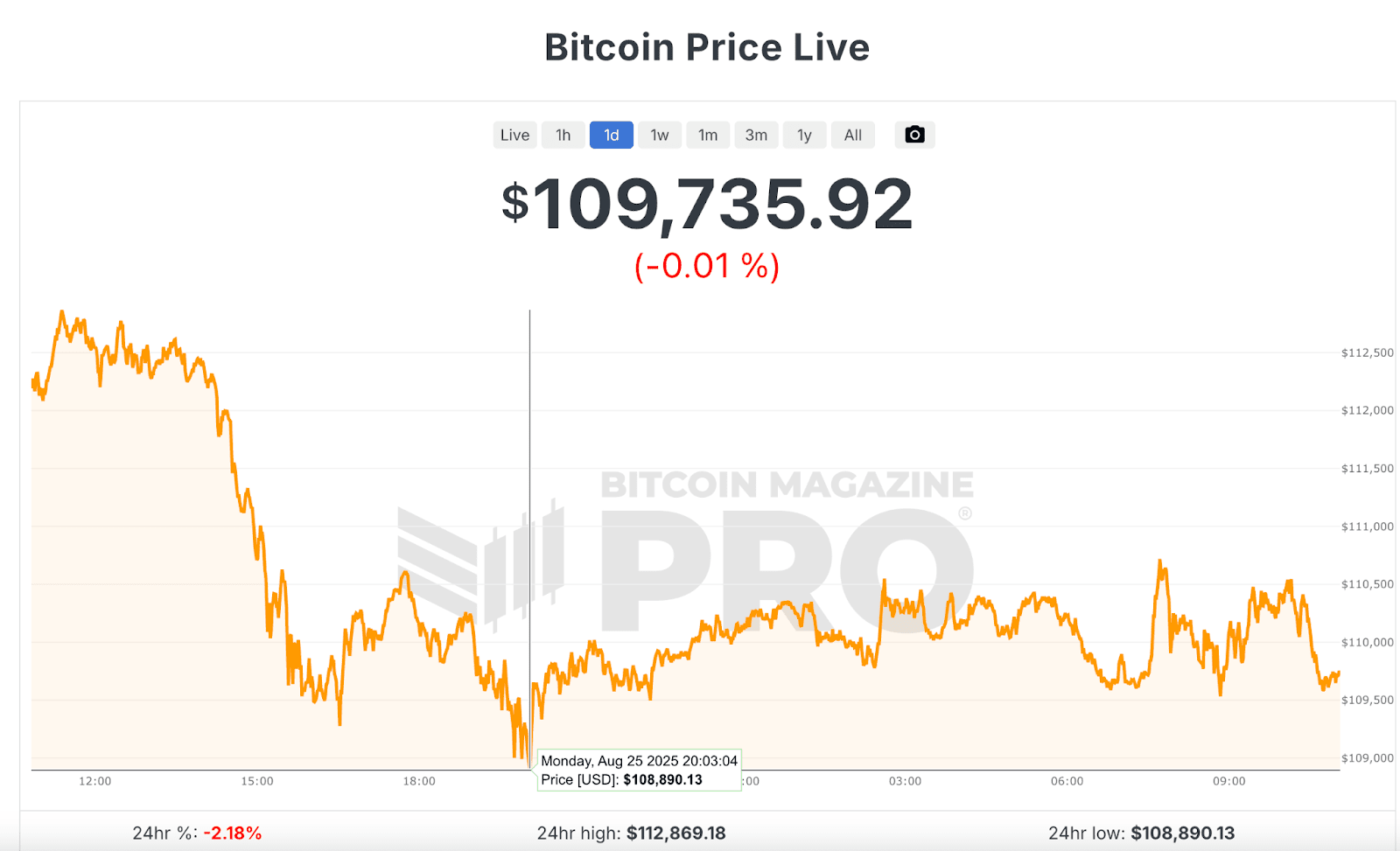

The worth of Bitcoin has plunged beneath $110,000 previously 24 hours, marking one in all its steepest corrections in weeks. In line with information from Bitcoin Journal Professional, the world’s largest cryptocurrency dropped to $108,890 and stays beneath the $110,000 threshold on the time of writing. The decline represents a pointy sell-off from simply final Friday, when Bitcoin traded as excessive as $117,000, earlier than tumbling to $109,894 over the weekend.

The downward momentum was accelerated by an enormous whale sale. Over the weekend, a single Bitcoin holder offloaded 24,000 BTC price greater than $2.7 billion, sparking extra promoting stress and driving the worth decrease. The massive transaction precipitated heightened volatility and weighed closely on market sentiment.

