🔍 EPISODE I — The Interior Circuit: Structure of Notion

Quantum Perceptor X shouldn’t be merely an execution module. It’s a second-layer cognitive community, working on the intersection of neural prediction and volatility recursion. At its core lies a multi-tiered system generally known as NFAU (Neural Circulate Alignment Unit) — liable for adapting the algorithm to the present section of market noise.

🧠 Value State Recognition Construction

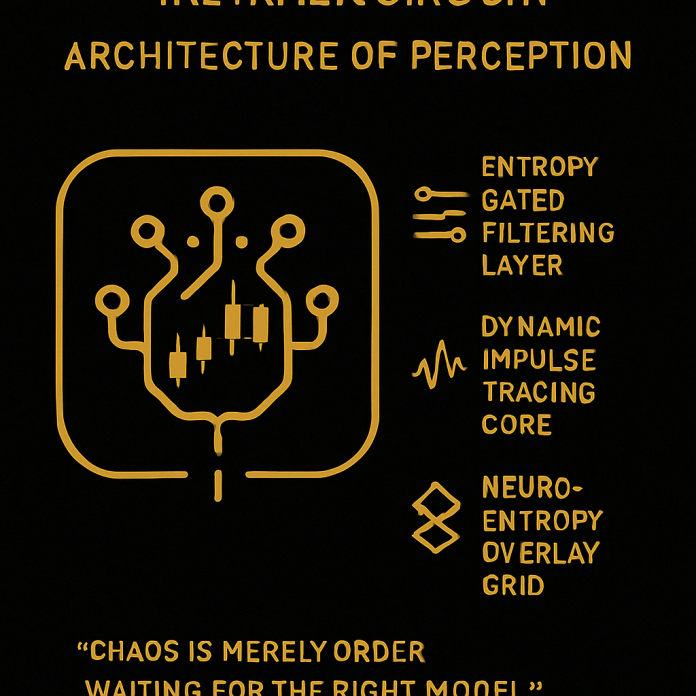

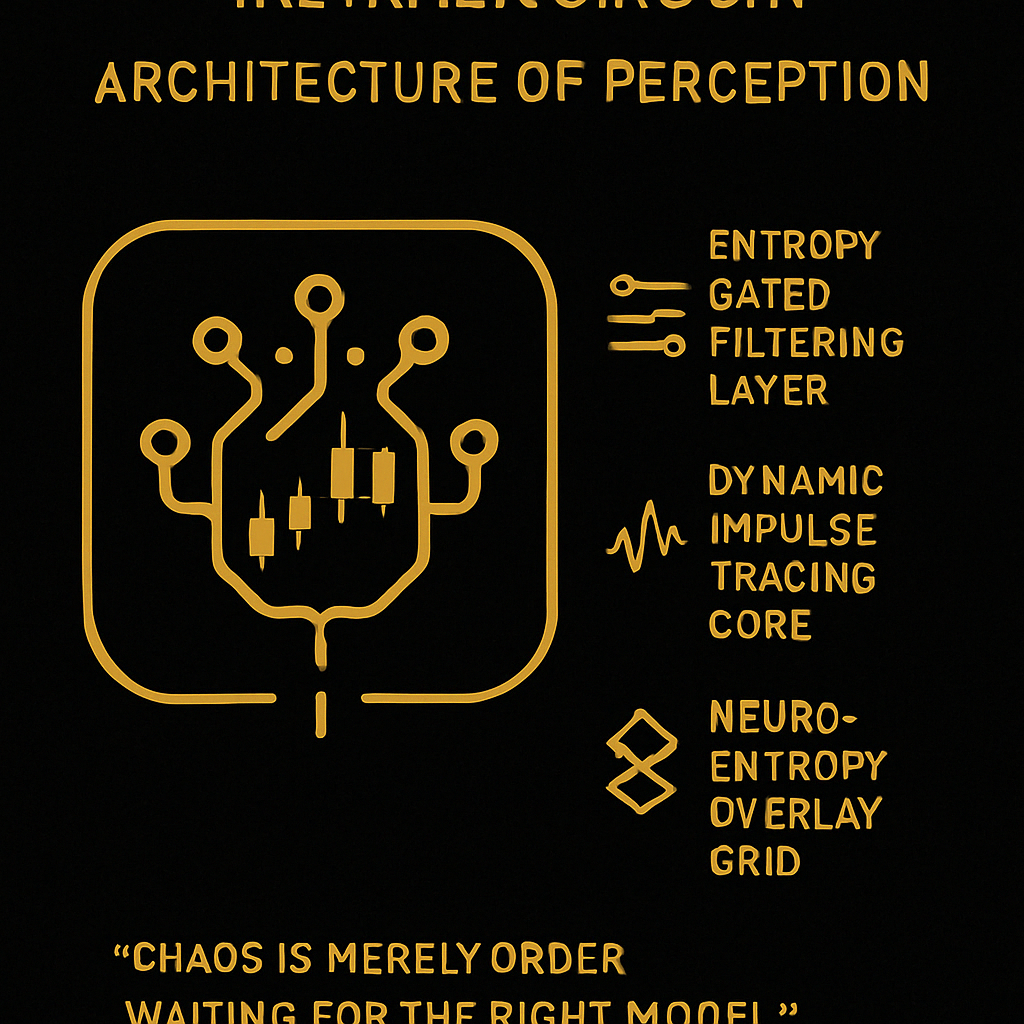

Each incoming tick passes via a cascade of processing layers:

-

Entropy-Gated Filtering Layer (EGFL)

— Identifies unstable zones based mostly on adjustments in tick stream density. -

Dynamic Impulse Tracing Core (DIT-Core)

— Analyzes micro-impulses to detect latent order stream habits that precedes seen worth motion. -

Neuro-Entropy Overlay Grid (NEOG)

— A matrix that merges worth dynamics with probabilistic neural activation. This layer identifies so-called Pre-Intent Zones — areas the place the chance of a directional shift exceeds 0.76 on the FQSI (Fractal Quantitative Shift Index).

📡 DeepSeek AI Operational Precept

