3. Validation and retraining management system

3.1. How validation works

3.2. Suggestions for organising validation (10-20% of the variety of examples is beneficial)

4. Superior settings

4.2. Extra parameters

4.3. Activation and scaling settings

- ActivationPreset – preset configurations of activation features (Auto/Handbook)

- ActivationTypeHidden – activation operate for hidden layers (when configured manually)

- ActivationTypeOut – activation operate for the output layer (when configured manually)

- InputScale – enter information scaling technique (S11/S01)

- OutputScale – output information scaling technique (S11/S01)

- GradientLimiting – Allow gradient limiting

- max_grad – most gradient worth (with limitation enabled)

4.4 Notification and Logging Settings

- EnableAlerts – Allow buying and selling alerts

- AlertThreshold – alert set off threshold

- PushNotifications – sending push notifications

- EmailAlerts – Sending electronic mail alerts

- SoundAlerts – Sound Alerts

- EnableLogging – enabling the logging system

- ReduceLog – frequency of logging (discount)

- LogExamples – logging coaching examples

- LogResults – logging of coaching outcomes

- LogLoad – logging community loading

- LogSave – logging of community saving

4.5. Extra indicator settings

- UniverseOutputScale – common output scaling

- FixIndicatorWindowMinMax – fixing the minimal/most of the indicator window

- MaxBars – most variety of bars within the indicator window

- AutoColor – automated coloration scheme

- Coloration – choose coloration (when AutoColor is disabled)

5. Interpretation of outcomes

5.1. Info panel (GUI)

- The data panel shows:

- Community construction – layer configuration (L1, L2, L3, L4)

- Accuracy – present evaluation of the accuracy of forecasts

- Coaching interval – the time vary of knowledge on which the community was skilled

- Activations – activation features used for hidden and output layers

- Scale kind – the strategy of scaling enter and output information (S01 [0,1] or S11 [-1,1])

5.2. Visible components on the chart

- Forecast Line – a coloured line that shows the forecast for the chosen bar

- Graphic objects – visualization of future forecasts immediately on the value chart

- Vertical strains – signify the interval of knowledge used to coach the final loaded community

- Coloration indication – informs in regards to the compatibility of the loaded community with the present image and timeframe

6. Integration with advisors (EA)

6.1 To name the indicator from the advisor, use the iCustom() operate.

- Instance of initialization within the advisor:

int OnInit()

{

// Loading the indicator

indicator_handle = iCustom(_Symbol, _Period, Indicator_Name, FutureBar, File_Name, 0);

if(indicator_handle == INVALID_HANDLE)

{

Alert(“Error loading the indicator: “, GetLastError());

return(INIT_FAILED);

}

return(INIT_SUCCEEDED);

}

6.2 Parameters for optimization within the technique tester:

- Prediction Quantity (1 to six)

- Threshold values for producing buying and selling indicators (SignalLimit)

- Community kind (Variations) – T1, T2, T3, T4 and their modifications

- Sizes of neural community layers (LL1, LL2, LL3, LL4)

7. Often Requested Questions (FAQ)

Q: The community doesn’t load or doesn’t begin coaching.

ABOUT:

- Examine the write permissions within the MQL5/Recordsdata/ folder

- Be certain that there’s sufficient historic information out there

- Examine the correctness of the desired community parameters (layer sizes)

- Be certain that the community information exist and should not corrupted.

Q: What Community kind ought to I select?

ABOUT:

- T1 – Primary choice. It’s endorsed to start out with it

- T1Dif, T2Dif – Methods that analyze value variations. May be extra correct for figuring out directional actions

- T2 – Context-dependent evaluation. Takes into consideration volatility

- T3/T4 – Specialised methods for correct willpower of tendencies and impulses

Q: Learn how to decide the enter/output scale kind?

ABOUT:

- Examine the Sort parameter on the indicator info panel (GUI)

- If the UniverseOutputScale parameter = true, the show within the indicator window is standardized to the vary [-1,1]

- If UniverseOutputScale = false, the output values correspond to the unique scale of the chosen technique (S01 or S11)

Q: Why does the indicator use this specific validation technique?

ABOUT:

- This strategy is commonplace in machine studying and gives a good evaluation of the standard of the mannequin on information that was not utilized in coaching.

Q: How typically ought to the community be retrained?

ABOUT:

- It’s endorsed to retrain the community at any time when market circumstances change considerably or each 1-2 weeks to maintain the mannequin related.

8. Suggestions to be used

- Decide the dimensions kind – Understanding the dimensions of the output information (S01 or S11) is vital to correctly deciphering the indicators.

