In keeping with the Bitcoin Reserve Monitor, 20 states have pending Strategic Bitcoin Reserve (SBR) laws. As bullish as these efforts appear, they might be overshadowed by a sweeping federal framework pushed by Senator Cynthia Lummis, now the top of the Banking Subcommittee on Digital Belongings.

After 16 years of hypothesis, experimentation, block wars and debanking, evidently Bitcoin is on the precipice of a significant threshold. Bitcoin’s inflation fee is already decrease than 1% and its 21 million BTC shortage serves as a bulwark towards inevitable foreign money erosion by the world’s central banks.

Maybe most significantly, Bitcoin’s ledger will be simply verified by everybody, not like gold reserves. These and different components are clearly positioning Bitcoin because the premiere retirement asset, one that’s extremely immune to tampering by central planners.

However what would leveraging Bitcoin for retirement truly appear to be? First, we have to study the significance of the actual fact that BSR is being mentioned at such a excessive stage.

BSR: The Last Perceptual Push?

On the finish of the road, the final word useful resource for human construction to operate is belief. It underpins not solely interpersonal relations however large-scale societal methods. That is why narrative management, lately uncovered by Elon Musk’s DOGE going via USAID funding, is so important for governance methods no matter what they’re labeled as.

Though extremely valuable, belief is a fungible useful resource. For the aim of social stability, if belief in fakery is achieved, it’s as invaluable as belief in fact. But, the previous sort of belief lacks resilience, necessitating ever-escalating levers of management. In flip, this makes managed belief extra fragile.

Reverse to managed belief, we’ve got Bitcoin as a trustless system. Paradoxically, Bitcoin represents the best, most resilient type of belief administration exactly as a result of it minimizes subjective belief concurrently it maximizes goal reality through its cryptography and proof-of-work mechanism.

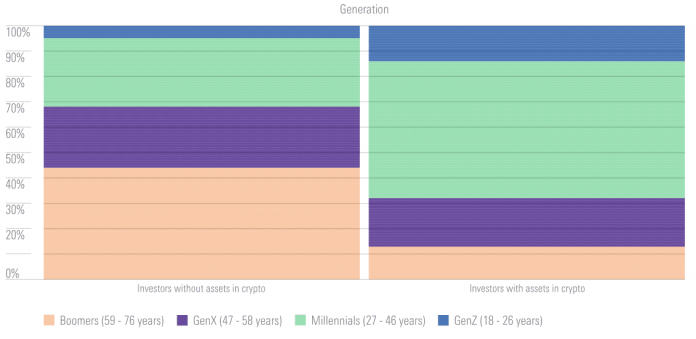

At a look, this may make Bitcoin the apparent alternative as a retailer of worth, proper? Not so quick. Time and time once more, surveys have proven that the older individuals are, the much less reliable they’re of Bitcoin and digital belongings basically.

2023 Voice of the Investor research. Picture credit score: Morningstar

Why is that the case? Why would individuals with a better expertise pool be least trustful of the best type of belief administration like Bitcoin? Wouldn’t they welcome such main innovation?

That’s as a result of reputational signaling overrides technical understanding. And for most individuals, technical understanding is just not even tried with out the social push. In different phrases, for one thing to be adopted and built-in, it needs to be sanctified by authority figures, lest it’s constrained to the fringes.

The older demographic, particularly, depends on “better reputation-related exercise in mentalizing/reminiscence areas whereas making their choices” as proven from computational modeling in a 2023 research titled Age-related Variations within the Social Associative Studying of Belief Info.

Suffice to say, for the older demographic, the bottom widespread denominator mainstream media has been the first purveyor and sanctifier of Bitcoin data. However as a result of mainstream media is tightly interwoven with the federal government, as DOGE-powered revelations clearly present, the sanctification course of begins and ends with the federal government.

That is why the potential Bitcoin Strategic Reserve is such a monumental threshold. It will sign belief in Bitcoin from the very prime, which might then trickle right down to sanctification layers that offer the older demographic with cues. Even when the MSM is inimical to the Trump admin, the existence of BSR would change the tone of Bitcoin protection, endlessly.

As such, BSR needs to be understood as the ultimate perceptual push that modifications the Bitcoin panorama. The implications are already obvious.

Boomers vs Zoomers: Holders vs Strivers

Simply as surveys present that youthful generations are most certainly to partake in digital belongings, additionally they present that Gen Z is the least expectant to personal a house. It is a main generational cleavage, successfully burying the so-called “American Dream”. However is that basically the case transferring ahead?

What if BSR establishes new social signaling for the newborn boomer era? In that state of affairs, boomers would function (1946 – 1964) huge holders of wealth. Overshadowing each GenX (1965 -1980) and Millennials (1981 -1996), boomers maintain an estimated $78.1 trillion, or 52% of US internet wealth as of 2023.

On common, child boomers have a internet value of $2.31 million, in accordance with Terry Rawnsley, KPMG City Economist. In distinction, GenX has a mean internet value of $1.88 million, Millennials at $757,000, whereas Gen Z is on the backside of the generational pile at $96,000.

