The method

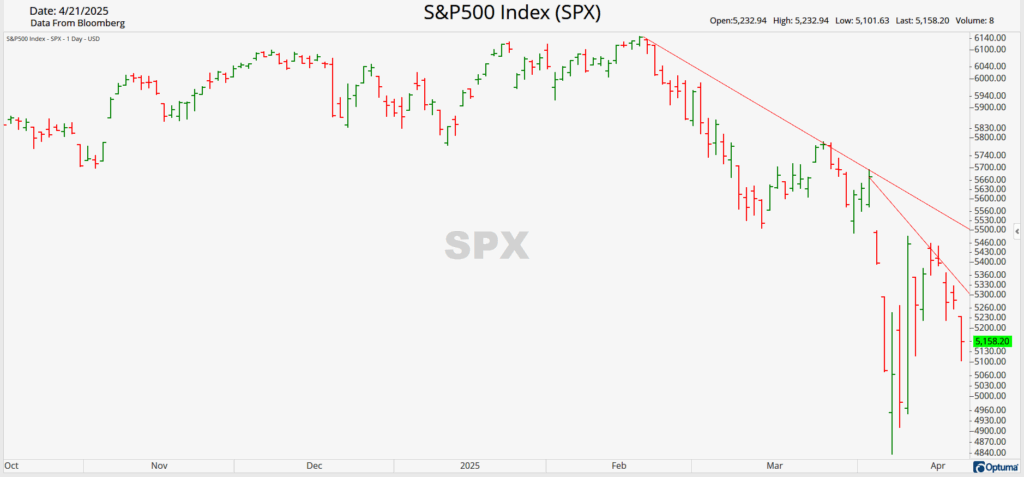

Bottoming is a course of, so let it unfold. Yesterday’s market message was clear: the S&P 500 misplaced one other -2.36%. Whereas many technical indicators signaled oversold situations not too long ago and the market did have a brief rebound, essentially the most essential indicator, worth, has but to substantiate the all-clear.

Value holds immense knowledge as a result of it displays the collective view of market contributors. Each transaction entails a purchaser and a vendor, and the motion of securities costs displays their collective sentiment. For this reason worth tendencies are so essential. The adage “The pattern is your pal” might actually be interpreted because the rising variety of “pals” (patrons or sellers) aligning with the pattern. So long as this pattern persists, market contributors reaffirm their perception that the asset will proceed transferring in that course. Quantity additional corroborates this view, indicating that extra contributors share the identical sentiment.

Presently, the market indicators that the dip patrons who emerged from excessive oversold situations two weeks in the past are stepping again. Furthermore, not sufficient contributors imagine the market is ready to rise from right here. Because the present pattern within the S&P 500 is downward, await a breakout from this pattern earlier than worth indicators an all-clear.

