Bitcoin is buying and selling above key demand ranges however continues to face resistance in breaking into uncharted territory. After setting a brand new all-time excessive at $109,300 on Monday, the value has struggled to push increased, leaving merchants and buyers unsure about its subsequent transfer. Regardless of the market’s present indecision, BTC stays sturdy above vital assist, signaling potential for additional upside.

Crypto skilled Axel Adler has supplied key insights, suggesting that BTC could also be at a horny degree from an funding perspective. Drawing on historic information, Adler highlights that Bitcoin’s present value aligns with patterns seen throughout earlier bull cycles, the place sturdy assist close to all-time highs usually preceded vital rallies. This has bolstered optimism amongst long-term buyers who view the present consolidation as a possible shopping for alternative.

Nonetheless, BtC’s lack of ability to interrupt decisively above its ATH has left the market in suspense, as merchants look forward to affirmation of the following pattern. A sustained push above $109,300 might spark a brand new bullish part and drive BTC into value discovery, whereas failing to carry key demand ranges might result in additional consolidation or perhaps a short-term correction. The approaching days might be pivotal for Bitcoin because the market seeks readability on its subsequent path.

Bitcoin Enters A Key Section

Bitcoin is getting into a vital part because it approaches the ultimate stage of the 4-year bullish cycle, a interval traditionally marked by heightened hypothesis and substantial value surges. With buyers and analysts anticipating a major transfer within the coming months, many are starting to set formidable value targets for the cryptocurrency. This part is characterised by rising curiosity, market momentum, and a deal with Bitcoin’s capability to defy macroeconomic challenges.

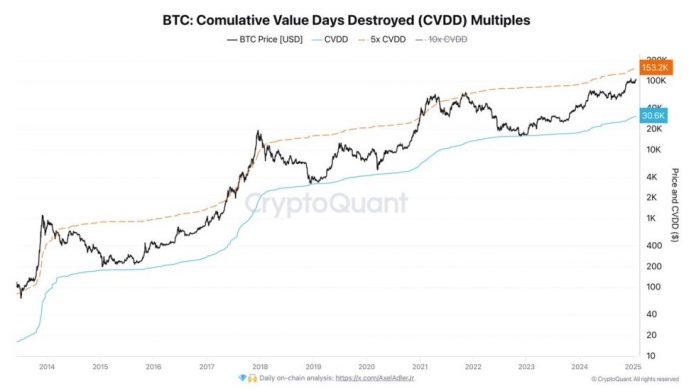

Famend crypto analyst Axel Adler has make clear Bitcoin’s potential utilizing the Cumulative Worth Days Destroyed (CVDD) mannequin. Based on Adler, the CVDD mannequin suggests a conservative value goal of $153.2K, primarily based on a 5x multiplier. This metric, derived from historic information, factors to Bitcoin’s present value ranges as doubtlessly engaging for long-term buyers. The CVDD mannequin has traditionally been a dependable indicator, providing insights into Bitcoin’s valuation relative to its previous efficiency.

Nonetheless, Adler cautions that this and comparable fashions don’t account for exterior macroeconomic and political dangers. Occasions just like the COVID pandemic or the mining ban in China have beforehand disrupted Bitcoin’s trajectory, demonstrating the unpredictable nature of the market. Whereas Bitcoin has traditionally proven resilience and a outstanding capability to get well from setbacks, it’s essential to keep in mind that previous efficiency doesn’t assure future outcomes.

As Bitcoin continues to consolidate close to its all-time highs, the market’s consideration stays on whether or not it might maintain its bullish momentum. If the CVDD mannequin’s predictions align with precise efficiency, the approaching months might see Bitcoin attain unprecedented ranges. Nonetheless, buyers ought to stay conscious of exterior dangers and market volatility as they navigate this pivotal stage in Bitcoin’s cycle.

BTC Value Motion Indicators Lengthy-Time period Power

Bitcoin has skilled vital volatility following Monday’s inauguration day, showcasing the market’s unsure however energetic sentiment. After tagging a brand new all-time excessive at $109,300, BTC noticed a speedy pullback, testing the vital $100,000 degree inside hours. This sharp fluctuation highlights the continued tug-of-war between bulls and bears because the market seeks a clearer path.

On a long-term timeframe, Bitcoin’s value motion stays bullish, with constant new highs being set since late November 2024. This regular upward pattern underscores the energy of BTC’s bullish momentum, even amid heightened volatility and market uncertainty. Traders stay optimistic about Bitcoin’s potential for additional good points, supported by its sturdy efficiency over the previous months.

Nonetheless, for BTC to substantiate its bullish part and sign the continuation of the rally, it should decisively break above its all-time excessive and maintain the breakout. A profitable transfer above $109,300 would possible entice contemporary shopping for curiosity and reaffirm confidence amongst market individuals, paving the best way for BTC to enter value discovery and set new data.

Failing to reclaim the ATH might result in additional consolidation round key ranges, maintaining the market in suspense. The approaching days might be essential as BTC navigates this pivotal part in its present bullish cycle.

Featured picture from Dall-E, chart from TradingView