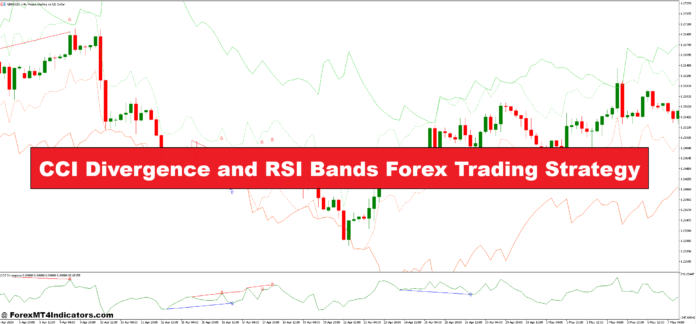

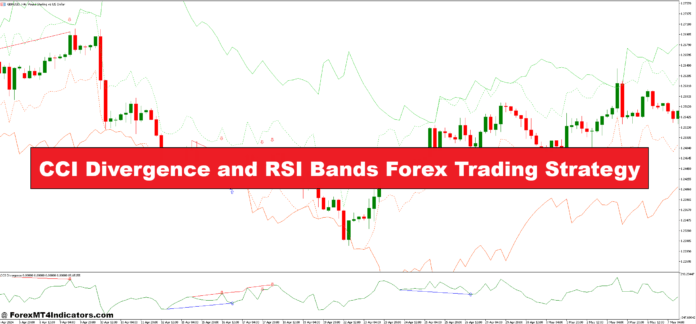

The CCI Divergence and RSI Bands Foreign exchange Buying and selling Technique is a robust mixture of two confirmed technical indicators that supply merchants a dynamic method to figuring out market reversals and potential worth tendencies. Within the extremely unstable world of foreign currency trading, counting on a single indicator can usually result in inconsistent outcomes. By integrating the Commodity Channel Index (CCI) and Relative Power Index (RSI) Bands, this technique creates a sturdy system that helps merchants filter out market noise, enhance entry timing, and optimize exit factors. The synergy between these two indicators makes this technique notably efficient for short-term and swing merchants on the lookout for precision and reliability of their trades.

The CCI Divergence performs a crucial position in recognizing early indicators of worth reversals. Divergence happens when the value of a foreign money pair strikes in a single route whereas the CCI indicator strikes in the other way. This discrepancy indicators weakening momentum and the potential of a pattern reversal, providing merchants worthwhile insights into upcoming market actions. Alternatively, RSI Bands are designed to establish overbought and oversold situations with a better stage of flexibility than the normal RSI. By increasing and contracting based mostly on volatility, RSI Bands present merchants with clearer zones for high-probability commerce entries and exits. Collectively, these indicators complement one another, enhancing the technique’s accuracy in figuring out reversals and pattern continuations.

What units this technique aside is its capability to adapt to totally different market situations, providing merchants an edge whether or not the market is trending or consolidating. By combining the predictive nature of CCI Divergence with the dynamic construction of RSI Bands, merchants achieve a complete view of market momentum, permitting them to make knowledgeable choices with confidence. Whether or not you’re a novice exploring new methods or an skilled dealer seeking to refine your edge, the CCI Divergence and RSI Bands Foreign exchange Buying and selling Technique presents a dependable framework to navigate the complexities of the foreign exchange market successfully.

CCI Divergence Indicator

The Commodity Channel Index (CCI) Divergence Indicator is a flexible instrument designed to establish shifts in momentum and potential reversals within the foreign exchange market. The CCI measures the deviation of a foreign money pair’s worth from its common worth over a particular interval, indicating whether or not the market is overbought or oversold. When the CCI begins to diverge from the precise worth motion, it indicators that the present pattern is shedding momentum, and a reversal could possibly be imminent. As an illustration, if the value is making greater highs whereas the CCI is making decrease highs, it creates bearish divergence, suggesting that purchasing strain is weakening. Equally, bullish divergence happens when the value makes decrease lows whereas the CCI varieties greater lows, indicating potential shopping for alternatives as sellers lose power.

