Bitcoin and Ethereum maintain regular as ETF flows, Fed bets, and new regulatory actions have crypto in a holding sample.

Bitcoin (BTC) and Ethereum (ETH) slipped just a little within the final 24 hours, as BTC fluctuated across the mark of $115,000, and ETH across the mark of $4,160 on Tuesday.

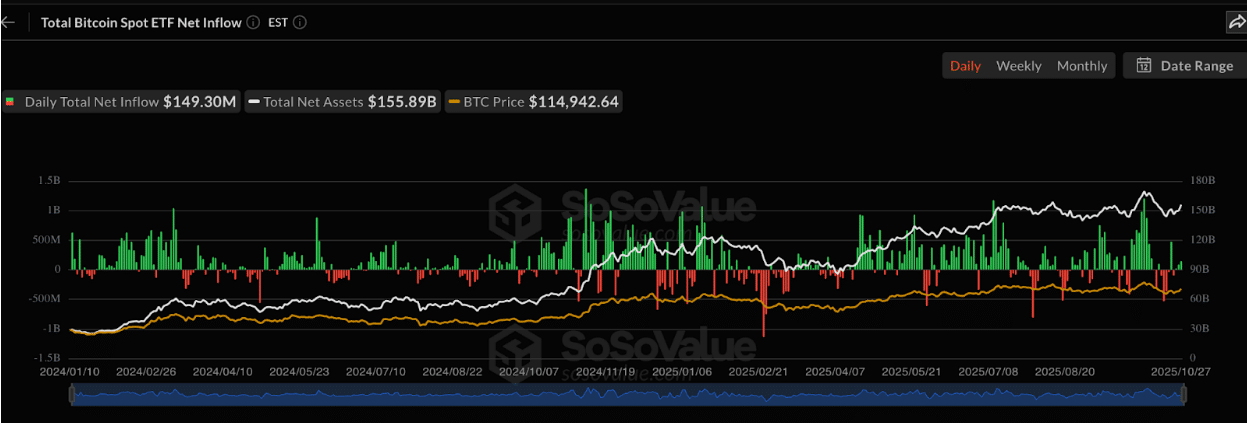

SoSoValue information reveals that US spot Bitcoin ETFs recorded a internet influx of $149 million, indicating that traders have been persistently displaying curiosity in Bitcoin regardless of the worth fluctuations.

Why Did Bitcoin Appeal to $931M Whereas Ethereum Logged Outflows?

In keeping with CoinShares’ report, traders added about $931 million into Bitcoin funds final week, at the same time as ether merchandise logged $169 million in outflows.

The break up has continued this week, pointing to stronger demand for BTC than ETH.

Reuters reported that Canary Capital plans to roll out the primary US spot Litecoin and Hedera ETFs on Tuesday. Bitwise is making ready a Solana-focused product, a transfer seen as testing the.

A separate report stated the SEC is “poised” to approve Hedera and Litecoin ETFs, suggesting extra altcoin merchandise could quickly enter the market.

In Washington, the White Home has nominated crypto coverage lawyer Mike Selig to guide the Commodity Futures Buying and selling Fee, signaling continued give attention to digital-asset oversight and market construction.

