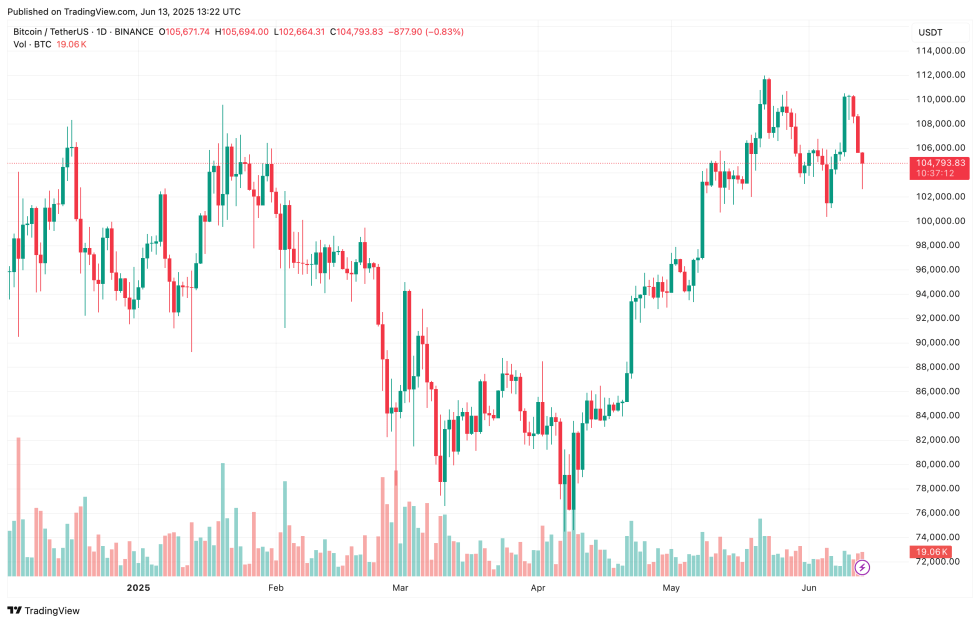

Regardless of a current stoop in Bitcoin (BTC) worth pushed by rising geopolitical tensions within the Center East, general market sentiment stays constructive, with the main cryptocurrency nonetheless buying and selling within the mid-$100,000 vary. Additional, a key on-chain indicator means that the present BTC rally might nonetheless have extra room to run.

Bitcoin Puell A number of Suggests Extra Features Forward

Based on a current CryptoQuant Quicktake submit by contributor Gaah, Bitcoin’s Puell A number of means that the continued bullish rally could also be removed from over. The on-chain metric is at present hovering close to the low cost zone, beneath 1.40.

For the uninitiated, the Puell A number of is an on-chain metric that compares the every day income earned by Bitcoin miners to its 365-day transferring common (MA), serving to to determine intervals of potential market overvaluation or undervaluation.

Traditionally, values beneath 1.0 have a tendency to point miner stress or market accumulation phases, whereas considerably larger values might sign overheated circumstances or potential market tops. Commenting on the indicator’s current habits, Gaah famous:

This habits of the Puell A number of means that, regardless of the numerous worth appreciation, miners’ revenues have but to observe swimsuit – signaling that the market could also be being pushed by exterior forces, resembling institutional demand, ETFs, or tightening circulating provide.

The contributor additionally pointed to the drop in block rewards following the April 2024 halving, which has possible exacerbated the income hole for miners – at the same time as BTC costs rise on the again of broader adoption.

Gaah concluded that present circumstances might characterize a “potential window of alternative” to build up BTC. The mix of elevated costs and subdued miner fundamentals means that the present cycle might have extra upside potential within the coming months.

BTC Exhibiting Indicators Of Euphoria?

Retail curiosity in BTC stays muted in comparison with prior cycle peaks, however institutional curiosity continues to develop as adoption will increase. An increasing variety of entities are accumulating BTC, showcasing Bitcoin’s maturation as a legit retailer of worth.

For instance, GameStop just lately introduced plans to lift $1.75 billion by convertible notes, shortly after buying 4,710 BTC. This transfer echoes methods employed by firms like Metaplanet and Technique, which have additionally used debt financing to spice up their BTC publicity.

In the meantime, bullish forecasts for a brand new BTC all-time excessive (ATH) proceed to emerge. Bitwise CEO Hunter Horsley just lately predicted that BTC would possible face minimal resistance as soon as it breaks previous the $130,000 mark.

As for the timeline, crypto analyst Ted Pillows urged that BTC might attain $130,000 as early as Q3 2025. On the time of writing, Bitcoin is buying and selling at $104,793, down 2% up to now 24 hours.

Featured Picture from Unsplash.com, charts from CryptoQuant and TradingView.com

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent overview by our crew of high know-how consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.