17 Nov Chart Decoder Sequence: Ichimoku Cloud – Your Full Buying and selling Dashboard on a Single Chart

Welcome again to the Chart Decoder Sequence, the place we rework complicated chart instruments into easy, actionable buying and selling methods.

At present we go to Ichimoku Cloud, the Japanese buying and selling system that does all of it: development, momentum, and future equilibrium, all at a look.

The Origins of the Cloud

The Ichimoku Kinko Hyo (which accurately interprets to “one-glance equilibrium chart”) was developed by Japanese journalist Goichi Hosoda within the Thirties.

His purpose was to create an indicator that lets merchants see the complete market image: steadiness, route, and momentum, immediately. No switching between instruments. No guesswork. Only one look.

Many years later, Ichimoku stays one of the crucial full methods for analysing market construction. It exhibits not simply the place the value is, however the place it needs to be heading.

What Ichimoku tells you:

- Which manner the market is trending

- The place help and resistance ranges sit

- What the momentum seems to be like

- The place worth would possibly transfer subsequent

Understanding the elements

ngth and future resistance zones

- Inexperienced Cloud (Span A > Span B): Bullish sentiment

- Crimson Cloud (Span B > Span A): Bearish sentiment

3. Future Projection

In contrast to most indicators that lag, Ichimoku’s Cloud initiatives 26 intervals into the longer term, displaying the place help or resistance is prone to type subsequent.

4. Crossovers

Conversion and Final analysis relationship reveals momentum energy and potential turning factors

- Bullish sign: Conversion line (blue) crosses above Final analysis (particularly above the Cloud)

- Bearish sign: Conversion line (blue) crosses beneath Final analysis (particularly beneath the Cloud)

5. Lagging Line Affirmation

Lagging Span place confirms whether or not the development has real follow-through

- Lagging Span (white) above worth = bullish affirmation

- Lagging Span (white) beneath worth = bearish affirmation

Instance in Motion

In response to Bitfinex Alpha 180 (issued on November tenth, 2025), Bitcoin’s current 21 p.c pullback from its October all-time excessive isn’t a collapse however a consolidation. The transfer beneath $100,000 marked the creation of a brand new base relatively than the beginning of a sell-off, as on-chain information exhibits that long-term holders (the sensible cash) aren’t dumping their Bitcoin. As a substitute, they’re rebalancing their positions, taking some income however preserving most of their holdings. Additionally, roughly 72% of all Bitcoin in circulation remains to be worthwhile at present costs, that means most holders aren’t underwater and determined to promote.

