Binance introduced plans to delist 4 altcoins from its product suite on Monday, inflicting vital worth drops for the affected tokens.

The motion, which is able to take impact on February 24 at 03:00 UTC, is one other try by Binance to reinforce market high quality.

4 Altcoins Queued for Binance Delisting

In a weblog publish shared on Monday, Binance introduced plans to delist and stop buying and selling on all spot buying and selling pairs for 4 tokens.

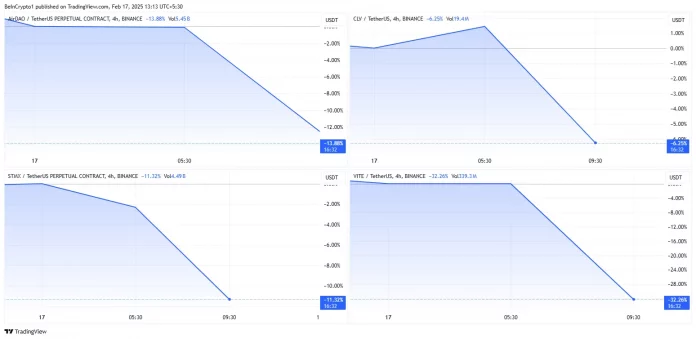

“…we have now determined to delist and stop buying and selling on all spot buying and selling pairs for the next token(s) at 2025-02-24 03:00 (UTC): AirDAO (AMB), CLV (CLV), StormX (STMX), and VITE (VITE),” Binance stated.

The buying and selling pairs slated for elimination are AMB/USDT, CLV/BTC, CLV/USDT, STMX/TRY, STMX/USDT, and VITE/USDT. Following the Binance delisting announcement, many of the tokens recorded double-digit losses.

The turnout is unsurprising, given the worth implication of token delistings on well-liked exchanges. As an example, Binance’s elimination of six altcoins in August led to substantial worth drops for these cryptocurrencies.

Particularly, PowerPool (CVP) and Ellipsis (EPX) noticed 14% and 22% declines instantly after their delisting bulletins. Equally, a current Binance delisting announcement in December despatched three altcoins into free fall, mirroring the newest turnout.

Conversely, token listings on well-liked exchanges like Binance and Coinbase encourage worth surges. As BeInCrypto reported, the Coinbase trade’s current transfer to checklist POPCAT and PENGU impressed double-digit positive factors for the tokens.

What Binance Customers Ought to Know

The Binance delisting announcement is a part of the trade’s occasional transfer to evaluate the efficiency of its listed buying and selling pairs. Particularly, the trade analyzes parts resembling the extent and high quality of improvement exercise. It additionally assesses the community and sensible contract stability.

“When a coin or token now not meets these requirements or the trade panorama modifications, we conduct a extra in-depth evaluate and doubtlessly delist it,” an excerpt within the weblog added.

These measures come as Binance appears to be like to make sure the perfect companies and protections for its customers. Accordingly, Binance customers ought to know that each one commerce orders for the tokens marked for delisting will probably be eliminated after buying and selling ceases on February 24.

This implies the token’s valuation will now not be displayed in customers’ accounts after delisting. Additional, deposits of those tokens is not going to be credited to customers’ accounts beginning February 25. On the identical be aware, withdrawals of those tokens from Binance is not going to be supported after April 24. As a substitute, delisted tokens may very well be transformed into stablecoins mechanically beginning April 25.

Binance additionally said that this delisting motion would have an effect on perpetual contracts for AMB and STMX beginning February 21 at 09:00 UTC. This implies merchants holding open positions for these futures contracts ought to think about closing them earlier than the delisting time to keep away from automated settlement.

Disclaimer

In adherence to the Belief Undertaking tips, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed data. Nevertheless, readers are suggested to confirm info independently and seek the advice of with knowledgeable earlier than making any choices primarily based on this content material. Please be aware that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.