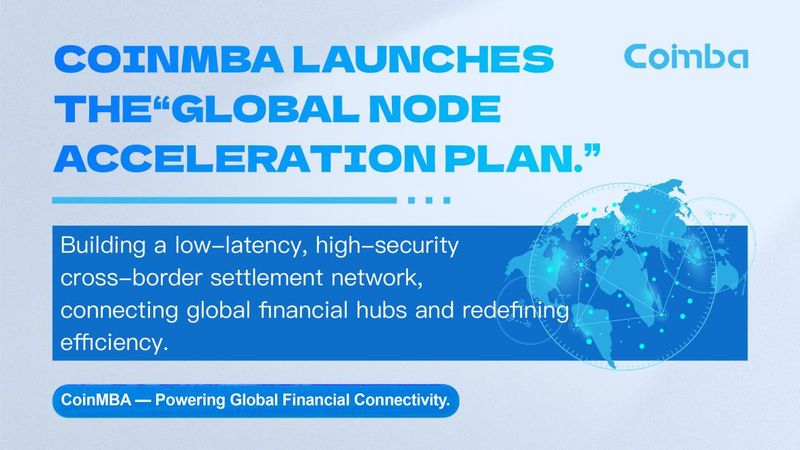

This program will set up infrastructure nodes throughout main world monetary hubs to attain increased community throughput, sooner transaction confirmations, and decrease cross-border settlement prices.

The corporate has lengthy centered on cross-border settlement, RWA(Actual World Asset)tokenization, institutional custody,and digital fee options, selling the business adoption of blockchain know-how in world monetary infrastructure.

International Node Deployment:Connecting East-West Monetary Channels

In line with the plan, CoinMBA will deploy operational nodes in additional than 10 main world monetary facilities inside the subsequent 12 months.

The primary batch of operational nodes has already launched in Singapore, Dubai, and London, whereas further deployments in Zurich, Hong Kong, Seoul, and the Cayman Islands are at present underway.

Every node will characteristic the next features:

Native Clearing and Settlement: Actual-time multi-currency change assist for USD, EUR, USDT, and USDC.

Cross-Chain Connectivity: Integration with main networks together with BTC, ETH, SOL, BNB, and AVAX.

Sensible Danger Management and Auditing: Regional regulatory compliance by means of clear on-chain monitoring.

Know-how-Pushed Monetary Innovation

CoinMBA’s aggressive energy lies in its deep technological innovation.

The corporate’s self-developed high-performance matching engine helps over 1 million transactions per second (1M TPS) and adopts a dual-layer safety construction combining MPC (Multi-Social gathering Computation) and cold-hot pockets segregation, offering institutional-grade safety.

CoinMBA’s Chief Know-how Officer commented: “The final word purpose of blockchain finance will not be hypothesis, however effectivity. By way of our node community, we intention to attain settlement velocity and safety that meet—and even surpass—conventional banking programs.”

Enterprise Shoppers and Institutional Ecosystem

CoinMBA has already attracted a broad vary of institutional shoppers, together with cross-border e-commerce platforms, provide chain finance firms, asset administration corporations, and fee suppliers, all taking part in pilot operations.

Preliminary information reveals that early node members have achieved a mean 68percentreduction in settlement time,reducing transaction durations from a number of hours to only minutes—considerably bettering company liquidity and capital turnover.

A senior operations government at CoinMBA added: “The node community makes us extra like a distributed monetary working system fairly than a single buying and selling platform. This marks a milestone within the infrastructure evolution of the digital economic system.”

At present, CoinMBA has established partnerships with a number of worldwide clearing banks and fee service suppliers, delivering unified and compliant settlement channels for world enterprises and monetary establishments.

International Strategic Imaginative and prescient

The International Node Acceleration Plan represents a cornerstone of CoinMBA”s long-term strategic roadmap. Over the following three years, the corporate goals to:

Set up over 30 operational nodes throughout main monetary markets worldwide.

Launch the CoinMBA Settlement Cloud,opening clearing APIs to third-party monetary establishments.

Allow multi-currency real-time settlements with synchronized compliance reporting.

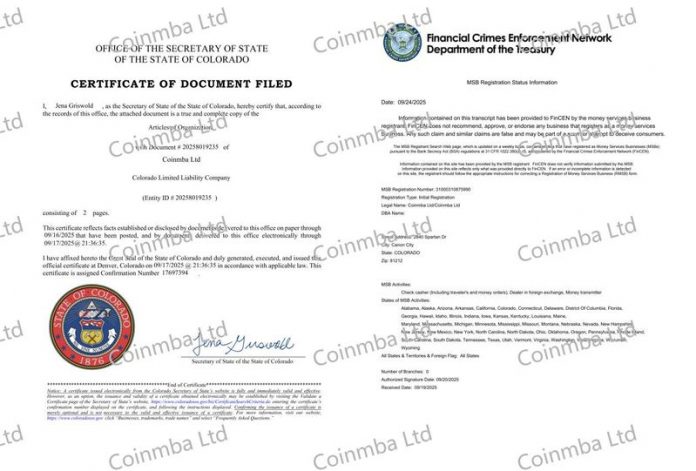

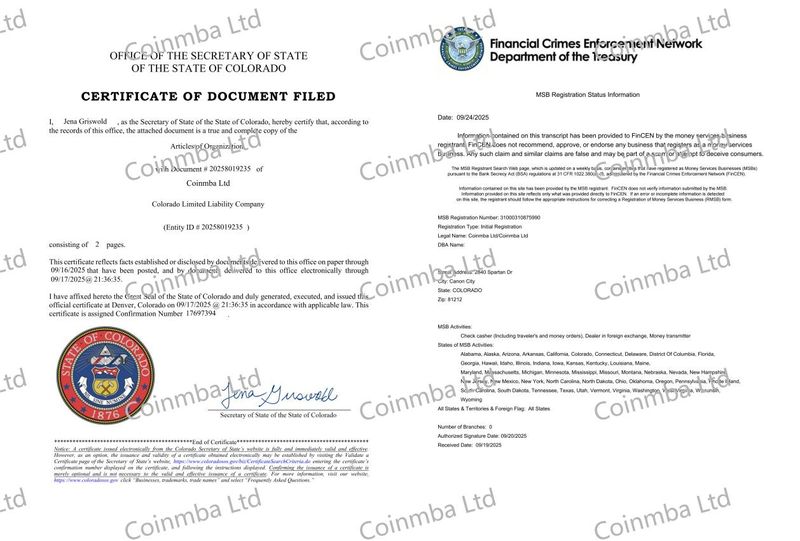

CoinMBA’s International Vice President of Advertising and marketing famous: “Our mission is to make cross-border finance as frictionless because the web. The MSB registration approval is just the start—we’re rebuilding the foundational logic of future world finance.”

Conclusion

Trade observers consider that CoinMBA’s node technique is extra than simply enterprise growth—it represents a structural transformation of digital monetary infrastructure.

By integrating know-how, compliance, and community structure, CoinMBA is steadily evolving from a buying and selling platform into the core engine for world cross-border settlement and digital asset clearing.

Media contact

Contact: Leonel Okay. Oleary

Firm Title: Coinmba Ltd

Web site: https://coinmba.com/major.html#/

Disclaimer: The knowledge offered on this press launch will not be a solicitation for funding, neither is it supposed as funding recommendation, monetary recommendation, or buying and selling recommendation. Investing entails danger, together with the potential lack of capital. It’s strongly beneficial you observe due diligence, together with session with an expert monetary advisor, earlier than investing in or buying and selling cryptocurrency and securities. Neither the media platform nor the writer shall be held answerable for any fraudulent actions, misrepresentations, or monetary losses arising from the content material of this press launch.