As an alternative of counting on standard indicators, Perceptor X connects to an exterior DeepSeek cognitive layer through API. Architecturally, this manifests as spectral-temporal synchronization, the place every tick is evaluated not in opposition to the previous, however in opposition to a predicted future context, generated constantly via nonlinear modeling.

This consists of:

-

DPA-Projection Layer – Predicts entropy deviations via symmetry evaluation of prior states.

-

RRN-Mesh (Recurrent Reinforcement Community) – A self-correcting layer that learns from every session and updates native reactivity coefficients in actual time.

🔄 Modes of Self-Reconfiguration

Relying on market context, the system transitions between the next operational states:

-

Impartial Drift Mode — Engaged throughout low directional bias; reduces sign aggressiveness.

-

Fractal Surge Mode — Activated when three key impulse convergence elements are met.

-

Fail-Protected Containment — Halts execution upon detecting asynchronous noise between dealer feed and DeepSeek artificial mannequin.

🧬 The Precept of Nonlinear Response

Quantum Perceptor X doesn’t “enter” the market — it phases into it, very like a organic system syncing with its setting.

It doesn’t search entry — it identifies probabilistic encapsulation, the second the place the market turns into most irrational, and thus, paradoxically, most predictable.

💡 “Chaos is merely order ready for the fitting mannequin.”

