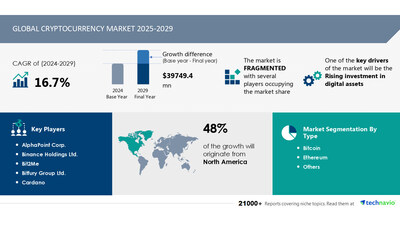

NEW YORK, Jan. 30, 2025 /PRNewswire/ — Report with market evolution powered by AI – The worldwide cryptocurrency market dimension is estimated to develop by USD 39.75 billion from 2025-2029, in line with Technavio. The market is estimated to develop at a CAGR of 16.7% in the course of the forecast interval. Rising funding in digital belongings is driving market development, with a pattern in the direction of acceptance of cryptocurrency by retailers. Nonetheless, volatility in worth of cryptocurrency poses a problem. Key market gamers embody AlphaPoint Corp., Binance Holdings Ltd., Bit2Me, Bitfury Group Ltd., Cardano, CEX.IO Corp., Coinbase International Inc., DOGECOIN, FMR LLC, Gemini Belief Co. LLC, KuCoin, Ledger SAS, Marathon Digital Holdings, Pantera Capital, PT Pintu Kemana Saja, Riot Platforms Inc., Ripple Labs Inc., Shiba Inu, Valora Inc., WazirX, and Xapo Financial institution Ltd..

AI-Powered Market Evolution Insights. Our complete market report prepared with the newest developments, development alternatives, and strategic analysis- View Free Pattern Report PDF

|

Forecast interval |

2025-2029 |

|

Base 12 months |

2024 |

|

Historic Knowledge |

2019 – 2023 |

|

Section Coated |

Sort (Bitcoin, Ethereum, and Others), Element ({Hardware} and Software program), Geography (North America, Europe, APAC, South America, and Center East and Africa). |

|

Area Coated |

North America, Europe, APAC, South America, and Center East and Africa |

|

Key firms profiled |

AlphaPoint Corp., Binance Holdings Ltd., Bit2Me, Bitfury Group Ltd., Cardano, CEX.IO Corp., Coinbase International Inc., DOGECOIN, FMR LLC, Gemini Belief Co. LLC, KuCoin, Ledger SAS, Marathon Digital Holdings, Pantera Capital, PT Pintu Kemana Saja, Riot Platforms Inc., Ripple Labs Inc., Shiba Inu, Valora Inc., WazirX, and Xapo Financial institution Ltd. |

Key Market Developments Fueling Development

Cryptocurrencies, like Bitcoin and Ethereum, are digital currencies based mostly on decentralized know-how known as Blockchain. This know-how permits safe, clear transactions with out the necessity for intermediaries. International adoption of cryptocurrencies is on the rise, with Ethereum main the cost as a well-liked platform for decentralized purposes. Nonetheless, worth volatility stays a priority, together with cybersecurity dangers and theft. Regulatory outlooks range, with some nations embracing the digital revolution and others cautious. Vitality consumption and environmental results are additionally matters of debate. Expert builders are in excessive demand for monetary providers and cryptocurrency initiatives. Shopper safety and monetary stability are key issues, with scams and fraudulent investments a threat. Renewable vitality and blockchain expertise are driving innovation. Cryptography and encryption guarantee safe transactions, whereas decentralized programs supply transparency by means of public ledgers. Altcoins, mining, digital wallets, and buying and selling are a part of the cryptocurrency panorama. Brokers, cryptocurrency exchanges, and cost strategies like ACH transfers and wire transfers facilitate transactions. Fiat forex, Bitcoin trusts, mutual funds, and shares supply funding alternatives. Cryptocurrencies are utilized in e-commerce, luxurious items, insurance coverage funds, and extra. Safety is paramount, with cold and warm wallets offering totally different ranges of safety. Be cautious of crypto scams, fraud, and romance scams.

The adoption of cryptocurrencies like Bitcoin and Ether has gained traction among the many public, companies, and retailers for on a regular basis transactions. In 2022, the utilization of cryptocurrencies by main retailers, comparable to Starbucks, enhanced public acceptance and belief. Beforehand, cryptocurrencies have been utilized for buying vehicles and ordering meals and groceries. Firms like Starbucks at the moment settle for cryptocurrency funds by means of third-party exchanges, comparable to iPayYou, which convert cryptocurrencies to money. Starbucks Company (Starbucks) could take into account accepting direct cryptocurrency funds sooner or later. In April 2022, Starbucks launched Non-Fungible Tokens (NFTs) and cryptocurrencies as cost strategies of their shops.

Insights on how AI is driving innovation, effectivity, and market growth- Request Pattern!

Market Challenges

- Cryptocurrency markets current important alternatives for companies and people within the digital revolution. Nonetheless, they arrive with challenges. Decentralized currencies like Bitcoin and Ethereum face worth volatility, cybersecurity dangers, and theft. Regulatory outlooks range globally, impacting adoption. Vitality consumption and environmental results are issues. Expert builders are in excessive demand for blockchain know-how and cryptography. Monetary providers search to combine digital belongings into their choices, however shopper safety and monetary stability are essential. Digital wallets and buying and selling platforms require safety. Value volatility and scams, together with romance scams and fraudulent investments, pose dangers. Renewable vitality and blockchain expertise supply options. Companies should navigate this advanced panorama fastidiously, contemplating funding automobiles like Bitcoin trusts and mutual funds, and the position of cryptocurrency in e-commerce, luxurious items, insurance coverage funds, and extra.

