In a latest announcement, Finest in Slot, the infrastructure firm powering a number of the hottest Bitcoin functions and wallets like Xverse and Liquidium, revealed that BRC-20s are getting an improve.

Dubbed BRC2.0, it’s anticipated to go dwell on Bitcoin Testnet in Q1 of 2025, with the purpose to convey “sensible contracts” to BRC-20s, enabling them to compete with Bitcoin sidechain designs.

In brief, the “BRC20 Programmable Module” is designed to “unlock infinite new use circumstances for native property on Bitcoin—together with seamless DeFi, RWAs, DAOs, stablecoins, and extra—with out counting on multisig bridges or L2s.”

After a few years within the house, we will all agree that we’ve heard guarantees like this earlier than. Nevertheless, metaprotocols have one distinguishable benefit: they’re absolutely on-chain, somewhat than counting on totally separate chains with new belief assumptions. Positive, metaprotocols might not be the perfect strategy to decentralizing the token economic system on Bitcoin, however they’re a begin.

Runes suffered from overwhelmingly excessive expectations earlier than their launch, and this is a chance for BRCs to make a comeback. Regardless of your stance on tokens on Bitcoin, competitors between completely different requirements will finally convey extra effectivity and cut back on-chain bloat—one thing we will all agree is fascinating.

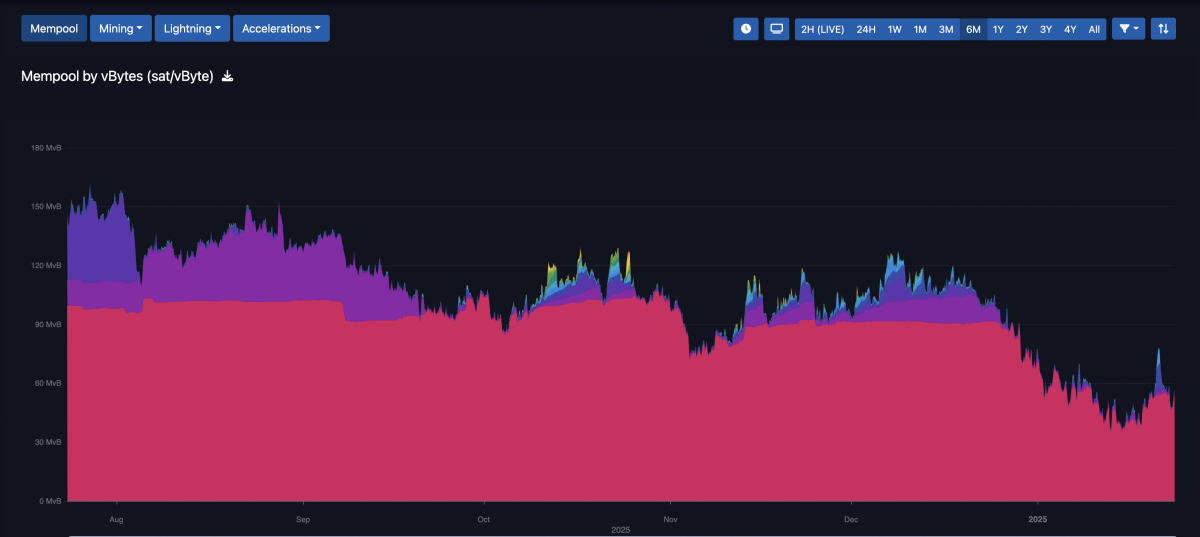

The true query is that this: for normal Bitcoiners who use Bitcoin purely as a financial community, do we actually must undergo this once more? On-chain congestion, ineffective pump-and-dump schemes, skyrocketing charges…

My reply is: completely!

The mempool has been “useless” for the higher a part of the final six months.

First, as Bitcoiners, we’re presupposed to assist free markets. Having further fee-paying customers is actually the very best final result for Bitcoin’s survival. Miners have simply gone by way of one other halving, and maintaining mining worthwhile is the one approach to forestall centralization within the fingers of backed actors (whether or not governments or monetary markets—sure, miners issuing limitless loans to purchase machines won’t final perpetually).

For context, in keeping with CoinDesk, Solana’s validators skilled a report inflow of over 100,000 SOL, price practically $25.8 million, in charges and suggestions as a consequence of intense buying and selling exercise of the TRUMP and MELANIA tokens.

Second, the Pandora’s field has already been opened. Tokens on Bitcoin are right here to remain. If customers need further programmability, who has the authority to cease it? (Except for pro-censorship thinkbois, in fact.)

