29 Sep Bitfinex Alpha | Markets Calm as Consolidation Continues

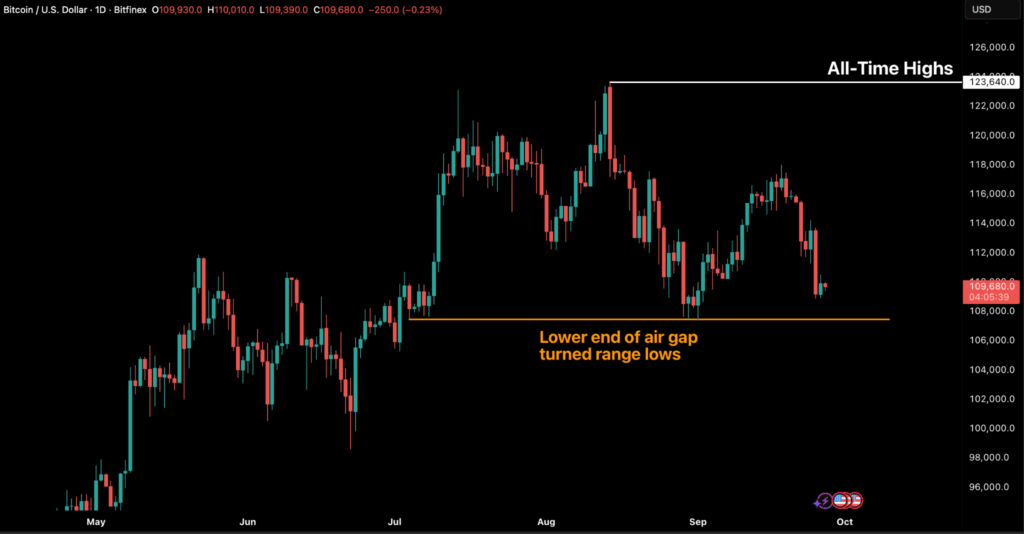

Bitcoin slid 5.1 p.c final week to shut at $109,690, breaking beneath key helps because the post-FOMC rally gave method to renewed promoting stress. Ether fell 10.1 p.c and Solana dropped 14.3 p.c, reinforcing the broad risk-off tone throughout majors. But, selective rotation into speculative altcoins endured, reflecting buyers’ continued seek for higher-beta alternatives whilst complete market capitalisation contracted 5.9 p.c on the week to $3.7 trillion, down 12.6 p.c from latest highs. Open curiosity additionally declined 13.7 p.c from its September peak, signalling a broad discount in speculative leverage.

From a cycle perspective, realised capital inflows spotlight the structural scale of the present bull market. Since January 2023, Bitcoin has absorbed $678 billion in internet inflows, 1.8 occasions the scale of the complete prior cycle pushed by institutional adoption and deepening liquidity. Not like earlier cycles, this one has superior in three distinct multi-month surges, every punctuated by heavy profit-taking when greater than 90 p.c of cash moved have been transacted in revenue. Lengthy-term holders have already realised 3.4 million BTC, surpassing all prior cycles and underscoring the unprecedented maturity of this cohort and the depth of capital rotation underpinning at present’s market. With the third wave of distribution now fading, circumstances favour a cooling section as realised positive factors are digested earlier than the following structural leg increased.

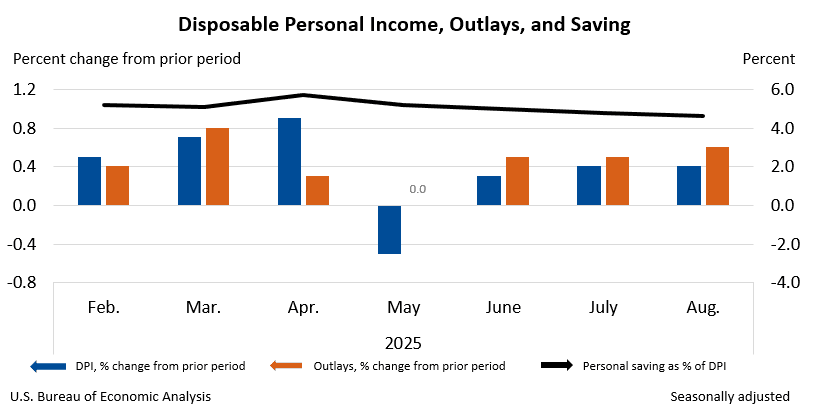

The US financial system is exhibiting a posh mixture of resilience and pressure. Client spending stays sturdy, with households boosting outlays on providers, journey, and items, serving to drive second-quarter GDP development to its quickest tempo in almost two years and protecting third-quarter projections near 4 p.c. This momentum, nonetheless, is erratically distributed: higher-income households, supported by rising wealth, proceed to spend, whereas lower-income households are more and more counting on financial savings as wages stagnate and important prices like meals and vitality climb.

Inflation stays cussed, with the Fed’s most well-liked measure, the Private Consumption Expenditures Index, rising 2.7 p.c year-over-year in August and core inflation holding at 2.9 p.c, pushed by persistent service-sector and items worth pressures.

The Federal Reserve minimize charges by 25 foundation factors on September seventeenth to 4–4.25 p.c, aiming to steadiness slowing job development with inflation management. But this easing highlights a delicate rigidity: whereas short-term yields have fallen, long-term Treasury charges stay elevated as buyers demand compensation for fiscal dangers. Nationwide debt has surged to $37.3 trillion, with annual curiosity prices exceeding $1.1 trillion, making debt service the federal government’s second-largest expense. This backdrop has steepened the yield curve, leaving mortgage charges caught close to 7 p.c and borrowing prices excessive for households and companies.

The cryptocurrency panorama is being formed by a mixture of political threat, regulatory shifts, and monetary innovation throughout main economies. In the USA, a looming authorities shutdown on September thirtieth, the tip of the fiscal 12 months, underscores deep political polarisation. Whereas quick shutdowns have traditionally had little affect on markets, at present’s backdrop of fiscal pressure and world fragility may amplify dangers. Equities might face stress from delayed knowledge releases, bond yields may swing on deficit issues, and crypto might draw renewed consideration as buyers query Washington’s stability.

Throughout the Atlantic, the UK is starting to take a extra constructive path to crypto adoption, with main banks together with Barclays, HSBC, and NatWest launching a dwell pilot for tokenised sterling deposits. Operating by way of mid-2026, this system will check use instances reminiscent of peer-to-peer funds, sooner mortgage processing, and digital asset settlement, all inside present regulatory protections.

In the meantime, Australia has moved to tighten its regulatory perimeter. Draft laws launched by the Treasury would require crypto exchanges and custody suppliers to acquire monetary providers licenses, aligning them with conventional intermediaries underneath the Firms Act.