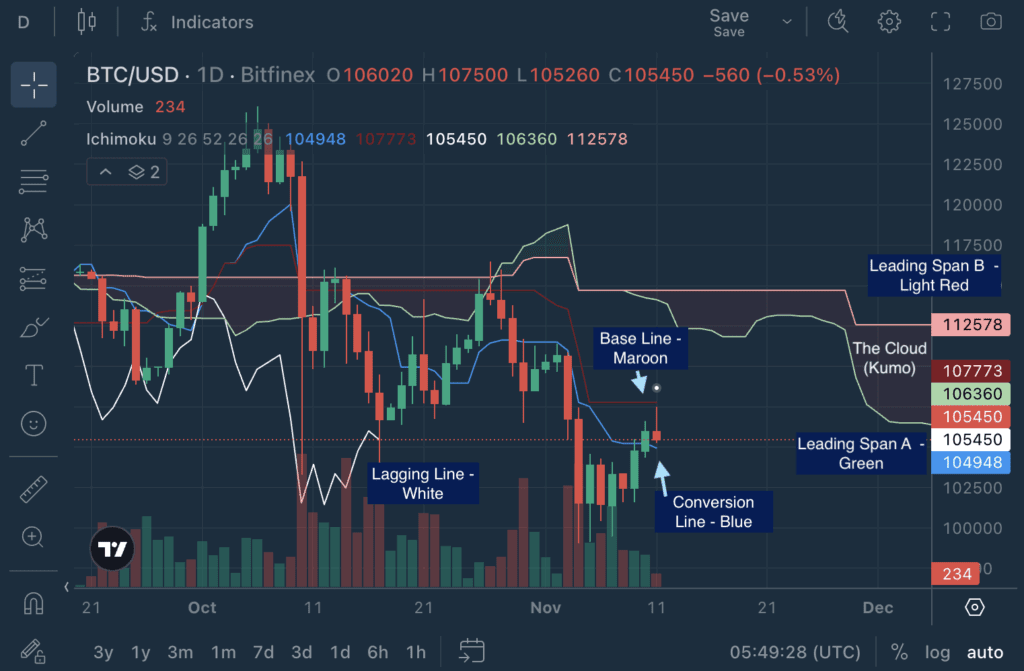

Now, let’s see how these fundamentals line up with the Ichimoku Cloud on the each day BTC/USD chart on November eleventh, 2025 and whether or not the technical image helps this narrative of managed consolidation.

The value is sitting beneath the Cloud with a pink, comparatively flat Cloud forward reflecting each day construction stays bearish. When worth sits beneath the Cloud, sellers have the higher hand.

The Conversion Line (104,948) sits beneath the Base Line (107,773), confirming short-term bearish momentum. The Lagging Line is hovering close to present worth ranges, signalling indecision within the quick time period. Nevertheless, because it stays beneath the Cloud, the broader development bias remains to be bearish.

The Cloud projection forward is pink and comparatively flat, spanning from 106,360 to 112,578. This 6,218-point vary represents the equilibrium zone the place patrons and sellers are anticipated to battle it out over the approaching weeks. The flatness of the Cloud is critical because it confirms weak momentum. A thick, angled Cloud would sign sturdy directional conviction. A flat, horizontal Cloud like this one alerts indecision. The market is pausing, not trending.

Wanting forward, The flat Cloud prime close to 112,500 acts as a powerful ceiling, the value would want a decisive breakout above that to shift sentiment bullish. Till BTC clears each the Base Line and the Cloud, rallies are prone to face promoting stress. For now, Ichimoku’s ahead projection aligns with the broader market temper. The momentum is weak however steady, not accelerating downward. BTC is in what you may name a bearish consolidation.

Superior Ichimoku Methods

1. Pattern + Momentum Alignment

The only but only method:

- Commerce lengthy when worth and Cloud are bullish (worth above inexperienced Cloud)

- Commerce quick when each are bearish (worth beneath pink Cloud)

- Ignore alerts contained in the Cloud. It’s the fog of indecision

2. The “Three-Level Confluence” Setup

The very best-probability trades happen when:

- Conversion line (Tenkan) crosses Final analysis (Kijun)

- Value breaks above/beneath the Cloud

- Lagging Span (Chikou Span) confirms the transfer

When all three align, it’s a full Ichimoku affirmation: momentum, construction, and timing all pointing in a single route.

3. Cloud as Dynamic Assist/Resistance

The thicker the Cloud, the stronger the zone. In uptrends, Span A and B act like a gentle cushion. In downtrends, they type a ceiling that repels worth.

4. Multi-Timeframe Evaluation

When multi timeframes agree, it strengthens your conviction. In the event that they disagree, it’s normally finest to attend, conflicting Clouds imply conflicting forces.

5. Ichimoku + Quantity or RSI

- Cloud + RSI oversold close to help = potential bounce

- Cloud thinning + falling quantity = early development exhaustion

- RSI divergence close to Cloud edges = potential reversal zone

Bonus Learn: BTC/USD (1-Hour Chart)