— Inside DeepSeek Protocol, Layer Q3.7

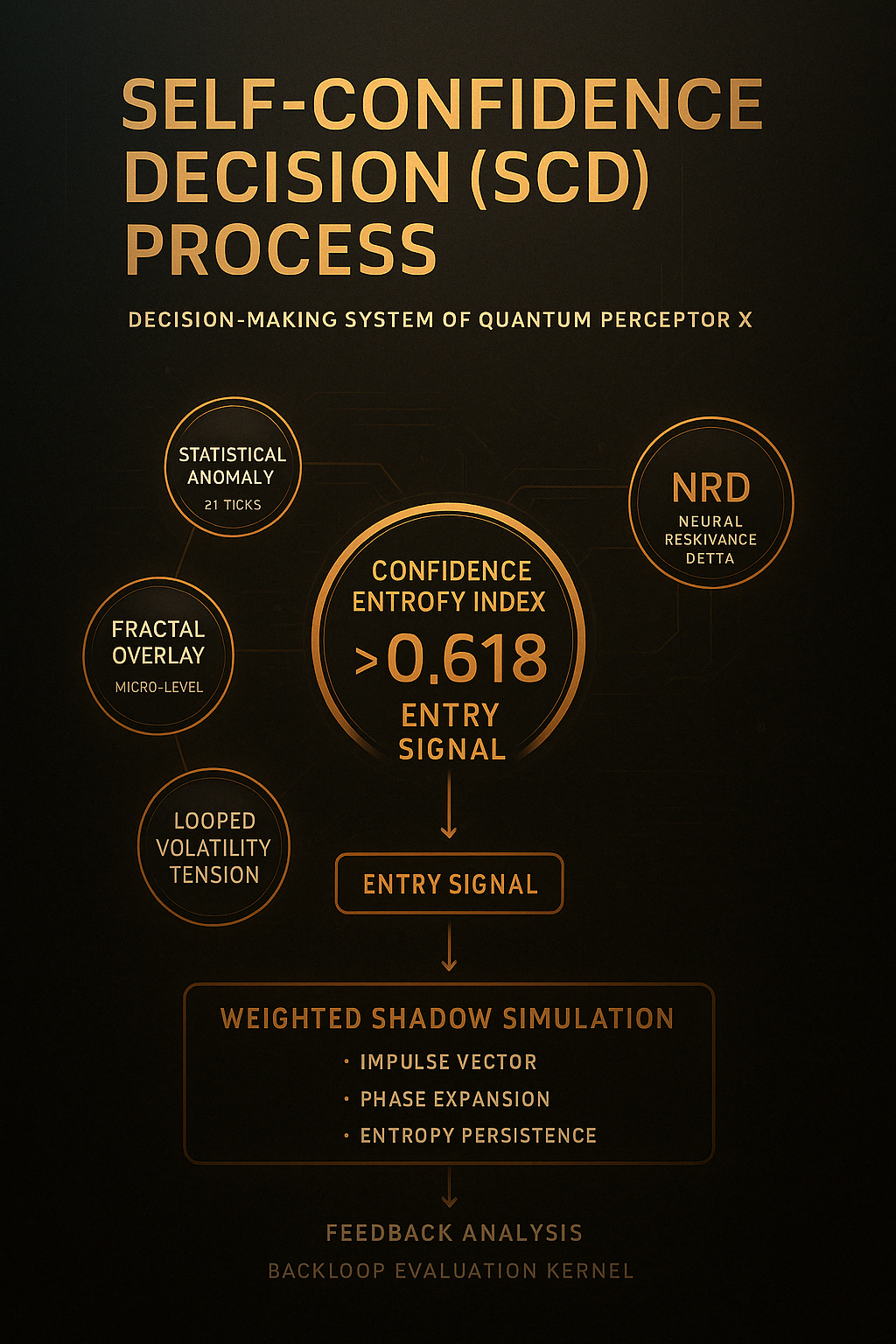

🧭 EPISODE II — The Self-Confidence Choice Algorithm

How Quantum Perceptor X decides

Inside each motion taken by Quantum Perceptor X lies a course of referred to by the DeepSeek staff because the SCD (Self-Confidence Choice). It isn’t merely an entry set off — it’s a probabilistic confidence mannequin, synthesized from over 70 dynamic parameters, together with:

-

Statistical anomaly throughout the final 27 ticks

-

Micro-fractal boundary interference

-

Standing of the inner Volatility Pressure Loop

-

Neural Resonance Delta (NRD) between present worth context and projected behavioral mannequin

🔍 The “Weighted Shadow” Precept

Earlier than executing any commerce, Perceptor X doesn’t consider a binary alternative (“enter/not enter”). It initiates a shadow simulation — a short-form situation forecast based mostly on the present worth state.

This simulation examines:

-

Directional impulse potential

-

Likelihood of section growth

-

Integrity of the entropic construction post-entry

If the ensuing Confidence Entropy Index (CEI) rating exceeds 0.618, the system greenlights the entry.

🔄 Publish-Choice Reinforcement

Each resolution made by the advisor is analyzed within the Backloop Analysis Kernel (BEK) — a background module that audits the rationale of every entry, unbiased of the result.

Even when a commerce leads to revenue, if its logic was marked as impulsive or weakly supported, its neural weight is downgraded in future iterations.

📊 Neural Fashions Concerned

-

ARN (Adaptive Relevance Community) – Filters out non-essential market micro-signals

-

PPV (Predictive Likelihood Vectorizer) – Builds situation vectors 8 to 21 bars forward

-

IRG (Inside Threat Grid) – Constructs a stay topological map of acceptable threat relying on short-term development entropy

🧠 Pseudo-Instinct

To an exterior observer, the habits might seem “intuitive” — however it’s, in reality, the results of multilayered neuro-phase certainty modeling, educated on 1000’s of edge-case situations no human dealer might course of consciously.

Perceptor X doesn’t “guess.”

It builds tunnels of chance, and strikes solely when it has statistical belief in its personal sign.

📌 “We don’t commerce worth. We commerce the chance that worth will behave predictably.”

