With all the present bearish sentiment and macroeconomic uncertainty swirling round each Bitcoin and the broader world financial system, it would come as a shock to see miners as bullish as ever. On this article, we’ll unpack the information that means Bitcoin miners should not simply staying the course, they’re accelerating, doubling down at a time when many are pulling again. What precisely do they know that the broader market could be lacking?

For a extra in-depth look into this matter, try a latest YouTube video right here:

Why Bitcoin Miners Are Doubling Down Proper Now

Bitcoin Hash Charge Going Parabolic

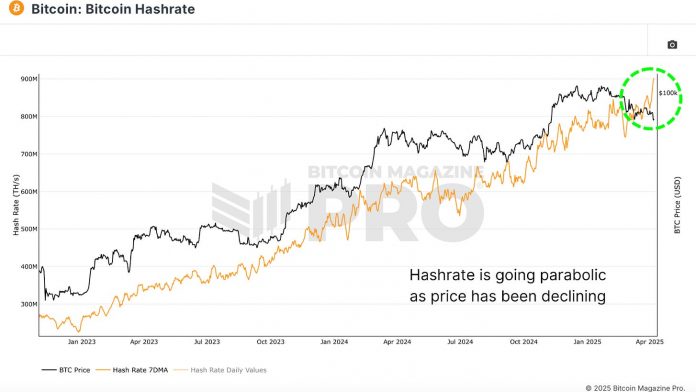

Regardless of Bitcoin’s latest value underperformance, the Bitcoin Hashrate has been going completely vertical, breaking all-time highs with seemingly no regard for macro headwinds or sluggish value motion. Sometimes, hash price is tightly correlated with BTC value; when value drops sharply or stays stagnant, hash price tends to plateau or decline as a result of financial stress on miners.

But now, within the face of heightened world tariffs, financial slowdown, and a consolidating BTC value, hash price is accelerating. Traditionally, this stage of divergence between hash price and value has been uncommon and infrequently vital.

