17 Nov Bitfinex Alpha | BTC in Search of a Backside

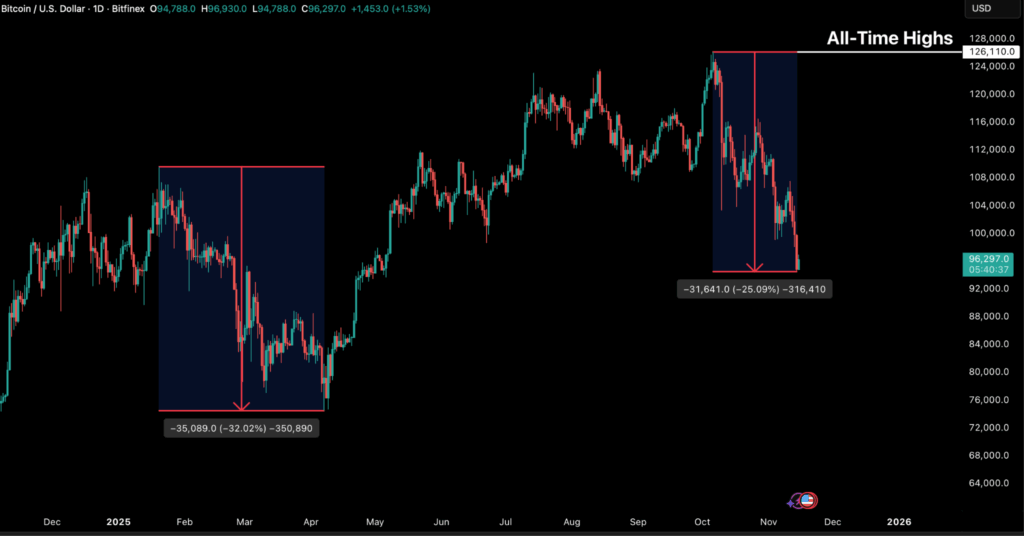

Bitcoin has now logged its third-largest drawdown of the present cycle, falling 25 p.c from its all-time excessive to commerce under $94,000 and momentum stays in the direction of the draw back on decrease timeframes. Nonetheless, the present tempo of promoting and the dimensions of realised losses being skilled by traders has begun to stabilise, hinting that the market could also be getting into a consolidation part reasonably than an prolonged capitulation.

BTC is now buying and selling firmly under the short-term holders’ (STH) value foundation of $111,900 and the –1 standard-deviation band close to $97,500, retaining draw back dangers alive till this degree is reclaimed. Nonetheless, on-chain exhaustion indicators are rising. The STH Realised Revenue-Loss Ratio has dropped under 0.20, which means that over 80 p.c of cash moved on-chain are being bought at a loss, a zone traditionally in line with native bottoms. Likewise, STH provide in revenue has collapsed to 7.6 p.c, ranges final seen close to prior cycle troughs. Whereas additional affirmation is required through renewed demand inflows, this confluence of metrics implies that we’re attributable to type a sturdy base quickly, extra by way of time than in worth, setting the stage for potential stabilisation into late This autumn.

The US enters late 2025 with a noticeably softer macroeconomic backdrop. The 43-day authorities shutdown has ended however left clear financial scars, with roughly $7–$14 billion in everlasting GDP losses, widespread liquidity stress amongst furloughed employees, and renewed issues over fiscal brinkmanship forward of one other funding deadline in January. Markets initially shrugged off the disruption, however sentiment deteriorated rapidly afterward, with the S&P 500 pulling again as traders reassessed fiscal dangers and the prospect of a Fed pause.

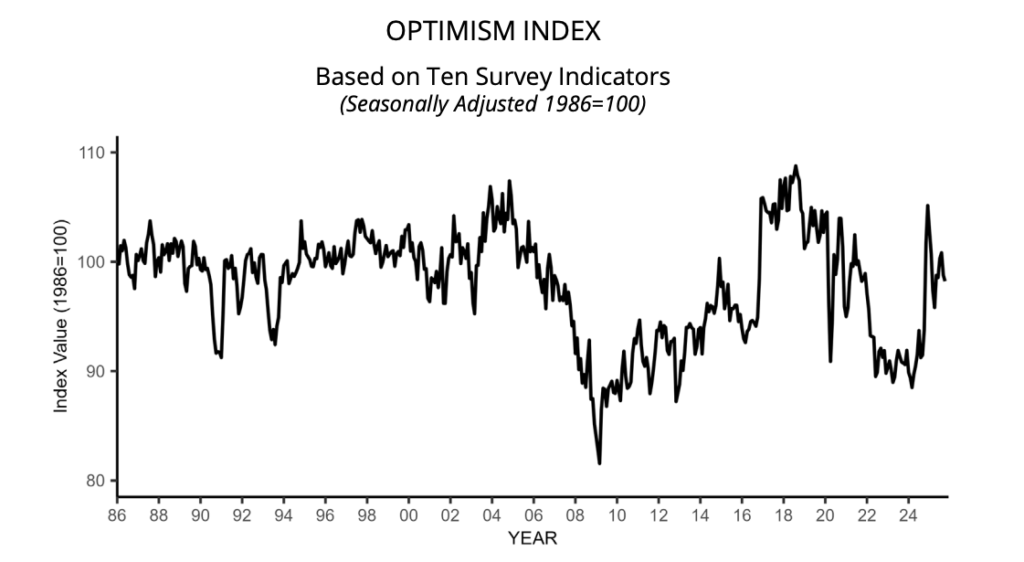

On the similar time, home enterprise sentiment is cooling. The NFIB Small Enterprise Optimism Index slipped in October, reflecting weaker gross sales, tighter income, and protracted labour shortages. This fall aligns with weakening world demand: the International PMI New Export Orders Index fell to 48.5, marking its quickest contraction in practically two years, with each manufacturing and companies displaying broad-based declines.

Inflation provides one other layer of strain. With official CPI knowledge unavailable throughout the shutdown, different indicators level to persistent worth stickiness, New York Fed expectations sit at 3.2 p.c, and market-based breakevens hover close to 2.2 p.c. Elevated inflation expectations and heavy fiscal spending counsel the Fed might preserve charges greater for longer, retaining mortgage charges above 6 p.c and leaving households with little aid.

US crypto regulation took a serious step ahead this week as a bipartisan Senate draft invoice proposed shifting main oversight of digital property from the SEC to the CFTC. The laws would classify most tokens as “digital commodities” and require exchanges and custodians to register beneath a commodities-style framework, although key questions round DeFi, AML guidelines, and company coordination stay unresolved.

Crypto additionally expanded additional into leisure as TKO Group Holdings, mother or father of the UFC, signed a multiyear deal with Polymarket to combine real-time prediction-market knowledge into reside occasions beginning in 2026. The partnership marks a deeper convergence of sports activities engagement and Web3 instruments.

In the meantime in Europe, the Czech Nationwide Financial institution launched a $1 million pilot portfolio containing Bitcoin, a stablecoin, and a tokenised deposit, its first direct publicity to digital property. Framed as a technical experiment, the initiative displays rising central-bank curiosity in understanding how blockchain-based devices might form future monetary infrastructure.