13 Oct Bitfinex Alpha | After the Carnage, Nonetheless Some Hope

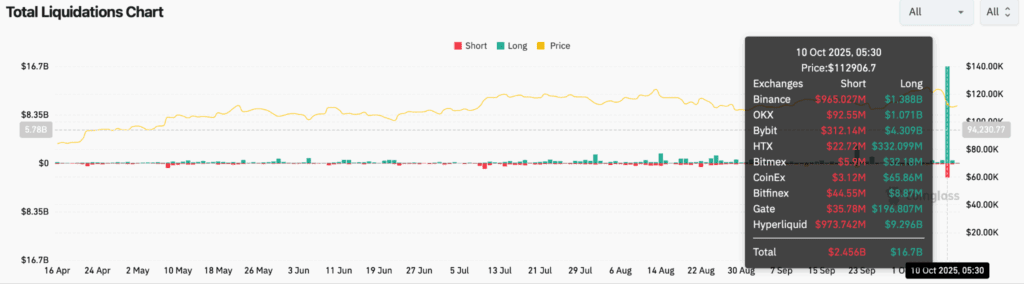

Bitcoin moved from above $126,000 final week to briefly under $103,310, marking an 18.1 p.c drawdown and triggering the largest liquidation occasion in crypto historical past by notional worth. Ether fell from $4,750 to $3,500, whereas a number of altcoins noticed momentary declines of over 80 p.c amid vanishing liquidity. Roughly $1 trillion in whole market worth was erased inside three hours on Friday 10, October, as whole crypto market capitalisation briefly plunged 22.6 p.c from its October excessive of $4.26 trillion to $3.3 trillion. Greater than $19 billion in positions have been liquidated in a single day, dwarfing earlier information set through the COVID crash and FTX collapse.

The sell-off was sparked by aggressive spot promoting as US-China tariff tensions started escalating on 10 October, making a 2.5x imbalance between sellers and consumers throughout main exchanges. As soon as the information broke of US tariffs on Chinese language imports, futures markets compounded the decline, with Cumulative Quantity Delta readings exhibiting an awesome dominance of sell-side stream throughout each spot and perpetual markets. Traditionally, such liquidation-driven capitulations have been adopted by mechanical rebounds as volatility compresses and extra leverage is flushed. For Bitcoin, reclaiming and holding above $110,000 would affirm a stabilisation part and open restoration targets close to $117,000–$120,000, whereas failure to take action dangers a retest of the $100,000 zone.

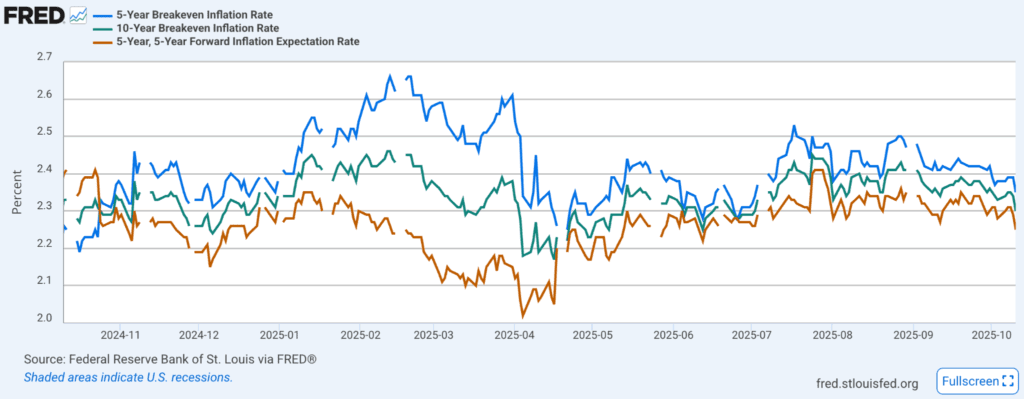

The most recent financial backdrop in the USA displays a widening disconnect between coverage intent and real-world impression. The Federal Reserve’s September assembly minutes revealed deep divisions inside the Federal Open Market Committee over the tempo and scale of upcoming charge cuts. Whereas most policymakers favour further easing to counter slowing job development, a minority stay involved that progress on tackling inflation has stalled, and warn towards transferring too shortly.

Compounding the problem is a surge in financial coverage uncertainty, pushed by the continuing authorities shutdown, shifting tariff insurance policies, and tighter immigration guidelines. The shutdown has halted key knowledge releases, forcing markets to depend on non-public indicators exhibiting an financial system that’s cooling however not contracting.

Regardless of the fiscal gridlock, monetary markets have remained resilient. Treasury yields declined as traders sought security, and a powerful response to current bond auctions highlighted sustained demand for long-duration belongings. Credit score markets have additionally held agency: each investment-grade and high-yield spreads sit close to two-year lows, signalling regular investor confidence and restricted concern over defaults.

The previous week underscored how crypto and conventional finance are quickly converging. In Japan, cellular funds large PayPay acquired a 40 p.c stake in Binance Japan, paving the best way for its 70 million customers to commerce and switch crypto straight inside the nation’s hottest digital pockets. Institutional finance can also be deepening its crypto ties. Digital asset financing group, Antalpha led a $100 million funding to create Aurelion Treasury, quickly to grow to be the primary Nasdaq-listed company treasury backed solely by Tether Gold (XAUt).In the meantime, GraniteShares filed to launch 3x leveraged crypto ETFs monitoring Bitcoin, Ethereum, Solana, and XRP, increasing Wall Avenue’s roster of advanced digital asset devices. Grayscale debuts US Spot Crypto ETP with Native Staking Performance.