The S&P 500 took a breather after making recent report highs earlier this month.

However the U.S. inventory index is now buying and selling close to a assist zone, which may permit the bulls to leap in a broader pattern.

What do you consider the asset’s day by day chart?

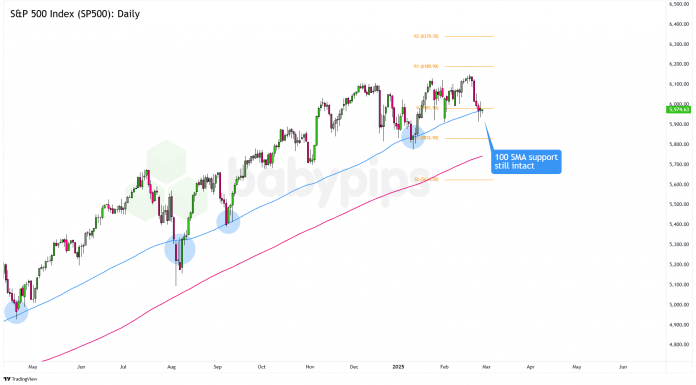

S&P 500 Index (SP500) Every day Chart by TradingView

The S&P 500 has been easing off its latest excessive close to 6,150, with investor warning setting in forward of Nvidia’s earnings and a few underwhelming financial knowledge fueling hopes for faster Fed charge cuts.

This seems to be like a pure pullback inside a broader uptrend, however the subsequent transfer may go both approach. Proper now, the index is hovering round 5,975, just below that key 6,000 stage that merchants appear to like to look at.

Do not forget that directional biases and volatility situations in market value are usually pushed by fundamentals. In the event you haven’t but carried out your homework on the U.S. inventory market, then it’s time to take a look at the financial calendar and keep up to date on day by day basic information!

Take observe that the 100 SMA is sitting close to 5,850 and has acted like a stable “ground” for the market since November 2023. Each time the index has examined this line over the previous 12 months, it’s bounced again as a substitute of breaking via.

This time, the 100 SMA can be sitting near the important thing 6,000 mark and the Pivot Level (5,981) stage within the day by day timeframe.

For bulls, hold an eye fixed out for lengthy wicks under the 100 SMA, bullish candlesticks, or regular buying and selling above 6,000. These may sign recent shopping for demand, probably pushing the index again to its 6,150 highs or perhaps even its recent report highs.

On the flip facet, if crimson candlesticks begin displaying up or the index stays under the 100 SMA, we may see a deeper pullback. The primary cease may be the 5,850 zone, however a slide towards 5,750, nearer to the 200 SMA assist, wouldn’t be out of the query.

Whichever bias you find yourself buying and selling, don’t neglect to observe correct threat administration and keep conscious of top-tier catalysts that might affect total market sentiment!