API3, a decentralized oracle answer that goals to make real-world information accessible through blockchain APIs, noticed its token value explode practically 90% over the previous seven days, peaking above $1.80.

However within the final 24 hours, it dropped practically 10%, sparking confusion amongst merchants. Is that this the beginning of a deeper correction, or only a brief cooldown earlier than extra upside?

Shorts Stack Up as Funding Fee Drops

Funding charges on API3 flipped deeply damaging over the previous 24 hours. On August 19, the OI-weighted funding charge stood at -0.47%. By August 20, it plunged additional to -1.10%. Meaning most merchants are actually paying to carry brief positions, betting closely on a value drop.

This reveals aggressive short-side sentiment. But, the API3 value hasn’t collapsed. It dipped barely from the height, however API3 bulls haven’t absolutely backed off. So regardless of bearish bets piling up, sellers haven’t taken management at press time.

For token TA and market updates: Need extra token insights like this? Join Editor Harsh Notariya’s Day by day Crypto E-newsletter right here.

Sensible Cash Buys Whereas CMF and Trade Knowledge Keep Bullish

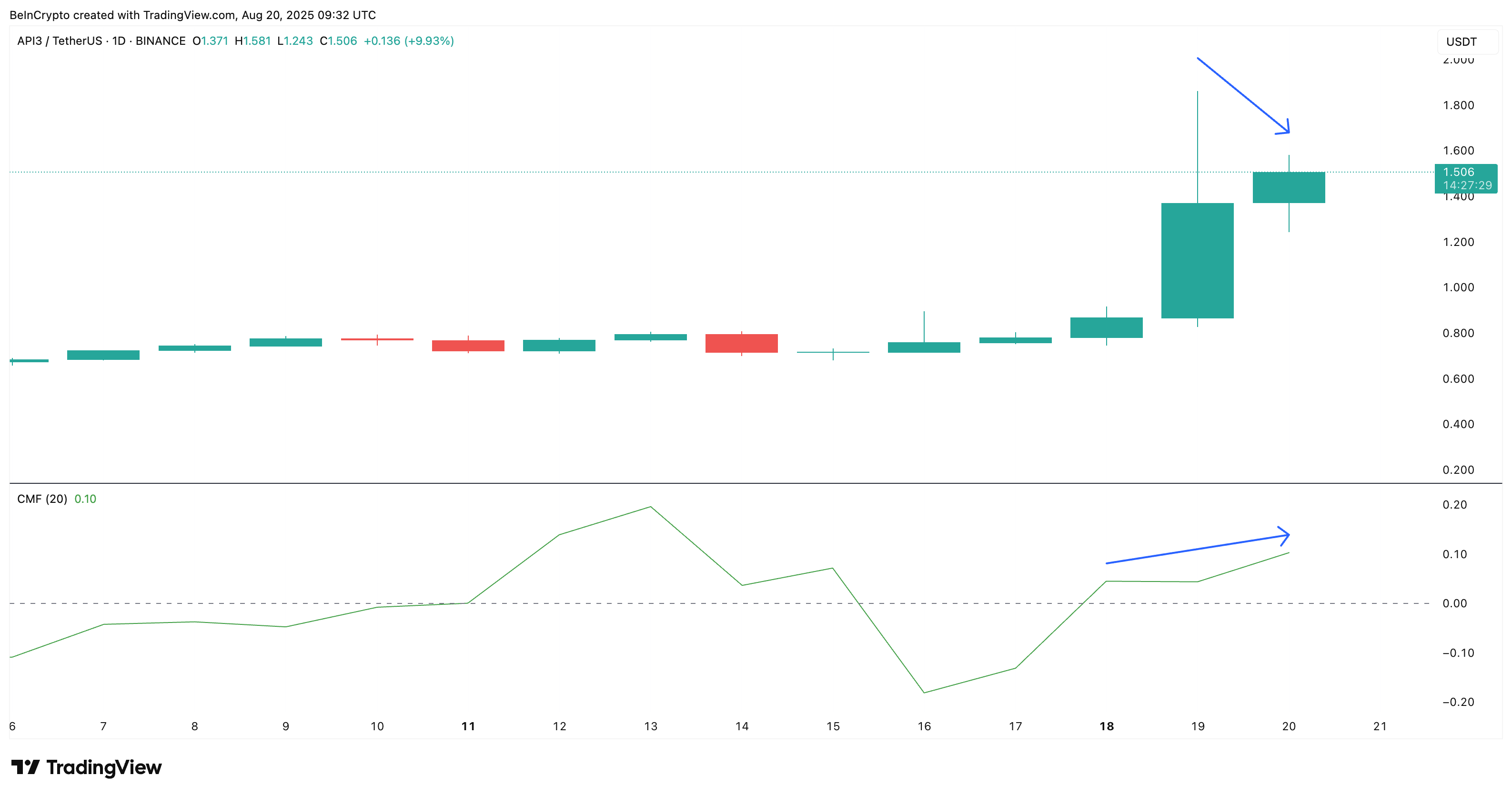

Beneath the hood, consumers are nonetheless stepping in. The Chaikin Cash Circulation (CMF) on the every day chart has climbed steadily from 0.04 to 0.10 over the previous few hours, even whereas the API3 value cooled down barely. CMF rising regardless of a small value pullback suggests accumulation: extra capital is flowing in than out.

CMF is a volume-weighted indicator that reveals if cash is flowing into or out of a token based mostly on value and quantity.

Trade reserves verify this. Over the previous 7 days (in the course of the rally), API3’s change balances fell 30.5%, now sitting at 28.63 million tokens.

On the similar time, the highest 100 addresses elevated holdings by 25.98%, whereas Sensible Cash wallets jumped 204%.

API3 Value Chart Exhibits Bullish Bias

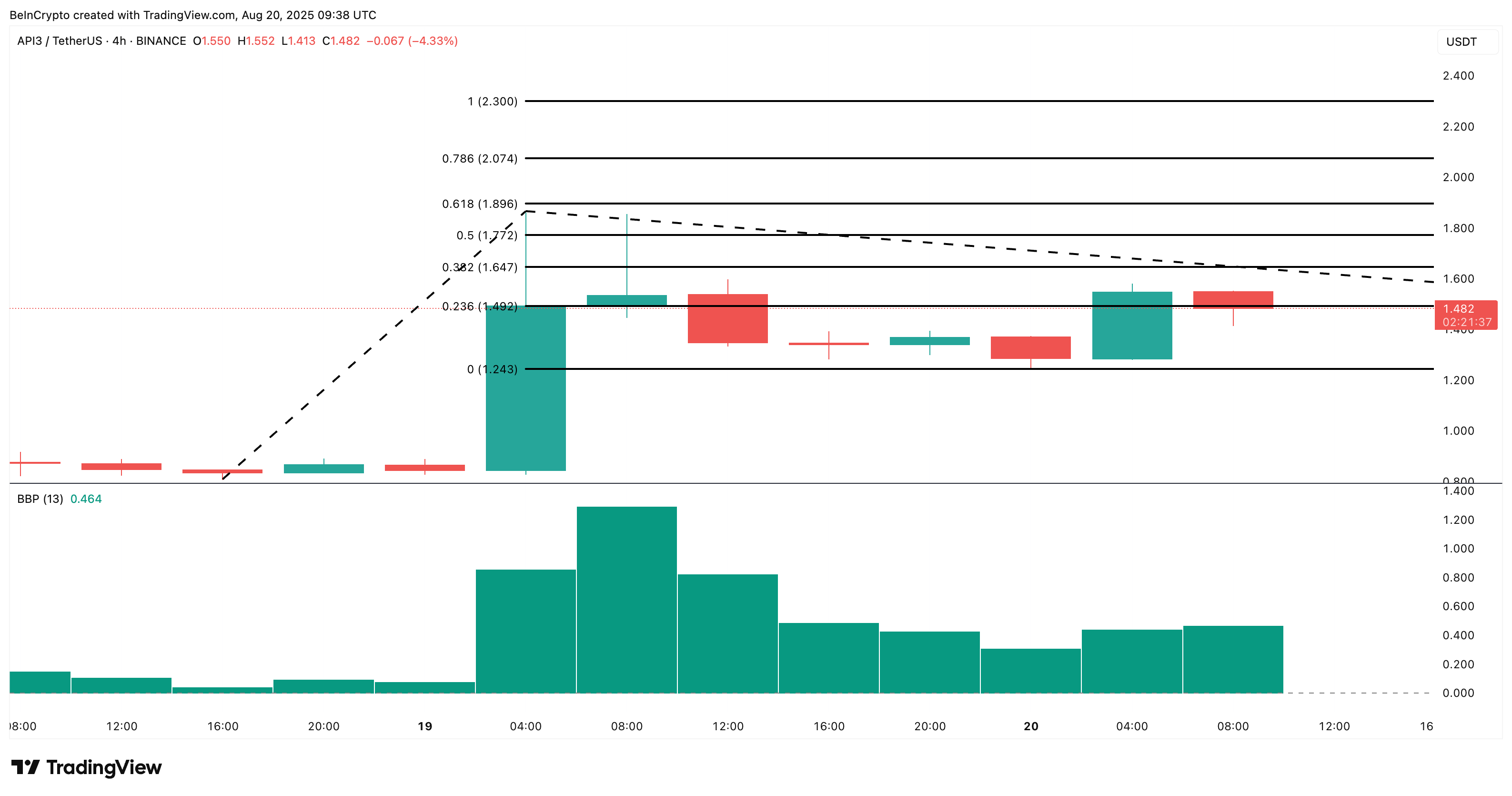

On the 4-hour chart, API3 continues to be exhibiting bullish momentum. The value bounced off the 0.236 Fibonacci degree close to $1.49, and the Bull-Bear Energy (BBP) index stays optimistic at 0.464.

This implies bulls aren’t executed, and if shopping for continues, the short-heavy crowd or the bearish bets may get liquidated quick. That will push the costs larger, with the instant targets sitting at $1.64 and $1.77.

Because the bullish momentum appears to be selecting up, with rising inexperienced bars, an API3 value rally continuation appears to be like extra possible. The BBP indicator measures the energy of bulls vs. bears by evaluating highs and lows with a shifting common.

But when value breaks decrease than $1.24 and consumers cool off, the identical shorts may win the spherical, invalidating the bullish outlook. Longs would then be uncovered, and liquidations may deepen the drop quick.

The put up API3 Value Rally Caught Between Bullish Buys and Bearish Bias appeared first on BeInCrypto.