02 Oct Chart Decoder Sequence: Fibonacci Retracements – The Mathematical Sample That Predicts Market Behaviour

Welcome again to the Chart Decoder Sequence, the place we flip complicated buying and selling instruments into actionable methods.

Our journey up to now:

Right this moment, we’re exploring Fibonacci retracements, the mathematical software that reveals the place markets are most certainly to search out assist and resistance.

The Mathematical Basis

The Fibonacci sequence is an easy sample the place every quantity is the sum of the 2 earlier than it (1, 1, 2, 3, 5, 8, 13…). What makes it fascinating is the ratio between these numbers. Because the sequence grows, the ratio stabilises round 1.618, often known as the Golden Ratio.

This ratio exhibits up in all places within the pure world:

- The spiral of seashells and galaxies

- The way in which leaves develop round a stem

- The proportions of the human physique

- The branching of bushes and rivers

In buying and selling, we convert these mathematical relationships into retracement percentages. The important thing Fibonacci ratios are derived from the Golden Ratio (1.618):

- 61.8% = 1 ÷ 1.618 (the inverse of the Golden Ratio)

- 38.2% = 1 – 61.8%

- 23.6% = 38.2% × 61.8%

- 78.6% = the sq. root of 61.8%

Why this issues for buying and selling:

These aren’t arbitrary numbers – they’re mathematical relationships that seem all through nature. When utilized to cost actions, they usually mark the place shopping for and promoting stress naturally shifts.

- 61.8%: The golden ratio. Probably the most highly effective retracement, the place main bounces usually occur. Institutional merchants monitor this stage intently because it represents the mathematical “determination level” for pattern continuation.

- 38.2%: A typical correction stage the place worth briefly pauses earlier than resuming the first pattern.

- 23.6%: Signifies robust underlying momentum. Sturdy tendencies hardly ever retrace past this stage earlier than persevering with.

- 78.6%: Represents the “final stand” for pattern continuation. Breaks under this stage usually sign impending pattern reversal.

Setting Up Fibonacci Retracement on Bitfinex

Fibonacci retracements determine potential reversal ranges throughout market corrections. Right here’s the method:

- Establish the pattern:

- Open buying and selling.bitfinex.com and choose your buying and selling pair.

- On the left toolbar, search for the “Fib Retracement” software (it seems like 4 horizontal strains)

- Spot a transparent transfer on the chart – both a rally (low to excessive) or a drop (excessive to low).

- Discover your swing factors:

- Swing Low: The plain lowest level the place worth bottomed out earlier than transferring up

- Swing Excessive: The plain highest level the place worth peaked earlier than transferring down

- Tip: Zoom out to see the larger image – you need the obvious turning factors, not small bumps

- Apply the software:

- Uptrend: Click on the swing low, drag to the swing excessive

- Downtrend: Click on the swing excessive, drag to the swing low

- Watch the degrees: The software robotically plots retracement strains (23.6%, 38.2%, 50%, 61.8%, 78.6%). These act as potential assist and resistance zones.

- Plan your trades: Merchants use these ranges to time entries, set revenue targets, and place cease losses.

The psychology behind it: Markets transfer in waves attributable to human feelings, worry and greed create predictable patterns, and Fibonacci ranges usually line up with the place merchants collectively step in or take revenue.

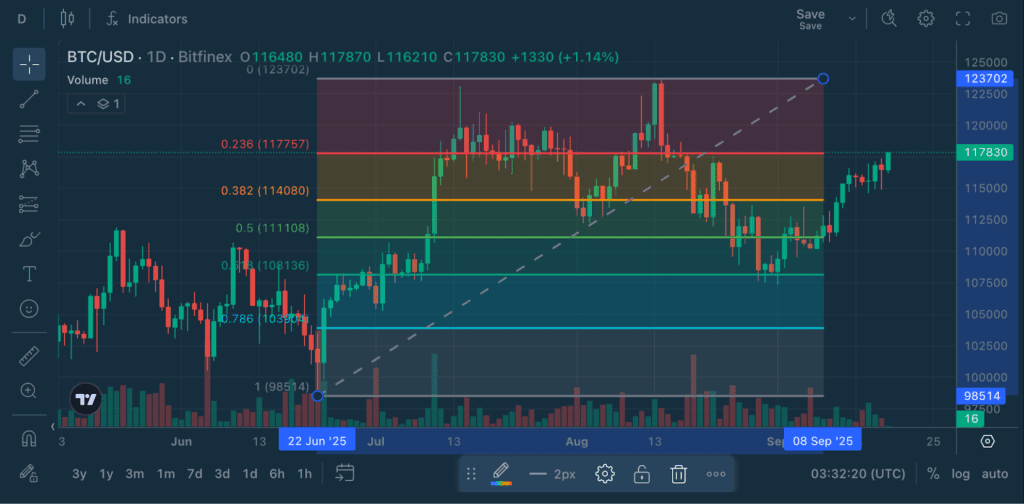

Actual Instance: BTC/USD Evaluation

- Swing low: $98,514 (22 Jun)

- Swing excessive: $123,702 (8 Sep)

- Vary: ~$25,188

Calculated retracements:

- 23.6% – $117,757

- 38.2% – $114,080

- 50% – $111,108

- 61.8% – $108,136

- 78.6% – $103,904

Present worth: $117,830

Discover how BTC retraced deeply from its September excessive, testing the crucial 61.8% “Golden Ratio” stage round $108,136. This demonstrates the facility of Fibonacci retracements – the 61.8% stage acted as robust assist and generated a major bounce. That is basic Fibonacci habits the place the Golden Ratio stage supplies a high-probability reversal zone, permitting the pattern to proceed after testing this mathematically vital assist stage.

