Are you struggling to maintain your cash secure within the foreign exchange market? Many merchants discover it exhausting to guard their capital whereas attempting to make earnings. The temptation of fast cash typically results in dangerous selections, risking every part.

However, there’s a option to preserve your investments secure and do effectively in foreign currency trading.

Foreign exchange threat administration is vital to success. By utilizing examined methods to guard your capital, you’ll be able to face market ups and downs with confidence. Let’s take a look at how you can preserve your cash secure from huge losses and construct a long-lasting buying and selling profession.

Key Takeaways

- Implement stop-loss orders to restrict attainable losses.

- Use correct place sizing to handle threat effectively.

- Diversify throughout many forex pairs to chop general threat.

- Preserve emotional self-discipline for higher selections.

- Develop a strong buying and selling plan with life like objectives.

- Use leverage properly to keep away from an excessive amount of threat.

Understanding the Fundamentals of Capital Preservation

Capital preservation is vital in foreign currency trading. It’s about retaining your cash secure whereas making earnings. Let’s discover how you can shield your buying and selling capital.

Defining Buying and selling Capital Safety

Buying and selling capital safety means retaining your funds secure from huge losses. It’s like having a security web in your cash. Good methods allow you to keep within the sport longer, even when the market is hard.

The Function of Danger Administration

Danger administration is the center of capital preservation. It’s about making sensible selections to keep away from huge losses. For instance, setting stop-loss orders at 2% under the acquisition worth can restrict losses on unstable trades. Efficient threat administration is vital to avoiding huge hits to your buying and selling capital.

Key Parts of Capital Security

To maintain your capital secure, you want a mixture of instruments and strategies. Listed below are some vital ones:

- Diversification: Unfold your trades throughout completely different forex pairs.

- Place sizing: Don’t put an excessive amount of cash in a single commerce.

- Leverage management: Use leverage properly to keep away from huge losses.

- Common foreign exchange threat evaluation: Control market situations.

By utilizing these capital safety methods, you’ll be able to scale back dangers and shield your buying and selling funds. Bear in mind, in foreign currency trading, retaining your cash secure is simply as vital as making earnings.

Capital Preservation in Foreign exchange Buying and selling

Foreign exchange capital security is vital for buying and selling success. The market is open 24/7 and makes use of excessive leverage. This makes it important to guard your funds.

Conserving your capital secure is extra than simply avoiding losses. It’s about staying out there for a very long time. By defending your cash, you’ll be able to preserve buying and selling and seize good alternatives after they come.

Good methods to maintain your foreign exchange capital secure embrace:

- Setting strict stop-loss orders.

- Implementing sensible place sizing.

- Managing leverage properly.

- Diversifying forex pairs.

Listed below are some vital stats about retaining your capital secure:

| Side | Information |

|---|---|

| Advisable threat per commerce | 1-2% of whole account |

| FDIC insurance coverage restrict | $250,000 |

| Inflation influence (3% yearly) | 50% worth discount in 24 years |

Conserving your buying and selling funds secure is not only about tech. It’s additionally about emotional management. Avoiding revenge buying and selling and understanding when to cease throughout losses is vital. By specializing in capital preservation, merchants develop into stronger and set themselves up for long-term success within the foreign exchange market.

Important Danger Administration Methods

Foreign currency trading wants sensible threat administration to maintain your cash secure. Let’s take a look at key methods to guard your investments and enhance your buying and selling success.

Setting Efficient Cease-Loss Orders

A stop-loss in foreign exchange is vital to restrict losses. It closes your commerce at a set worth. For instance, in EUR/USD, you would possibly set a 50-pip stop-loss.

This implies if the commerce goes towards you by 50 pips, it closes. This limits your loss to $500 for the standard lot.

Place Sizing Methods

Place sizing is vital for threat administration. Danger not more than 1-2% of your account per commerce. For a $10,000 account, risking 2% means a max lack of $200 per commerce.

To search out your place measurement, use this components: Place Dimension = Danger Quantity / (Cease-Loss Distance × Pip Worth). Danger administration and capital preservation are key in foreign currency trading.

Managing Leverage Correctly

Leverage administration is essential in foreign exchange. Leverage can improve earnings but in addition losses. Use conservative ratios like 1:10 or 1:20 to handle threat.

Bear in mind, emotional choices with excessive leverage may cause huge losses. All the time use stop-losses with leveraged trades, even in unstable markets.

| Technique | Advice |

|---|---|

| Danger per Commerce | 1-2% of account stability |

| Cease-Loss Vary (Scalping) | 10-20 pips |

| Cease-Loss Vary (Swing Buying and selling) | 50-100 pips |

| Leverage Ratio | 1:10 to 1:20 |

| Danger-to-Reward Ratio | Minimal 1:2 |

By utilizing these methods, you’ll shield your capital and succeed within the foreign exchange market. Bear in mind, constant use of those strategies is important for long-term success.

Psychological Points of Buying and selling

Foreign currency trading psychology is essential for achievement. Buying and selling might be an emotional rollercoaster. This could result in dangerous choices if not managed effectively.

Research present that 60-80% of merchants face overconfidence. This could trigger them to take an excessive amount of threat and act impulsively.

Conserving feelings in test is vital to defending your cash. Merchants who do that effectively see a 20-25% increase in efficiency. This reveals how vital mindfulness and managing feelings are in foreign currency trading.

Worry and greed are huge traps for merchants. About 70% of foreign exchange merchants really feel these feelings extra when utilizing leverage. This could result in making dangerous selections.

To keep away from this, profitable merchants work on:

- Constructing a powerful buying and selling mindset.

- Utilizing threat administration instruments.

- Following a transparent buying and selling plan.

- Studying consistently.

Solely 15% of merchants use instruments like stop-loss orders usually. However, understanding about foreign exchange psychology and utilizing these instruments can minimize losses by as much as 40%.

| Psychological Trait | Affect on Buying and selling |

|---|---|

| Self-discipline | 70% extra prone to stick with buying and selling plans |

| Endurance | 20% extra worthwhile in the long term |

| Resilience | 25% extra profitable in bouncing again from losses |

| Emotional Management | 40% fewer impulsive trades throughout unstable occasions |

By specializing in these psychological points, merchants can do higher within the complicated world of foreign exchange. They’ll improve their probabilities of success over time.

Superior Danger Evaluation Strategies

Foreign exchange market evaluation is vital for superior threat evaluation. Merchants use many strategies to identify threats and make sensible selections. Let’s take a look at some vital strategies to guard your cash.

