In an interview with CNBC’s Road Indicators on February 27, Geoffrey Kendrick, Head of Digital Asset Analysis at Normal Chartered, provided insights on Bitcoin’s current value decline and laid out a daring forecast for the world’s largest cryptocurrency. Regardless of near-term volatility, Kendrick expects Bitcoin to achieve $200,000 this 12 months and as excessive as $500,000 earlier than the top of President Trump’s time period.

Bitcoin Crash? No Drawback!

Kendrick opened the dialogue by noting the affect of political developments on investor sentiment: “So I believe the Trump Administration will probably be optimistic medium time period. So we got here into January 20, hoping for quite a bit and you can argue there was already various positivity priced in.”

He highlighted the rapid post-inauguration shift in regulatory stance—particularly, the removing of SAB 121, which he described as having “been hampering monetary establishments.” Kendrick additionally addressed the shortage of a broadly anticipated strategic Bitcoin reserve, changed as an alternative by a “stockpile” strategy. In line with Kendrick: “The stockpile for me is okay as a result of it legitimizes different sovereigns […] each inside the US [and outside]. A variety of US states are contemplating holding Bitcoin on their steadiness sheet.”

Nonetheless, markets have been rattled by contemporary uncertainties. Kendrick pointed to ongoing commerce warfare and geopolitical flashpoints: “Initiatives within the final couple of weeks have been very complicated for danger property […] tariffs on and off. Canada, Mexico, EU […] clearly some potential positives coming round Ukraine and or the Center East however nothing strong actually on any of these and danger property don’t like uncertainty.”

Throughout the crypto sphere particularly, he cited the Bybit hack, hassle with the Solana meme coin scams, and a usually “complicated” atmosphere as contributors to the pullback. Kendrick underscored the cascading impact on Bitcoin.

When requested whether or not Bitcoin stays a real diversifier amid its correlation with equities, Kendrick maintained a nuanced view: “Actually after we see massive strikes like we’ve seen in the previous few weeks […] on the damaging course danger property all commerce collectively […] Medium-term, I believe the diversification story is affordable […] The use case for Bitcoin specifically is to diversify towards dangers round conventional monetary markets.”

Kendrick additionally addressed the massive outflows from the spot ETFs since Trump’s inauguration: “Even within the final week, we’ve seen about $3 billion of outflows by way of ETFs […] we bought to a web place of about $40 billion of inflows over the primary 12 months of these ETFs within the US […] however within the final week or so we’ve seen $3 billion of outflows.”

He estimates that those that purchased Bitcoin post-election in November at the moment are “closely underwater” to the tune of $2 billion in paper losses. This newer cohort of holders, mixed with the sector’s still-robust retail participation, has amplified volatility: “It’s far more tough for traders then to carry by way of losses […] once you see strikes like we noticed this week, you are likely to get some panic promoting.”

$200,000 Goal Nonetheless In Play

He additionally reiterated the necessity for deeper institutional participation—citing banks like Normal Chartered and funding giants corresponding to BlackRock—to enhance custody options and scale back the frequency of such hacks just like the Bybit one, resulting in damaging headlines:

“Because the trade turns into extra institutionalized it ought to be safer […] hopefully we get some regulatory readability within the US too […] that ought to add to that medium-term prime facet potential which for me is Bitcoin as much as $200,000 this 12 months and $500,000 earlier than Trump leaves workplace.”

Trying forward, Kendrick underscored that regulatory readability—significantly round stablecoin guidelines and KYC—may set off a wave of institutional and even sovereign capital inflows. He recognized long-term public pension funds and sovereign wealth funds as pivotal market movers, referencing the Abu Dhabi Sovereign Wealth Fund’s buy of 4,700 BTC-equivalent shares within the BlackRock ETF on the finish of 2024:

“There’s that very long-term sector that’s nonetheless to take part extra […] after which additionally Sovereign so the one Sovereign that we all know up to now has purchased the ETFs is Abu Sovereign wealth fund […] I’d anticipate extra of that to come back by way of this 12 months as nicely.”

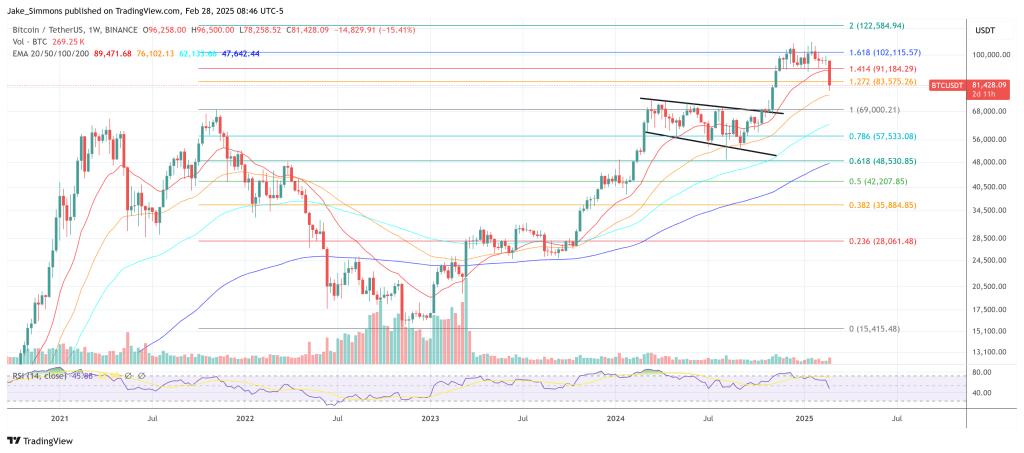

At press time, BTC traded at $81,428.

Featured picture from YouTube, chart from TradingView.com