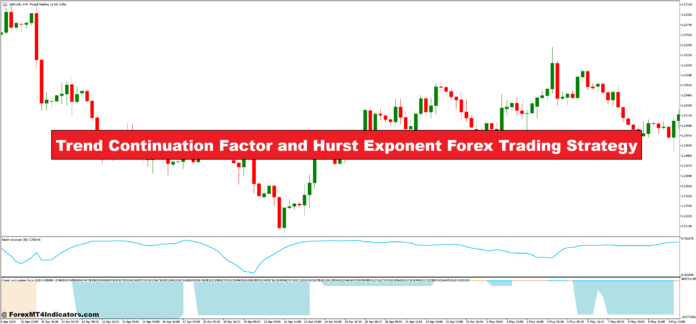

The Development Continuation Issue and Hurst Exponent Foreign currency trading technique is a robust method that helps merchants assess the probability of a development persisting in Forex. In an atmosphere the place market circumstances continually change, one of the vital essential challenges merchants face is figuring out whether or not a present development will proceed or if a reversal is imminent. By combining the Development Continuation Issue, which measures the energy of a development, and the Hurst Exponent, which evaluates the market’s long-term reminiscence, this technique gives merchants a complicated option to establish high-probability trend-following alternatives.

The Development Continuation Issue is designed to seize the persistence of a value motion, permitting merchants to evaluate how possible it’s {that a} development will maintain progressing. It really works on the precept that traits don’t simply happen randomly; they have an inclination to observe patterns, usually extending for longer intervals than merchants may anticipate. By analyzing the energy and continuation of traits, merchants can enter positions with larger confidence, timing their trades based mostly on when a development is more likely to lengthen. This issue permits merchants to filter out noisy value motion and deal with traits with the best potential.

In the meantime, the Hurst Exponent brings a novel statistical perspective to the desk. Originating from the examine of long-term reminiscence in time collection information, the Hurst Exponent measures whether or not a market is trending, mean-reverting, or displaying a random stroll. A Hurst Exponent worth larger than 0.5 signifies a persistent development, whereas a price nearer to 0.5 suggests random motion, and values beneath 0.5 level to mean-reverting conduct. By incorporating the Hurst Exponent right into a Foreign currency trading technique, merchants achieve insights into the underlying dynamics of market conduct, enabling them to make extra knowledgeable selections about development continuation or reversal.

Development Continuation Issue Indicator

The Development Continuation Issue (TCF) Indicator is a instrument designed to measure the energy and sustainability of a development available in the market. Its main perform is to evaluate whether or not an ongoing development is more likely to proceed, giving merchants the arrogance to remain able longer or to enter a commerce when the development is at its strongest. The TCF Indicator analyzes value motion over an outlined interval and assigns a price based mostly on the momentum and persistence of the development. A better TCF worth signifies a stronger and extra possible continuation of the development, whereas a decrease worth means that the development could also be weakening or reversing.

Merchants can use the Development Continuation Issue to filter out intervals of market indecision or range-bound actions. By specializing in traits with excessive TCF values, merchants can keep away from false indicators and scale back the probabilities of coming into trades throughout market noise. This indicator is especially helpful in trend-following methods, because it helps merchants establish when to enter or keep in a commerce, counting on the concept that traits, as soon as established, usually tend to proceed than reverse. The TCF Indicator is handiest when mixed with different instruments like transferring averages or momentum oscillators, because it permits merchants to substantiate the energy of a development earlier than making buying and selling selections.

The Development Continuation Issue is straightforward to interpret: when the TCF reveals a price above a sure threshold, it signifies that the market is trending strongly and will proceed in that course. Conversely, a drop within the TCF worth beneath the brink indicators a weakening development or a possible reversal, which may very well be an early warning to exit a commerce or regulate stop-loss ranges.

Hurst Exponent Indicator

The Hurst Exponent (HE) Indicator is a statistical instrument used to measure the long-term reminiscence of value actions in a market. It offers a novel perception into market conduct by quantifying whether or not a market is trending, mean-reverting, or behaving randomly. The Hurst Exponent values vary between 0 and 1, the place a price nearer to 0.5 signifies random conduct (a random stroll), values above 0.5 recommend a persistent development (trending conduct), and values beneath 0.5 point out mean-reverting tendencies (markets that oscillate round a imply stage).

The Hurst Exponent Indicator is predicated on the premise that markets usually exhibit a “reminiscence” of previous value actions, and this reminiscence can provide merchants useful insights into future market conduct. When the Hurst Exponent is larger than 0.5, it means that the market tends to observe its earlier actions, making it extra more likely to proceed in the identical course. Conversely, when the Hurst Exponent is beneath 0.5, it signifies that the market is extra more likely to return to a imply or equilibrium stage, signaling potential reversals or consolidation intervals.

Merchants use the Hurst Exponent to establish whether or not the market is in a trending part or a ranging part. Throughout trending intervals, merchants may search for alternatives to enter positions within the course of the development, whereas throughout mean-reverting phases, merchants may deal with reversal methods. By utilizing the Hurst Exponent alongside different indicators, merchants can refine their technique, enhancing their potential to foretell whether or not a development will persist or if the market will return to a imply.

Tips on how to Commerce with Development Continuation Issue and Hurst Exponent Foreign exchange Buying and selling Technique

Purchase Entry

- The TCF worth must be above an outlined threshold (e.g., above 70 or 80), indicating a powerful uptrend.

- The Hurst Exponent must be above 0.5, signaling a persistent trending market (indicating the development is more likely to proceed).

- When each the TCF and Hurst Exponent are in alignment (TCF is excessive and HE > 0.5), this confirms the energy and persistence of the bullish development.

- Enter a purchase place when the market reveals affirmation of an uptrend with these indicators.

Promote Entry

- The TCF worth must be above an outlined threshold (e.g., above 70 or 80), indicating a powerful downtrend.

- The Hurst Exponent must be above 0.5, signaling a persistent downtrend (indicating the development is more likely to proceed).

- When each the TCF and Hurst Exponent are in alignment (TCF is excessive and HE > 0.5), this confirms the energy and persistence of the bearish development.

- Enter a promote place when the market reveals affirmation of a downtrend with these indicators.

Conclusion

The Development Continuation Issue and Hurst Exponent Foreign currency trading technique offers merchants with a sturdy framework for figuring out and buying and selling with robust, persistent traits. By combining the insights from the Development Continuation Issue, which gauges the energy of a development, and the Hurst Exponent, which evaluates the development’s probability of continuous, merchants could make extra knowledgeable and assured buying and selling selections.

Advisable MT4 Dealer

XM Dealer

- Free $50 To Begin Buying and selling Immediately! (Withdraw-able Revenue)

- Deposit Bonus as much as $5,000

- Limitless Loyalty Program

- Award Profitable Foreign exchange Dealer

- Further Unique Bonuses All through The Yr

- Unique 50% Money Rebates for all Trades!

Already an XM consumer however lacking out on cashback? Open New Actual Account and Enter this Companion Code: 𝟕𝐖𝟑𝐉𝐐

Click on right here beneath to obtain: