Meta pays Alphabet $10 billion over six years for entry to Google Cloud’s infrastructure.

The shares of Google father or mother Alphabet (GOOGL 3.10%) (GOOG 2.98%) and Meta Platforms (META 2.04%) shot increased in Friday buying and selling. Though most shares rose as a result of the Federal Reserve strongly hinted at a September lower in rates of interest, one other issue was possible the announcement of Meta’s cloud take care of Google, as reported by The Data.

Contemplating the $10 billion dimension of the deal, one has to imagine it’s vital, significantly to Alphabet. Nonetheless, contemplating the state of the synthetic intelligence (AI) inventory, it might function a much-needed catalyst for the corporate’s buyers. Here is why.

Picture supply: Getty Pictures.

Phrases of the partnership

Below the phrases of the deal, Meta pays Google $10 billion over six years. In alternate, it is going to obtain entry to Google Cloud’s storage, server, and networking providers, together with different merchandise.

Meta has beforehand relied on Amazon‘s Amazon Net Companies (AWS) and Microsoft‘s Azure for such providers. The deal doesn’t essentially imply it is going to deal much less with these firms. Extra possible, it speaks to Meta’s insatiable demand for cloud infrastructure because it seeks to change into a significant participant within the AI area.

Moreover, Meta and Alphabet are one another’s largest rivals within the digital promoting market. And within the first half of 2025, 98% of Meta’s income got here from digital adverts. Therefore, in a way, it’s exceptional that these two would change into companions in a special enterprise.

The way it helps Alphabet

Nevertheless, in one other sense, this can be a enormous step ahead for Alphabet’s future. Within the first half of this 12 months, Alphabet earned 74% of its income from the digital advert market, down from 76% in the identical interval in 2024. That is additionally by design, as Alphabet has bought dozens of companies unrelated to the digital advert market in its efforts to transition right into a extra diversified know-how enterprise.

Thus far, Google Cloud is the one considered one of these enterprises to seem in Alphabet’s financials. It accounted for 14% of Alphabet’s income within the first two quarters of 2025, up from 12% in the identical year-ago interval.

Moreover, Google Cloud generated over $49 billion in income over the trailing 12 months, implying the $10 billion from Meta over six years will make up a comparatively small portion of Google Cloud’s enterprise.

Nonetheless, the deal serves as a vote of confidence for Alphabet’s cloud enterprise, one which continues to lag AWS and Azure by way of market share.

Picture supply: Statista. Y-o-y = 12 months over 12 months.

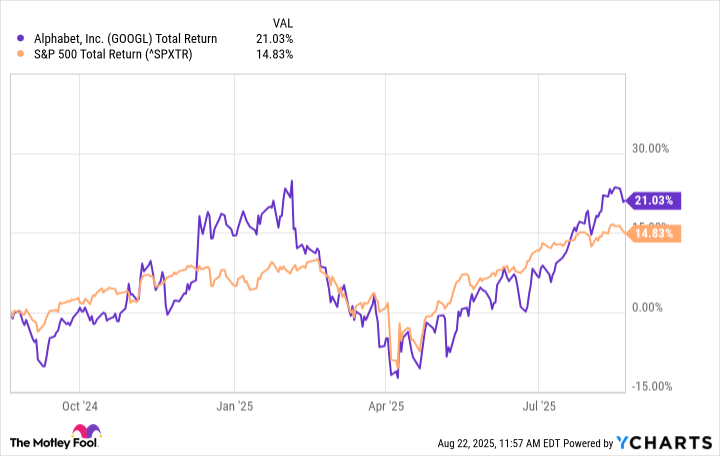

The investor perspective can be essential. During the last 12 months, Alphabet inventory has outpaced the whole returns of the S&P 500 by a major however not eye-popping margin. Nevertheless, it could assist that Alphabet’s price-to-earnings (P/E) ratio of twenty-two is the bottom amongst “Magnificent Seven” shares. Therefore, the Meta deal might immediate buyers to look extra favorably upon that earnings a number of.

GOOGL Complete Return Degree knowledge by YCharts.

Moreover, if the Meta deal prompts different firms to do extra enterprise with Google Cloud, it might present a lift to its market share and, by extension, Alphabet inventory.

The Meta deal and Alphabet inventory

Finally, Meta’s take care of Google Cloud will greater than possible take Alphabet inventory a leg increased, however buyers ought to anticipate the results to be extra oblique. Certainly, the deal is exceptional in that it serves as a lift for third-place Google Cloud and is notable because the two firms are direct rivals in one another’s largest enterprises.

Though $10 billion in added enterprise over six years is substantial, Google Cloud generated $49 billion during the last 12 months. Thus, it’s a vital however not game-changing enhance to the enterprise.

Nevertheless, the deal could make Google Cloud extra enticing to potential prospects, and the low P/E ratio might entice extra buyers to Alphabet. Ultimately, these might change into the extra vital advantages of the deal.

Will Healy has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Alphabet, Amazon, Meta Platforms, and Microsoft. The Motley Idiot recommends the next choices: lengthy January 2026 $395 calls on Microsoft and quick January 2026 $405 calls on Microsoft. The Motley Idiot has a disclosure coverage.