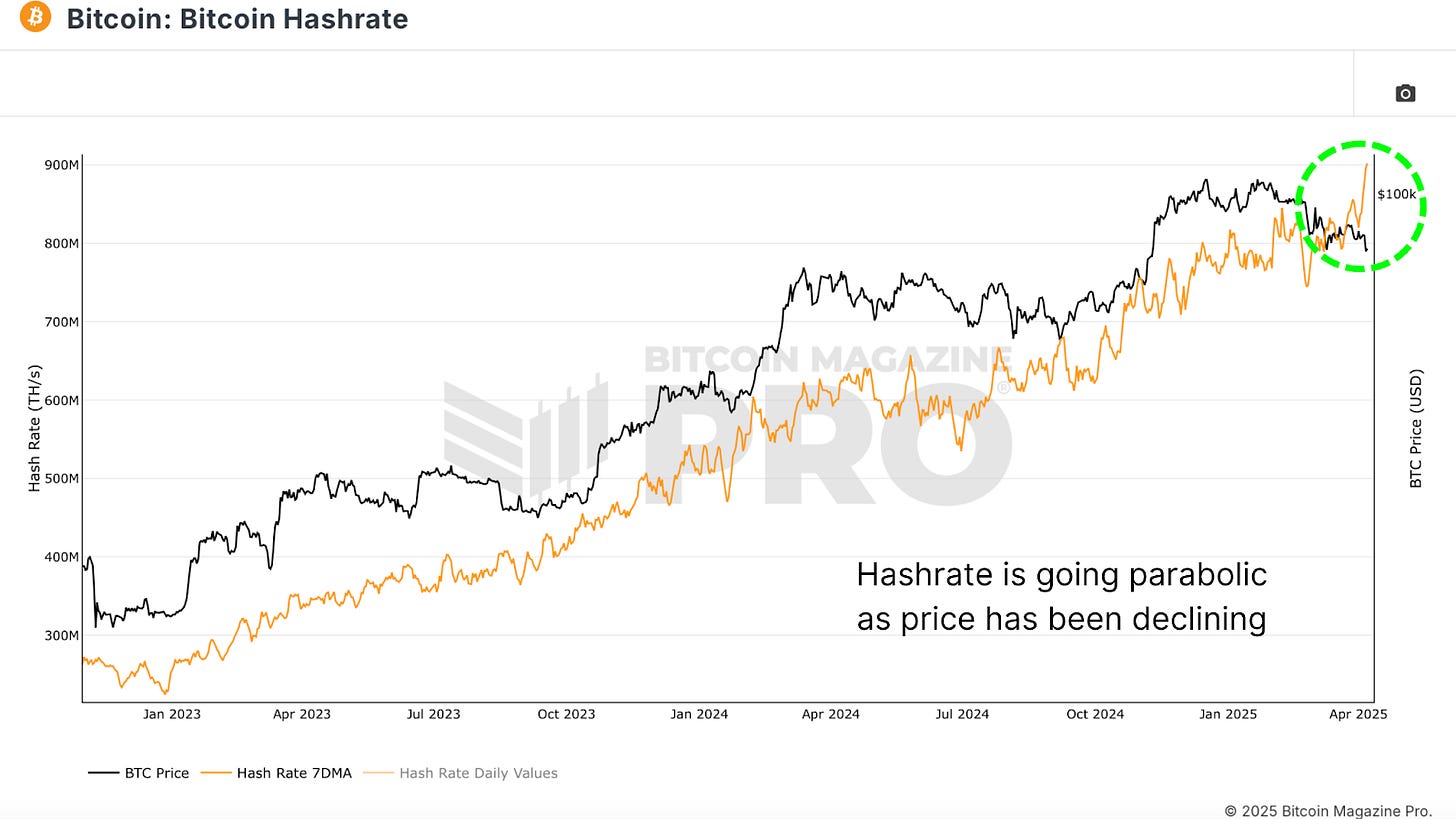

Bitcoin Miner Issue, an in depth cousin to hash price, simply noticed one among its largest single changes upward in historical past. This metric, which auto-adjusts to maintain Bitcoin’s block timing constant, solely will increase when extra computational energy floods the community. A problem spike of this magnitude, particularly when paired with poor value efficiency, is sort of unprecedented.

Once more, this implies that miners are investing closely in infrastructure and sources, even when BTC value doesn’t seem to help the choice within the brief time period.

