Bitcoin (BTC) is displaying weak point, slipping to the $115,000 vary and pulling additional away from its current highs.

It comes amid intense promote stress related to Galaxy Digital, pushed by a multi-day offloading spree sourced from one of many largest identified BTC whale wallets.

Dormant Bitcoin Giants Stir as Galaxy Digital Stress Peaks

Blockchain analytics instrument Lookonchain revealed that Galaxy Digital deposited 2,850 BTC, valued at $330 million, to exchanges early Friday. The transaction provides to over 12,800 BTC ($1.5 billion) moved to exchanges inside 24 hours alone.

“Appears like Galaxy Digital has already dumped the ten,000 BTC ($1.18B)! Over the previous 3 hours, they’ve withdrawn $370M USDT,” Lookonchain reported earlier.

The Bitcoin offered originated from a legendary whale tackle holding 80,009 BTC, value round $9.6 billion earlier than the sell-off.

This tackle started shifting cash to Galaxy Digital on July 15. In keeping with a number of posts from Lookonchain, the total switch was accomplished by July 18. Over 40,000 BTC was moved in in the future alone, triggering market issues.

“The Bitcoin OG with 80,009 BTC appears to be promoting BTC…Previously hour, they transferred 9,000 BTC ($1.06B) to Galaxy Digital—seemingly getting ready to promote by means of their companies,” Lookonchain famous on July 15.

Though the promote stress weighed closely on Bitcoin’s short-term value, some merchants imagine the worst could also be over.

Including to the market’s unease, a number of long-dormant Bitcoin wallets immediately turned energetic in July, triggering hypothesis that extra promoting might comply with. In keeping with blockchain analytics platform SpotOnChain, three wallets, seemingly tied to a single entity, moved 10,606 BTC value $1.26 billion this week.

All wallets obtained their BTC on December 13, 2020, when Bitcoin was priced at $18,803. At at the moment’s costs, these Bitcoin tokens have recorded a 6.3x achieve.

Dormant Bitcoin Wallets Wake Up En Masse in July

Lookonchain additionally recognized a whale pockets that has been dormant for 14.5 years. This week, it transferred 3,962 BTC ($468 million) to a brand new tackle.

The identical pockets obtained its Bitcoin at $0.37 per coin in January 2011, making it one of many oldest addresses to reactivate in current reminiscence.

Earlier in July, one other pockets moved 6,000 BTC ($649 million) after being quiet for six years. All three circumstances contain long-term holders transitioning to newer wallets or exchanges.

Neighborhood members on X (Twitter) have taken discover. Some speculate that these Satoshi-era Bitcoin holders could also be getting ready to exit throughout the subsequent bullish leg.

“There’s been a whole lot of previous bitcoin transfers currently,” one consumer posted. “Might they be getting ready to dump throughout the subsequent bull run?” wrote one consumer.

Mixed with Galaxy Digital’s current liquidation exercise, the reawakening of those aged wallets suggests a shifting dynamic within the crypto market. Outdated provide is more and more being repositioned forward of anticipated volatility.

Whereas Bitcoin’s fundamentals stay robust, July’s development of whales shifting cash has injected recent uncertainty into the short-term outlook. Now, merchants are monitoring volatility to substantiate that the promoting is completed, and traders hope recent inflows can raise BTC again towards new highs.

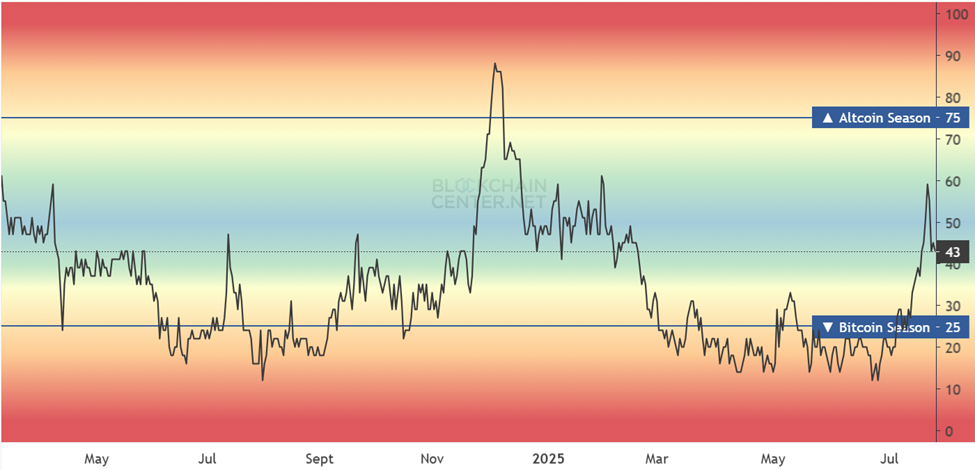

In the meantime, as Bitcoin whales spook markets, altcoin merchants sign capital rotation that might catalyze an altseason.

This expectation comes because the timing aligns with a steep decline in Bitcoin dominance. This index fell from 64% to 60% between July 17 and July 21.

The index tried a modest restoration on Friday, with a 61.55% studying as of this writing.

A falling dominance metric suggests traders are rotating out of Bitcoin and into altcoins. This development is likely one of the earliest indicators of an rising altcoin season.

The Altcoin Season Index, at 43, reveals that the crypto trade isn’t but within the altseason. Nonetheless, the rising trajectory additional helps the shift in market momentum.

Disclaimer

In adherence to the Belief Undertaking pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to supply correct, well timed info. Nonetheless, readers are suggested to confirm info independently and seek the advice of with an expert earlier than making any selections primarily based on this content material. Please observe that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.