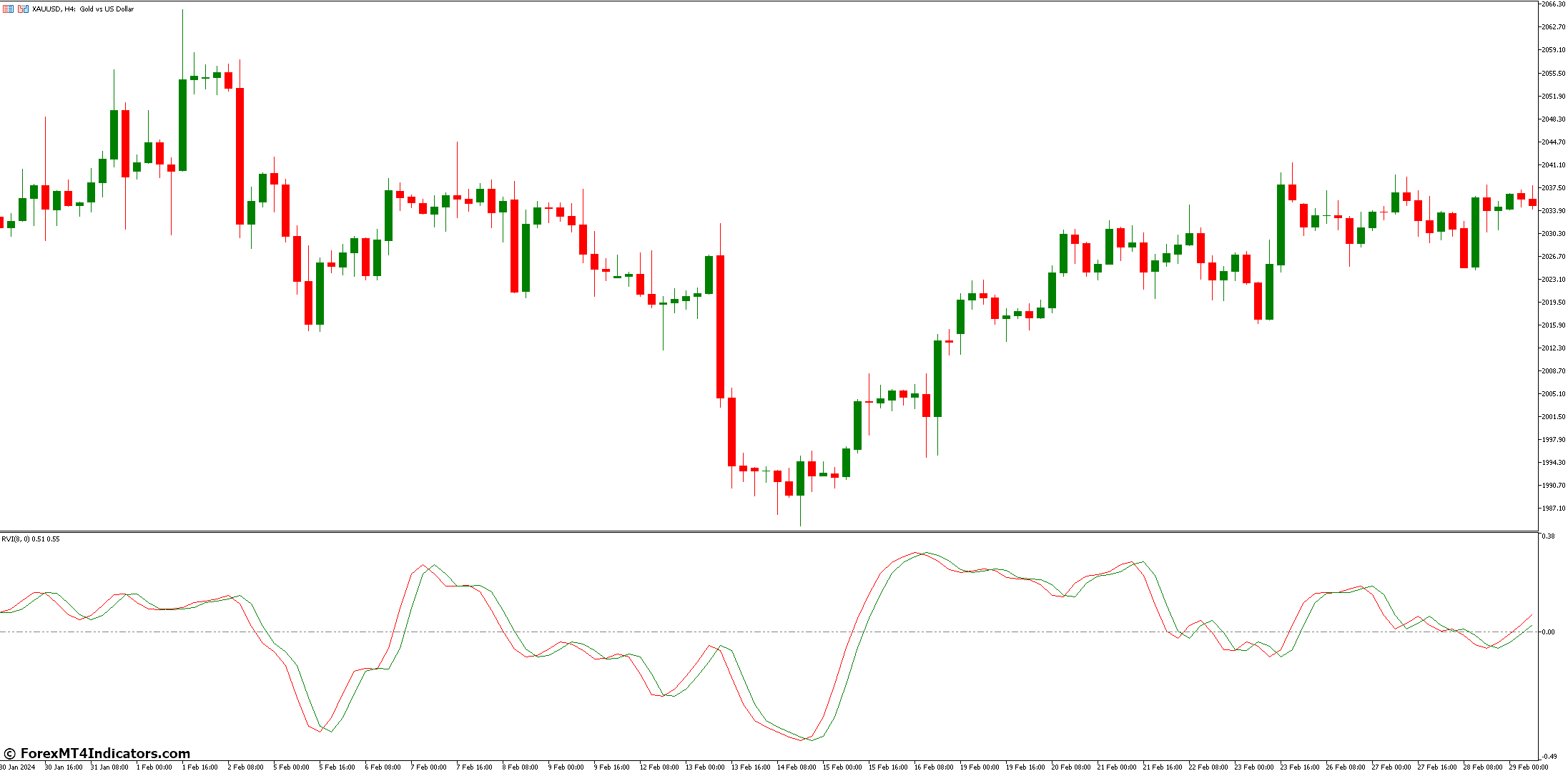

Market Evaluation Methods

Good foreign exchange market evaluation means finding out worth patterns and developments. Merchants use chart patterns and candlestick formations to guess future costs. Figuring out these patterns helps you notice dangers and alter your technique.

Technical Indicators for Danger Administration

Technical indicators are nice for managing threat in foreign currency trading. Well-liked ones embrace:

- Transferring Averages

- Relative Power Index (RSI)

- Bollinger Bands

These instruments assist discover overbought or oversold situations and development reversals. For instance, setting a stop-loss order at 1.1950 when shopping for at 1.2000 limits loss to 50 pips.

Elementary Evaluation in Danger Evaluation

Elementary evaluation is important for long-term threat evaluation. It appears to be like at financial indicators, political occasions, and central financial institution insurance policies. Merchants who use basic evaluation can predict market modifications higher. This helps them modify their positions.

By utilizing these superior strategies, merchants can preserve their capital secure and make constant earnings within the foreign exchange market.

Diversification Methods in Foreign exchange

Foreign exchange diversification is vital to constructing a powerful buying and selling portfolio. By investing in numerous forex pairs, merchants can handle threat and improve returns. Let’s take a look at how you can create a balanced foreign exchange portfolio.

Forex Pair Choice

Choosing the proper forex pairs is vital. Main pairs like EUR/USD and USD/JPY have excessive liquidity and tight spreads. Minor pairs, resembling AUD/CAD, supply distinctive possibilities. Unique pairs like USD/ZAR add pleasure however are riskier.

Cross-Market Correlation

It’s important to grasp forex pair correlation for efficient diversification. Pairs like EUR/USD and GBP/USD transfer collectively, growing threat if traded collectively. Combine correlated and uncorrelated pairs to stability your portfolio.

| Pair Sort | Instance | Traits |

|---|---|---|

| Main | EUR/USD | Excessive liquidity, low spreads |

| Minor | AUD/CAD | Reasonable liquidity, huge strikes attainable |

| Unique | USD/ZAR | Extra volatility, wider spreads |

Portfolio Steadiness Methods

To maintain a balanced portfolio, commerce in numerous timeframes. Brief-term trades on 1-minute charts supply many possibilities. Weekly charts give a extra relaxed tempo. Mixing methods like trend-following and range-bound buying and selling makes your portfolio stronger.

Bear in mind, a well-diversified Foreign exchange portfolio wants common checks and tweaks. By spreading threat and utilizing completely different market situations, merchants can goal for regular efficiency and higher capital safety.

Monitoring and Efficiency Monitoring

Keeping track of your buying and selling efficiency is important for foreign exchange success. A buying and selling journal is sort of a private scorekeeper. It tracks your wins, losses, and progress. By recording trades, you study your habits and discover methods to get higher.