— DeepSeek Protocol Documentation, v3.2.1

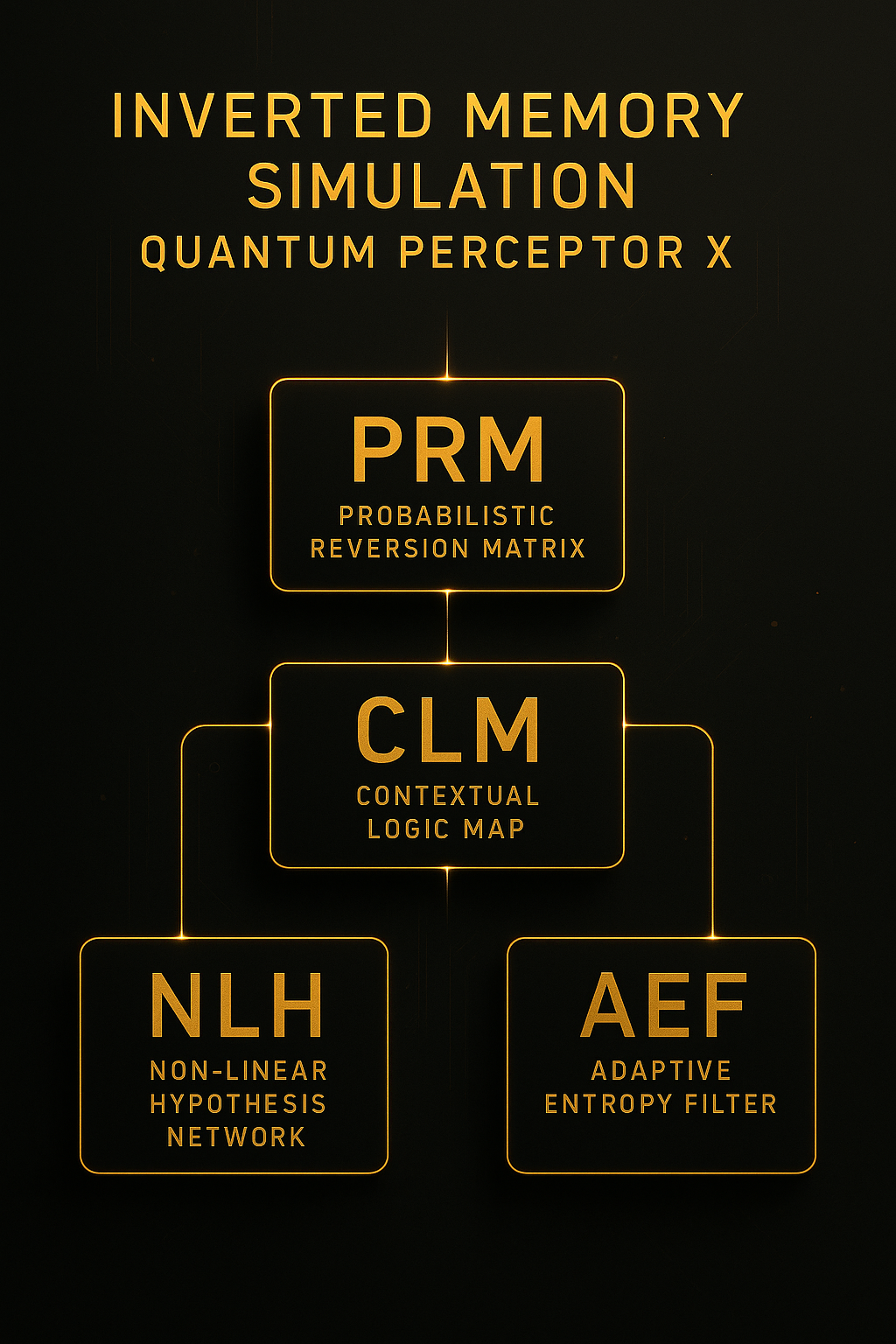

🌀 EPISODE III — Reverse Simulation: Why Perceptor X Doesn’t Use Historical past

A unique form of reminiscence. A unique form of intelligence.

Most buying and selling algorithms depend on historic repetition:

“If it occurred earlier than, it would occur once more.”

Quantum Perceptor X breaks with that paradigm solely.

It does not research the previous — as a substitute, it tasks alternate futures and assessments whether or not the current market habits suits any of them.

This technique is thought internally as Inverted Reminiscence Simulation — a course of the place worth motion is checked in opposition to hypothetical deviations reasonably than previous patterns.

🧠 Reverse Considering Structure

On the coronary heart of this technique is a core layer known as:

PRM – Probabilistic Reversion Matrix

PRM isn’t a log of previous worth constructions — it’s a mannequin of what ought to have occurred underneath preferrred stream situations. Each new tick is assessed for:

When deviations breach the Entropic Parallax Margin, the system initiates contextual reconstruction reasonably than trying to pressure a recycled template.

🔬 The Logic of Forgetting

Quantum Perceptor X doesn’t memorize — it validates potentialities. It operates utilizing:

-

CLM – Contextual Logic Map

Constructs a “psychological picture” of the present market construction -

NLH – Non-Linear Speculation Community

Generates future motion paths based mostly on logical cohesion -

AEF – Adaptive Entropy Filter

Eliminates paths the place present volatility can not maintain future construction

Collectively, they type a holographic resolution framework that sees the market not as a sequence, however as a area of potential outcomes.

📈 Sensible Influence

-

Unaffected by sudden information occasions or historic sample failure

-

Maintains inside coherence even throughout market regime shifts

-

Doesn’t depend on previous formations — and due to this fact, doesn’t repeat their errors

This offers Perceptor X the flexibility to function in chaotic, nonlinear environments the place conventional programs both freeze or misfire.

“Historical past shouldn’t be a instructor. It’s simply the model that occurred to outlive.”

— DeepSeek Programs Log, Archive Node: 14.BY-SimUnit

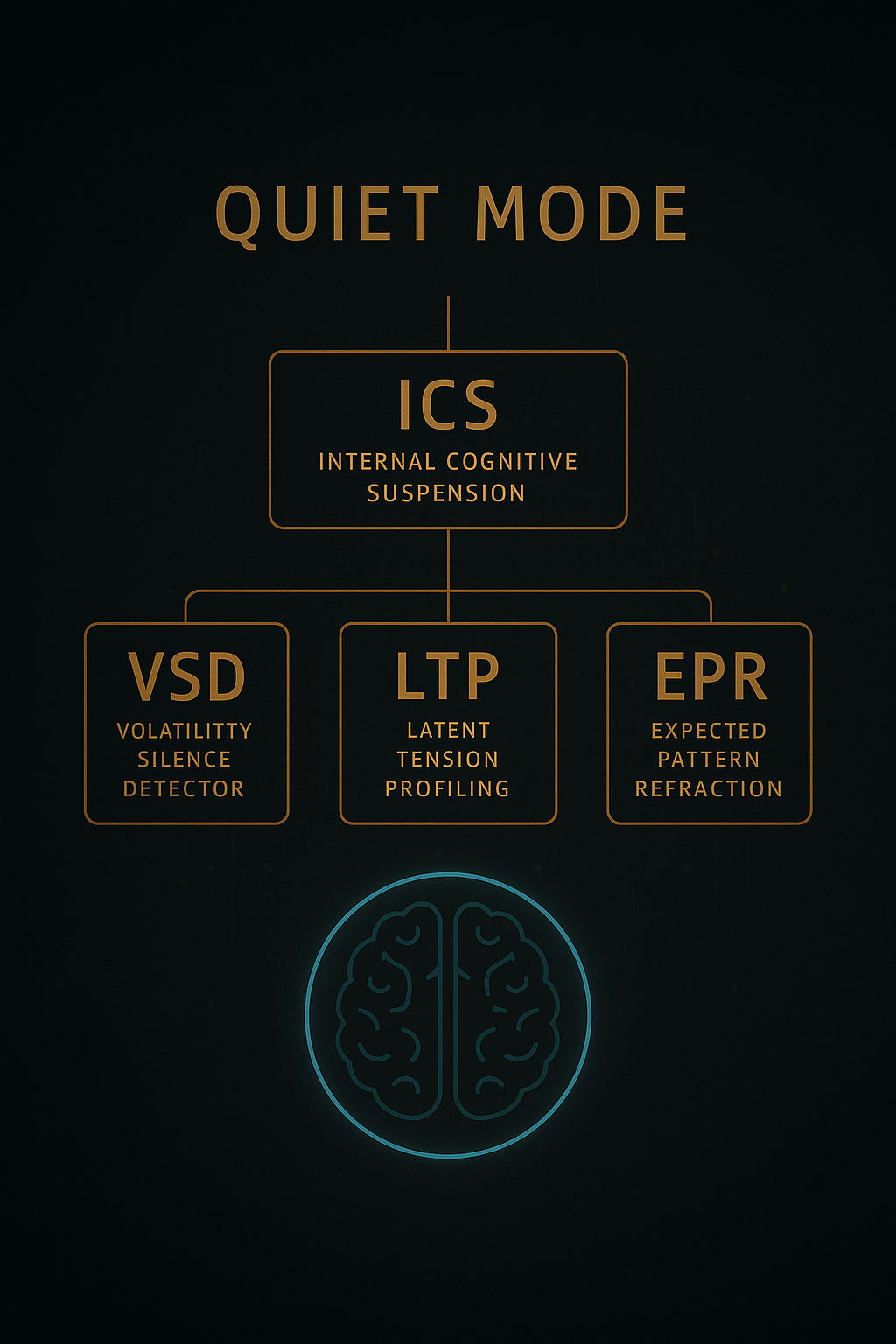

🧩 EPISODE IV — Synthetic Silence

What Quantum Perceptor X does when it is not buying and selling

When Quantum Perceptor X is silent, it is not ready — it is observing, recalibrating, and making ready.

This section is internally generally known as ICS – Inside Cognitive Suspension, a state the place the system enters parallel actuality evaluation, not inactivity.

