Chainlink worth dropped for 3 consecutive days and stays in a deep bear market regardless of essential catalysts just like the upcoming LINK ETF approval and falling alternate reserves.

Abstract

- Chainlink worth remained beneath strain this month.

- The availability of LINK tokens in exchanges has dived.

- Grayscale will launch the spot LINK ETF subsequent week.

Chainlink (LINK) token dropped to $13, down by ~53% from its highest degree in September, a transfer that has erased billions of {dollars} in worth.

LINK worth has crashed regardless of notable bullish catalysts. One in every of them is that Grayscale will launch its LINK ETF subsequent week. As one of many high utility tokens within the crypto trade, this ETF will seemingly result in substantial demand from buyers.

Some high utility tokens have had strong demand. For instance, spot Solana (SOL) ETFs have had over $618 million in inflows and are actually nearing the $1 billion mark when it comes to property.

Equally, spot XRP ETFs have added over $666 million in inflows, an indication that the demand is accelerating. All XRP ETFs now have $687 million in property, a development that will speed up within the close to time period.

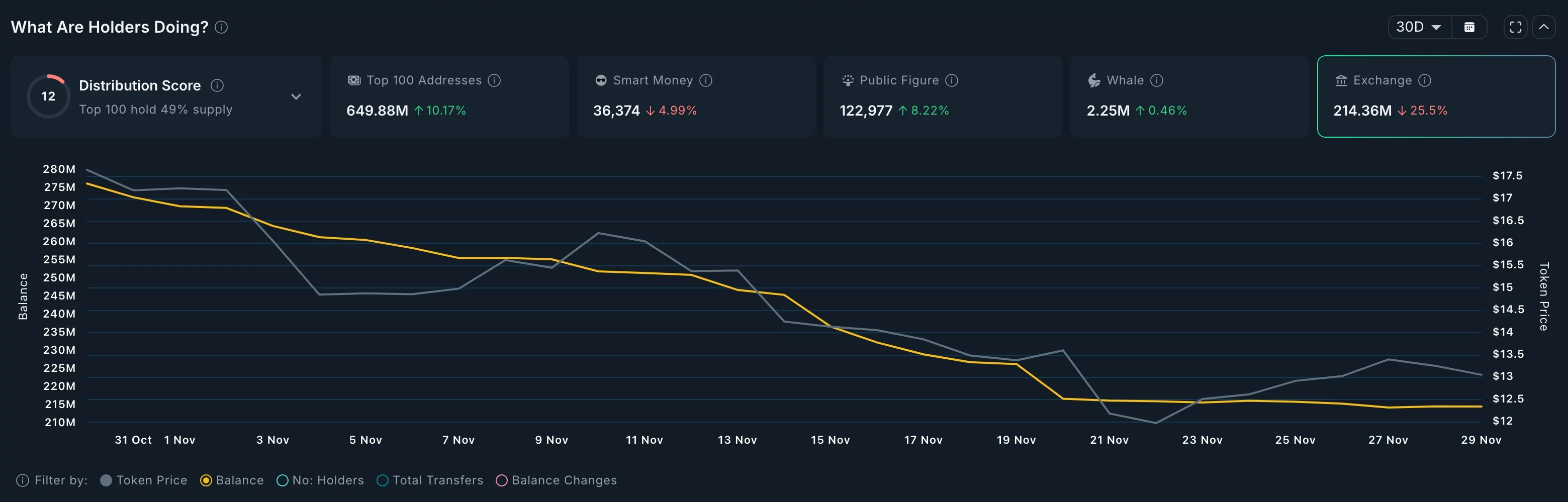

The opposite notable catalyst for Chainlink worth is that its provide in exchanges has continued falling. Nansen knowledge exhibits that this provide has been in a freefall and now stands at 214 million, down sharply from 275 million.

Falling LINK reserves is an indication that demand is rising, with extra buyers shifting their tokens to exchanges. One minor cause why that is occurring is that Chainlink has continued so as to add extra tokens to its strategic reserves. These reserves are nearing 1 million, a couple of months after they have been launched.

Chainlink worth technical evaluation

The weekly chart exhibits that Chainlink worth has shaped an alarming sample and is now sitting at an essential assist. It has shaped a head-and-shoulders sample, a typical bearish reversal signal.

LINK worth has moved to the neckline of this sample. It has moved under the 100-week Exponential Shifting Common and the Supertrend indicator.

Subsequently, the almost definitely Chainlink forecast is bearish, with the subsequent goal to observe being at $10, down by 22% from the present degree. A transfer under that degree will level to extra draw back, probably to the 2023 low of $8.