Foreign exchange efficiency evaluation means numbers to see how effectively you commerce. Let’s take a look at some key metrics:

- Win Price (WR): (Variety of Profitable Trades / Complete Trades) × 100

- Danger-Reward Ratio (RR): Compares revenue to loss

- Anticipated Worth (EV): Reveals the common end result of trades

- Complete Revenue and Loss (P&L): Provides up your buying and selling outcomes

- Return on Funding (ROI): Reveals revenue in comparison with funding

Checking these metrics typically in your journal helps enhance your methods. As an example, a win charge of over 50% is nice. However, your risk-reward ratio issues too. Goal for a 3:1 ratio, the place you make $3 for each $1 risked.

| Metric | System | Significance |

|---|---|---|

| Win Price | (Profitable Trades / Complete Trades) × 100 | Measures buying and selling success frequency |

| Danger-Reward Ratio | Potential Revenue / Potential Loss | Evaluates commerce threat administration |

| Anticipated Worth | (WR × Avg Revenue) – (Loss Price × Avg Loss) | Predicts long-term profitability |

By monitoring these metrics effectively, you’ll perceive your buying and selling strengths and weaknesses. Bear in mind, common monitoring results in long-term buying and selling success.

Constructing a Sustainable Buying and selling Plan

An excellent foreign currency trading plan is vital to retaining your cash secure. It units clear guidelines for buying and selling. This helps merchants keep centered and disciplined, even when the market is wild.

Setting Real looking Objectives

Setting objectives that match your threat stage and cash is vital. For instance, you would possibly goal for a ten% return in three months. Or, you could possibly goal for a 5% revenue in two months with a swing buying and selling technique. These objectives needs to be reachable with out taking too many dangers.

Danger-to-Reward Ratios

In foreign currency trading, an excellent risk-reward ratio is 1:2. This implies risking $100 to make $200. It’s vital to threat not more than 1-2% of your whole capital on any commerce. This helps preserve your cash secure when the market modifications.

Commerce Documentation Strategies

Conserving good data of your trades is crucial for getting higher. Write down each commerce in a buying and selling journal. This helps you notice patterns and enhance your methods over time. Embody particulars like once you entered and exited the commerce, how huge the commerce was, and why you made the choice.

| Component | Advice |

|---|---|

| Danger per Commerce | 1-2% of whole capital |

| Danger-Reward Ratio | 1:2 or higher |

| Objective Setting | 10-15% return in 3-6 months |

| Documentation | Detailed buying and selling journal |

By utilizing these components in your foreign currency trading plan, you construct a powerful base for retaining your capital secure. This results in success in the long term.

Market Volatility and Capital Safety

Foreign exchange market volatility can drastically have an effect on a dealer’s success. It’s vital to know how you can deal with it effectively. This fashion, you’ll be able to preserve your investments secure.

Dealing with Market Turbulence

In unpredictable markets, merchants have to be fast and sensible. Utilizing stop-loss orders is essential. They assist restrict losses and shield your cash from sudden modifications.

It’s sensible to threat solely 1-2% of your whole cash on one commerce.

Adapting to Market Circumstances

Adaptive buying and selling methods are important within the unstable foreign exchange market. Recurrently checking your methods is vital. Watch financial information and international occasions carefully, as they have an effect on forex costs rather a lot.

Emergency Danger Protocols

Having threat plans can save your buying and selling account in excessive occasions. Listed below are some vital factors:

- Use leverage rigorously, aiming for a 2:1 ratio or much less

- Unfold your investments throughout completely different forex pairs to reduce the loss influence

- Arrange automated stop-loss orders to keep away from making rash choices

- Continue to learn about market developments to make higher selections

| Danger Administration Method | Profit |

|---|---|

| Cease-loss orders | Caps attainable losses |

| Leverage limitation | Reduces threat publicity |

| Diversification | Acts as a buffer towards market shifts |

| Steady studying | Enhances decision-making |

By utilizing these methods and threat plans, merchants can handle foreign exchange market volatility higher. This helps shield their capital.

Conclusion

Foreign exchange capital preservation is vital to long-term buying and selling success. The foreign exchange market is large, stuffed with possibilities but in addition dangers. Merchants who give attention to retaining their capital secure typically do higher than those that simply search for earnings.

Just one in three merchants with related abilities make it within the robust buying and selling world. That is due to good bankroll administration and cautious threat management. Winners typically set a restrict on their losses, like $100 per commerce, to handle threat.

Even merchants who win lower than 25% of the time can become profitable. They do that by retaining small losses low and grabbing huge wins. This reveals how vital managing threat is, not simply successful.

In brief, foreign exchange capital preservation is not only about being cautious. It’s about being sensible and staying within the sport. By managing cash effectively and utilizing good buying and selling methods, merchants can succeed within the fast-paced foreign exchange market.