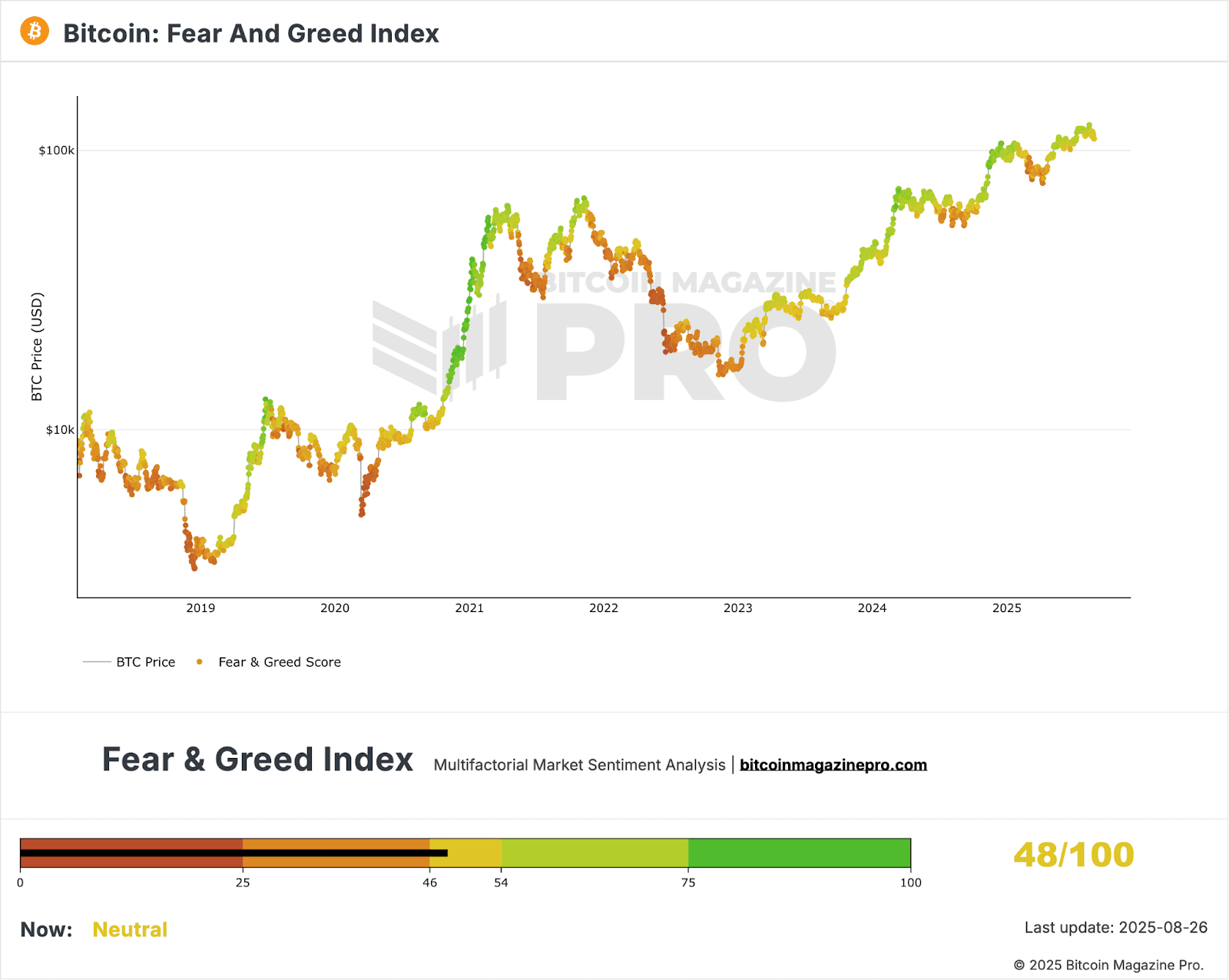

Regardless of the sharp transfer down, sentiment has not but tipped totally into concern. The Bitcoin Worry and Greed Index, a extensively watched market sentiment software, presently sits at 48/100, which is categorized as “impartial” however hovers simply above “concern.”

The Worry and Greed Index is a software that helps buyers and merchants analyze the Bitcoin and Crypto market from a sentiment perspective. It identifies the extent to which the market is turning into overly fearful or overly grasping. Therefore why it’s known as the Worry and Greed Index.

Bitcoin Journal Professional explains that the Index helps buyers separate their feelings from broader market reactions, providing insights into when property could also be overbought or oversold. Scores close to zero replicate “excessive concern,” whereas scores near 100 characterize “excessive greed.” With Bitcoin presently at 48, sentiment is edging towards concern however has not but totally entered bearish territory.

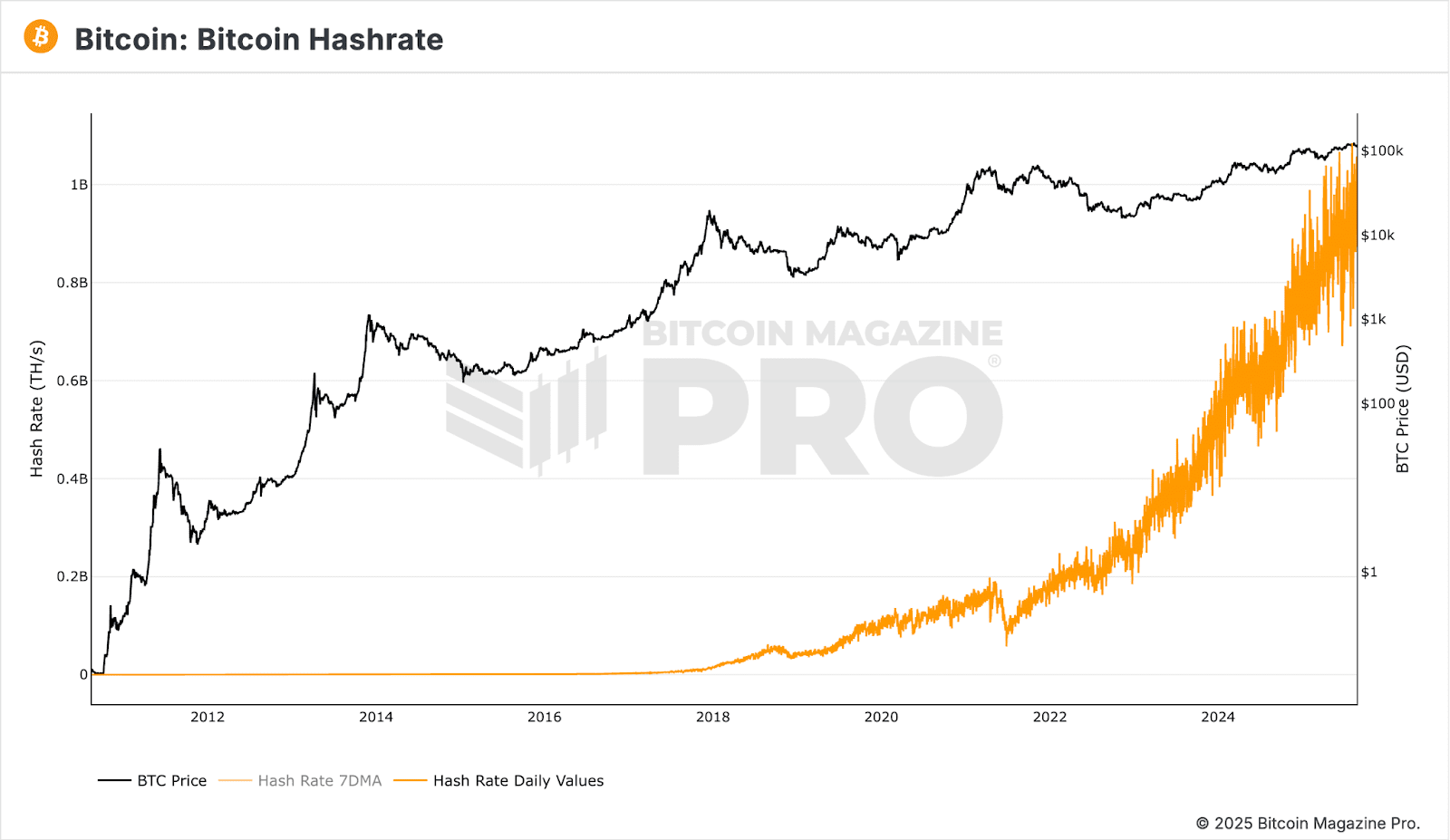

In the meantime, underlying community fundamentals stay robust regardless of worth weak point. Bitcoin’s hash fee—a measure of the full computational energy securing the community—is approaching a brand new file excessive. The present every day worth stands at 909,080,589 Th/s, simply shy of the all-time excessive of 1,084,828,947 Th/s set on August 4 when Bitcoin was buying and selling at $115,149.

Lengthy-term holders might discover reassurance in historic profitability information. Bitcoin Journal Professional notes that holding Bitcoin has been worthwhile for 99.1% of its existence:

- Variety of worthwhile days: 5,437

- Complete variety of days tracked: 5,487

- P.c of worthwhile days: 99.1%

Whereas the latest drop beneath $110,000 has rattled short-term merchants, Bitcoin’s monitor file and community power counsel resilience. Buyers might be carefully watching whether or not the Worry and Greed Index shifts additional into concern territory, and if whales proceed to unload giant holdings, probably including extra turbulence to the market within the coming days.