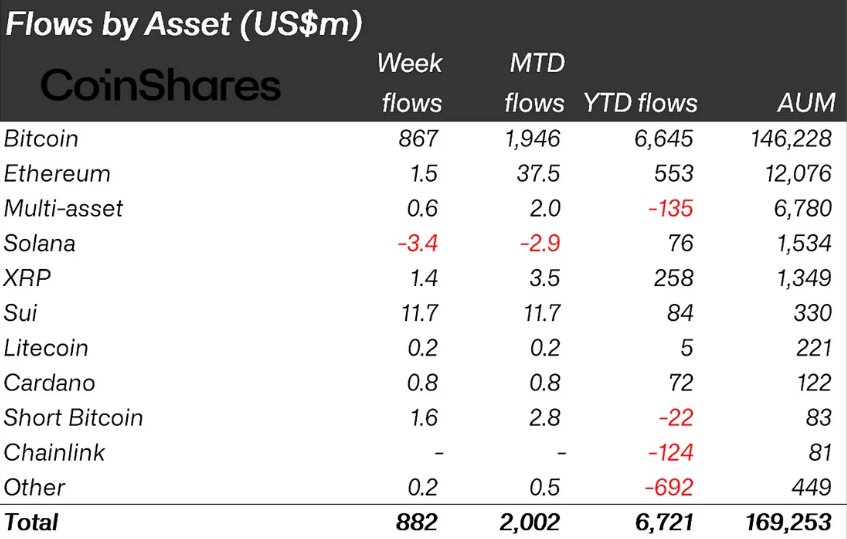

Digital asset funding merchandise witnessed a surge in institutional curiosity final week, elevating $882 million in crypto inflows globally.

This marks the fourth consecutive week of good points, pushing year-to-date (YTD) inflows to $6.7 billion, simply shy of the $7.3 billion peak noticed in early February.

4 Consecutive Weeks of Crypto Inflows

The most recent CoinShares report reveals the fourth week of consecutive optimistic flows. Within the week earlier than that, crypto inflows hit $2 billion. The week prior, crypto inflows reached $3.4 billion as buyers turned to digital property for his or her haven standing.

Earlier than that, inflows into digital asset funding merchandise had been $146 million, the place XRP bucked the development.

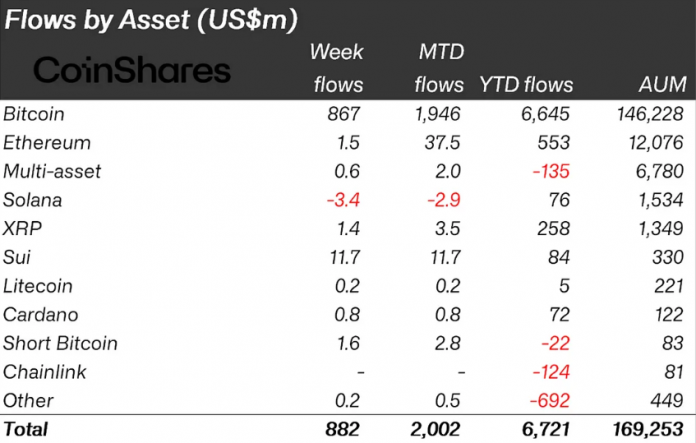

CoinShares’ researcher James Butterfill notes that Bitcoin led the cost with $867 million in inflows, reflecting its rising position as a macro hedge amid rising financial uncertainty.

For the reason that launch of spot Bitcoin ETFs (Trade-Traded Funds) within the US in January 2024, cumulative internet inflows have hit $62.9 billion, surpassing the earlier excessive of $61.6 billion. Whereas Ethereum has seen a robust worth restoration, investor sentiment stays lukewarm, with solely $1.5 million in inflows final week.

Sui, then again, stands out amongst altcoins. It recorded $11.7 million in inflows, overtaking Solana weekly and year-to-date. Sui’s whole inflows now stand at $84 million YTD, outpacing Solana’s $76 million, regardless of the latter seeing $3.4 million in outflows over the previous week.