One of many main benefits of the CCI Divergence Indicator is its capability to identify reversals earlier than they happen, giving merchants an edge in getting into trades early. In contrast to lagging indicators that observe worth actions, divergence highlights refined discrepancies between worth motion and market momentum. This enables merchants to anticipate shifts in route and capitalize on rising tendencies. To maximise its effectiveness, the CCI Divergence Indicator is commonly used along with different instruments like help and resistance ranges or candlestick patterns to substantiate the indicators and scale back false positives. By incorporating CCI Divergence into their technique, merchants achieve a deeper understanding of market dynamics and might higher handle danger when positioning their trades.

RSI Bands Indicator

The RSI Bands Indicator is a modified model of the traditional Relative Power Index (RSI) that adapts to market volatility through the use of dynamic bands as a substitute of fastened overbought and oversold ranges. Whereas the normal RSI operates inside a variety of 0 to 100, with the 70 and 30 ranges indicating overbought and oversold situations respectively, the RSI Bands create higher and decrease bands that broaden and contract based mostly on volatility. This dynamic adjustment permits merchants to establish high-probability commerce setups extra successfully, because the bands mirror altering market situations slightly than inflexible thresholds. When worth motion reaches the outer RSI Bands, it usually indicators a possible reversal or exhaustion within the prevailing pattern, offering merchants with alternatives for entries or exits.

What makes the RSI Bands notably helpful is their capability to filter out market noise and supply clearer indicators during times of excessive volatility. In trending markets, the RSI Bands may help merchants experience tendencies confidently by figuring out pullbacks or corrections inside the pattern. In ranging markets, the bands function dependable boundaries, highlighting areas the place worth is more likely to reverse. By combining the RSI Bands with different indicators, such because the CCI Divergence, merchants can verify indicators and improve their decision-making course of. This adaptability makes the RSI Bands Indicator a worthwhile instrument for merchants in search of precision and consistency in each trending and uneven market situations.

Collectively, the CCI Divergence and RSI Bands indicators kind a synergistic technique, offering merchants with the instruments wanted to navigate complicated worth actions with confidence.

The way to Commerce with CCI Divergence and RSI Bands Foreign exchange Buying and selling Technique

Purchase Entry

- Determine Bullish Divergence:

- Worth makes decrease lows.

- CCI varieties greater lows (divergence sign).

- RSI Bands Affirmation:

- Worth approaches or bounces from the decrease RSI Band.

- Watch for a bullish reversal candlestick (e.g., hammer, bullish engulfing).

- Enter the Commerce:

- Enter on the shut of the confirming bullish candlestick.

Promote Entry

- Determine Bearish Divergence:

- Worth makes greater highs.

- CCI varieties decrease highs (divergence sign).

- RSI Bands Affirmation:

- Worth reaches or rejects the higher RSI Band.

- Watch for a bearish reversal candlestick (e.g., capturing star, bearish engulfing).

- Enter the Commerce:

- Enter on the shut of the confirming bearish candlestick.

Conclusion

The CCI Divergence and RSI Bands Foreign exchange Buying and selling Technique is a extremely efficient method for figuring out potential market reversals and bettering commerce accuracy. By combining the predictive energy of the CCI Divergence with the dynamic flexibility of the RSI Bands, merchants can anticipate adjustments in momentum and make well-informed buying and selling choices. This technique works seamlessly in each trending and ranging markets, permitting merchants to identify high-probability commerce setups whereas filtering out market noise.

Really helpful MT4 Dealer

XM Dealer

- Free $50 To Begin Buying and selling Immediately! (Withdraw-able Revenue)

- Deposit Bonus as much as $5,000

- Limitless Loyalty Program

- Award Profitable Foreign exchange Dealer

- Further Unique Bonuses All through The Yr

- Unique 50% Money Rebates for all Trades!

Already an XM shopper however lacking out on cashback? Open New Actual Account and Enter this Companion Code: 𝟕𝐖𝟑𝐉𝐐

Click on right here beneath to obtain: