtrodden economic system, it is that the price of dwelling does not go up as a lot — and often goes down. Thus, you probably have the means, a recession truly could possibly be time to make a big-ticket buy, akin to a automotive or family equipment.

That stated, many people are sufficiently old to recollect the Nineteen Seventies and the period of stagflation, when costs rose regardless of a muddling economic system.

Supply: YCharts.

Shore up your private funds

To get your funds recession prepared, begin with the boring but vital Silly recommendation to be sure you defend any cash you want within the subsequent few years by preserving it largely in money or short-term bonds. That is additionally time to look at your price range and scale back pointless or underappreciated bills.

What you must do additionally will depend on the place you might be alongside the street to retirement. In the event you’re a number of years or extra from retiring, the No. 1 threat of a recession is job loss. So now’s the time to bolster your human capital by:

- On the lookout for methods to show worth to your employer and prospects

- Keeping track of how your organization is doing so you may anticipate layoffs

- Sustaining an expert community

- Protecting your expertise updated in case you might want to hit the job market

- Ensuring you may have an emergency fund to pay the payments should you lose your job

In the event you’re close to or in retirement, the priority is extra to your portfolio, since you will quickly be utilizing it as a paycheck, should you’re not already. That is the place asset allocation and diversification develop into essential. It begins with constructing an “revenue cushion,” which is 5 years’ price of portfolio-provided revenue in money or short-term bonds.

It is also essential to have a mixture of various kinds of shares and personal sufficient of them — at the least 25 (ideally extra), with some index funds thrown in. You may put money into growth-oriented tech shares but in addition have some stable dividend-paying client staples shares. You do not need an excessive amount of of your portfolio counting on only one sector, business, or model of investing.

Additionally, among the best issues retirees can do for the longevity of their portfolios is to not promote shares after they’re down. Thus, retirees might have to chop again on spending throughout a recession or market decline.

There’s all the time a morning after

Financial expansions and increase occasions are kind of like the vacation season. All of us spend extra, we eat extra, we go to events, and we journey to see kinfolk. Our bank card balances go up — and we do not suppose fairly as a lot about our budgets.

Then comes the Jan. 1 hangover — i.e., a recession. The occasion is over, and it is time to revisit the price range, repay that debt, and make some resolutions about how we could possibly be higher with our cash and our jobs. It is also time to try our portfolios, reassess our asset allocations, and maybe do some rebalancing. Primarily, it is a time to hunker down for the winter…and sit up for spring.

In spite of everything, an growth and bull market comply with each recession as reliably because the change of seasons. Financial winter could be coming … or not. But when so, it by no means lasts perpetually. And within the meantime, with each contribution to your 401(okay) and IRA, you are in a position to put money into firms at cheaper costs.

I am going to go away you with a parting thought from the Stoic thinker Seneca: “The person who has anticipated the approaching of troubles takes away their energy after they arrive.”