You run a backtest.

It seems to be wonderful.

Excellent fairness curve.

90 % win charge.

Steady drawdown.

You’re feeling a rush of hope.

“This may lastly be the one.”

So that you go reside.

After which…

A random spike.

A bizarre unfold.

A information candle you didn’t count on.

Out of the blue the bot’s down 15 %.

And it simply retains buying and selling.

You examine the backtest once more.

No signal of this catastrophe.

Welcome to the actual world.

The Backtest Lure

Let’s be clear:

Backtesting isn’t ineffective.

However most merchants utterly misinterpret what it tells you.

Backtests are like rehearsals —

managed, predictable, clear.

However reside buying and selling?

It’s messy. Unforgiving.

And stuffed with noise that no simulation can totally replicate.

That’s why so many EAs look good in technique tester…

…after which implode in actual markets.

It’s not simply dangerous luck.

It’s a structural flaw in how these bots are constructed — and examined.

3 Causes EAs Fail in Stay Buying and selling

Let’s break it down:

1. Over-Optimized Settings

In case your bot has 15+ inputs…

…and the backtest was fine-tuned to actual market circumstances…

It’s not “good.” It’s fragile.

It was constructed to win that market —

not this one.

2. No Danger Management Logic

Most EAs will preserve buying and selling even after a serious loss.

However your psychology received’t.

One brutal day and your confidence is gone.

You begin tweaking.

You override the system.

You lose each consistency and management.

3. Backtest Circumstances Are Too Clear

No slippage.

No random disconnections.

No news-driven volatility spikes.

However actual buying and selling?

You’ll get all of these. Usually in the identical week.

The Hidden Value: Emotional Capital

The worst half isn’t the cash misplaced.

It’s the belief you lose.

You cease believing in automation.

You begin watching each commerce.

Second-guessing every little thing.

And shortly you’re again to sq. one:

Handbook trades. Emotional selections. No plan.

That’s why most merchants don’t fail technically.

They fail emotionally — as a result of their instruments weren’t constructed for the actual world.

So What Ought to You Look For?

Right here’s what separates a show-off backtest bot…

from a real-world performer:

✅ Stay-verified efficiency — not simply Technique Tester screenshots

✅ Constructed-in day by day drawdown cap — to keep away from blow-up days

✅ Simplified enter logic — no overfitting traps

✅ Ahead testing beneath actual volatility

If an EA can’t move that check,

it’s not price operating in your account.

That’s why I constructed this:

