Markets kicked off the week with cautious optimism regardless of political turmoil in Japan and France, as threat urge for food held agency on Fed price lower expectations.

Gold hit report highs whereas the greenback stayed on the defensive, setting the tone forward of Thursday’s US CPI report.

Take a look at the headlines and financial updates you’ll have missed within the newest buying and selling classes!

Headlines:

- Japanese Prime Minister Shigeru Ishiba resigned on Sunday following LDP’s election losses

-

Japan GDP Progress Charge Remaining for Q2 2025: 0.5% q/q (0.3% q/q forecast; 0.0% q/q earlier); 2.2% y/y (1.0% y/y forecast; -0.2% y/y earlier)

- Japan GDP Worth Index Remaining for Q2 2025: 3.0% y/y (3.0% y/y forecast; 3.3% y/y earlier)

- Japan GDP Capital Expenditure Remaining for Q2 2025: 0.6% q/q (1.3% q/q forecast; 1.1% q/q earlier)

- Japan Present Account for July 2025: 2,684.0B (3,100.0B forecast; 1,348.0B earlier)

- Australia Constructing Permits Remaining for July 2025: -8.2% m/m (-8.2% m/m forecast; 11.9% m/m earlier)

- Australia Non-public Home Approvals Remaining for July 2025: 1.1% m/m (1.1% m/m forecast; -1.9% m/m earlier)

- China Steadiness of Commerce for August 2025: 102.33B (95.0B forecast; 98.24B earlier)

- Japan Eco Watchers Survey Outlook for August 2025: 47.5 (47.5 forecast; 47.3 earlier)

- SNB Chairman Schlegel stated they gained’t hesitate to behave if essential, however the hurdle for reintroducing unfavourable rates of interest is excessive

- Germany Steadiness of Commerce for July 2025: 14.7B (21.4B forecast; 14.9B earlier)

- Germany Industrial Manufacturing for July 2025: 1.3% m/m (1.1% m/m forecast; -1.9% m/m earlier)

- U.S. Shopper Inflation Expectations for August 2025: 3.2% (3.1% forecast; 3.1% earlier)

- EU goals to coordinate with the US to sanction Russia following heaviest strikes on Ukraine

- François Bayrou ousted as French PM after dropping confidence vote

- Saudi Arabia to chop oil costs for Asia as OPEC+ sticks with output hike

Broad Market Worth Motion:

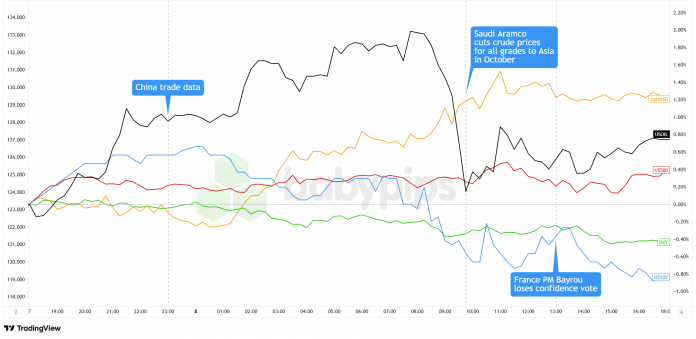

Greenback Index, Gold, S&P 500, Oil, U.S. 10-yr Yield, Bitcoin Overlay Chart by TradingView

Markets began the week in cautious optimism as political upheaval rippled throughout main economies. European shares posted modest beneficial properties regardless of French political uncertainty, with the DAX climbing 0.54% and the CAC 40 including 0.49%, whereas the FTSE lagged at 0.07%. Higher-than-expected German industrial manufacturing information probably supplied some help.

Wall Avenue prolonged the optimistic momentum with the Nasdaq hitting contemporary report highs, led by software program shares rallying 1.2%. The S&P 500 edged up 0.2% as merchants solidified expectations for a September Fed price lower following Friday’s disappointing employment report.

Gold surged to unprecedented territory above $3,640, pushed by falling actual yields because the 10-year Treasury yields dropped to 4.04%, its lowest since April. The dear metallic’s relentless march increased mirrored each price lower expectations and continued central financial institution accumulation.

Crude oil recovered modestly to $62.40 after OPEC+ introduced a smaller-than-feared manufacturing enhance of 137,000 barrels per day for October, whereas potential Russian sanctions supplied further help. Bitcoin remained comparatively subdued close to $112,000, consolidating current beneficial properties regardless of the broader risk-on sentiment sweeping via conventional markets.

FX Market Conduct: U.S. Greenback vs. Majors:

Overlay of USD vs. Majors Chart by TradingView

The greenback opened on a defensive footing as Asian markets digested Friday’s disappointing employment information, with merchants cementing expectations for a September Fed price lower. The yen proved the notable exception, gapping sharply decrease following Prime Minister Ishiba’s weekend resignation announcement, permitting USD/JPY to briefly spike earlier than the transfer was utterly retraced throughout Tokyo buying and selling.

The Dollar’s weak spot accelerated via European hours as better-than-expected German industrial manufacturing information bolstered threat urge for food, whereas dovish Fed bets weighed on the forex. The euro examined month-to-month vary highs close to 1.1765 because the greenback selloff gained momentum, shrugging off issues about French political instability following PM Bayrou’s confidence vote defeat. Sterling equally flirted with current peaks whereas commodity currencies outperformed, with the Australian and New Zealand {dollars} posting the strongest beneficial properties amongst majors.

The greenback’s decline endured after the London shut as Treasury yields held close to multi-month lows, with the 10-year yield anchored round 4.04%. Market individuals appeared to place defensively forward of Thursday’s essential CPI report, which might both validate or problem present price lower assumptions which have the greenback buying and selling close to its weakest ranges since early summer time.

Upcoming Potential Catalysts on the Financial Calendar

- New Zealand Manufacturing Gross sales for Q2 2025 at 10:45 pm GMT

- U.Okay. BRC Retail Gross sales Monitor for August 2025 at 11:01 pm GMT

- Australia Westpac Shopper Confidence Change for September 2025 at 12:30 am GMT

- Australia NAB Enterprise Confidence for August 2025 at 1:30 am GMT

- Japan Machine Instrument Orders for August 2025 at 6:00 am GMT

- France Industrial Manufacturing for July 2025 at 6:45 am GMT

- U.S. NFIB Enterprise Optimism Index for August 2025 at 10:00 am GMT

- Germany Bundesbank Nagel Speech at 11:30 am GMT

- U.S. Non Farm Payrolls Annual Revision at 2:00 pm GMT

- U.S. API Crude Oil Inventory Change for September 5, 2025, at 8:30 pm GMT

- New Zealand Customer Arrivals for July 2025 at 10:45 pm GMT

The London and U.S. classes will probably keep cautious as merchants maintain again forward of Thursday’s U.S. CPI, although surprises from Germany’s Nagel or U.S. jobs revisions might set off temporary swings.

Secure haven flows into the greenback and franc might proceed if geopolitical tensions flare, whereas threat currencies might stay uneven.

As at all times, look out for international commerce developments and geopolitical headlines that might affect general market sentiment. Keep nimble and don’t overlook to take a look at our Foreign exchange Correlation Calculator when taking any trades!