Be a part of Our Telegram channel to remain updated on breaking information protection

The BNB worth has soared 17% within the final 24 hours to commerce at $1,356 as of 4:00 a.m. EST on a 74% improve within the day by day buying and selling quantity to $11.89 billion.

That worth surge comes as Binance prepares to pay $283 million in compensation to customers affected by the Oct. 10 flash crash that precipitated a number of belongings together with Ethena’s USDe stablecoin, BNSOL, and WBETH to depeg.

Market information reveals that USDE, BNSOL, and WBETH skilled extreme depegging occasions on Binance early at this time. USDE plunged to as little as $0.6567, BNSOL fell to $34.9, and WBETH dropped to $430.65 on the lowest level. Binance has responded to the incident, stating that the crew is… pic.twitter.com/QLS6H1PfnH

— Wu Blockchain (@WuBlockchain) October 11, 2025

Ethena’s USDe, meant to remain at $1, briefly fell beneath $0.66 on Binance, though its worth remained steadier on different main venues. The primary set off seems to have been a fast wave of liquidations, set off by macroeconomic information and panic promoting, reasonably than any technical malfunction on Binance itself.

This isn’t trying good for Binance😳

New studies recommend the trade might have been underreporting liquidations by as much as 100×.

Jeff Yan, founding father of $HYPE (Hyperliquid), claims Binance and different main CEXs are masking the true scale of liquidations by bundling a number of occasions… https://t.co/DeNcmMvhaY pic.twitter.com/Ajw1QbsF9d

— Cowboy (@CryptoCowboy_AU) October 13, 2025

On-chain information confirmed a heavy cluster of compelled liquidations between 21:36–22:16 UTC, whereas macro information, together with coverage strikes and world tensions, had already sparked a market-wide sell-off minutes earlier. The occasion coincided with a report $20 billion crypto liquidation, one of many largest single-day selloffs in historical past.

To handle the fallout, Binance agreed to compensate customers who suffered verified collateral losses in futures, margin, and mortgage accounts.