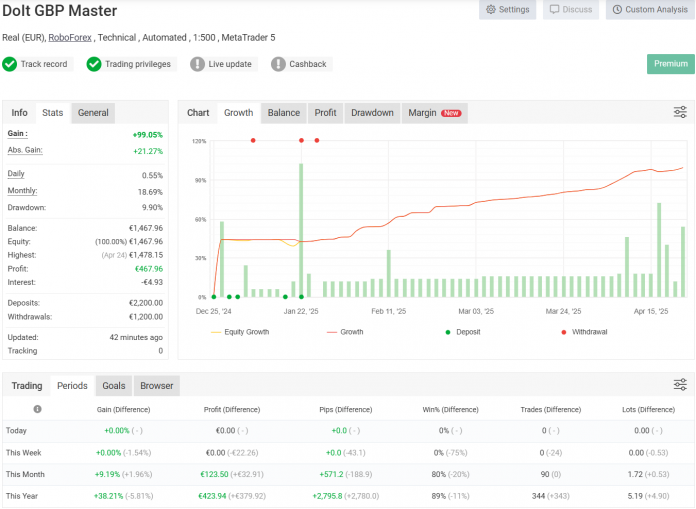

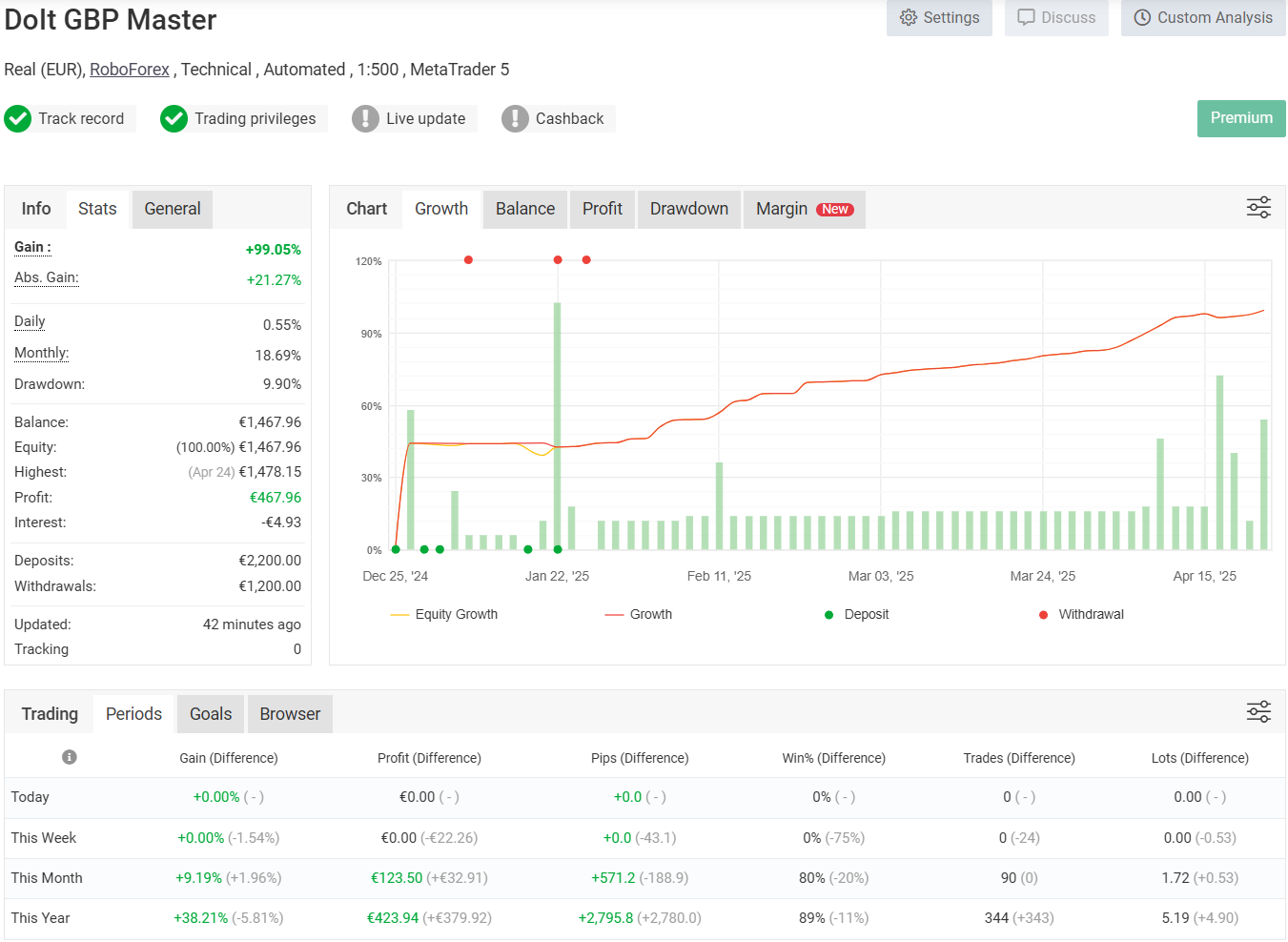

✅ Actual Ahead Check, Actual Management: DoIt GBP Grasp

This bot has been forward-tested for over a 12 months —

with constant outcomes beneath unstable GBP/USD circumstances.

🧠 Every day drawdown is capped.

📉 Losses are dealt with routinely.

📊 MyFxBook hyperlink with full verified historical past:

See Stay Stats

It’s not a holy grail.

But it surely does move the survival check most bots fail.

🧠 Need to Keep away from the Subsequent Backtest Catastrophe?

Earlier than you belief one other EA — run it by this:

The Actual-World EA Survival Check

7 brutally easy questions that will help you spot:

– Overfitting traps

– Harmful restoration logic

– Lacking threat management

– Emotional crimson flags

👉 Obtain the guidelines right here

🎯 Able to Check a Actual-World Bot?

You possibly can attempt the DoIt GBP Grasp EA risk-free in Technique Tester:

👉 Obtain Free Demo (Preconfigured)

It consists of the Protected Mode setup I exploit reside —

drawdown capped, volatility-ready, no over-optimization.

Run it.

Break it.

See the way it handles an actual market day.

And evaluate it to your present bots.

As a result of belief doesn’t come from curve-fitting.

It comes from management.

💡 Don’t threat your EA on a random dealer — these are those I belief with actual cash

🔹 Pepperstone – Additionally appropriate with most EA methods: https://shorturl.at/V41RY

🌍 Dependable international dealer | 🛡️ Strong regulation

🔹 US-Pleasant Prop Agency (10% OFF with code DOITTRADING): https://shorturl.at/tymW3

🇺🇸 For US merchants | 💸 Reasonably priced entry | 🏆 Actual funding

💻 Dependable EA VPS Internet hosting (Rated 4.9/5 on Trustpilot)

🔹 Foreign exchange VPS – Steady internet hosting for automated buying and selling: https://www.forexvps.web/?aff=78368

🔒 24/7 uptime | 🖥️ Low latency | ⚙️ Simple MT4/MT5 setup

A number of the hyperlinks above are affiliate hyperlinks. In the event you use them, it helps supporting the channel at no additional value to you. Thanks! 🙌