- Cryptocurrencies, comparable to Bitcoin, exhibit excessive volatility because of the great amount managed by a small group of traders who regularly commerce on platforms and exchanges. In June 2022, Bitcoin skilled a big 10% lower in worth, dropping from its November 2021 excessive of USD69,000 per token. This decline was influenced by the Indian authorities’s announcement to ban cryptocurrencies and introduce their very own digital forex. Low-risk traders usually keep away from together with cryptocurrencies of their portfolios resulting from this unpredictable market habits.

Insights into how AI is reshaping industries and driving growth- Obtain a Pattern Report

Section Overview

This cryptocurrency market report extensively covers market segmentation by

- Sort

- 1.1 Bitcoin

- 1.2 Ethereum

- 1.3 Others

- 2.1 {Hardware}

- 2.2 Software program

- 3.1 North America

- 3.2 Europe

- 3.3 APAC

- 3.4 South America

- 3.5 Center East and Africa

1.1 Bitcoin– Bitcoin, the world’s main digital forex, boasts a market capitalization of over USD470 billion, making it the biggest cryptocurrency by far. With 95% recognition amongst events, Bitcoin operates as a decentralized, peer-to-peer (P2P) digital forex, bypassing the necessity for central authorities. 4 different prime cryptocurrencies, Tether, USD Coin, Binance USD, and DAI, are pegged to the US greenback. Within the US, roughly 8% of the inhabitants engages in cryptocurrency buying and selling. Bitcoin‘s reputation fuels the enlargement of the worldwide cryptocurrency market, as all transactions are recorded on a safe, decentralized public ledger known as the blockchain.

Obtain complimentary Pattern Report to realize insights into AI’s affect on market dynamics, rising developments, and future opportunities- together with forecast (2025-2029) and historic knowledge (2019 – 2023)

Analysis Evaluation

Cryptocurrencies, based mostly on blockchain know-how, symbolize a decentralized type of digital forex that operates exterior of conventional monetary establishments. Ethereum, one of many main platforms, permits the creation of decentralized purposes. International adoption of cryptocurrencies is rising, however worth volatility stays a big problem. Cybersecurity and theft threat are issues, with regulatory outlooks various worldwide. Vitality consumption is a subject of debate, with some arguing that renewable vitality sources can mitigate environmental results. Expert builders are in excessive demand for creating and sustaining these programs, and monetary providers are more and more integrating cryptocurrencies. The digital revolution brings alternatives for shopper safety and monetary stability, but additionally dangers of scams and fraudulent investments. Transactions are recorded on a public ledger, making certain transparency, whereas cryptography and a decentralized system present safety. Bitcoin, Ethereum, Litecoin, Ripple, and altcoins are probably the most well-known cryptocurrencies.

Market Analysis Overview

The cryptocurrency market is a decentralized financial system fueled by blockchain know-how, the place digital forex transactions are recorded on a public ledger. Ethereum, the second-largest cryptocurrency, powers good contracts and decentralized purposes. International adoption of cryptocurrencies is on the rise, however worth volatility stays a priority. Cybersecurity and theft threat are important challenges, with regulatory outlooks various worldwide. Vitality consumption and environmental results are additionally matters of debate. Expert builders are in excessive demand to construct the following era of monetary providers and digital belongings. Shopper safety and monetary stability are essential as cryptocurrencies turn out to be extra mainstream. Blockchain know-how presents encryption, decentralized programs, and safe transactions, however scams, fraudulent investments, and thefts persist. Renewable vitality and blockchain expertise are key to decreasing the environmental affect of cryptocurrency mining. Buying and selling, brokers, and cryptocurrency exchanges present varied cost strategies, together with fiat forex transfers and digital wallets. Cryptocurrencies are used for e-commerce, luxurious items, insurance coverage funds, and whilst investments by means of trusts, mutual funds, and shares. Nonetheless, the market is riddled with scams, fraud, and romance scams, making it important to train warning.

Desk of Contents:

1 Government Abstract

2 Market Panorama

3 Market Sizing

4 Historic Market Measurement

5 5 Forces Evaluation

6 Market Segmentation

- Sort

- Element

- Geography

- North America

- Europe

- APAC

- South America

- Center East And Africa

7 Buyer Panorama

8 Geographic Panorama

9 Drivers, Challenges, and Developments

10 Firm Panorama

11 Firm Evaluation

12 Appendix

About Technavio

Technavio is a number one international know-how analysis and advisory firm. Their analysis and evaluation focuses on rising market developments and gives actionable insights to assist companies determine market alternatives and develop efficient methods to optimize their market positions.

With over 500 specialised analysts, Technavio’s report library consists of greater than 17,000 studies and counting, overlaying 800 applied sciences, spanning throughout 50 nations. Their consumer base consists of enterprises of all sizes, together with greater than 100 Fortune 500 firms. This rising consumer base depends on Technavio’s complete protection, intensive analysis, and actionable market insights to determine alternatives in present and potential markets and assess their aggressive positions inside altering market situations.

Contacts

Technavio Analysis

Jesse Maida

Media & Advertising and marketing Government

US: +1 844 364 1100

UK: +44 203 893 3200

Electronic mail: media@technavio.com

Web site: www.technavio.com/

![]() View unique content material to obtain multimedia:https://www.prnewswire.com/news-releases/cryptocurrency-market-to-grow-by-usd-39-75-billion-2025-2029-rising-investment-in-digital-assets-to-boost-revenue-report-on-ai-driving-market-transformation—technavio-302363638.html

View unique content material to obtain multimedia:https://www.prnewswire.com/news-releases/cryptocurrency-market-to-grow-by-usd-39-75-billion-2025-2029-rising-investment-in-digital-assets-to-boost-revenue-report-on-ai-driving-market-transformation—technavio-302363638.html

SOURCE Technavio

Featured Picture: depositphotos @ monsit