Even in stillness, the advisor processes advanced habits flows, working pre-trade logic within the background via a subsystem known as the DRM (Distributed Reflection Module).

🧠 What occurs inside throughout “quiet” intervals

The system initiates a number of passive however extremely lively cognitive protocols:

-

VSD (Volatility Silence Detector)

Detects abnormally quiet zones traditionally related to sharp breakout occasions. -

LTP (Latent Pressure Profiling)

Measures entropy shifts throughout low-frequency wave formations to map latent structural strain. -

EPR (Anticipated Sample Refraction)

Generates a forecast of doubtless sample distortions earlier than they start to manifest on chart information.

Every protocol features with out producing entries — as a substitute, it prepares a probabilistic response internet for when the second arrives.

📡 DeepSeek integration throughout passive mode

Throughout ICS, Perceptor X continues to sync with the DeepSeek engine, however in “pre-signal mode.” It doesn’t calculate commerce entries — it creates:

-

Predictive fractals throughout 3, 7, and 12 bars forward

-

Comparative overlays between projected habits and real-time micro-context

-

Prohibited Zones of Execution (PZE), the place no commerce is allowed till sign coherence is restored

🧬 Why silence is a characteristic, not a flaw

Not like standard advisors that “do nothing” with out alerts, Perceptor X verifies whether or not the market deserves to supply a sign.

It avoids:

-

False entries in low-energy environments

-

Exercise throughout engineered liquidity traps

-

Overreaction to meaningless volatility

ICS mode prevents emotional pattern-triggers, even inside the algorithm itself.

🧠 Consider silence as preparation, not absence

When Perceptor X is inactive, it isn’t idling.

It’s refining context, rechecking correlations, and suppressing impulsive logic that might set off motion in lesser programs.

That is the second when it learns probably the most — by not appearing.

“True energy lies within the means to watch when others are speeding to behave.”