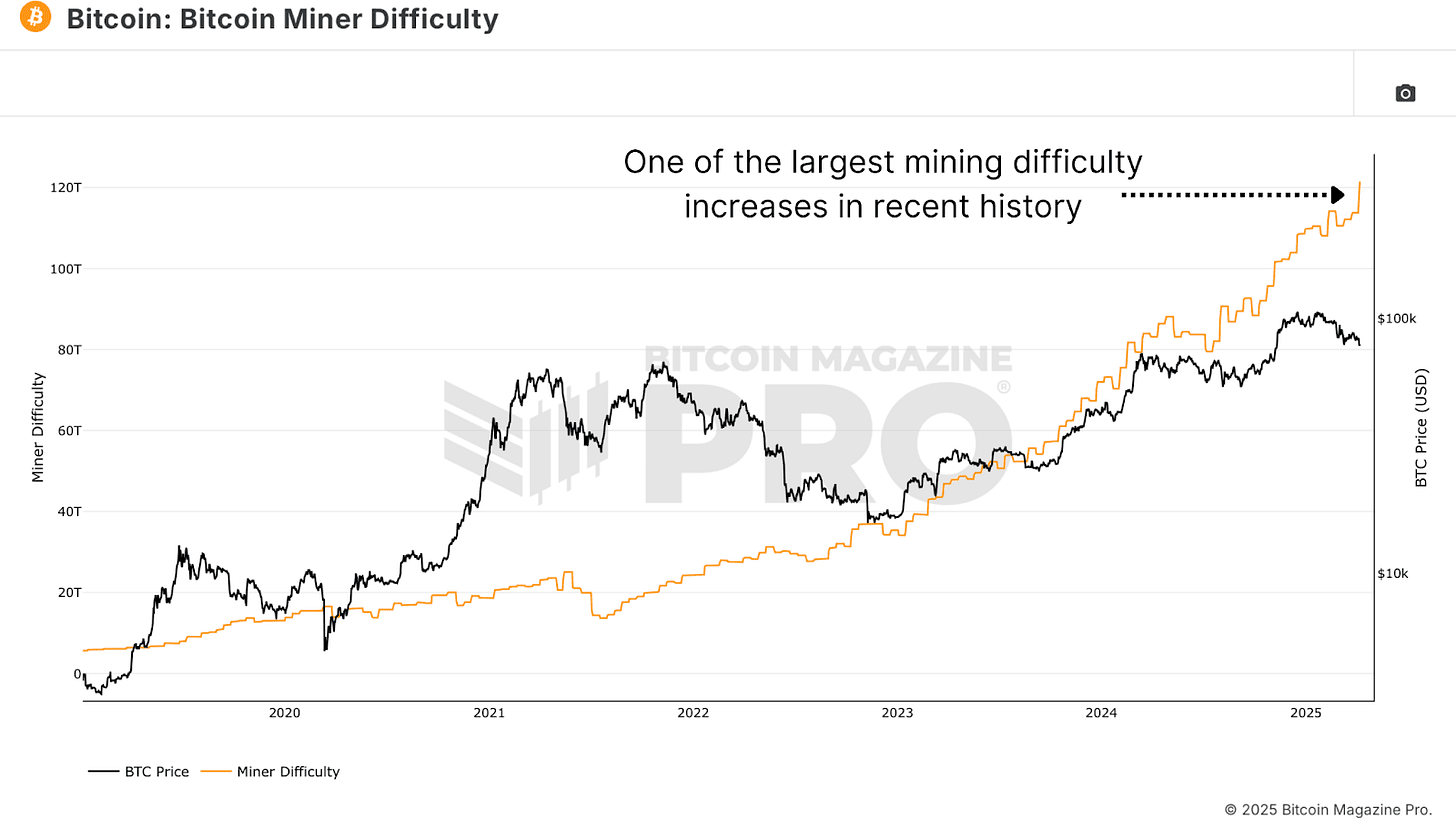

Including additional intrigue, the Hash Ribbons Indicator, a mix of brief and long-term hash price transferring averages, just lately flashed a traditional Bitcoin purchase sign.

When the 30-day transferring common (blue line) crosses again above the 60-day (purple line), it indicators the top of miner capitulation and the start of renewed miner energy. Visually, the background of the chart shifts from crimson to white when this crossover happens. This has usually marked highly effective inflection factors for BTC value.

What’s putting this time round is how aggressively the 30-day transferring common is surging away from the 60-day. This isn’t only a modest restoration, it’s an announcement from miners that they’re betting closely on the longer term.

The Tariff Issue

So, what’s fueling this miner frenzy? One believable clarification is that miners, particularly U.S.-based ones, try to front-run the influence of looming tariffs. Bitmain, the dominant producer of mining tools, is now within the crosshairs of commerce insurance policies that would see tools costs surge by 30–50%, doubtlessly to even over 100%!

