Bitcoin has skilled lackluster worth motion over the previous few days, buying and selling in a slim vary between $94,700 and $98,600 since final Friday. This stagnant motion has added to the speculative surroundings, leaving the market unsure about short-term course. Neither bulls nor bears have been capable of take management, creating a way of indecision amongst traders who had hoped for stronger momentum.

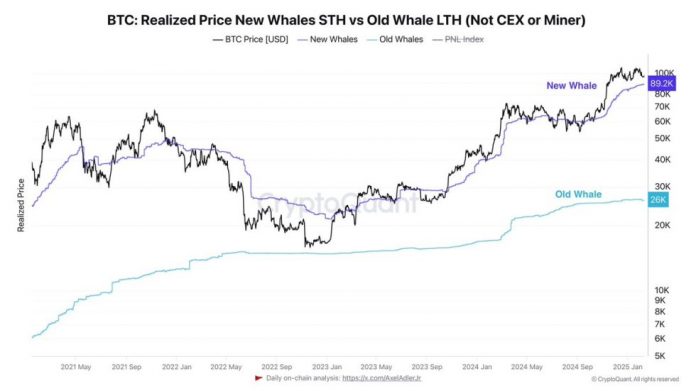

CryptoQuant analyst Axel Adler shared insightful metrics on X, revealing that the realized worth of latest whales sits round $89.2K. This degree represents the strongest help for the present consolidation section, which spans from all-time highs (ATH) at $109K to the $89K key demand zone. In response to Adler, this help highlights the importance of latest whale exercise, as these giant gamers are unlikely to promote at a loss, bolstering the market’s resilience within the occasion of a downturn.

For now, the market stays in a essential zone, with the consolidation between key ranges defining Bitcoin’s subsequent transfer. A push above $98,600 might sign bullish momentum, paving the best way for a check of the $100K mark and probably ATH. Nonetheless, shedding $94,700 would elevate the danger of a retest of the $89K help zone. Buyers proceed to observe these ranges intently.

Bitcoin Testing Liquidity Beneath $100K

Bitcoin continues to steer the market amid volatility and uncertainty, holding robust above essential demand ranges whereas most altcoins bleed closely. Bulls have managed to maintain BTC above the $95K mark, sustaining the bullish construction that has characterised this cycle. Regardless of this power, worth motion suggests no clear course within the quick time period, with volatility dominating the market as each bulls and bears battle for management.

Key metrics from CryptoQuant, shared by analyst Axel Adler on X, reveal that the realized worth of latest whales is round $89.2K. This degree is at the moment the strongest help for Bitcoin’s ongoing consolidation section. Adler notes that enormous gamers who purchased BTC at this worth are unlikely to promote at a loss, including resilience to the market. This implies that, even within the face of bearish sentiment and uneven worth motion, Bitcoin stays basically robust.

The $89.2K degree serves as a essential basis for Bitcoin’s present worth vary, which spans between all-time highs at $109K and demand ranges close to $89K. Whereas short-term course stays unclear, this robust help gives confidence to traders awaiting a breakout. If bulls reclaim the $98K degree and push above $100K, a check of vary highs might comply with.

Conversely, shedding $95K would open the door to a retest of $89K help. For now, Bitcoin is cementing its position as a market chief throughout this consolidation section, signaling the potential for upside because it holds above essential ranges.

BTC Worth Displaying Indecision

Bitcoin is buying and selling at $96,250 after a number of days of range-bound worth motion between $94,600 and $100,000. The market stays indecisive, with each bulls and bears struggling to take management. Bulls have been unable to push the value above the essential $100K mark, whereas bears haven’t managed to maintain the value beneath $95K. This back-and-forth has created uncertainty round short-term course, leaving merchants and traders on edge.

For bulls to reclaim momentum and make sure a short-term reversal, Bitcoin should break above the $98K degree and set up it as help. A subsequent push above the $100K mark could be essential to sign power and set the stage for a rally towards larger provide zones. Attaining this is able to shift market sentiment towards optimism and probably spark a brand new bullish section.

Nonetheless, if Bitcoin loses the $95K help degree, it dangers dropping towards decrease demand zones round $89K. This degree is taken into account a powerful help, backed by the realized worth of latest whales, in accordance with latest on-chain knowledge. Whereas the $95K degree stays intact, the market stays cautiously optimistic, however the coming days will probably be essential in figuring out whether or not Bitcoin can reclaim bullish momentum or slide additional into decrease ranges.

Featured picture from Dall-E, chart from TradingView