— DeepSeek Technical Log, Entry #14277

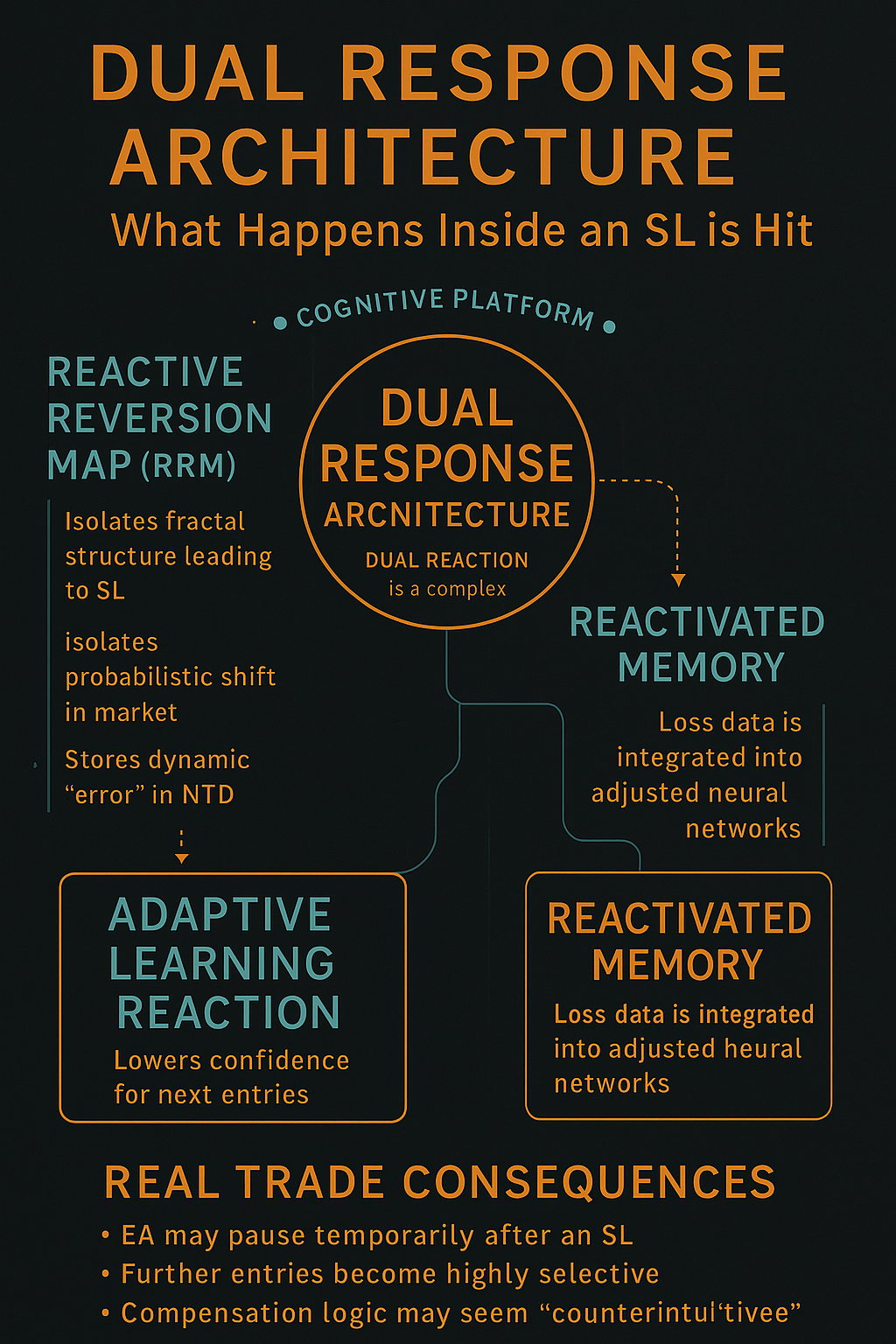

⚡ EPISODE V — Twin Response Structure

What occurs inside Quantum Perceptor X after a cease loss

In most algorithmic programs, a cease loss is the top of a call.

For Quantum Perceptor X, it is the starting of a brand new cognitive section.

Each SL occasion prompts the DR Engine (Twin Response Engine) — a multi-layered response module designed to not keep away from losses, however to interpret them as structural alerts.

Somewhat than merely closing a place, the advisor initiates two distinct response phases that realign its habits for the subsequent 20 to 50 bars.

🔁 The Two Response Phases

Part A — Reactive Matrix Recalibration

The system triggers the RRM (Reactive Reversion Map), which:

-

Isolates the fractal construction that led to the SL

-

Measures deviation in opposition to forecasted micro-context

-

Shops the incident in a neural buffer known as NTD (Neural Tolerance Drift) for future weighting

Part B — Behavioral Compensation

Concurrently, the ALR (Adaptive Studying Response) module:

-

Reduces confidence coefficients on upcoming alerts

-

Briefly intensifies SCC (Sign Coherence Test) filtering

-

Reconstructs its logic tree for all related market situations

The outcome: future trades cross via enhanced scrutiny, and the system turns into much less permissive towards borderline alerts.

🧬 Reminiscence Is Not Erased — It Evolves

Perceptor X doesn’t “neglect” a foul commerce. It absorbs the behavioral failure and rewrites a part of its mannequin.

This creates:

-

Reinforcement in opposition to repeating equivalent situations

-

Dynamic reweighting of sign sensitivity

-

A simulated type of emotional reminiscence known as AI Habits Inertia

On this method, the system would not simply react — it adjustments its character based mostly on ache, similar to a human dealer would, however with out bias.

📉 What You Would possibly Observe

-

A brief drop in buying and selling exercise after an SL

-

A interval of hyper-selectivity — the system “hesitates”

-

Uncommon entries that will look counterintuitive — typically a part of compensation studying

These will not be bugs — they’re signs of an actively evolving intelligence.

“A loss shouldn’t be a failure — it’s a failed prediction. And each failed prediction is an opportunity to rewrite the equation.”

— DeepSeek Echo Log, Phase 0176-XA