BitMart Analysis, the analysis arm of BitMart Trade, has launched a complete report on blockchain-based prediction markets, analyzing the sector’s speedy evolution within the wake of Polymarket’s breakthrough efficiency in the course of the 2024 U.S. election. As conventional polling fashions falter, decentralized prediction platforms are gaining traction by providing sooner, extra correct forecasts with clear, on-chain mechanisms. Backed by latest funding rounds from prime companies like Coinbase and Paradigm, initiatives comparable to Kalshi, Limitless, Myriad, and Flipr are redefining each institutional-grade forecasting and social-driven engagement. With twin momentum in regulatory approvals and product innovation, the prediction market sector is poised to emerge as a key element of each the monetary and data infrastructure of Web3.

1. Trade Background

The recognition of Polymarket in the course of the 2024 U.S. election marked a turning level for prediction markets, which outperformed conventional polling by offering sooner and extra correct forecasts. This demonstrated the precept that “value equals chance.”

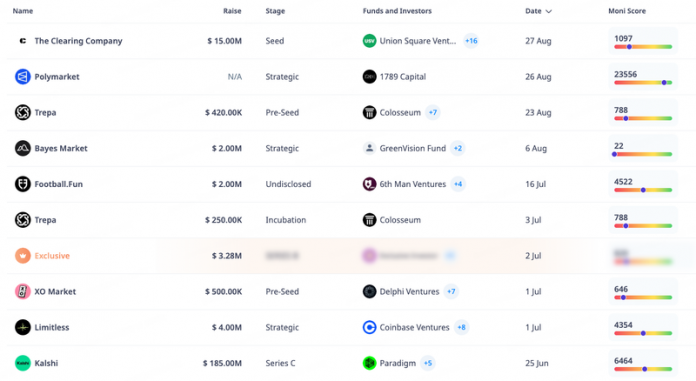

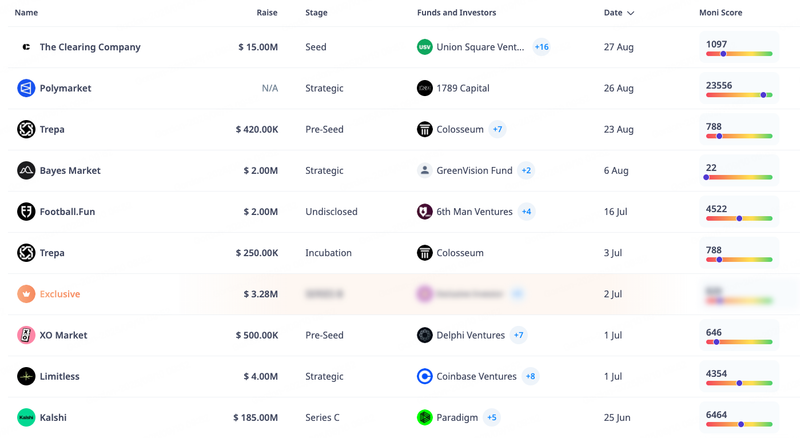

In 2025, the sector has seen speedy upgrades in each capital and product improvement. Practically ten initiatives have raised funding since June, with help from Coinbase, Paradigm, and Delphi. The enchantment lies in blockchain’s benefits: open participation, clear and immutable information, and direct monetary publicity with out intermediaries.

Two clear improvement paths are rising. On the compliance aspect, Kalshi obtained CFTC approval in all 50 states, whereas Polymarket acquired QCX for U.S. regulatory protection. On the product aspect, initiatives comparable to Myriad and Flipr embed prediction options into social platforms, Limitless leverages Base chain’s CLOB mannequin for deeper liquidity, and Drift experiments with integrating prediction into leveraged derivatives. In comparison with 2024, the market is advancing considerably in compliance, innovation, and consumer situations.

2. Key Mechanism Options

Buying and selling Fashions:

-

Order E-book: Utilized by Polymarket and Kalshi, environment friendly with robust liquidity however susceptible in skinny markets.

-

AMM: Gives steady buying and selling with out counterparties however is delicate to low liquidity and parameter dangers.

Contract Sorts:

-

Binary: Mounted payout on occasion outcomes, most typical for elections and sports activities.

-

Categorical: Covers a number of unique outcomes.

-

Scalar: Linked to numerical values comparable to financial indicators.

Oracles: Platforms like Polymarket use UMA to deliver real-world outcomes on-chain for settlement, bettering belief and decreasing disputes.

Different Components: Gasoline prices, UX design, and charge constructions form competitiveness and consumer retention.

3. Evaluation of Main Initiatives

Polymarket

Polymarket rose to prominence in the course of the 2024 U.S. election and different world occasions, outperforming conventional polling with sooner and extra correct forecasts. Constructed on Polygon’s Layer 2 community, it provides low charges, excessive throughput, and primarily operates binary “YES/NO” markets overlaying politics, economics, sports activities, and social subjects.