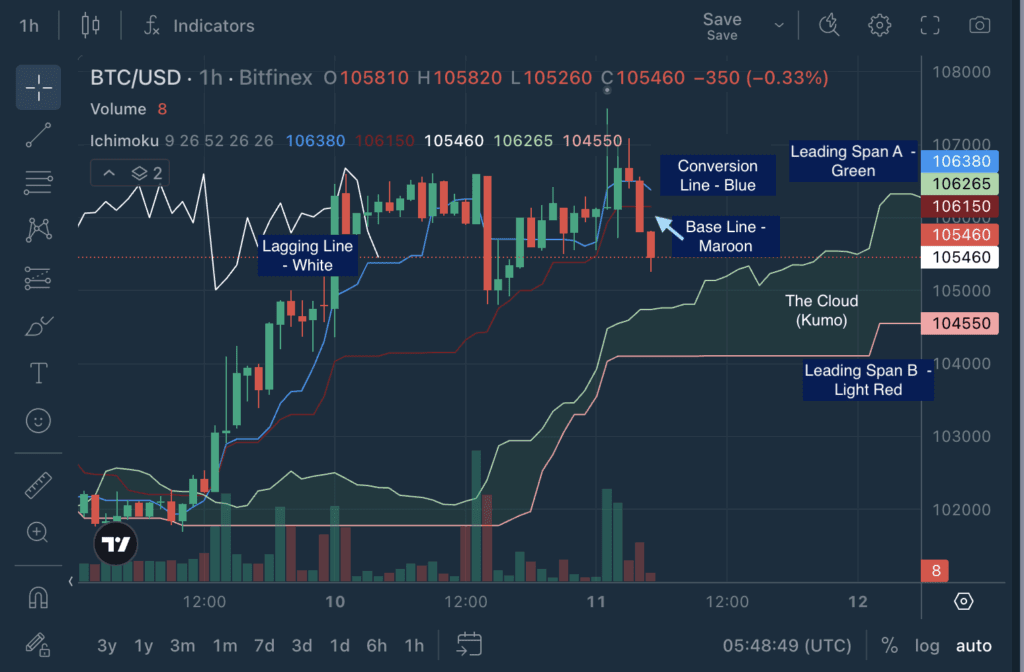

Let’s zoom in on the 1-hour chart inside the similar each day window on November eleventh, 2025, and see how Bitcoin is behaving inside this consolidation section.

The value on the 1-hour timeframe exhibits short-term weak point inside a broader consolidation.

Each the Conversion Line (106,380) and Base Line (106,150) are flattening out and converging. The hole between them is just about 230 factors. This slender hole alerts nearly no momentum in both route. The market is coiling, not trending.

The Cloud stays inexperienced and barely rising, which suggests the underlying 1-hour construction maintains a gentle bullish bias. Nevertheless, patrons are struggling to maintain any significant momentum above 106k. Every push larger will get met with promoting stress.

If worth holds above the highest of the Cloud, it might rebound towards 106.3k – 106.5k. A detailed beneath 104.5k would shift bias again to short-term bearish.

The 1-hour chart confirms a consolidation inside a bigger consolidation base, a wait and see interval.

Frequent Errors to Keep away from

1. Buying and selling contained in the Cloud:

That’s no-man’s-land. Indicators listed here are weak and unreliable. The Cloud represents equilibrium, a battle zone the place neither patrons nor sellers have management. Anticipate a transparent breakout above or beneath.

2. Ignoring Cloud projection:

A flat or narrowing Cloud forward usually alerts fading momentum. It’s telling you the development is shedding steam. Take note of what the Cloud is displaying you concerning the future, not simply the current.

3. Overcomplicating it:

Ichimoku already combines 5 indicators into one. Including extra instruments defeats the aim. Belief the system and maintain it easy.

4. Combating main information:

Even the most effective Cloud can’t cease a macro storm. Central financial institution choices, regulatory bulletins, and main financial information can override technical alerts. All the time examine context.

Setting It Up on Bitfinex

- Go to buying and selling.bitfinex.com

- Choose your buying and selling pair

- Click on Indicators → Ichimoku Cloud

- Default settings (9, 26, 52, 26) are normal

- Watch how the Cloud initiatives future help and resistance zones

Try different toolboxes from the Chart Decoder sequence: