The Bitcoin worth kicked off the weekend within the worst method potential, falling beneath the $115,000 degree for the primary time since early July. Contemplating the supposed significance of this worth mark, there have been questions on how a lot headroom the value of Bitcoin nonetheless has. The newest on-chain knowledge means that the Bitcoin bull run won’t be over simply but.

BTC Lengthy-Time period Holders Begin Distributing

In an August 1st put up on X, crypto analyst Joao Wedson reported that the Bitcoin cycle for the long-term holders appears to be coming to an finish.

Associated Studying

Wedson emphasised that, whatever the ongoing pleasure round ETFs, on-chain knowledge exhibits a transparent market shift. This shift indicators that the cryptocurrency’s long-term holders are starting to promote their cash, and, in giant volumes, too.

In line with the analyst, about 50% of the quantity of Bitcoin held in exchange-traded funds has been offered by the LTHs. No matter this case, nonetheless, Wedson expects the BTC bull market to go on for “a minimum of 2 extra months” and the altcoins’ bull cycle for 3 months.

Key Metrics Flash Warnings – However ‘Last High’ Not But Seen

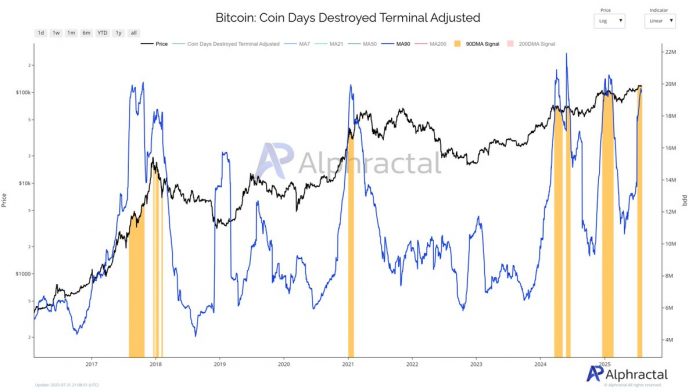

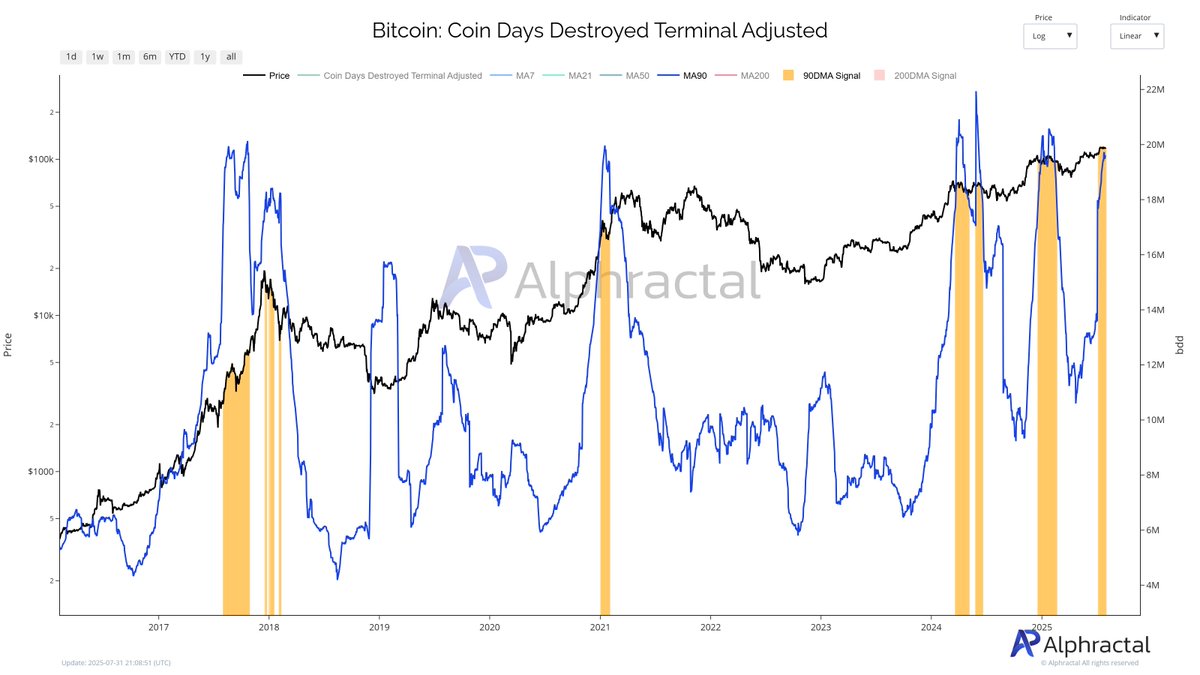

Wedson backed his declare with 4 on-chain indicators, beginning with the Coin Days Destroyed Terminal Adjusted Metric, which exhibits aged cash shifting after being dormant for an extended time frame.

The analyst defined that there was a important motion of previous BTC over the previous two years. This, Wedson emphasised, triggered three main warning indicators that coincide with a neighborhood high.

