Streaming viewership surpassed the mixed complete of broadcast and cable viewership for the primary time ever in Might 2025. It is a years-long development that has seen streaming viewership catapult 71% over the previous 4 years — whilst broadcast and cable viewership dropped 21% and 39%, respectively.

Traders must be asking themselves which firms are more likely to profit considerably from the shift of broadcast and cable viewers to streaming providers. The Commerce Desk (TTD 1.07%) is one in all them, and its inventory is on sale.

The Commerce Desk has an amazing future

In the event you’re not fully positive precisely what The Commerce Desk does, right here it’s in a nutshell. The Commerce Desk software program is a Demand Aspect Platform, or DSP. Which means that it executes programmatic promoting purchases on behalf of its shoppers.

It really works like this: When an internet site, streaming service, social media platform, or different digital service has advert area to promote, it sends out a bid request. The DSP responds in actual time with a bid based mostly on preset standards for its shopper’s advert marketing campaign. The advert then immediately seems. The Commerce Desk provides worth to its service by offering its shoppers with a wealth of helpful knowledge.

Picture supply: Getty Pictures.

The programmatic advert market is already huge and continues to develop quickly. Sources estimate that 91% of digital promoting and not less than 56% of complete international promoting is programmatic. For perspective, international promoting spending is anticipated to hit $1 trillion this yr.

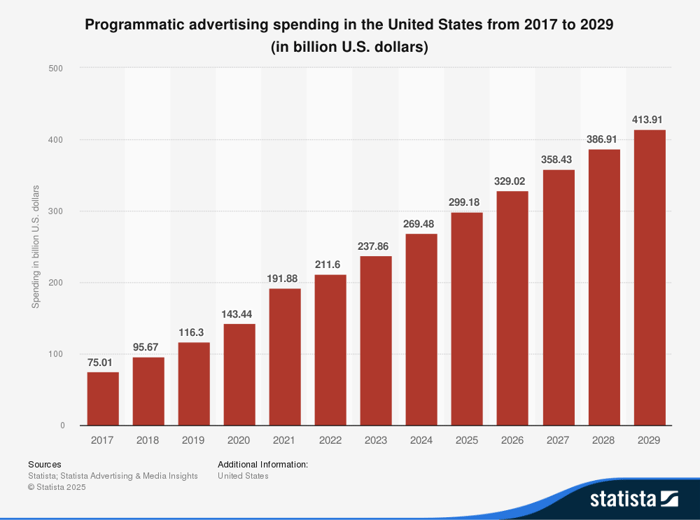

As proven under, programmatic promoting spending is anticipated to succeed in $299 billion this yr within the U.S. alone and is projected to extend to $414 billion over the following few years.

Statista.

The Commerce Desk is poised to learn tremendously, and stockholders must be rewarded handsomely over the lengthy haul.

Is The Commerce Desk a purchase now?

The Commerce Desk inventory slumped after it missed its earnings estimates for the primary time in eight years within the fourth quarter of 2024; nevertheless, the sell-off is significantly overdone. The autumn has induced a number of valuation metrics to dip nicely under historic averages. As an example, the corporate’s price-to-sales ratio (a standard metric to worth high-growth expertise firms) is 82% off its five-year common:

TTD PS Ratio knowledge by YCharts

The ratio drops underneath 13 on a ahead foundation. The market is pricing The Commerce Desk like a distressed enterprise, however it’s removed from that standing.

The earnings miss in This fall 2024 was disappointing. Nonetheless, gross sales nonetheless grew 22% yr over yr to $741 million within the quarter and 26% for the total yr, eclipsing $2.4 billion. The Commerce Desk has since reported encouraging Q1 2025 outcomes. Development accelerated to 25%, with gross sales reaching $616 million yr over yr. Working earnings almost doubled over the prior yr, going from $28.7 million to $54.5 million.

The corporate can be on agency monetary footing, with $1.7 billion in money and investments readily available, and present belongings of $4.9 billion, in comparison with $2.7 billion in present liabilities. Widespread inventory of $386 million was additionally repurchased throughout the quarter. When an organization buys again its inventory, the variety of shares obtainable decreases, making current shares extra precious.

Briefly, The Commerce Desk is rising quickly, in nice monetary form, and significantly undervalued, making it seem like an amazing purchase for traders proper now.