In late January, cloud-based cybersecurity firm CrowdStrike (CRWD 2.38%) surpassed a $100 billion market cap valuation for the very first time in its historical past. That valuation locations CrowdStrike in rarified firm — few companies are price this a lot, whatever the business. However amongst pure-play cybersecurity firms, it is in much more elite firm.

Palo Alto Networks (PANW 1.88%) is the one different pure-play cybersecurity inventory that is achieved a $100 billion market cap. However there’s a distinction between these two firms. Palo Alto Networks was based in 2005 and handed a $100 billion valuation in late 2024. For its half, CrowdStrike was based in 2011 and handed this milestone in early 2025.

In different phrases, Palo Alto Networks handed the $100 billion threshold mere weeks earlier than CrowdStrike. However CrowdStrike had six fewer years to get there.

The highway to $100 billion included pace bumps — CrowdStrike had a disaster lower than one 12 months in the past. The corporate calls it the “July 19 incident.” A software program replace contained an error that knocked out data expertise techniques world wide. The inventory plunged greater than 40% as traders puzzled if it will lose enterprise. However the inventory got here roaring proper again to new highs, as a result of CrowdStrike’s enterprise did not skip a beat.

Contemplating CrowdStrike is so massive already, is the inventory now as excessive as it’s going to ever be? That is a query price exploring.

What may this imply for traders in the present day?

For what it is price, Palo Alto Networks employed present CEO Nikesh Arora in 2018, and he quickly went on report predicting that his firm can be the primary $100 billion cybersecurity enterprise — rating one for Arora with this prediction come true. The corporate is thought for its management place in firewall {hardware} gadgets. However with a whole lot of acquisitions, Arora has positioned the corporate as a one-stop store for cybersecurity.

Being that it focuses on all the cybersecurity area, Palo Alto Networks’ enterprise does overlap with CrowdStrike, which is extra targeted on cloud-based endpoint safety. However I imagine there’s room for each companies.

In keeping with a number of third-party analysis corporations, the cybersecurity area is price a whole lot of billions of {dollars} and is anticipated to develop at a double-digit compound annual progress fee (CAGR) for years. Briefly, the area is giant and rising quick, which implies that a number of firms can take part within the upside, together with each Palo Alto Networks and CrowdStrike.

For its half, CrowdStrike does have a number of issues going for it. First, it is acknowledged as a pacesetter within the cybersecurity merchandise that it presents. For instance, Gartner named it a pacesetter in endpoint safety for the fifth straight 12 months in 2024. With this validation, clients are keen to present it a attempt, which unlocks an fascinating alternative for CrowdStrike.

CrowdStrike would not supply a single software program product, however quite a whole platform referred to as Falcon. Inside Falcon, the corporate presents 29 separate software program modules that work collectively and are simply deployed as wants come up. This has helped it obtain an unbelievable progress fee lately — current clients progressively subscribe to new modules, boosting their annual spend.

There’s a bonus to a enterprise mannequin similar to this: There are up-front prices related to successful a brand new buyer. However a lot of that expense (similar to gross sales and advertising) is not there when clients purchase extra modules. Which means incremental income from new modules by current clients is increased margin.

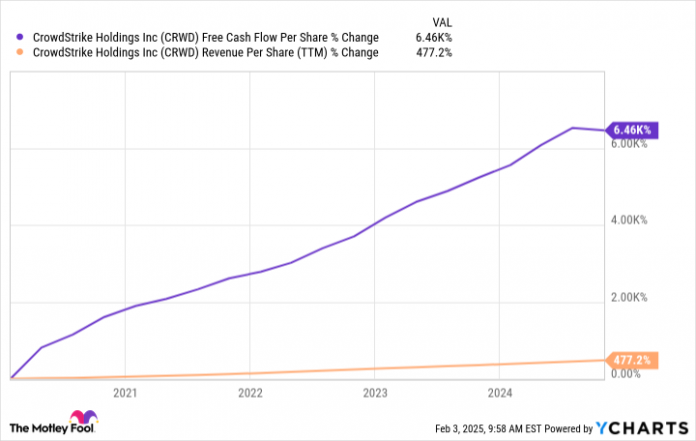

This dynamic is why CrowdStrike is having fun with quick income progress in addition to quick free money move progress. Its modules are simple to deploy, resulting in quick progress. And every new module is excessive margin, resulting in a lift in free money move.

CRWD Free Money Move Per Share knowledge by YCharts

Now, CrowdStrike clearly had a lot increased long-term upside when it was nonetheless a small firm. That stated, I do not imagine the nice occasions are over for shareholders now that the corporate is price $100 billion. Firms that maintain excessive progress charges are constantly among the many finest long-term inventory performers. People who additionally keep profitability are even stronger contenders. And I imagine that CrowdStrike can maintain doing each.

As famous, the cybersecurity market offers loads of extra market alternative for CrowdStrike in the present day, so its income progress fee may keep excessive for the foreseeable future. Accordingly, its steerage for the upcoming fourth quarter implies a powerful progress fee of over 20%. And since a lot of its progress may come from the adoption of extra modules, there’s good cause to imagine free money move will keep robust as nicely.

In abstract, CrowdStrike’s speedy rise from start-up to $100 billion firm underscores progress tendencies in cybersecurity, the corporate’s management place within the area, and its advantageous enterprise mannequin. The long-term tendencies additionally stay in CrowdStrike’s favor, which means that $100 billion in all probability will not be the final momentous milestone on this journey.

Jon Quast has no place in any of the shares talked about. The Motley Idiot has positions in and recommends CrowdStrike. The Motley Idiot recommends Gartner and Palo Alto Networks. The Motley Idiot has a disclosure coverage.