As Bitcoin (BTC) skilled a modest dip over the weekend – falling from practically $112,000 to $106,600 – late longs bore the brunt, with over-leveraged merchants dealing with important liquidations. In distinction, long-term buyers took benefit of the pullback to extend their BTC publicity.

Bitcoin Late Longs Get Wiped Out

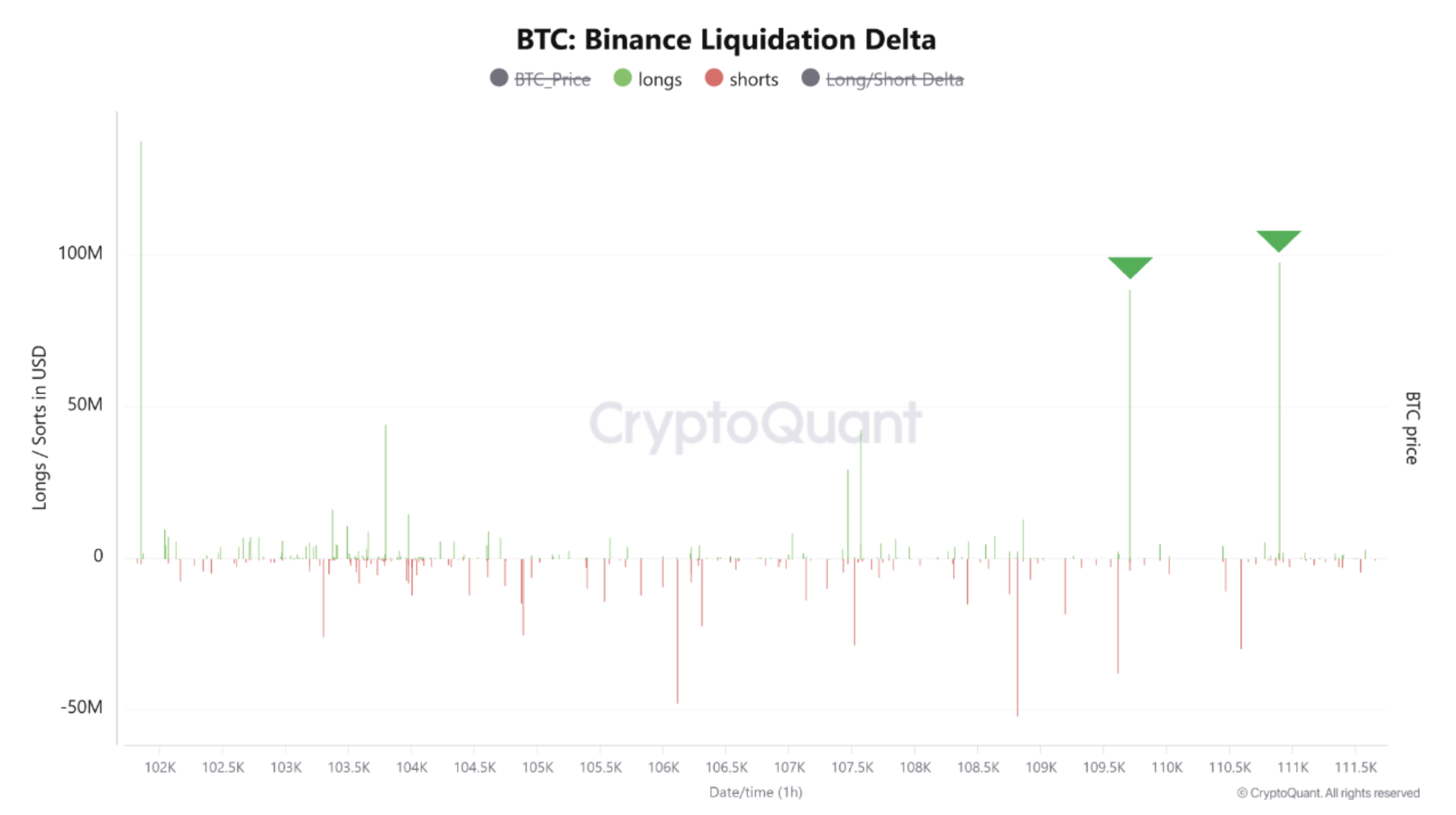

In line with a latest CryptoQuant Quicktake submit by contributor Amr Taha, Bitcoin’s value drop under the important thing $111,000 stage triggered a cascade of liquidations that primarily affected late lengthy positions. In complete, the downward transfer led to roughly $185 million in lengthy place liquidations.

For the uninitiated, Bitcoin late longs discuss with leveraged lengthy positions entered into after a value rally, usually by merchants anticipating additional short-term features. These positions are weak to sudden value drops, resulting in fast liquidations when assist ranges fail.

The primary main liquidation cluster occurred round $110,900. As soon as BTC fell under this stage, over $97 million in lengthy positions had been worn out. A second wave of liquidations adopted when the value dipped under $109,000, wiping out an extra $88 million in leveraged longs inside hours.

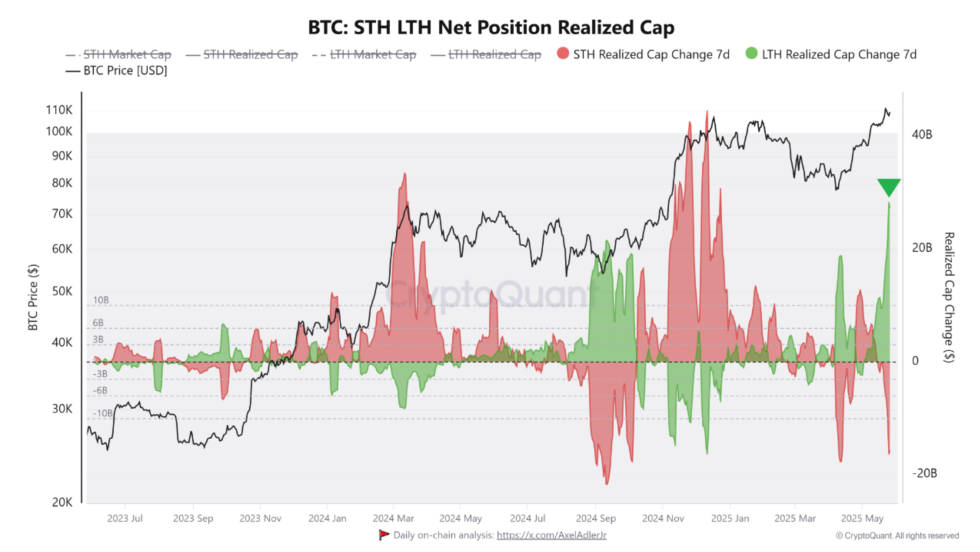

Whereas short-term holders (STH) confronted heavy losses, long-term holders (LTH) responded otherwise. Reasonably than being shaken out, they seized the chance to build up extra Bitcoin.

Taha highlighted that, primarily based on the STH/LTH Web Place Realized Cap chart, the LTH realized capitalization has now exceeded $28 billion for the primary time since April 2025. The analyst added:

With the LTH realized cap now surpassing $28 billion, it’s clear that long-term buyers are utilizing this era of compelled promoting to extend their publicity and accumulate extra Bitcoin for the long term. This strategic accumulation throughout moments of market stress displays the deep conviction of LTHs.

In a separate submit on X, famous crypto analyst Titan of Crypto famous that Bitcoin not too long ago achieved its highest weekly shut ever. This milestone underscores the robust bullish sentiment shared amongst long-term buyers, who proceed to anticipate greater costs.

What Is Working For BTC?

A number of market observers have identified that the present rally seems extra sustainable than earlier ones, with fewer indicators of euphoria. Analysts argue that Bitcoin’s ongoing upward momentum has not exhibited overheating, suggesting a more healthy market construction.

Furthermore, technical indicators counsel formidable value targets for Bitcoin. For instance, analyst Gert Van Lagen has projected that BTC might soar as excessive as $300,000 throughout this bull cycle.

Institutional curiosity additionally stays robust. Technique CEO Michael Saylor not too long ago hinted at one other massive Bitcoin buy, additional reinforcing confidence in BTC’s long-term potential. At press time, BTC trades at $109,535, up 1.9% up to now 24 hours.

Featured Picture from Unsplash.com, charts from CryptoQuant, X, and TradingView.com

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent overview by our group of prime know-how consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.