Following the US Client Value Index (CPI) knowledge launch, Bitcoin‘s value witnessed a rebound to the $98,000 degree, elevating traders’ hopes as soon as once more. Nonetheless, this rebound was temporary as BTC’s value started to drop a number of hours after the upward transfer. As costs see bearish actions, crypto analysts imagine that the drop may lengthen towards key help ranges.

Draw back Dangers Mounts For Bitcoin

Bitcoin’s value motion is beneath renewed strain post-US CPI knowledge launch on Wednesday as revealed by a latest evaluation by Negentropic, a market knowledgeable and co-founder of the world-leading on-chain knowledge and monetary platform Glassnode.

The occasion seems to have sparked volatility for the flagship asset simply as Negentropic beforehand predicted, which has fueled market uncertainty. Throughout unfavorable situations, Bitcoin is liable to experiencing a value breakdown if it fails to carry key help ranges.

Negentropic highlighted that after an inflation report that was extra intense than anticipated, BTC acquired liquidity on the $94,000 degree and reached its high at $98,000. Nonetheless, the crypto asset has at the moment retraced to the $96,000 mark.

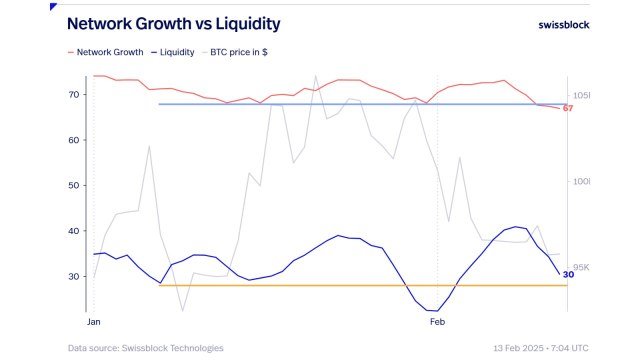

This improvement comes as BTC has seen declining community efficiency previously few days. With weak liquidity coinciding with waning community progress, BTC’s short-term outlook indicators bearish indicators.

Within the occasion that these adverse developments persist, Negentropci is assured that BTC’s subsequent transfer is likely to be towards the draw back, focusing on the $92,000 threshold. In consequence, the market knowledgeable has urged traders to remain vigilant amid these unsure instances.

Daan Crypto Trades, a crypto analyst and investor has additionally delved into Bitcoin’s liquidity seize following the US CPI knowledge report. In accordance to Daan Crypto Trades, the vast majority of liquidity acquired by BTC was taken on the decrease time frames.

Moreover, the knowledgeable outlined that in any case these decrease highs previously few weeks, there’s nonetheless numerous untapped liquidity mendacity increased. Ought to BTC be capable to reverse this native downward development, it may function a set off for a transfer to the upside.

Within the meantime, the $90,000 degree is the hazard zone the place the analyst expects many longs to be taken out since it’s the vary low. Additionally, the extent represents an space the place Bitcoin’s value has witnessed a rebound a number of instances.

A Change In BTC’s Market Dynamics

Despite the fact that BTC’s waning efficiency has induced minimal losses, CryptoQuant’s verified creator Axel Adler Jr believes it’s extra logical to focus on the development of revenue adjustments moderately than the quantity of holder losses. Over the past consolidation part close to $70,000, it took the market two extra months to construct a brand new impulse.

In the meantime, market dynamics have shifted within the ongoing part majorly influenced by information surrounding Donald Trump’s administration and recognition of BTC as a strategic reserve. “Basically, this might considerably speed up the event of a brand new development, not like in earlier macrocycles,” Adler acknowledged.

Featured picture from Unsplash, chart from Tradingview.com