Heightened bearish strain continues to hinder Bitcoin, inflicting its worth to drop as little as $89,000 Right this moment after a current try to recuperate the pivotal $100,000 mark. With the present decline in worth, many buyers are witnessing vital losses of their BTC investments, rising the chance of a sell-off.

A Persistent Lower In Bitcoin’s Realized Losses

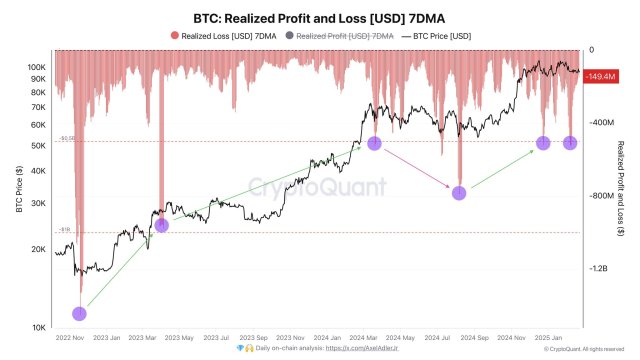

Bitcoin’s worth just lately skilled a notable decline thought-about to be triggered by broader market volatility. Following the pullback, on-chain knowledgeable and creator Axel Adler Jr outlined a damaging pattern in BTC’s market dynamics as buyers face mounting losses of their positions.

This fixed loss highlights the continuing wrestle for BTC to take care of and regain upward momentum. Moreover, it means that many buyers are both holding at a loss or promoting at a loss, reflecting weak market sentiment and potential capitulation. As BTC’s worth fails to carry key help ranges, buyers’ losses might develop bigger, which might result in large promoting strain within the brief time period.

Axel Adler revealed a persistent rise in realized losses after inspecting the Bitcoin Realized Revenue and Loss Metric within the 7-day time-frame. Nonetheless, the knowledgeable famous that the magnitude of those losses is way lower than it was throughout the panic sell-offs in late 2022.

Provided that the losses are decrease in comparison with 2022, this factors to a extra steady market construction for Bitcoin, the place buyers are promoting extra fastidiously and a few usually are not in a haste to exit at any worth.

Though realized losses are rising, on-chain knowledge reveals that the whole realized losses are nonetheless at a reasonable degree. Such improvement signifies an total constructive perspective and constant demand for BTC amidst unfavorable market circumstances. If the present sample continues, even periodic will increase in loss-taking gross sales are unlikely to alter the final upward pattern.

BTC’s internet realized revenue/loss metric has managed to remain flat and at its lows regardless of the current hack carried out on the Bybit crypto alternate. Whereas the event influenced Bitcoin’s worth, Negentropic highlighted that the hack solely stalled its push to $100,000, which brought about its worth to say no to the $95,000 degree.

Within the meantime, the important thing liquidity zone remains to be on the $92,000 mark. Ought to the realized loss surge, Negentropic believes that the formation of a backside will likely be extra strongly confirmed.

BTC’s Value Gearing Up For A Breakout

Up to now few days, BTC might have undergone waning performances, rising the potential of an extra bearish transfer. Nonetheless, Captain Faibik, a crypto knowledgeable has noticed an encouraging pattern on the 1-day chart, suggesting that upside momentum is constructing.

Particularly, the knowledgeable has hinted at an impending breakout from the Falling Wedge chart formation. As soon as BTC efficiently breaks out of the sample, Captain Faibik is assured that the asset might rally towards the $105,000 essential resistance degree within the upcoming days.

Featured picture from Unsplash, chart from Tradingview.com