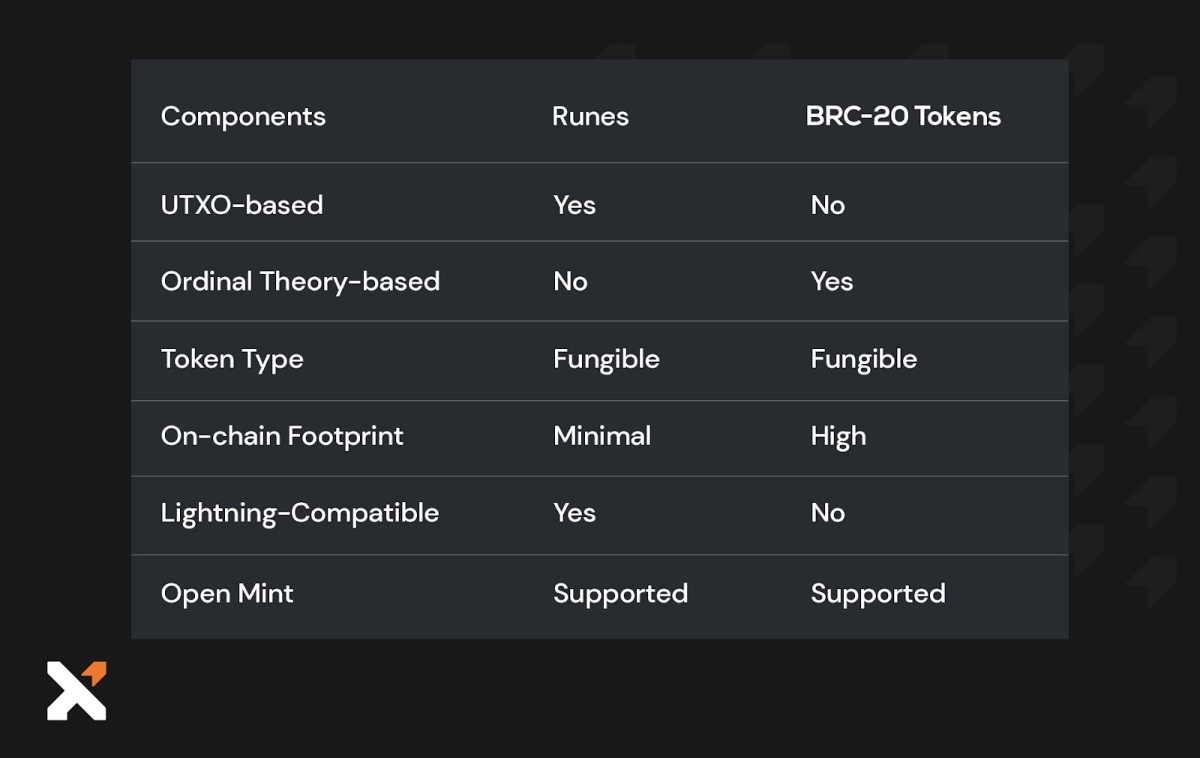

As Bitcoin’s ecosystem evolves, the introduction of the BRC-20 improve presents a compelling case for why it’d eclipse the Runes token customary. Listed below are a number of explanation why:

- The first attract of BRC2.0 lies in its promise to boost effectivity. With sensible contract performance, BRC-2.0 tokens might deal with complicated operations straight on the Bitcoin blockchain, doubtlessly lowering the necessity for added layers or sidechains. This might result in extra compact transactions, lowering on-chain bloat, an issue Runes have been criticized for as a consequence of their preliminary hype and subsequent congestion. This effectivity could possibly be a game-changer for Bitcoin’s scalability, providing a streamlined strategy to tokenization with out altering the core protocol’s safety or decentralization.

- BRC2.0 is designed to combine with present Bitcoin infrastructure. Because of collaborations with the likes of the Layer 1 Basis, it might enhance person expertise and interoperability. Not like Runes, which confronted challenges in person adoption as a consequence of complicated minting processes and dangerous UX, BRC2.0 goals to supply a extra user-friendly interface for token creation and interplay. This might result in broader acceptance and use, making Bitcoin a extra engaging platform for builders and customers alike.

My default place on something new associated to Bitcoin is at all times warning. We’ll have to attend for the precise specifics of this new protocol to be disclosed, however I’m excited in regards to the prospect of extra environment friendly DeFi use circumstances on Bitcoin—not on lesser chains.

If you happen to’re nonetheless skeptical, I’ll depart you with this query: If tokens on Bitcoin are inevitable, what’s worse?

- Metaprotocols utilizing Bitcoin’s block house in trade for charges, with out altering the community’s guidelines?

- Or Bitcoiners bridging their hard-earned Bitcoin to centralized, competing chains to entry the identical token markets?

As a Bitcoin Maxi, I would like all of the charges. I would like all of the customers. Bitcoin Maxis needs to be FEE REVENUE Maxis, so long as the core ethos of the underlying community stays unchanged ( feline enjoyyyyers).

My TL;DR:

- Wait and see what BRC2.0 has to supply. Will it actually turn into programmable in a approach that’s safe sufficient for Bitcoiners to belief?

- Runes might turn into irrelevant if BRCs stage an actual comeback, particularly with higher UX.

- Let the miners rejoice with degen charges.

- Tokens on Bitcoin with out altering the foundations are higher than tokens on Bitcoin that require new opcodes or altered guidelines.

- Grateful for all of the gigabrain devs constructing on Bitcoin apps as an alternative of vaporware chains.

This text is a Take. Opinions expressed are totally the creator’s and don’t essentially mirror these of BTC Inc or Bitcoin Journal.

Articles I write might talk about subjects or corporations which are a part of my agency’s funding portfolio (UTXO Administration). The views expressed are solely my very own and don’t symbolize the opinions of my employer or its associates. I’m receiving no monetary compensation for these takes. Readers mustn’t think about this content material as monetary recommendation or an endorsement of any specific firm or funding. At all times do your personal analysis earlier than making monetary choices.