Superior Fibonacci Methods

1. A number of Timeframe Evaluation

Apply Fibonacci on completely different timeframes for confluence:

- Every day chart: Main swing factors for place buying and selling

- 4-hour chart: Intermediate ranges for swing buying and selling

- 1-hour chart: Positive-tune entries for day buying and selling

2. Fibonacci Confluence Zones

Probably the most highly effective setups happen when a number of components align:

- Fibonacci stage + horizontal assist/resistance

- Fibonacci stage + transferring common

- Fibonacci stage + pattern line

- A number of Fibonacci ranges from completely different swings

3. Extension Projections

As soon as worth breaks previous the earlier excessive or low, Fibonacci isn’t nearly pullbacks, it may possibly additionally undertaking the place the transfer would possibly go subsequent. Merchants usually watch:

- 100% – Equal to the final swing.

- 127.2% – First extension goal.

- 161.8% – The “golden goal,” the place many tendencies pause.

- 200%+ – Aggressive strikes in robust tendencies.

4. Fibonacci + Different Indicators

- Fibonacci + RSI:

RSI oversold at key Fib stage = high-probability bounce. For instance, RSI under 30 at 61.8% retracement usually marks vital lows. Watch for RSI to show up from oversold at Fib assist - Fibonacci + ATR

Use ATR to set stops past Fibonacci ranges. For instance, If 61.8% stage is $96,460 and ATR is $3,000, place cease at $93,460. ATR ensures your cease accounts for regular volatility - Fibonacci + Quantity

Excessive quantity at Fib ranges confirms significance. For instance, Quantity spike + bounce at 61.8% = robust reversal sign. Excessive quantity break of 78.6% suggests pattern change - Fibonacci + MACD

MACD divergence at Fibonacci ranges creates highly effective reversal setups. Your entry set off comes when the MACD line crosses above its sign line whereas worth holds Fibonacci assist.

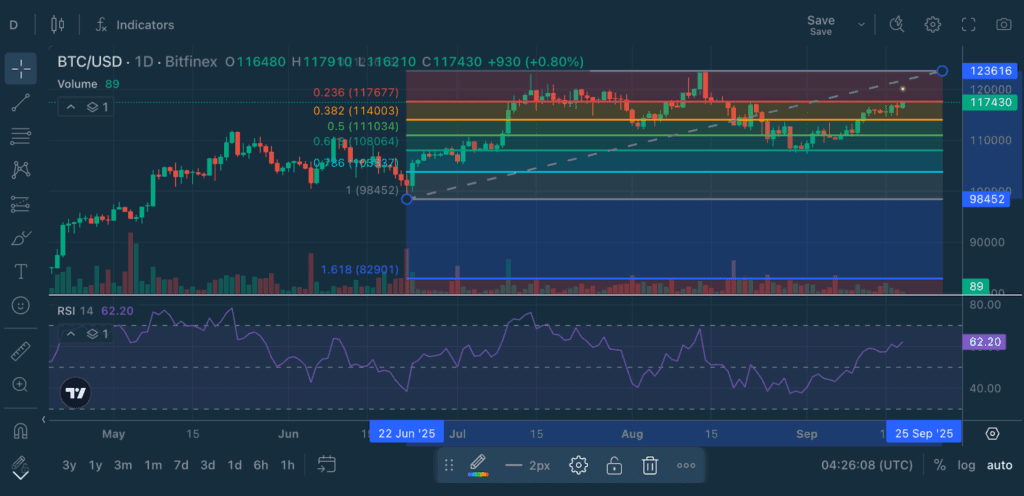

Bonus Learn: Fibonacci + RSI in Motion

Taking a look at this BTC day by day chart, we are able to see the 61.8% “Golden Ratio” stage at $108,064 performing as main assist. When BTC retraced from its highs right down to this crucial Fibonacci stage, it discovered robust shopping for curiosity and bounced considerably.

BTC rallied from this mathematical assist stage again above $117,000, demonstrating how the 61.8% retracement usually marks vital turning factors. The present RSI studying of 62.20 exhibits wholesome momentum has returned after the restoration.

The subsequent key stage to observe is the 23.6% retracement at $117,677. A break above with rising RSI might sign continuation towards new highs. Nonetheless, if RSI begins diverging negatively whereas worth struggles at this stage, it would point out one other check of deeper Fibonacci assist is coming.

Frequent Fibonacci Errors to Keep away from

Swing Level Slip-Ups

Don’t use tiny highs and lows. They provide messy indicators. Follow clear, apparent swing factors that present up on a number of timeframes.

Preventing the Development

One Fib line received’t overturn the larger image. All the time commerce within the course of the bigger pattern, not in opposition to it.

Leaping In Too Quick

Don’t purchase the second worth touches a stage. Watch for affirmation: candlestick patterns, quantity, or momentum indicators.

Trusting Fibs Blindly

Not each stage holds. Use stops and search for confluence with transferring averages or different Fibonacci ranges.

Ignoring Context

Take into account information, financial knowledge, and market sentiment alongside your Fibonacci evaluation.

Fibonacci Limitations

Subjectivity: Totally different analysts could choose various swing factors, resulting in barely completely different stage calculations.

Market Circumstances: Fibonacci evaluation performs optimally in trending markets however could present false indicators throughout uneven, sideways worth motion.

Historic Foundation: These instruments analyse previous worth actions somewhat than predict future worth motion with certainty.

False Indicators: Market circumstances can change quickly, inflicting worth to interrupt by way of anticipated assist or resistance ranges.