21 Oct Bitfinex Alpha | Market Stabilises, however Momentum Stays Tentative

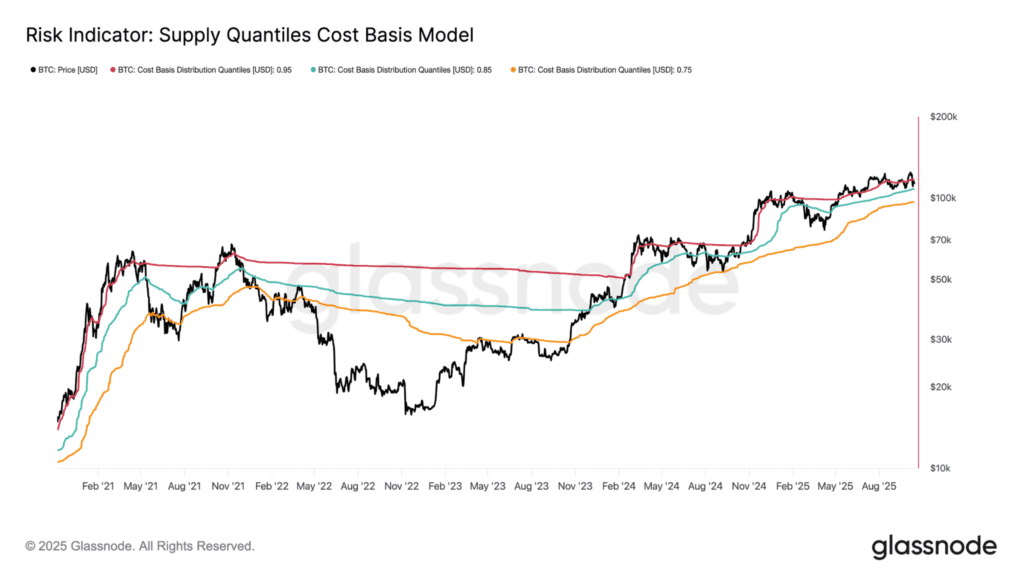

Following the historic $19 billion market liquidation occasion on October tenth, crypto markets have stabilised inside narrower ranges. Bitcoin continues to defend its key structural assist at $107,500, which is the decrease finish of the July air hole which now serves as a important flooring. Nonetheless, BTC stays beneath a number of key on-chain resistance ranges, suggesting that whereas draw back momentum has eased, the restoration section remains to be tentative.

The 18.1 % peak-to-trough drawdown now we have seen this month stays in line with prior cycle-high retests since 2023, usually marking consolidation phases somewhat than development reversals. But, institutional demand has but to return decisively. Bitcoin ETFs recorded over $1.22 billion in internet outflows final week, mirroring fairness market weak spot. Lengthy-term holders have additionally lowered provide by roughly 0.3 million BTC since July, signalling regular profit-taking whereas new inflows lag behind. For now, the $107,000–$108,000 zone stays a key inflection level. Failure to maintain above it might point out demand-side fragility, doubtlessly resulting in additional localised drawdowns earlier than equilibrium is restored.

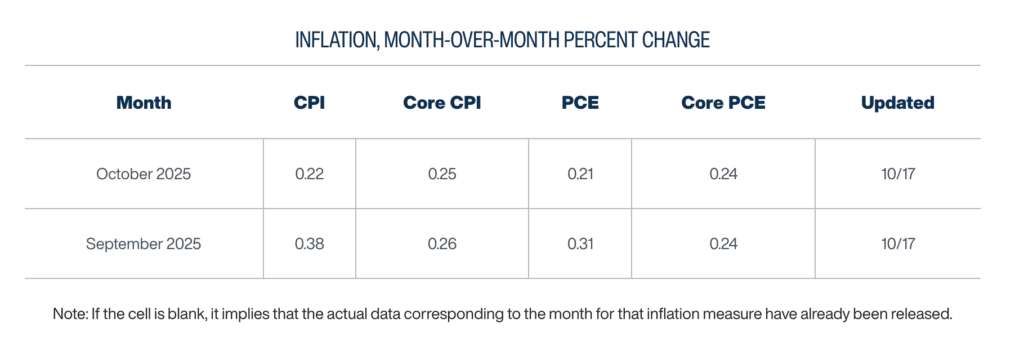

The US financial system is getting into a interval of heightened uncertainty because the Federal Reserve is compelled to function with out key knowledge amid a authorities shutdown. With official stories on inflation, jobs, and spending suspended, policymakers are counting on personal indicators to information choices forward of the late-October assembly.

The financial system exhibits neither clear weak spot nor power, leaving the Fed divided over whether or not to chop charges additional. Markets are pricing in a 25 foundation level minimize, however tightening liquidity, unstable bond yields, and widening credit score spreads reveal rising anxiousness a few potential coverage misstep.

Inflation stays stubbornly excessive, more and more pushed by tariffs somewhat than home demand. New commerce measures have added roughly half a share level to core inflation, with meals and sturdy items costs rising sharply. Grocery prices at the moment are the highest supply of shopper stress, protecting inflation expectations elevated and limiting the impression of future fee cuts. The manufacturing sector is feeling the pressure, manufacturing facility exercise has contracted as enter prices rise, whereas the housing market exhibits early restoration indicators, due to decrease mortgage charges.

In the meantime, escalating US-China tensions have reintroduced world provide chain dangers. New Chinese language export restrictions and potential US tariffs of as much as one hundred pc threaten to disrupt commerce flows and push prices increased. Though markets stay calm, supply-driven inflation dangers are re-emerging as firms shift manufacturing to Mexico and Southeast Asia.

The US crypto panorama is quickly maturing as establishments and policymakers transfer to combine blockchain into mainstream finance. On the coverage degree, Florida launched a invoice that will enable as much as 10 % of the state’s public and pension funds to be invested in Bitcoin, tokenised belongings, and crypto ETFs by 2026, an indication of rising acceptance of digital belongings as respectable portfolio diversifiers.

In the meantime, Ripple introduced a $1 billion acquisition of GTreasury, marking its enlargement from blockchain funds into company treasury infrastructure. The deal goals to present Ripple extra publicity to enterprise liquidity and money administration. Including to the momentum, New York Metropolis has launched an Workplace of Digital Belongings and Blockchain Know-how, in an try and develop its personal place as a possible hub for accountable crypto innovation and institutional adoption.