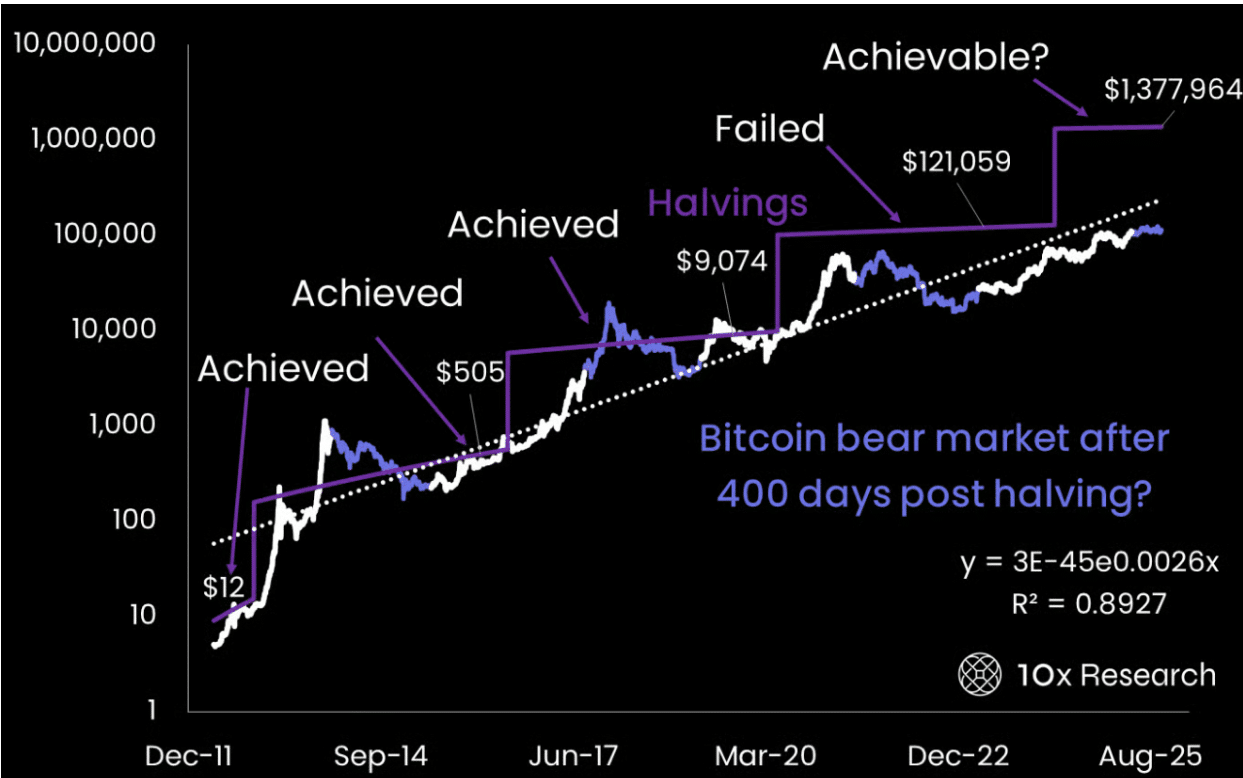

In the meantime, 10x Analysis warned that Bitcoin could now be too costly for regular retail shopping for, which may weaken expectations for a longer-running bull cycle.

The agency stated latest optimism about an prolonged market section may not maintain if on a regular basis patrons start to drag again.

Bitcoin is simply 16 years outdated, so drawing “agency statistical conclusions” from such a restricted historical past continues to be “extremely questionable,” the report stated.

Lookonchain reported BlackRock’s spot Ethereum ETF purchased 17,238 ETH price about $70.69 million on Oct. 27.

Oct 28 Replace:

10 #Bitcoin ETFs

NetFlow: +1,458 $BTC(+$167.4M)#BlackRock inflows 567 $BTC(+$65.15M) and at present holds 805,807 $BTC($92.51B).

9 #Ethereum ETFs

NetFlow: +27,066 $ETH(+$111M)#BlackRock inflows 17,238 $ETH($70.69M) and at present holds 4,010,286… pic.twitter.com/MbCiAP2ml7

— Lookonchain (@lookonchain) October 28, 2025

It’s also preceded by the US SEC signing off on spot ETFs of the ETFs, that are spot-ETFs, and these are indicative of the boldness BlackRock has in Ethereum as a long-term asset.

DISCOVER: Greatest New Cryptocurrencies to Put money into 2025

Bitcoin Value Prediction: Can Bitcoin Maintain Above $113,500 to Maintain Bullish Momentum?

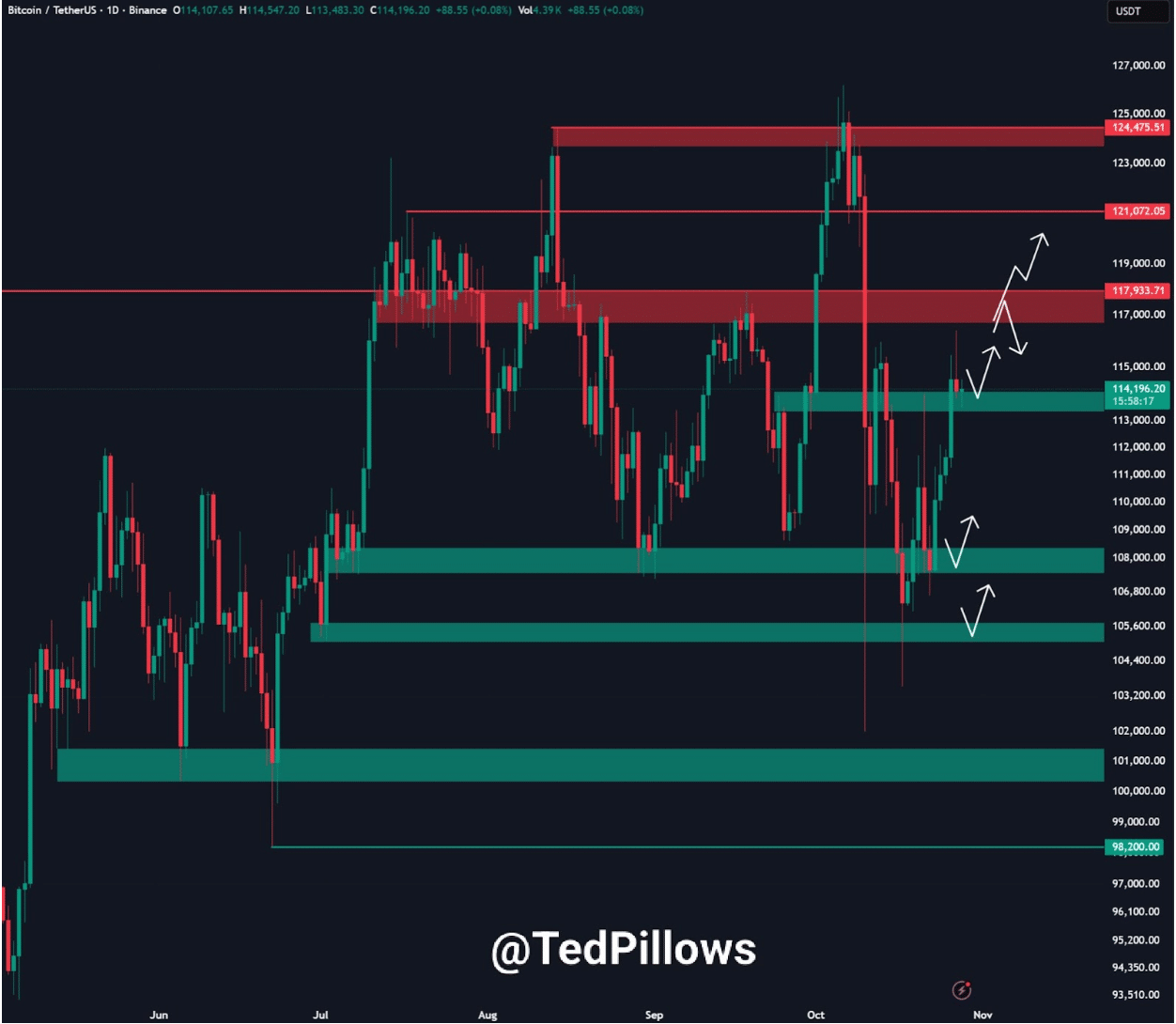

As per Ted’s evaluation, Bitcoin is buying and selling at a excessive of about $114,000 and has bounced off the assist of $113,500. This degree has served as a steady flooring in retests.

The chart signifies that there’s evident shopping for curiosity inside $112,000 to $113,500, and merchants intervened once more to guard additional losses.

Overhead, sellers seem lively between $116,500–$118,000 and once more at $121,000–$125,000. If worth strikes above $117,500, the subsequent goal sits close to $119,000, with room to stretch towards the $121,000 space.

If momentum cools, Bitcoin could dip again towards $111,000–$112,000. A break under that band may pull the market towards $108,000, with one other demand pocket close to $105,600.

For now, worth stays caught in a broad vary. Help is layered under, whereas provide caps upside strikes. The near-term outlook stays optimistic so long as BTC holds above $113,500.

Analyst Ali Martinez famous $111,160 as agency assist primarily based on cost-basis information. He positioned resistance close to $117,630, the place extra sellers are prone to seem.

For Bitcoin $BTC, $111,160 acts as key assist whereas $117,630 stays the resistance to interrupt for bullish continuation. pic.twitter.com/cRqVDrmdiZ

— Ali (@ali_charts) October 28, 2025

A transfer above that line may sign continuation. If not, Bitcoin could keep in its present consolidation section.

DISCOVER: 20+ Subsequent Crypto to Explode in 2025

Ethereum Value Prediction: Does Promoting Strain Close to Resistance Threaten a Pullback to $3,800?

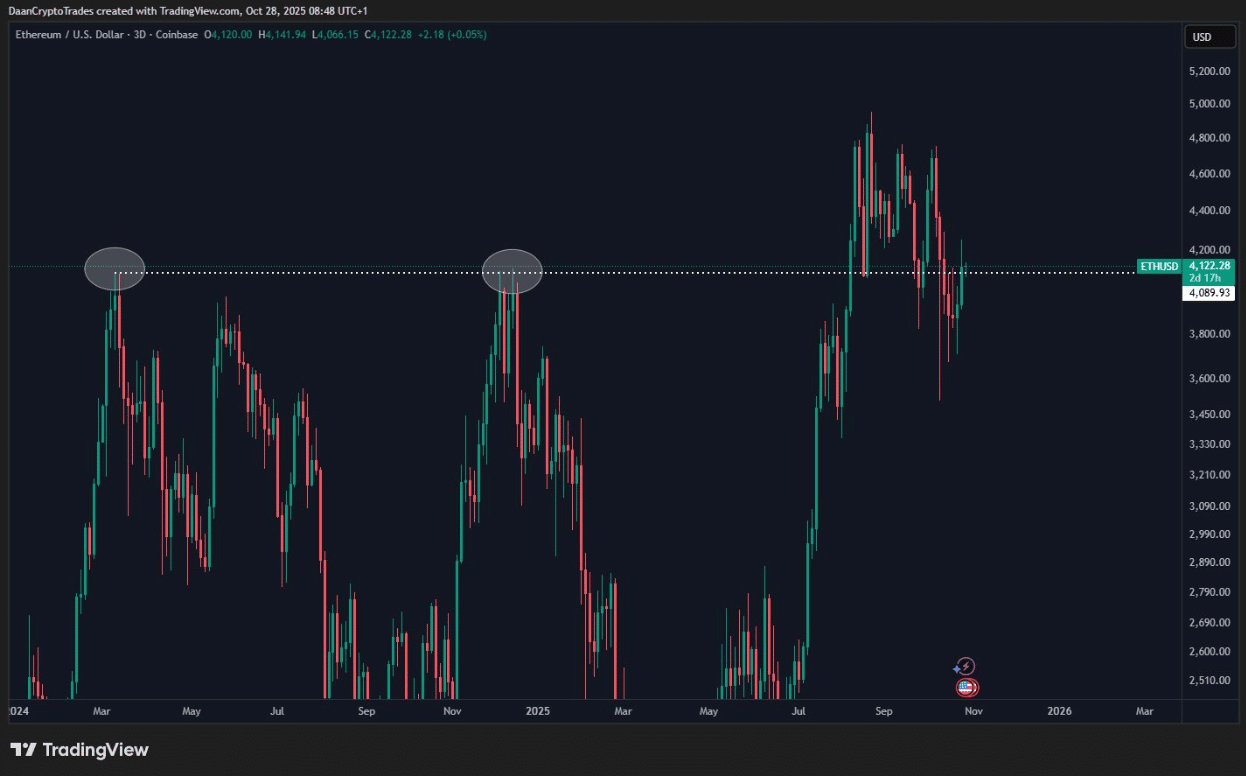

In keeping with Daan Crypto, Ethereum is as soon as once more pushing into a serious resistance space that beforehand marked cycle highs.

$ETH Huge check right here round its earlier cycle highs.

For me, that is the extent to interrupt and maintain if the bulls wish to get again to the highs in due time.

One other rejection right here wouldn’t be nice for this bigger timeframe view. https://t.co/xNJtY203aA pic.twitter.com/a4uoiZ6K1z

— Daan Crypto Trades (@DaanCrypto) October 28, 2025

The three-day chart signifies that ETH is buying and selling underneath the primary horizontal zone, which has already rejected the worth beforehand in March 2024 after which in late 2024.

These two reversals have been sharp, demonstrating how sturdy this provide space has been.

Current worth motion signifies {that a} gradual upward development will begin off the lows of mid-2025, and the upper swing factors will help in regaining construction.

The rally has calmed down, but assist of the development exists.

The brand new candles point out a reluctance with numerous wicks touching again resistance and indicating additional promoting.

The sample seems like a multi-top forming underneath a flat ceiling. If ETH can break above this zone and maintain, patrons could regain management and push towards $4,600 to $4,800.

But when resistance holds once more, worth may pull again towards $3,800, and even towards a broader demand zone close to $3,500.

DISCOVER: 20+ Subsequent Crypto to Explode in 2025

Be a part of The 99Bitcoins Information Discord Right here For The Newest Market Updates

The put up Bitcoin & Ethereum Value Forecast: Consolidation Forward? appeared first on 99Bitcoins.