Bitcoin is buying and selling beneath the $100K mark after a rollercoaster of every week, marked by intense volatility and sustained promoting stress. Final Sunday, the cryptocurrency confronted excessive market turbulence, dropping over 9% in lower than 24 hours. Whereas BTC managed a restoration bounce on Monday, the promoting stress has not subsided, leaving the market unsure about its subsequent route.

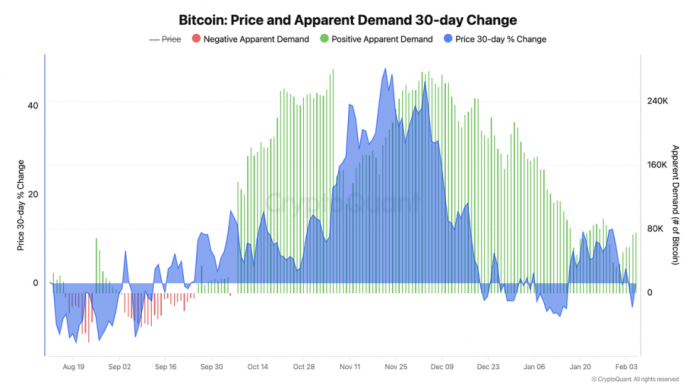

Amid this turbulent worth motion, key metrics spotlight a crucial relationship between Bitcoin’s efficiency and demand progress. CryptoQuant’s Head of Analysis, Julio Moreno, shared insights on X, revealing that Bitcoin’s worth return is carefully tied to its demand progress. Moreno emphasised that slowing demand since early December has instantly correlated with diminished returns, underscoring the essential position of market participation in sustaining bullish momentum.

This commentary sheds gentle on the present state of the market, the place declining speculative urge for food and weakening leveraged positions are contributing to uneven worth motion. As Bitcoin hovers beneath the $100K mark, each bulls and bears are locked in a battle for management, with demand progress serving as a pivotal consider figuring out the cryptocurrency’s trajectory. With market contributors carefully monitoring these dynamics, the approaching days might show decisive for BTC’s short-term and long-term outlook.

Bitcoin Demand Declines As Buyers Concern A Correction

Bitcoin has confronted vital volatility and promoting stress because the begin of February, sending ripples by way of the broader crypto market. Altcoins and meme cash, usually extra susceptible throughout bearish tendencies, have skilled even sharper worth drops, amplifying uncertainty amongst traders. Analysts are more and more signaling a possible correction, citing drained bulls and bearish worth motion that hints at additional declines.

Moreno supplied key insights on X, linking Bitcoin’s worth efficiency on to demand progress. Based on Moreno, Bitcoin’s worth return carefully follows the trajectory of its demand progress.

Since early December, demand progress has been slowing, which aligns with the weakening momentum in Bitcoin’s positive factors. Moreno emphasizes the significance of monitoring demand progress as a crucial indicator to foretell Bitcoin’s subsequent rally.

At present, Bitcoin’s worth is hovering round $96K as bulls wrestle to reclaim and maintain the psychological $100K mark. This degree is just not solely a crucial level of resistance but in addition a significant factor in figuring out short-term market sentiment.

And not using a breakout above $100K, BTC stays susceptible to further promoting stress and a possible drop to decrease demand zones. Nevertheless, reclaiming this degree and holding it as help would sign a shift in momentum, paving the way in which for a possible rally.

BTC Value Exhibiting Indecision

Bitcoin is presently buying and selling at $96,700 after a number of days of sideways worth motion between $100,000 and $95,600. The market seems caught in a spread, with no clear short-term route as each bulls and bears wrestle for management. Bulls misplaced their grip on momentum after the worth fell beneath the essential $100K degree final Tuesday, and so they have been unable to reclaim it since.

The dearth of upward motion has raised issues amongst traders, as Bitcoin’s incapacity to interrupt above $100K might sign rising weak spot available in the market. In the meantime, bears have been making use of constant stress, however they’ve but to power the worth beneath the crucial $95K help degree.

If Bitcoin drops beneath $95K within the coming days, an additional decline into the $90K demand zone is probably going. This may mark a major bearish transfer and will result in elevated promoting stress as traders develop cautious of a deeper correction.

Nevertheless, if BTC can preserve its place above $95K, there’s nonetheless potential for bulls to regain energy and push the worth again towards the $100K mark. For now, the market stays unsure, and merchants are carefully monitoring these key ranges for indicators of the subsequent main transfer.

Featured picture from Dall-E, chart from TradingView