BNB Value On-Chain Affect And Market Response

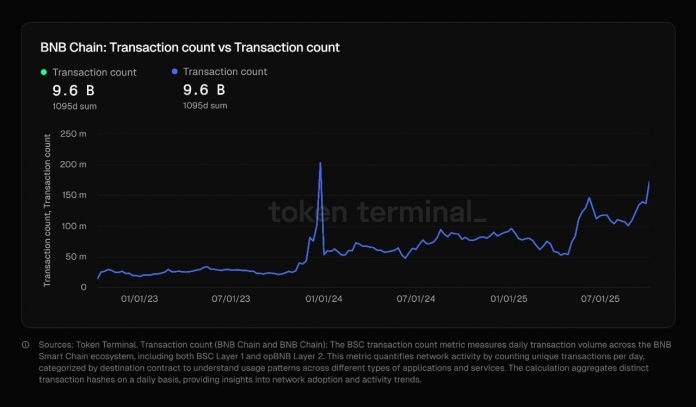

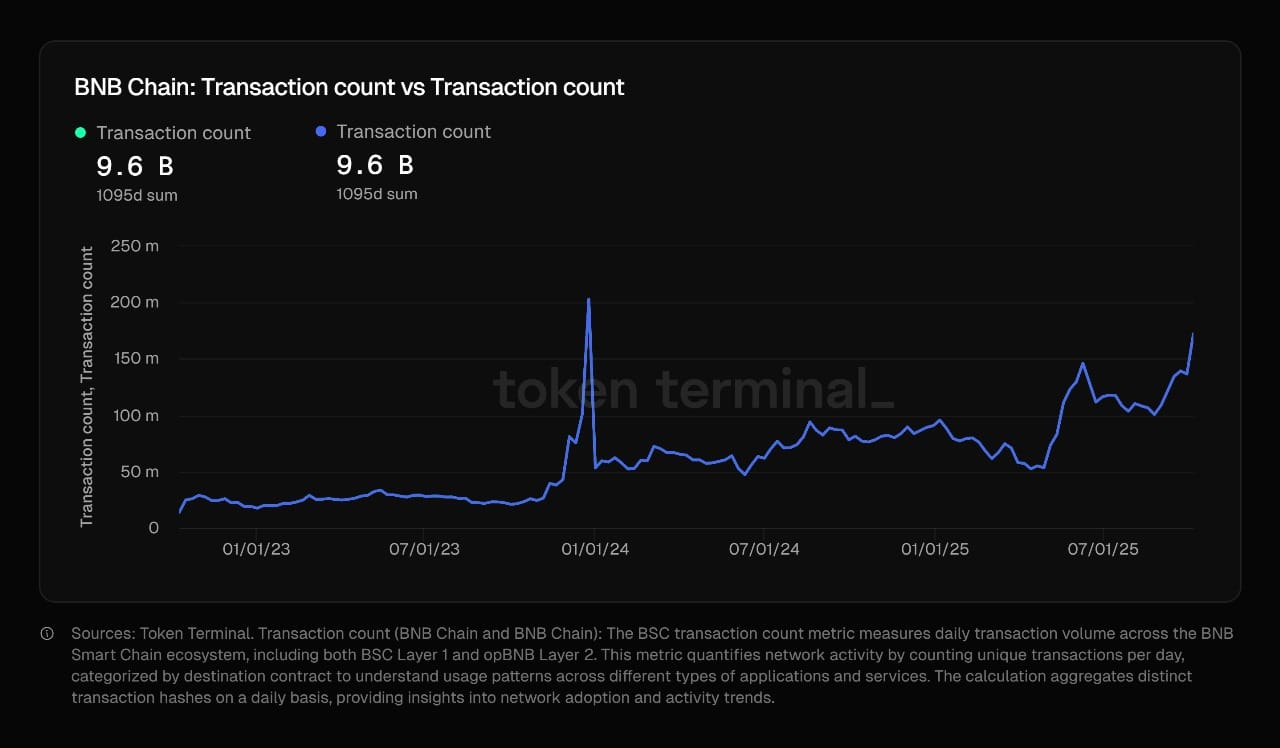

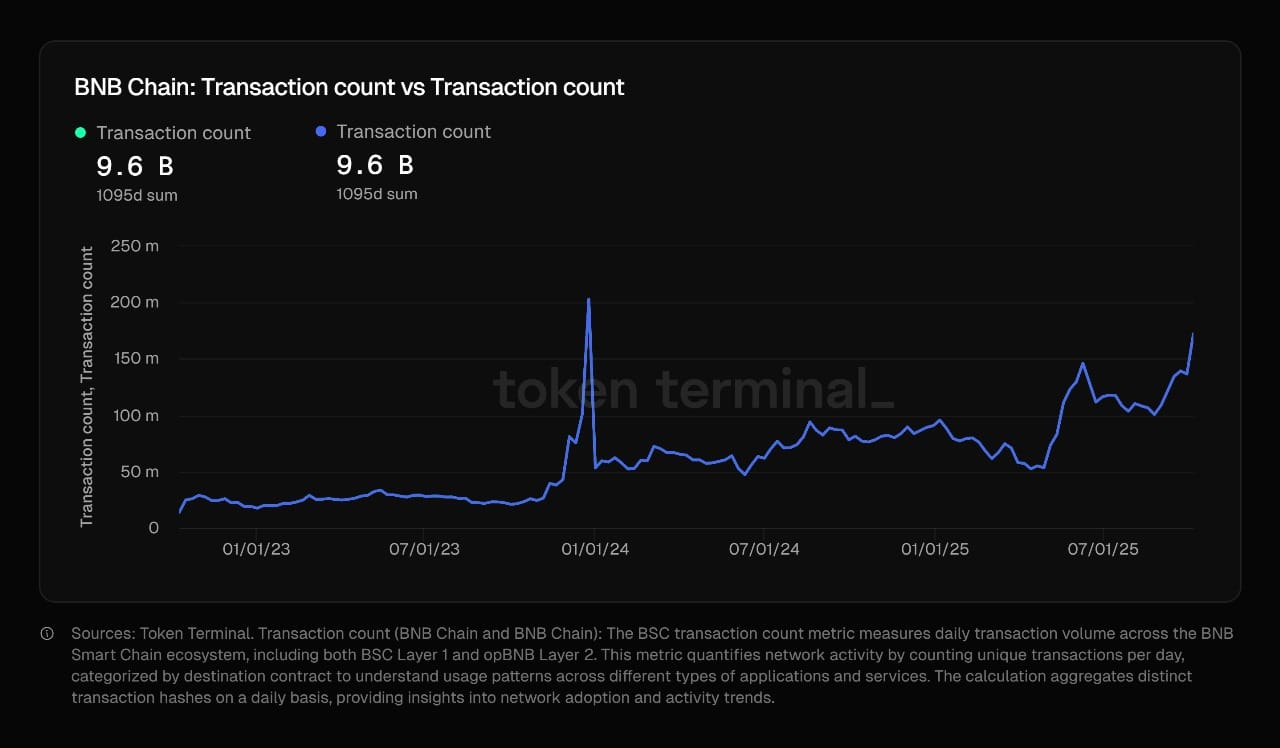

On-chain indicators since compensation was introduced present blended feelings. Information reveals a spike in each buying and selling exercise and pockets transfers, as customers shortly moved belongings and rebalanced holdings after the occasion.

Exercise on the Binance Chain has accelerated, with extra customers monitoring token stability and threat controls than ever earlier than. Whereas some USDe, BNSOL, and WBETH holders rushed to redeem or reposition, others took benefit of the momentary worth drops.

BNB Transaction Rely Supply: Token Terminal

Binance has now added new reference index protections and a tender worth ground for USDe to assist shield customers sooner or later. The corporate has additionally pledged to course of all assist instances manually for these not coated routinely, although customer support is reportedly overwhelmed with requests proper now.

BNB Value Targets $1,416 As Subsequent Main Resistance Stage

BNB has as soon as once more pushed increased, defying wider uncertainty within the crypto market. BNB at the moment trades close to $1,354 after hitting a weekly excessive of $1,360, marking a sustained restoration from the crash lows.

Technical evaluation from the weekly chart reveals that BNB is sitting effectively above its main shifting averages. The 50-week SMA stands at $731.95, and the essential 200-week SMA is at $456.42. The closest assist stage for the coin worth is the $730–$750 area, intently tied to the 50-week SMA. The longer-term assist is round $456.