In accordance with PolymarketAnalytics, cumulative buying and selling quantity has exceeded $898 million, inserting it first globally. Nevertheless, when it comes to consumer depend and open curiosity, Kalshi has surpassed it. This was largely as a result of earlier compliance restrictions that blocked U.S. customers from accessing the platform. In 2025, this limitation was lifted after the U.S. Division of Justice concluded its investigation in July. Polymarket additional strengthened its compliance standing by buying QCEX, a CFTC-licensed derivatives trade and clearinghouse, for $112 million.

In June, Polymarket partnered with Elon Musk’s X to combine prediction knowledge into Grok, xAI’s AI system, offering real-time predictive feeds and increasing its affect in media and market analytics. Whereas Kalshi is at present the strongest competitor as a result of compliance and political backing, Polymarket retains benefits in being on-chain, with token issuance expectations creating further incentives for early contributors. With regulatory boundaries resolved, Polymarket now has twin progress drivers—blockchain-native incentives and compliance integration.

Kalshi

Kalshi is the primary totally regulated prediction market accredited by the CFTC, with licenses overlaying all 50 U.S. states. This standing grants it quick legitimacy with conventional buyers and establishments. Not like blockchain-native platforms, Kalshi permits direct buying and selling on real-world outcomes somewhat than spinoff proxies. Its contracts are primarily binary, overlaying a broad scope from macroeconomic knowledge (inflation, unemployment) to elections, sports activities, and even crypto value actions.

Kalshi’s aggressive edge lies in compliance, capital, and political connections. The platform has raised over $260 million from main buyers comparable to Sequoia Capital, Paradigm, and Y Combinator, with a valuation reaching $2 billion. Politically, former CFTC commissioner Brian Quintenz served on its board, and Donald Trump Jr. acts as an advisor, boosting each public affect and regulatory attain. These benefits place Kalshi forward of Polymarket in consumer adoption and institutional acceptance.

Limitless

Limitless is a Base-chain prediction platform utilizing a CLOB system much like centralized exchanges. It helps restrict and market orders in addition to categorical contracts, with settlement powered by Pyth Community oracles. Markets embrace crypto, equities, and macroeconomic indicators, with USDC because the settlement asset.

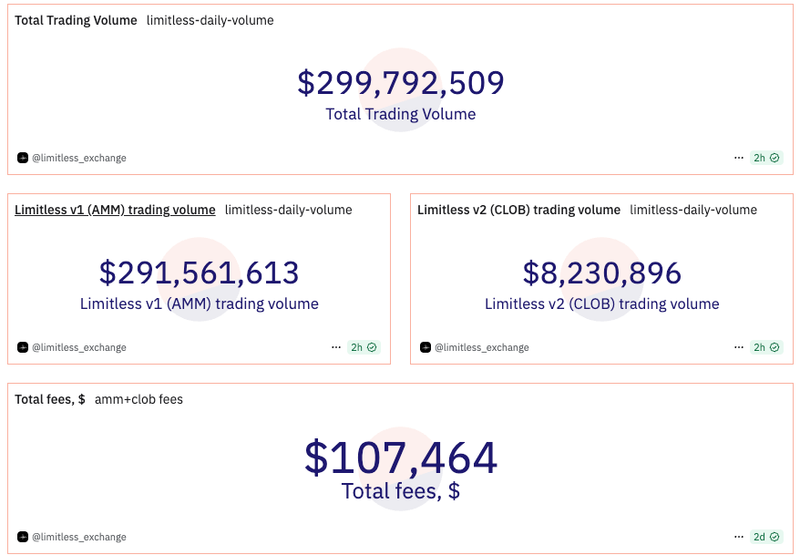

Thus far, Limitless has processed round $299 million in cumulative quantity, with $291 million from V1 and $8.23 million from V2. Complete charge income stands at $107,000. In July 2025, Limitless raised $4 million in a strategic spherical led by Coinbase Ventures and 1confirmation, changing into the biggest prediction market on Base.

Myriad Markets

Launched by media firm DASTAN Inc., Myriad integrates decentralized prediction buying and selling with digital content material. By a Chrome extension, it embeds prediction markets instantly into information, social media, and video platforms, enabling “content-as-market” interplay.

