27 Oct Bitfinex Alpha | Optimism Creeping Again

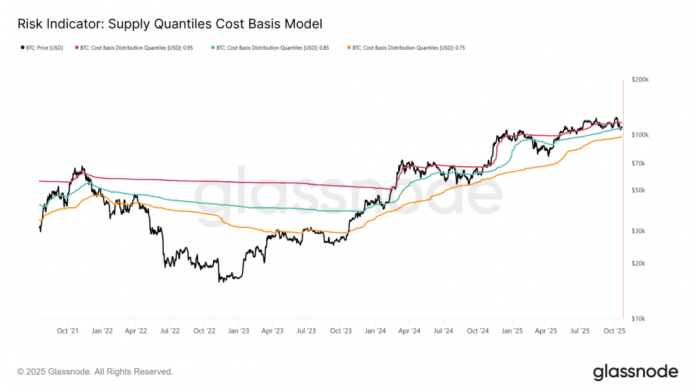

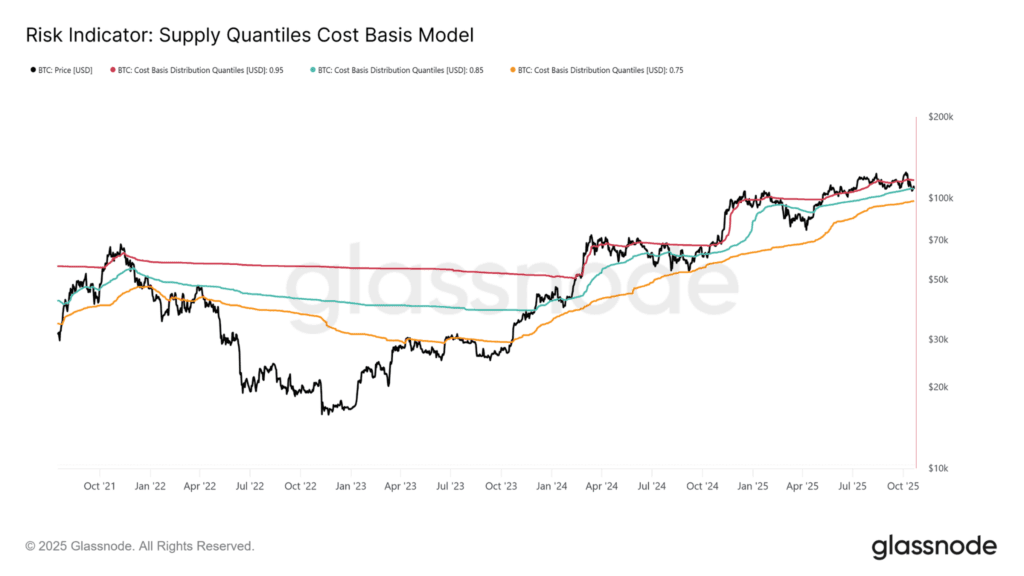

Bitcoin spent a lot of the week buying and selling beneath each the short-term holders’ (STH) value foundation and the 0.85 quantile degree mentioned in final week’s Bitfinex Alpha, reflecting fading momentum and market fatigue. Nonetheless, a softer CPI print and indicators of easing US–China tariff tensions helped BTC rebound above these resistance thresholds, enhancing near-term construction. Holding above the STH value foundation at $113,600 is now pivotal for confirming a constructive shift. Buying and selling above this degree has traditionally marked the transition from corrective to accumulation phases, whereas failure to maintain it could threat deeper retracement towards the 0.75 quantile close to $97,500, the possible decrease sure of the present consolidation vary if we’re to drag again additional.

Because the file $19 billion liquidation on 10 October, market volatility has cooled significantly, with whole BTC choices open curiosity contracting by roughly $7 billion to $31 billion, the sharpest weekly drop since June. The unwinding of short-dated upside publicity between $115,000–$120,000 strikes has neutralised vendor gamma, and reset speculative positioning. Implied volatility has compressed into the low-40s, and realised volatility continues to float decrease, 30-day at 44.1 % and 10-day at 27.9 %, suggesting that merchants now count on consolidation moderately than breakout. The info factors to a maturing post-liquidation reset: elevated however stabilising volatility.

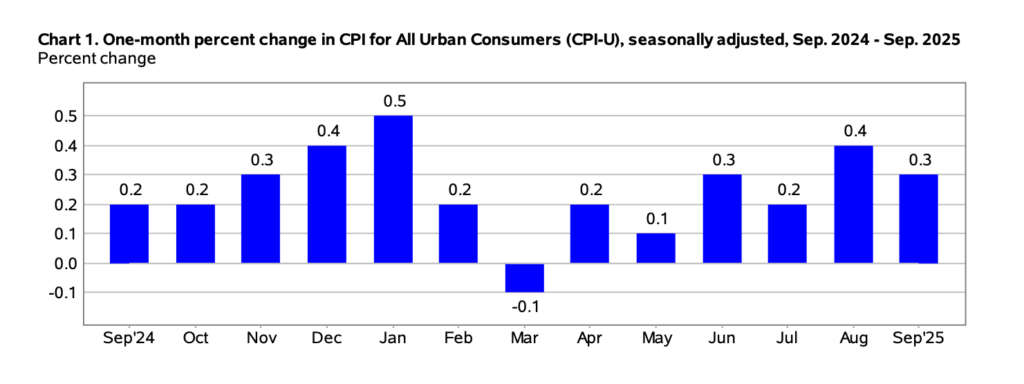

US inflation eased in September, rising simply 0.3 % for the month and three % year-over-year, signalling progress towards the Federal Reserve’s goal and setting the stage for an anticipated fee minimize on the finish of October.

But beneath the headlines, the information revealed a story of two economies: one buoyed by market good points and one other strained by on a regular basis prices. Whereas buyers celebrated contemporary file highs within the S&P 500 and Dow Jones indices, many households proceed to battle with greater gasoline, meals, and repair costs.

On the identical time, surging debt within the US, now at $38 trillion, or 124 % of GDP is testing international confidence. With rising curiosity prices, political gridlock, and waning demand for Treasuries, the US dangers borrowing extra simply to pay curiosity on what it already owes. Japan and China have diminished holdings, whereas home establishments more and more shoulder the burden. Although US bonds nonetheless supply enticing yields, cracks are forming within the “secure haven” narrative that underpins international finance. Collectively, easing inflation and a swelling debt load paint a fancy image: an economic system stabilising on the floor however carrying deep structural imbalances beneath.

Japan’s Monetary Providers Company is about to loosen up its strict stance on digital property by permitting home banks and their subsidiaries to commerce, maintain, and doubtlessly supply crypto change providers. This marks a big shift from Japan’s earlier coverage, which prohibited banks from proudly owning cryptocurrencies resulting from volatility and monetary stability considerations. In the meantime, US President Donald Trump granted a full pardon to Binance founder Changpeng “CZ” Zhao, who was convicted of anti-money-laundering violations and served 4 months in jail. The administration framed it as ending the “struggle on crypto,” although critics raised considerations about potential political motives and Binance’s ties to Trump-linked ventures. The pardon removes a key impediment to Binance’s US re-entry following its $4.3 billion settlement with regulators.

On the identical time, gold advocate and Bitcoin critic Peter Schiff introduced a blockchain-based gold platform by way of his firm Schiff Gold. The challenge permits customers to purchase and tokenise vaulted gold, spend fractions by way of a debit card, or redeem it bodily.