If boomers take the reputational cue from BSR, only a small fraction of capital inflows into Bitcoin, custodial or non-custodial, would drastically shift BTC worth. Wealth funds have already urged above 1% BTC allocation for portfolios.

VanEck places the determine at 3%, whereas Customary Chartered’s Geoffrey Kendrick expects as much as 5% allocation from sovereign wealth funds. Altogether, this may place the BTC worth at $500,000 by 2028, elevating Bitcoin’s market cap to almost $10 trillion.

In flip, even youthful generations with meager holdings in comparison with boomers would construct up a stable basis for his or her retirement plans. And if Bitcoin features the notion because the premiere retirement asset, this may be solely the start of its appreciation.

Bitcoin: Performant Retirement Asset

In its easiest kind, leveraging Bitcoin as a maturing asset will be accomplished two methods. A technique is to go the self-custody route by safeguarding entry (pockets) to Bitcoin blockchain with offline storage. The opposite means foregoes the trustless nature of Bitcoin by relying on establishments with any of listed Bitcoin exchange-traded funds (ETFs) or crypto exchanges.

From then on, authorities spending and central banking do the work for BTC holders. As respective fiat currencies lose worth, BTC receives inflows as a decentralized ledger backed up by an unlimited vitality/computing community.

Up to now, individuals have counted on equities, commodities or bonds to protect towards USD erosion. From these fundamental components, quite a few combos will be made to optimize for largest features over time. Some spend money on solo shares, some in mutual funds that pool cash into a mixture of belongings, and a few hoard valuable metals like gold and silver.

Mutual funds are significantly standard as retirement choices, as 401(okay)s and IRAs are tax-advantaged. In different phrases, the monetary infrastructure is already there to combine Bitcoin seamlessly.

Bitcoin particular person Retirement Accounts (IRAs) are already there to serve retirees, from BitIRA and iTrustCapital to Bitcoin IRA and Alto IRA.

In the intervening time, paper Bitcoin remains to be dominant with mutual funds. Working example, Bitcoin ProFund (BTCFX) brings publicity to Bitcoin however solely via futures contracts. Since inception in July 2021, this actively managed fund gave holders annualized efficiency of twenty-two.10%

For comparability, the typical mutual fund return on 401(okay) is inside 3%- 8% vary. This turns into even much less spectacular when one accounts for inflation, or how the inflation metric will be adjusted through the relative significance of things to ship politically palatable outcomes.

This carries over to jobs numbers and paychecks as nicely. When adjusted for inflation, it usually seems that actual revenue has flatlined as the very best case state of affairs.

When accounting for these components, even paper Bitcoin’s annualized efficiency of twenty-two.10% doesn’t sound spectacular. But, it’s nonetheless superior to the established order. Furthermore, it bears preserving in thoughts that 2022 – 2023 was an anomalous interval for Bitcoin.

Bitcoin obtained lumped in with the broader over-leveraged cryptosphere. This bubble popped simply a few months following the Fed’s rate of interest hike in March 2022. It began with Terra (LUNA) collapse, unfold to Celsius Community and BlockFi, solely to culminate within the bankruptcies of Core Scientific (CORZ) mining firm and the FTX alternate.

This anomalous interval was aided tremendously by concerted efforts of presidency companies through Operation Choke Level 2.0 to debank crypto companies from the monetary rails.

However on the finish of the road, not solely did one of many debanking instigators, Senator Elizabeth Warren utterly flip round, however Fed Chair Jerome Powell did as nicely, having said that he’s “troubled by the amount of those [debanking] reviews”.

In different phrases, whereas one can doubt inflation and jobs figures, one may doubt Bitcoin efficiency, however in a optimistic course now that the enjoying subject is extra even.

What Is the Final Finish-Aim for Bitcoin Retirees?

Presently, Bitcoin is being built-in into present monetary methods. As with different belongings, Bitcoin then turns into one other element to be added into hybrid portfolios and tax-advantaged accounts.

However finally, one might simply see extra blockchain-native methods to come up for generations youthful than boomers. These retirees are extra seemingly to make use of decentralized pensions, primarily based on automated good contracts for payouts.

The principle factor they want is options, like reviews you’ll be able to snap a photograph of and scan the QR code, or protected automated backups they don’t take into consideration. Accessibility is the secret.

It is usually seemingly that AI brokers might be dealing with individuals’s affairs, using layer 2 options just like the Lightning Community for ultra-low transaction charges and near-instant speeds. As soon as in place, such pension methods might evolve to incorporate micro-lending, collateralized loans, and yield-staking, lowering the necessity to promote Bitcoin and additional compounding its shortage.

This shift would profit all events concerned. If a good portion of Bitcoin retirees prioritize producing yield over promoting their holdings, it might cut back promoting strain available on the market. This, in flip, might stabilize and even drive sustained upward momentum in Bitcoin’s worth.

In the end, Bitcoin has the potential to rework not simply how we take into consideration cash, but additionally how we method retirement. As a substitute of viewing retirement as a drain on accrued wealth, Bitcoin-powered methods might create new alternatives for retirees and their descendants, reshaping the idea of retirement itself.

It is a visitor publish by Shane Neagle. Opinions expressed are fully their very own and don’t essentially mirror these of BTC Inc or Bitcoin Journal.