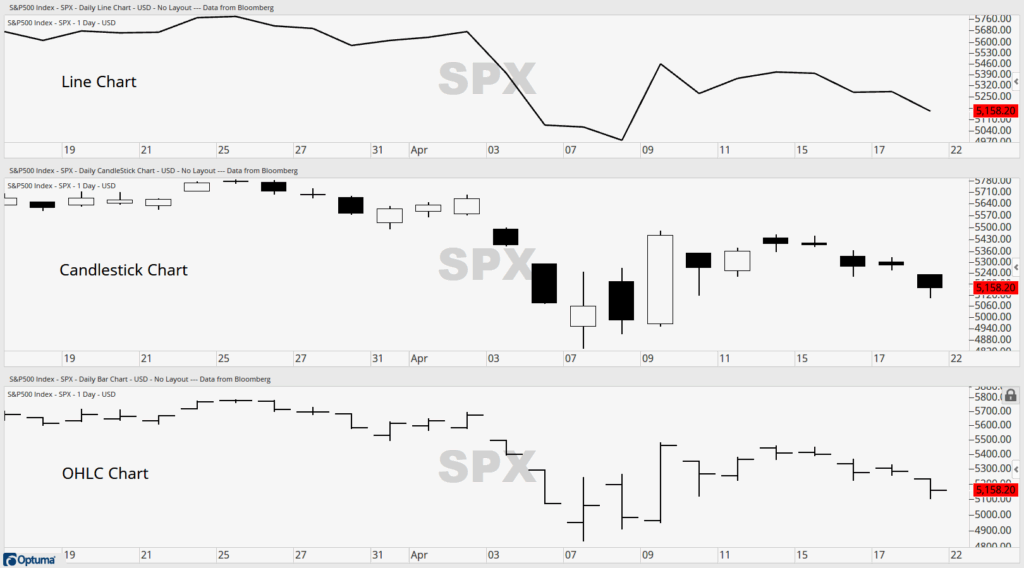

To keep away from confusion, think about using OHLC charts

Charting can inform the story of an asset’s efficiency, however some tales are extra detailed than others. Line charts are nice for exhibiting the course of an asset’s worth over time, by exhibiting the closing worth on the finish of every interval. This enables customers to simply see if an asset’s worth is transferring up or down on any given timeframe. Nevertheless, line charts maintain considerably much less data than what’s obtainable in different charts.

Candlestick charts, which originated in 18th-century Japan, present further details about an asset’s buying and selling exercise throughout a particular timeframe. The physique of the candlestick represents the open and shutting costs, whereas the wicks characterize the excessive and low costs of the timeframe. These charts provide precious buying and selling insights that aren’t obtainable in line charts.

The wicks of the candlestick are self-evident, however the open and shut costs could be much less clear. Historically, inexperienced or white candlesticks point out that the asset was up from open to shut, whereas pink or black candlesticks point out that it was down. This implies a safety might be up from one interval to the following, however nonetheless pink if it closed decrease than the open. When the candlestick physique is stuffed in, it means the asset closed decrease than it opened, whereas an open physique signifies that it closed greater. This may result in confusion, particularly when candlestick charts are all black and white, because it requires you to recollect what the physique of the candlestick signifies.

This brings me to OHLC Charts, a sort of Bar Chart. These charts embody all the data current in a Candlestick chart, eliminating any confusion concerning the open and shut costs. OHLC stands for Open, Excessive, Low, and Shut, and it consists of two tick marks and a vertical line. One tick mark to the left represents the open worth, a vertical line represents the excessive and low or the vary of the timeframe, and one tick mark to the correct represents the shut worth. An easy method to learn a chart with a transparent starting, center, and finish, Open, Excessive, Low, and Shut. Whereas OHLC Charts are sometimes coloured pink and inexperienced, just like Candlestick charts, these colours are usually not important for figuring out how the asset closed. Moreover, there’s no physique left to be stuffed in, forcing you to recollect if it closed up or down from the open. What was it once more? As you learn a chart from left to proper, the older time frames are positioned on the left (open), the buying and selling vary is within the center, and the final commerce is on the correct (shut). Easy.

A Gold Cup, with a deal with

Amidst market turmoil, discovering energy is paramount to your subsequent commerce. Whereas Gold continues to soar to new all-time highs amidst financial uncertainty, the Gold Miners have simply emerged from a Cup and Deal with formation. Some might understand this as too late to commerce, however upon a more in-depth look, it presents potential for upside. From August 2020 to October 2022, the GDX skilled a major worth drawdown of roughly 50%, an important indicator in Cup and Deal with formations. Subsequently, it accomplished the correct aspect of the rounded backside of the cup however encountered a stall close to the $44.22 degree. As a downward sloping channel fashioned the deal with into the brand new yr, a breakout from it was swiftly adopted by one other breakout above the highest of the cup. Thus far, this sample resembles a traditional Cup and Deal with formation. Nevertheless, did you miss this chance? A traditional measure of a Cup and Deal with formation suggests a worth goal equal to the depth of the cup, on this case, $22 greater. This degree remarkably aligns with the earlier all-time excessive within the GDX set again in 2011, and which is a possible 25% improve from its present worth. With ample room to run as Gold costs proceed to rise, the GDX arrange might show to be pretty much as good as Gold.

Unlock unique gold and silver buying and selling indicators and updates that the majority traders don’t see. Be part of our free e-newsletter now!