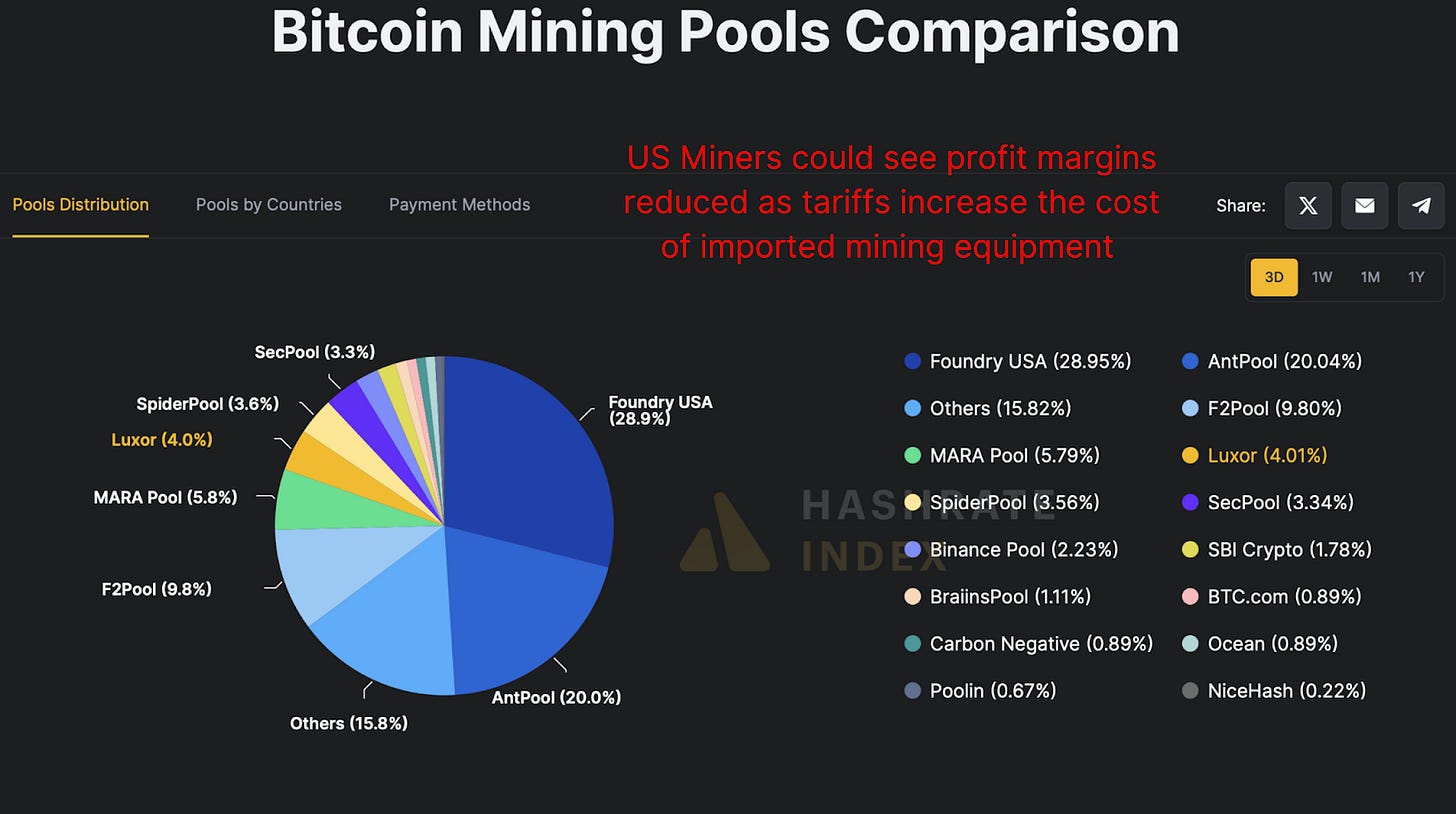

On condition that over 40% of Bitcoin’s hash price is managed by U.S.-based swimming pools like Foundry USA, Mara Pool, and Luxor, any value improve would drastically scale back revenue margins. Miners could also be aggressively scaling now whereas {hardware} remains to be (comparatively) low cost and obtainable.

Bitcoin Miners Preserve Mining

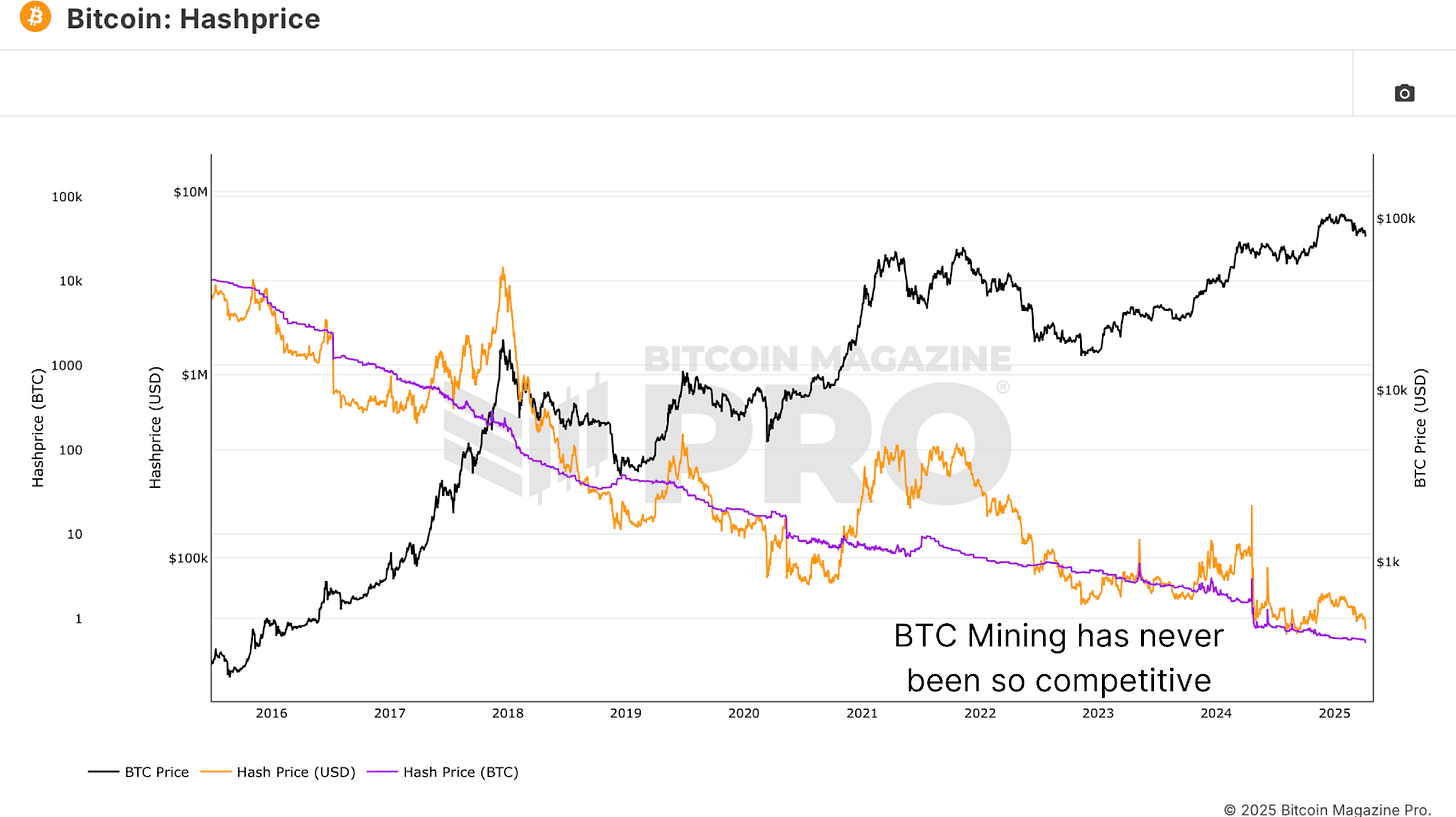

Hashprice, the BTC-denominated income per terahash of computational energy, is at historic lows. In different phrases, it’s by no means been much less worthwhile in BTC phrases to function a Bitcoin miner on a per-terahash foundation. Sometimes, we see hash value improve towards the tail-end of bear markets, as competitors fades and weaker gamers exit the area.

However that’s not taking place right here. Regardless of horrible profitability, miners should not solely staying on-line, they’re deploying extra hash energy. This might indicate one among two issues; both miners are racing towards deteriorating margins to front-load BTC accumulation, or, extra optimistically, they’ve sturdy conviction in Bitcoin’s future profitability and are shopping for the dip aggressively.

Bitcoin Miners Conclusion

So, what’s actually taking place? Both miners are desperately front-running {hardware} prices, or, extra probably, they’re signaling one of many strongest collective votes of confidence in the way forward for Bitcoin we’ve seen in latest reminiscence. We’ll proceed monitoring these metrics in future updates to see whether or not this miner conviction is confirmed proper.

Should you’re fascinated about extra in-depth evaluation and real-time knowledge, contemplate testing Bitcoin Journal Professional for invaluable insights into the Bitcoin market.

Disclaimer: This text is for informational functions solely and shouldn’t be thought-about monetary recommendation. At all times do your personal analysis earlier than making any funding choices.