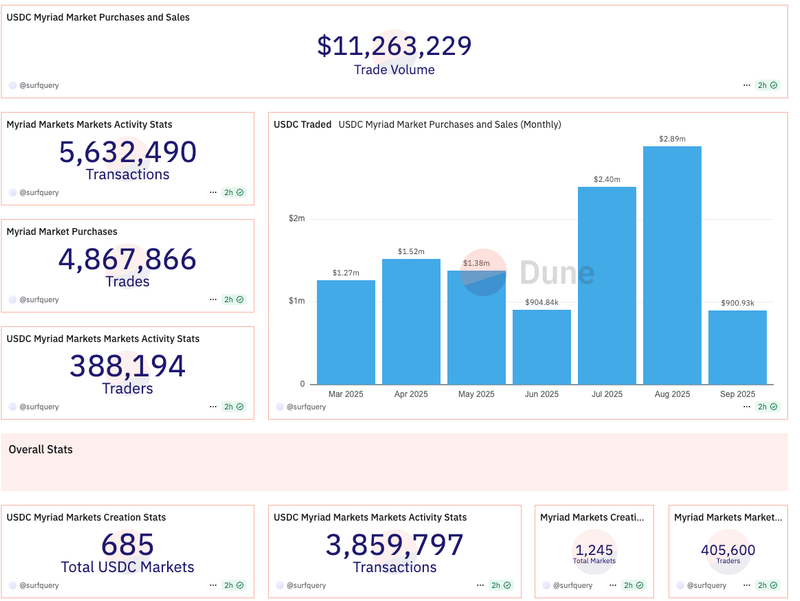

Myriad makes use of an AMM bonding-curve mannequin and helps binary, categorical, and scalar contracts. It has processed 5.63 million trades, with 388,000 lively wallets and $11.26 million in complete buying and selling quantity. Its benefit lies in seamless integration with media ecosystems, providing a brand new monetization mannequin whereas fostering sticky consumer engagement throughout politics, sports activities, crypto, and macro themes.

Flipr

Flipr is a social-first prediction interface constructed on X. Its entry level is Fliprbot, a buying and selling bot that permits customers to put bets just by tagging it in tweets or sending natural-language DMs. It helps leveraged buying and selling, stop-loss/take-profit orders, and volatility safety, whereas embedding prediction into group chats and communities.

Flipr’s token $FLIPR trades at $0.017 with a market cap of $17.21 million. Not like Polymarket or Kalshi, Flipr doesn’t compete instantly in liquidity or compliance however as a substitute differentiates itself as a social overlay, turning prediction into interactive content material and considerably reducing consumer boundaries.

4. Future Outlook

Prediction markets are more likely to evolve alongside a dual-track path:

-

Mass adoption via social integration: Platforms like Flipr embed prediction instantly into conversations, decreasing friction and broadening participation.

-

Institutional adoption via compliance: Platforms like Kalshi leverage regulatory licenses to draw conventional capital and combine with danger administration programs.

This twin strategy suggests prediction markets could perform each as leisure and sentiment instruments for the general public, and as monetary infrastructure for skilled establishments.Nonetheless, three main challenges stay:

-

Liquidity constraints: Restricted depth will increase spreads and undermines buying and selling expertise.

-

Regulatory uncertainty: Straddling playing and derivatives, prediction markets face authorized grey zones in lots of jurisdictions. Constructing frameworks that steadiness decentralization with authorized compliance might be essential for mainstream adoption.

-

Capital effectivity: With out yield-generating mechanisms similar to conventional monetary instruments, prediction markets battle to draw sticky institutional capital.

If these challenges persist, progress will stay speculative and event-driven. Nevertheless, if capital effectivity and regulatory frameworks enhance, prediction markets may scale into core infrastructure for info aggregation, danger administration, and monetary innovation.

About BitMart

BitMart is a premier world digital asset buying and selling platform with greater than 12 million customers worldwide. Persistently ranked among the many prime crypto exchanges on CoinGecko, BitMart provides over 1,700 buying and selling pairs with aggressive charges. Dedicated to steady innovation and monetary inclusivity, BitMart empowers customers globally to commerce seamlessly. Be taught extra about BitMart at Web site, observe their X (Twitter), or be part of their Telegram for updates, information, and promotions. Obtain BitMart App to commerce anytime, anyplace.

Danger Warning:

The data offered is for reference solely and shouldn’t be thought-about a advice to purchase, promote or maintain any monetary asset. All info is offered in good religion. Nevertheless, we make no representations or warranties, specific or implied, as to the accuracy, adequacy, validity, reliability, availability or completeness of such info.

All cryptocurrency investments (together with returns) are extremely speculative in nature and contain important danger of loss. Previous, hypothetical or simulated efficiency just isn’t essentially indicative of future outcomes. The worth of digital currencies could rise or fall, and there could also be important dangers in shopping for, promoting, holding or buying and selling digital currencies. It is best to fastidiously think about whether or not buying and selling or holding digital currencies is appropriate for you based mostly in your private funding aims, monetary scenario and danger tolerance. BitMart doesn’t present any funding, authorized or tax recommendation.