Welcome again to the Chart Decoder Collection, the place we break down the world of technical evaluation into instruments you’ll really use.

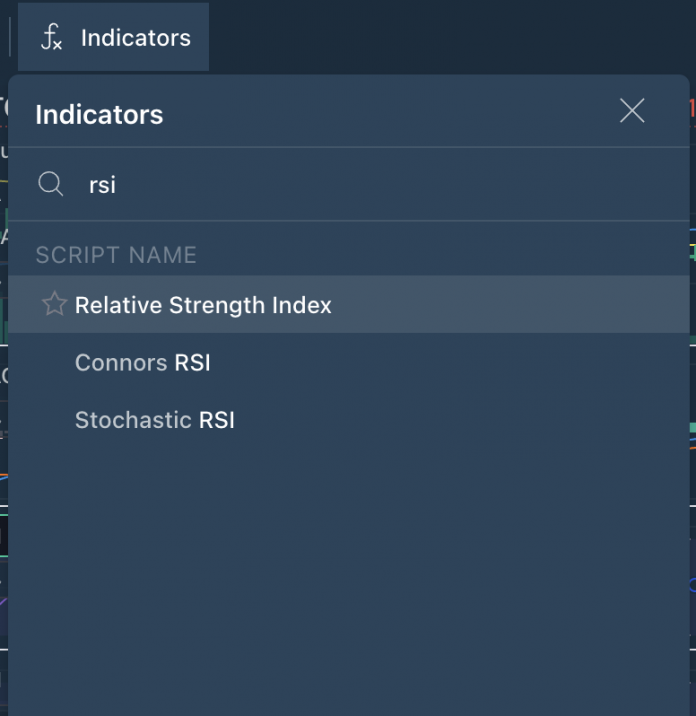

In our earlier entries, we coated shifting averages and MACD, nice for figuring out traits and momentum. Now let’s have a look at RSI, a device many merchants use to time their trades with higher confidence.

What’s RSI?

RSI stands for Relative Power Index. It helps you see if a coin has been purchased or bought an excessive amount of just lately and is likely to be able to reverse.

It’s plotted as a line that strikes between 0 and 100. Most merchants use it with a 14-period setting. Relying in your chart’s timeframe, this might imply 14 days, 14 hours, and even 14 minutes.

Not like price-following indicators, RSI doesn’t simply observe the place value is. It tells you how excessive current shopping for or promoting stress has been. That method, you may determine if the market’s about to flip earlier than it really does.

How one can Learn It:

- RSI above 70 = Overbought → Market could also be due for a correction

- RSI beneath 30 = Oversold → Market could also be due for a bounce

- RSI between 40–60 = Impartial → No robust sign

Instance in Motion:

RSI (Purple Panel): Overbought Alert

- RSI is sitting above 70, signalling basic overbought situations.

- This means that Bitcoin’s current bullish run could also be shedding steam or approaching a pure correction.

What Merchants Are Watching:

- RSI dropping again beneath 70 may imply a pullback is beginning.

- If BTC stays robust, RSI would possibly keep overbought. This can be a conduct widespread in robust uptrends but additionally a dangerous zone for late patrons.

For higher accuracy, use RSI along with MACD and Shifting Averages to make extra knowledgeable selections.

MACD: Bullish, however Momentum Slowing?

- MACD Line (Blue): 4,142

- Sign Line (Orange): 3,536

- Histogram: Constructive however beginning to flatten, hinting that momentum is slowing down.

The MACD stays bullish with the blue line comfortably above the orange, however control that histogram. If these bars begin to shrink, it’s typically the primary clue that bullish momentum is fading.

Shifting Averages: Is BTC Overextended?

- 50-Day EMA (Yellow Line): 92,570

- 200-Day SMA (Blue Line): 91,673

BTC is buying and selling properly above each these crucial shifting averages, which confirms the energy of the present uptrend.

However this additionally raises a flag: Is the market overstretched?

When value pulls too far-off from these averages, a wholesome correction typically follows, bringing value again towards the 50 EMA, a degree many merchants view as dynamic assist in a bull market.

Last Takeaways: Ought to You Act Now or Wait?

- Present Pattern: Strongly bullish however doubtlessly overextended.

- RSI: In overbought territory, train warning.

- MACD: Nonetheless bullish, however displaying early indicators of slowing momentum.

- Technique:

- If you happen to’re already in revenue, this can be a nice time to think about securing good points or tightening your stop-losses.

- If you happen to’re ready to enter, look ahead to a pullback towards the 50 EMA for a stronger, lower-risk entry level.

Professional Ideas for Utilizing RSI Like a Professional

RSI is straightforward, however utilizing it properly is the place it actually counts. Right here’s how skilled merchants make the very best of RSI:

- Perceive Market Context

RSI works superbly in sideways or ranging markets, the place value bounces between assist and resistance. However in robust traits (like a bull run), RSI can keep overbought or oversold for weeks. So don’t hit that promote button simply because RSI hits 70. Take a look at the larger image first.

- Mix It with Different Indicators

RSI works greatest when it’s a part of the dialog. Attempt pairing it with:- MACD to verify if momentum agrees with what RSI is telling you.

- Shifting Averages (just like the 50 EMA) to see if value is stretched too removed from key assist ranges.

- Look ahead to Divergence

If value makes a new excessive, however RSI doesn’t? That’s known as bearish divergence, momentum may very well be slipping.

If value makes a new low, however RSI doesn’t? That’s bullish divergence, a bounce is likely to be across the nook.

Divergence doesn’t all the time play out instantly, but it surely’s a type of clues that severe merchants don’t ignore

- RSI Is an Early Indicator, Not a Direct Name to Motion

Simply because RSI is flashing overbought or oversold doesn’t imply you should rush into motion. Use it as an early warning, not as a purpose to panic-buy or panic-sell.

- Play with Timeframes to Refine Your Technique

RSI readings change primarily based on the timeframe you’re taking a look at. If the every day RSI exhibits overbought, however the 1-hour RSI is cooling off, this typically means the market is in a short-term pullback inside a bigger uptrend. Sensible merchants use this to their benefit, ready for the short-term RSI to reset earlier than leaping again into the bigger pattern. This strategy helps you keep away from chasing tops and provides you higher, lower-risk entry factors. All the time verify a number of timeframes earlier than making your transfer.

Coming quickly in Chart Decoder Collection: Bollinger Bands – How one can Commerce Volatility Like a Professional

Bitfinex. The Unique Bitcoin Alternate.

The submit <robust>Chart Decoder Collection: RSI – The Best Technique to Spot Overbought and Oversold Markets</robust> appeared first on Bitfinex weblog.