CoinShares attributed the sharp rise in crypto costs and funding flows to a number of converging macroeconomic traits.

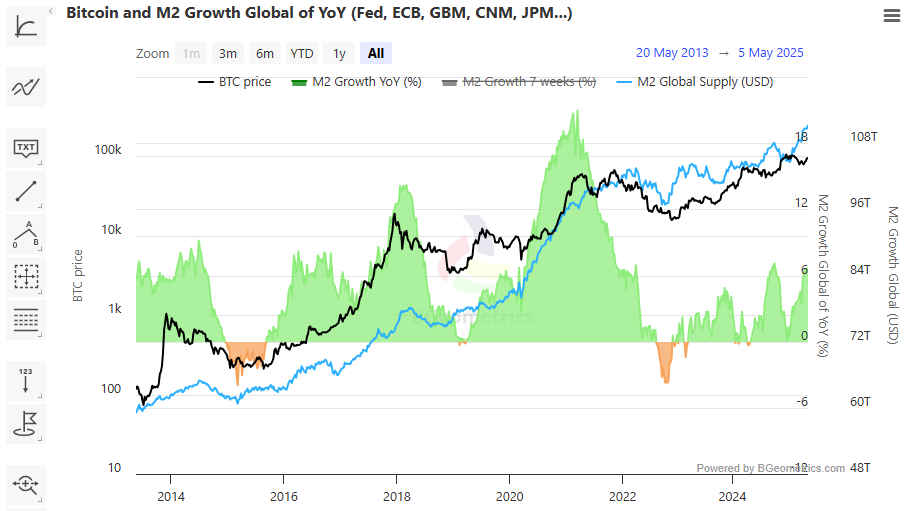

“We consider the sharp enhance in each costs and inflows is pushed by a mixture of things: a worldwide rise in M2 cash provide, stagflationary dangers within the US, and several other US states approving Bitcoin as a strategic reserve asset,” wrote Butterfill.

Certainly, states comparable to Arizona and New Hampshire superior their efforts with Bitcoin strategic reserves. Nonetheless, others, like Florida, hit a brick wall.

Macro Shifts Providing a Buying and selling Compass for Crypto Buyers

In the identical tone, the increasing international M2 cash provide is changing into a focus for Bitcoin buyers. Knowledge on TradingView reveals China’s M2 cash provide stays at an all-time excessive of $326.13 trillion. This alerts a possible flood of worldwide liquidity that danger property like Bitcoin are actually absorbing.

Analysts have additionally noticed that Bitcoin’s worth correlates positively with international M2 traits. This outlook reinforces Bitcoin’s narrative as a macro-responsive asset.

Nevertheless, not all consultants are satisfied. Whereas a rising consensus is linking M2 growth with crypto worth motion, skeptics argue that the connection could also be overstated.

Recession fears within the US are additional fueling crypto allocations. Goldman Sachs lately raised its 12-month US recession likelihood to 45%, quietly growing publicity to Bitcoin through funds that embrace spot ETF merchandise.

Buyers interpret this as a sign that aligns with the broader theme of crypto as a hedge in opposition to faltering conventional finance (TradFi) devices and dollar-denominated property.

This notion is gaining institutional validation. Normal Chartered lately famous that Bitcoin is more and more positioned as a hedge in opposition to Treasury market volatility and systemic monetary danger. That is notably related as US deficits balloon and Treasury yields stay risky.

The bullish momentum in crypto inflows, alongside Bitcoin’s growing position in institutional portfolios, means that buyers are turning to digital property as each a directional wager and a macro hedge.

Disclaimer

In adherence to the Belief Mission pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed data. Nevertheless, readers are suggested to confirm information independently and seek the advice of with knowledgeable earlier than making any selections primarily based on this content material. Please be aware that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.