Australia reported weaker than anticipated worth pressures for the final quarter of 2024, additional stoking expectations that the Reserve Financial institution of Australia (RBA) may begin easing quickly.

The quarterly studying got here in at 0.2% versus the 0.3% consensus, though the annual headline CPI ticked increased from 2.3% to 2.5% as anticipated. Nonetheless, the trimmed imply CPI or the RBA’s most popular inflation measure mirrored cooling worth pressures at 0.5% versus the earlier 0.8% quarterly achieve.

Key Takeaways:

- Electrical energy costs fell 9.9% within the quarter as a result of Power Invoice Aid Fund rebates

- Housing and transport prices each declined 0.7%

- Providers inflation remained elevated however eased to 4.3% yearly

- Non-discretionary inflation dropped to its lowest degree since March 2021 at 1.8%

The trimmed imply CPI, which excludes risky gadgets and gives a clearer view of underlying inflation, advised that core inflationary pressures are moderating however stay above the Reserve Financial institution of Australia’s goal band.

Hyperlink to Australia’s This fall 2024 CPI Report

The federal government’s Power Invoice Aid Fund performed a vital function in containing inflation, with electrical energy costs falling 25.2% over the previous 12 months. With out these rebates, electrical energy costs would have risen 0.2% within the December quarter.

Market Response

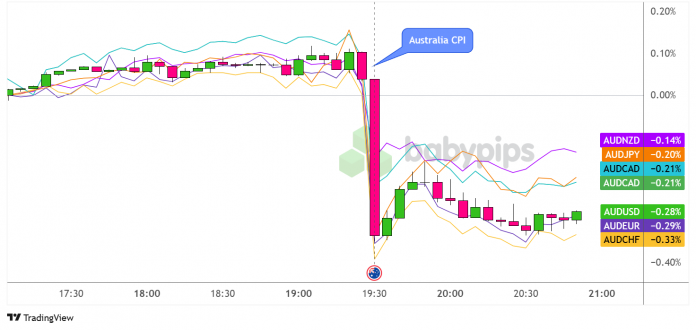

Australian Greenback vs. Main Currencies: 5-min

Overlay of AUD vs. Main Currencies Chart by TradingView

The Australian greenback slipped sharply following the softer-than-expected inflation knowledge, raking in rapid losses significantly versus CHF (-0.33%) and EUR (-0.29%) whereas limiting declines versus NZD (-0.14%) and JPY (-0.20%).

Nonetheless, AUD managed to maneuver sideways after the preliminary selloff, as merchants are probably holding out for upcoming top-tier market catalysts later within the day, together with the highly-anticipated FOMC determination.