Funding flows into crypto exchange-traded merchandise surged to a document degree final week, signaling sturdy demand from massive buyers.

Associated Studying

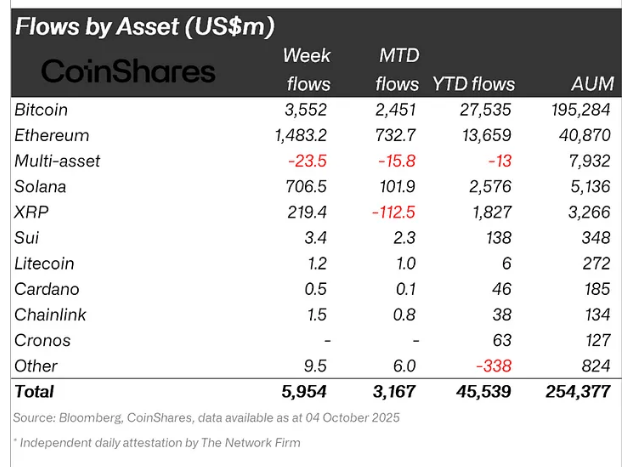

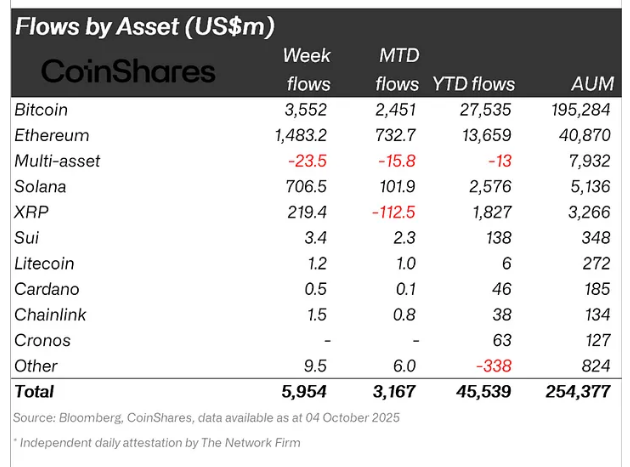

In keeping with CoinShares, crypto ETPs drew near $6 billion in new cash within the week that ended Friday, the largest weekly influx on document. Bitcoin led the transfer, taking in $3.6 billion alone as merchants and funds piled into BTC choices.

Bitcoin Dominates The Week’s Inflows

Experiences have disclosed that the newest complete beat the prior excessive of $4.4 billion by about 35%. The week’s good points weren’t evenly unfold. Whereas earlier data had been cut up extra between Bitcoin and Ether, this time Bitcoin funds attracted the lion’s share.

Ether ETPs nonetheless registered sturdy curiosity, including $1.48 billion and bringing year-to-date inflows for Ether to roughly $13.7 billion. Solana ETPs pulled in $706.5 million, and XRP merchandise noticed $219 million. These figures present that buyers are placing contemporary capital into a variety of crypto merchandise, at the same time as BTC takes the lead.

Macro Headlines Drove Contemporary Shopping for

Based mostly on stories, merchants pointed to a mixture of macro occasions that doubtless pushed allocations into crypto. A current lower to rates of interest by the Fed, weaker-than-expected employment numbers, and considerations a couple of US authorities shutdown have been all cited by market watchers as triggers.

Some buyers handled crypto instead play whereas political and financial worries persevered. Markets reacted quick. Bitcoin climbed above $125,000 in the course of the week, a transfer that pushed complete crypto belongings below administration previous $250 billion, reaching slightly over $254 billion.

Technical Readings And Analyst Targets Add Gas

In keeping with market analysts and on-chain information observers, the provision of Bitcoin on exchanges has dropped to ranges not seen in six years. That development is commonly learn as holders selecting to maintain cash off market platforms, which may cut back promoting strain.

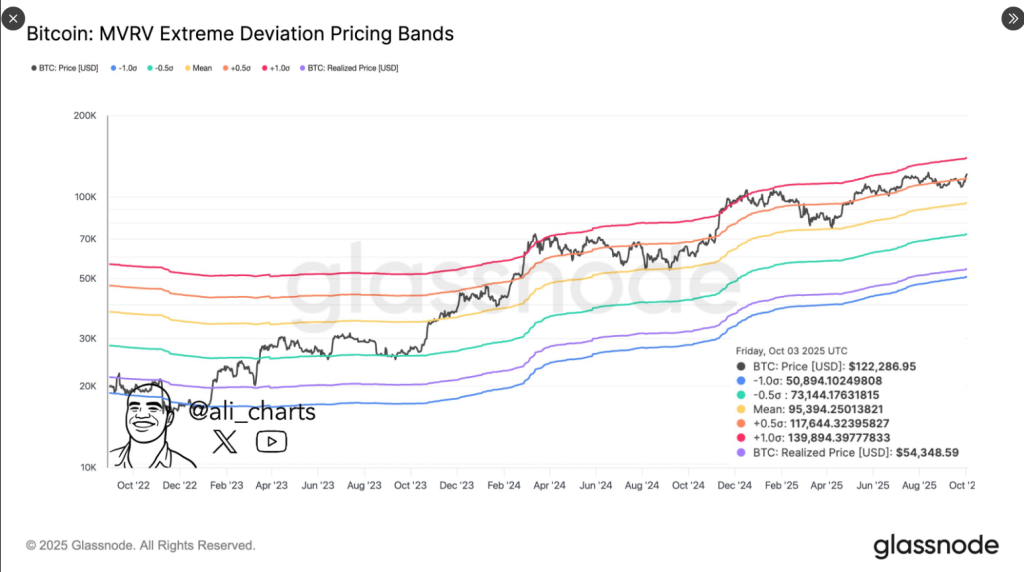

So long as Bitcoin $BTC holds above $117,650, the Pricing Bands level to $139,800 subsequent. pic.twitter.com/DTPtz3Wj52

— Ali (@ali_charts) October 4, 2025

Glassnode’s pricing bands have been utilized by some analysts to argue that Bitcoin was holding a key assist space and that upside towards $139,800 was doable if that assist stayed intact.

Associated Studying

One other forecast talked about a decrease time horizon at round $135,000. These targets have been used out there commentary, and so they helped form market expectations in the course of the transfer up.

Buying and selling flows, too, indicated a transparent bias: buyers have been usually lengthy. As James Butterfill, head of analysis at CoinShares, describes, patrons didn’t even flip to quick funding merchandise at worth highs. If this conduct doesn’t replicate an intent to hedge towards the uptick, then it displays confidence that the asset continues to understand.

Featured picture from Unsplash, chart from TradingView