After bouncing off assist close to $730, BNB’s worth has powered increased, breaking above key Fib retracement ranges. This bullish step places $1,297 (3.618 Fib stage) and $1,416 (the main resistance space from prolonged Fibonacci projections) as the following key hurdles.

BNBUSD Evaluation Supply: Tradingview

Technical momentum stays sizzling. The RSI (Relative Energy Index) sits in overbought territory at 81.78, which warns that the value may see a short-term cool-down or sideways motion earlier than making its subsequent massive transfer.

In the meantime, the MACD is deeply optimistic, with a robust divergence supporting the uptrend. The ADX at 43.1 confirms a robust development, but additionally indicators that volatility could also be forward.

The BNB worth has been making increased highs and better lows for the reason that bounce in late 2024 as effectively. Bulls are in management so long as BNB stays above $1,250–$1,280. Ought to profit-taking set in, draw back is protected by a robust cluster of patrons close to $1,200 and, if damaged, a take a look at for assist at $1,050–$1,100 may observe earlier than a brand new uptrend kinds.

If optimistic momentum holds and better threat urge for food returns, a detailed above $1,360 opens the door to a possible transfer in the direction of $1,416 within the coming weeks. In any other case, merchants will search for dips as recent entry factors, so long as the BNB worth holds above the $1,200 assist.

BNB stays one of many best-performing cash, outpacing most different massive caps thanks partially to sturdy administration response and enhancing ecosystem sentiment.

Associated Articles:

Finest Pockets – Diversify Your Crypto Portfolio

- Straightforward to Use, Function-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Energetic Customers

Be a part of Our Telegram channel to remain updated on breaking information protection