The highest two cryptocurrencies have delivered spectacular returns over time.

One of many oft-mentioned makes use of for Bitcoin (BTC -0.50%) is as an inflation hedge, and it is generally known as “digital gold” for that cause. The concept is that as costs rise as a consequence of inflation, Bitcoin may probably preserve its worth higher than fiat forex.

Ethereum (ETH 1.02%), the second-largest cryptocurrency, has extra makes use of than Bitcoin due to its smart-contract capabilities. However its success up to now has additionally made it common as a approach to hedge in opposition to inflation, in order that they have that in frequent. Let’s examine which of those high cryptocurrencies is extra as much as that activity.

Picture supply: Getty Photographs.

Bitcoin is a deflationary asset

Bitcoin has a hard and fast most provide of 21 million cash, and 19.9 million are already in circulation. New cash are launched by means of Bitcoin mining, which is its technique of validating transactions. As soon as all 21 million cash are mined, which ought to occur round 2040, no extra might be created.

This built-in shortage is the principle argument for Bitcoin as an inflation hedge. Like gold, it does not have an infinite provide.

It is value noting, nonetheless, that it does not have all the advantages of gold. Gold has real-world utility, not simply in jewellery but in addition in electronics, dentistry, and different areas. Bitcoin is solely a chunk of code saved on a blockchain community — a really beneficial piece of code proper now, however nonetheless code.

Gold can also be far more established than Bitcoin as a retailer of worth. Folks have been utilizing gold for hundreds of years and can probably proceed to take action. Bitcoin has solely been round since 2009. Final however not least, gold is much much less unstable than Bitcoin, which has misplaced over 50% of its worth on a number of events.

Ethereum has a singular manner of dealing with inflation

Most cryptocurrencies are both inflationary, which means their provide will increase over time, or deflationary, which means the provision stays the identical or decreases. Ethereum could be inflationary or deflationary relying on the extent of exercise on its blockchain community.

Ethereum does not have a provide restrict, and as much as 18 million new ETH tokens could be issued per 12 months. Nonetheless, in August 2021, its EIP-1559 improve launched a token-burning mechanism. When community exercise is excessive, this mechanism burns (destroys) a portion of the ETH tokens used to pay transaction charges.

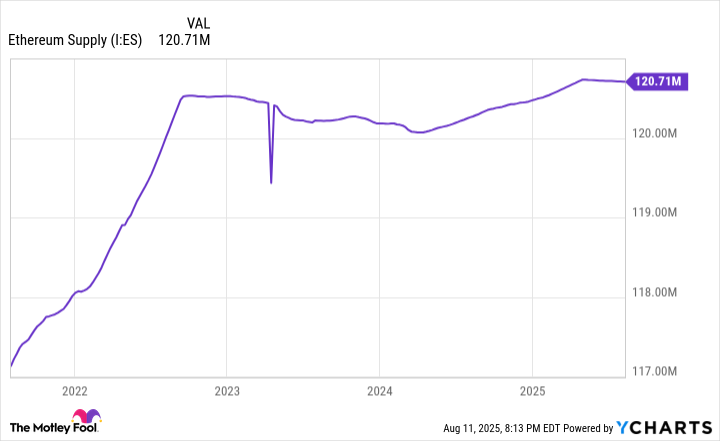

Whereas Ethereum’s provide initially elevated following this improve, it has leveled off. As you may see within the chart under, it has been round 120 million for the final two years.

Ethereum provide knowledge by YCharts.

Ethereum shares a few of Bitcoin’s drawbacks as an inflation hedge. It has a fair shorter observe document, having solely been round since 2015, and can also be extraordinarily unstable. This 12 months alone, it has misplaced over 50% of its worth, after which rebounded to realize over 180%.

Which cryptocurrency is the higher inflation hedge?

I might decide Bitcoin over Ethereum, and every other cryptocurrency, for hedging in opposition to inflation. It is the oldest, most confirmed cryptocurrency, and it makes up almost 60% of the whole market. The truth that it has a tough ceiling on its provide additionally offers it an edge in preserving worth.

That mentioned, for those who’re strictly in search of an inflation hedge, you are most likely higher off investing in gold or shares. An excellent inflation hedge is an asset that maintains its worth. Bitcoin, Ethereum, and most different cryptocurrencies are too unstable, contemplating they’ll drop by 20% or extra in a matter of weeks. Gold and shares can dip throughout downturns, too, however they are typically sturdier property, significantly for those who go together with low-volatility shares.

Though they might not be the best inflation hedge, Bitcoin and Ethereum could make sense as investments. The previous is getting increasingly more common as a digital retailer of worth, and the latter is essentially the most broadly used blockchain platform. They’re dangerous, however if you wish to add digital property to your portfolio, they could every be value a small funding.