Welcome again to the Chart Decoder Sequence, your step-by-step information to mastering technical indicators and chart patterns like a professional.

Within the earlier publish, we lined SMA and EMA, two important instruments for understanding pattern route. Now, let’s discuss momentum. Particularly, the way to spot momentum shifts earlier than they present up in worth.

Enter: MACD (Transferring Common Convergence Divergence).

What’s MACD?

MACD stands for Transferring Common Convergence Divergence. In easier phrases, MACD is a momentum indicator. It exhibits whether or not the market is gaining steam in a route or shedding power. In different phrases: “Is the market about to make a transfer?”

Whereas shifting averages assist you see the place the market goes, MACD tells you ways sturdy that transfer is. It’s one of many quickest methods to identify early indicators of pattern shifts, earlier than the value absolutely reacts.

It’s made up of three components:

1. MACD Line (Blue)

Consider this as your momentum tracker.

It reacts when costs begin altering route displaying if the market is gaining power or slowing down.

2. Sign Line (Orange)

This line follows the MACD Line intently.

- When the blue line crosses above the orange one, it typically means momentum is popping upward (purchase sign)

- When the blue line crosses beneath, it may well imply momentum is popping down (promote sign)

3. Histogram Bars (Purple or Inexperienced Bars)

These bars present the distance between the blue and orange traces.

Right here’s the way to learn them:

- Bars rising = momentum is getting stronger

- Bars shrinking = momentum is slowing down

- Inexperienced bars = bullish power (consumers are energetic)

- Purple bars = bearish stress (sellers are energetic)

Why Use MACD?

MACD is nice for figuring out potential entry and exit factors. It tells you:

- When momentum is choosing up

- When a pattern could also be reversing

- When to sit down tight and wait

Instance in Motion:

MACD Indicator (Backside Panel)

- MACD Line (Blue): 326

- Sign Line (Orange): –279

- MACD Line simply crossed above the Sign Line: bullish crossover

- Histogram Bars turned inexperienced and are rising: momentum is constructing

- This crossover occurred beneath the zero line: early indicators of pattern reversal

Transferring Averages (Essential Chart)

- 20-day EMA (Blue Line): ~84,067

- 50-day MA (Inexperienced Line): ~84,170

- Present BTC Worth: 87,269. BTC worth is above each averages, consumers are in management, pattern probably continues up.

Professional Suggestions:

Mix MACD with EMA or SMA for stronger affirmation

Use MACD crossovers close to key assist/resistance for larger accuracy

Keep away from relying solely on MACD in sideways markets—it might give false alerts

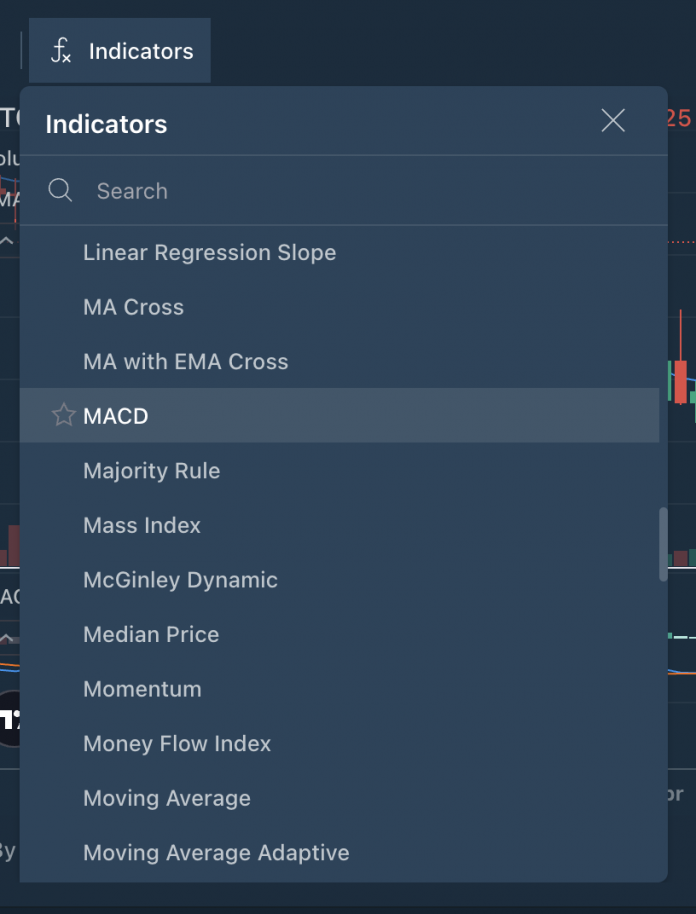

Strive It Now on Bitfinex:

- Log in to Bitfinex

- Choose any buying and selling pair (e.g. BTC/USD)

- From the Indicators tab, add “MACD”

Look ahead to:

Bullish Sign: MACD Line crosses above Sign Line

Bearish Sign: MACD Line crosses beneath Sign Line

Histogram Bars Rising: Development is gaining momentum

Histogram Bars Shrinking: Development is slowing down

This observe builds your instinct over time, so you possibly can act with confidence, not confusion.

MACD is a favourite amongst merchants for a purpose: it presents early insights into shifts in momentum earlier than they’re apparent in worth motion.

MACD vs SMA/EMA: What’s the precise distinction?

Developing subsequent in our Chart Decoder Sequence: RSI – Know When a Market’s Overbought or Oversold.

The publish <sturdy>Chart Decoder Sequence: MACD – The Momentum Sign to Spot Early Entries</sturdy> appeared first on Bitfinex weblog.