Wedson additionally referenced the Reserve Danger Indicators to gauge present LTH conviction. This metric, from evaluation, has entered a warning zone, as there may be elevated promoting exercise and hand exchanges.

Subsequent, the net pundit quoted outcomes from the Spent Output Revenue Ratio (SOPR) Development Sign. The SOPR measures whether or not cash (on this case, Bitcoin) are moved at a revenue or loss. Wedson identified that this indicator lately flashed a bearish sign, which means elevated profit-taking out there.

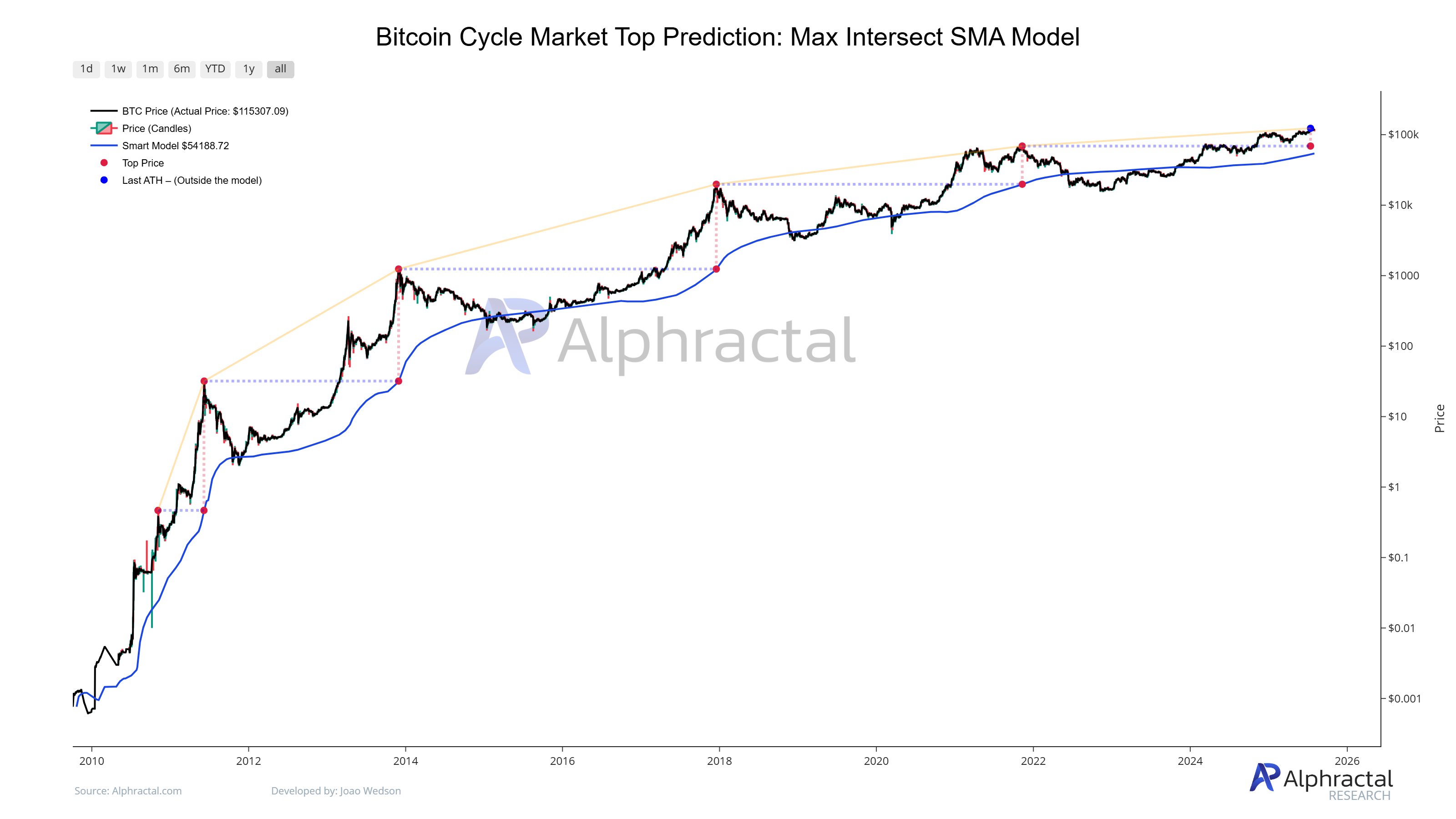

Referring to it as ‘essentially the most correct metric on the planet’ used to determine Bitcoin’s macro tops, the Bitcoin Cycle Market High Prediction: Max Intersect SMA Mannequin was put out final. Wedson highlighted that this metric is but to flash any bearish sign. Utilizing the chart beneath, the analyst defined that till the blue line reaches the $69,000 degree, the ultimate high is but to reach.

Finally, the analyst preached warning towards panicking, as historic cycle patterns counsel that the ultimate market high has but to reach. As of this writing, Bitcoin is valued at about $113,052, reflecting a 1.2% worth decline previously 24 hours.

Associated Studying

Featured picture from iStock, chart from TradingView