- Arrange thresholds – Optimize the SignalLimit parameter to your buying and selling technique and chosen timeframe

- Take a look at several types of networks – Methods based mostly on value variations (T1Dif, T2Dif) can present higher outcomes on unstable devices

- Think about the timeframe – Excessive time frames (H4, D1) typically require extra conservative (bigger) thresholds to filter out noise

- Periodic retraining – Recurrently retrain the community on new information to maintain the mannequin updated

Essential validation notes:

- The validation interval is minimize off from the tip of the historic information.

- For max relevance, it is strongly recommended to periodically retrain the community on new information.

- The validation interval dimension ought to match your buying and selling horizon.

9. Help

When you’ve got any questions or issues:

- Initially, examine the logs within the “Specialists” and “Journal” tabs. Guarantee that logging is enabled within the settings

- Ensure you have sufficient historic information for the image and timeframe you select.

- Decide the kind of community used and the info output scale – this info is commonly wanted for diagnostics

- For complicated questions, please contact the indicator’s dialogue part on the Market or the developer by way of personal messages

Word: The market and setup suggestions under got by synthetic intelligence based mostly on the evaluation of the indicator algorithms. As a developer, I’ve not examined all methods on all markets.

APPENDIX A: Description of methods (Community kind) and proposals for activation and scaling (applied in Auto)

T1 – Normalized unbiased evaluation

- Enter: Normalized window of L1 opening costs

- Output: Normalized window of L4 predicted opening costs

- The gist: The neural community learns to immediately predict future costs based mostly on historic

- Activations: Tanh / Tanh

- Scale: S11 / S11

T2 – Context-dependent evaluation

- Enter: Normalized window of L1 opening costs

- Output: Predicted costs normalized to the vary of enter information

- The underside line: The forecast is scaled relative to the present volatility

- Activations: Tanh / Tanh

- Scale: S11 / S11

T1Dif / T2Dif – Value Distinction Evaluation

- Enter: Variations between future and present costs, normalized to protect signal

- Output: Predicted value variations (T1Dif: unbiased norm., T2Dif: enter norm.)

- The gist: The community predicts the path and energy of motion, not the value

- Activations: Tanh (LReLu) / Linear

- Scale: S11 / S11

T3 – Development Detector with Filtering

- Entry: Normalized Opening Value Window

- Output: If all L4 future bars are above/under the present value, their values are normalized. In any other case, the output is ignored.

- The gist: The community learns to detect secure unidirectional actions

- Activations: Tanh / Sigm

- Scale: S11/S01

T3Bin – Binary Development Classification

- Enter: Similar as T3

- Output: Binary values (1/-1 or 1/0) for every future bar

- Essence: Simplification of the issue to binary classification for clear indicators

- Activations: Tanh / Sigm

- Scale: S11/S01

T4 – Pure Pulse Detector

- Entry: Normalized Opening Value Window

- Output: Just like T3, however studying happens solely on pronounced actions

- The gist: Tighter choice. Concentrate on discovering sturdy, momentum strikes

- Activations: Relu / Tanh

- Scale: S11 / S11

T4Bin – Binary Impulse Classification

- Enter: Similar as T4

- Output: Binary values (1/-1 or 1/0)

- The gist: Extraordinarily aggressive seek for momentum for brief trades

- Activations: Relu / Sigm

- Scale: S11/S01

For prime timeframes (H4, D1, W1), it is strongly recommended to set extra conservative settings: if there was ActivationHidden == Relu, then set ActivationHidden = Tanh;

For low timeframes (M1, M5, M15) extra aggressive settings: if ActivationHidden == Tanh, then set ActivationHidden = LRelu;

Abstract desk of suggestions:

| Technique | Hidden Activation | Output Activation | Enter Scale | Output Scale |

|---|---|---|---|---|

| T1 | Tanh | Tanh | S11 | S11 |

| T2 | Tanh | Tanh | S11 | S11 |

| T1Dif | Tanh(LRelu) | Linear | S11 | S11 |

| T2Dif | Tanh(LRelu) | Linear | S11 | S11 |

| T3 | Tanh | Sigm | S11 | S01 |

| T3Bin | Tanh | Sigm | S11 | S01 |

| T4 | Relu | Tanh | S11 | S11 |

| T4Bin | Relu | Sigm | S11 | S01 |

APPENDIX B – Suggestions for devices and intervals (in Handbook mode):

- For unstable devices (Crypto, Gold):

- Extra aggressive activations.

- For instance for “BTCUSD”, “XAUUSD”

- ActivationHidden = Relu; or LRelu;

- OutputScale = S11; // full vary

- For low volatility devices (Main FX):

- Extra conservative settings.

- For instance for “EURUSD” or “USDJPY”

- ActivationHidden = Tanh; // easy activations;

- OutputScale = S01; // probabilistic output

- For various timeframes:

- Excessive TF (H4, D1) – extra conservative

- ActivationHidden = Tanh;

- ActivationOut = Tanh;

- Low TF (M1, M5) – extra aggressive

- ActivationHidden = Relu;

- ActivationOut = Linear;

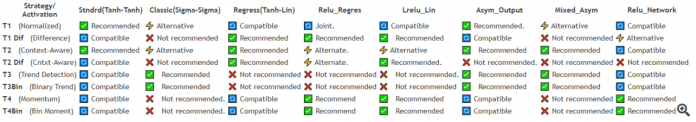

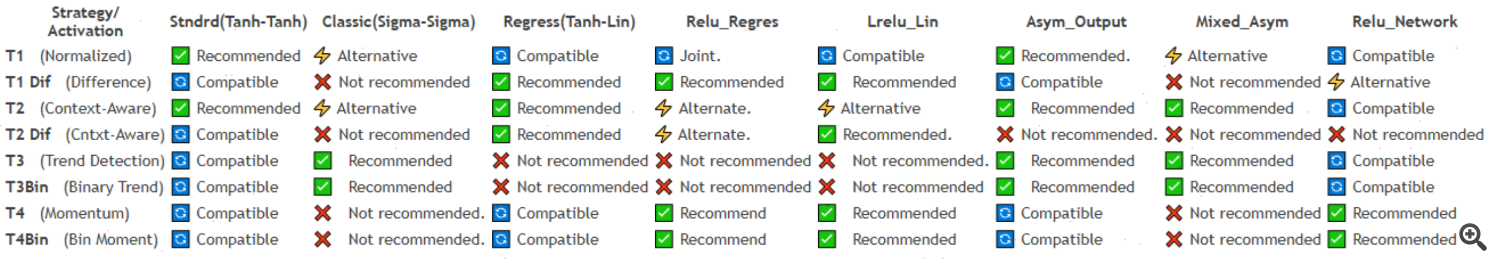

APPENDIX B – Technique and Activation Presets Compatibility Desk

Legend:

- ✅ Really useful – Good match

- ⚡ Various – Good various

- 🔄 Suitable – Works, however not optimally

- ❌ Not beneficial – Dangerous mixture

Key suggestions:

For T1 (Normalized Evaluation):

-

Higher: Customary, Asym_Output

-

Good: Basic, Mixed_Asym

For T1Dif (Distinction Evaluation):

-

Higher: Regression, Relu_Regression, Lrelu_Linear

-

Keep away from: Basic, Mixed_Asym

For T2Dif (Context-Conscious Distinction Evaluation):

- Higher: Regression, Lrelu_Linear, Relu_Regression

- Keep away from: Basic, Mixed_Asym, Asym_Output

For T2 (Context-Conscious):

-

Higher: Customary, Asym_Output, Mixed_Asym

-

Good: Basic, Regression, Relu_Regression

For T3/T3Bin (Development Detection):

-

Higher: Basic, Asym_Output, Mixed_Asym

-

Keep away from: All Linear outputs

For T4/T4Bin (Momentum):

-

Higher: Relu_Regression, Lrelu_Linear, Relu_Network

-

Keep away from: Basic, Mixed_Asym

Simplified suggestions:

For learners:

For skilled:

For consultants:

APPENDIX C – Suggestions for the applying of methods in numerous markets:

Abstract desk of suggestions:

| Technique | Greatest Markets | Good markets | Not beneficial | Peculiarities |

|---|---|---|---|---|

| T1 | Foreign exchange Majors, Indices CFD | Metals, Commodities | Crypto CFD | Common for secure markets |

| T2 | Foreign exchange Crosses, Metals | Foreign exchange Majors, Indices CFD | Crypto CFD | For devices with pronounced ranges |

| T1Dif | Crypto CFDs, Commodities | Foreign exchange Minor, Metals | Foreign exchange Main | For unstable and trending markets |

| T2Dif | Foreign exchange Crosses, Metals | Indices, FX Main | Crypto CFD | For context-sensitive evaluation of value variations |

| T3 | Foreign exchange Majors, Indices CFD | Metals, Commodities | Crypto CFD | For clear pattern actions |

| T3Bin | All markets (coaching) | – | – | Common binary classification |

| T4 | Crypto CFDs, Commodities | Foreign exchange Minor, Metals | Foreign exchange Main | For sturdy impulse actions |

| T4Bin | Crypto CFDs, USA Shares CFDs | Commodities, Metals | Indicatives | For aggressive momentum methods |

Detailed market suggestions:

1.T1 – Normalized Impartial Evaluation

-

Foreign exchange Main (EURUSD, GBPUSD, USDJPY): ✅ Wonderful – secure tendencies

-

Foreign exchange Minor (EURAUD, GBPNZD): ✅ Good – reasonable volatility

-

Metals (XAUUSD, XAGUSD): ✅ Good – clear tendencies

-

Indices CFD (US30, SPX500): ✅ Wonderful – appropriate for indices

-

Commodities (XBRUSD, XNGUSD): ✅ Good – however wants adaptation

-

Crypto CFD (BTCUSD, ETHUSD): ⚠️ Warning – too unstable

-

USA Shares CFD (AAPL, TSLA): ✅ Good – for shares with liquidity

2. T2 – Context-Conscious Normalized Evaluation

-

Foreign exchange Crosses (EURGBP, AUDCAD): ✅ Wonderful – good ranges

-

Metals (XAUUSD, XPTUSD): ✅ Wonderful – clear technical ranges

-

Indices CFD (DAX30, FTSE100): ✅ Good – however there could also be gaps

-

Foreign exchange Main: ✅ Good – however much less pronounced ranges

-

Commodities: ⚠️ Conditional – will depend on the particular product

3. T1Dif – Value Distinction Evaluation

-

Crypto CFD: ✅ Ultimate – excessive volatility

-

Commodities (Oil, Gasoline): ✅ Wonderful – sharp actions

-

Foreign exchange Minor (unique pairs): ✅ Good – excessive volatility

-

Metals (XAUUSD): ✅ Good – throughout information

-

Foreign exchange Main: ⚠️ Conditionally – solely in periods of excessive volatility

4. T2Dif – Context-Conscious Distinction Evaluation

- ✅ Foreign exchange Crosses (EURGBP, AUDCAD, EURCHF) – your best option

- ✅ Metals (XAUUSD, XAGUSD) – particularly within the Asian session

- ✅ Indices CFD (DAX30, FTSE100) – on every day timeframes

- ⚠️ Foreign exchange Main (EURUSD, GBPUSD) – solely in periods of excessive volatility

- ❌ Crypto (too unstable)

5. T3 – Development Detection with Filtering

-

Foreign exchange Main: ✅ Ultimate – secure tendencies

-

Indices CFD: ✅ Wonderful – clear every day tendencies

-

Metals: ✅ Good – particularly gold

-

Commodities: ✅ Good – trending actions

-

Crypto CFD: ⚠️ Beware – Too Noisy for T3

6. T3Bin – Binary Development Classification

-

All markets: ✅ Common – for coaching and testing

-

Particularly: Foreign exchange Main, Indices – for dependable indicators

-

For Inexperienced persons: Greatest Option to Begin With

7. T4 – Pure Momentum Detection

-

Crypto CFD: ✅ Ultimate – sturdy impulses

-

Commodities: ✅ Wonderful – sharp actions on information

-

Foreign exchange Minor: ✅ Good – unstable pairs

-

Metals: ✅ Good – particularly silver

-

Foreign exchange Main: ⚠️ Solely in periods of excessive volatility

8. T4Bin – Binary Momentum Classification

-

Crypto CFD: ✅ Ultimate – for scalping

-

USA Shares CFD: ✅ Wonderful – Excessive Volatility Shares

-

Commodities: ✅ Good – for information impulses

-

Metals: ✅ Good – gold throughout crises

-

Indicatives: ❌ Not beneficial – low volatility

APPENDIX D – Timeframe Suggestions:

For Foreign exchange Main:

For Crypto CFDs:

-

T1Dif, T4, T4Bin: M5, M15, H1

-

T3: H4, D1 (for long-term tendencies)

For Indices CFD: For Commodities:

-

T1Dif, T4: M15, H1

-

T3: H4, D1

Particular suggestions:

Asian session (Foreign exchange):

-

T1, T2 – for vary of movement

-

Keep away from T4, T4Bin – low volatility

European/American session:

-

T3, T4 – for pattern actions

-

T1Dif – for breakout methods

Information occasions:

-

T4, T4Bin – for capturing pulses

-

Keep away from T3 – the filter can minimize off sudden actions

Durations of low liquidity:

-

T1, T2 – extra secure operation

-

Keep away from T1Dif, T4 – could also be false indicators

Cross-market suggestions:

-

Begin with Foreign exchange Main + T3Bin – probably the most secure choice

-

For coaching use T3Bin on completely different markets – common technique

-

For aggressive buying and selling: Crypto CFD + T4Bin – excessive volatility

-

For conservative buying and selling: Indices CFD + T1 – secure tendencies

APPENDIX E – Suggestions for organising neural community structure:

Timeframe settings:

1. Quick timeframes (M1-M15)

-

Enter layer (L1): 12-15 neurons – brief value historical past

-

Hidden layer 1 (L2): 8-10 neurons – compact processing

-

Hidden Layer 2 (L3): 0 – normally not required

-

Output layer (L4): 3-4 neurons – short-term forecast

2. Medium timeframes (M30-H1)

-

L1: 20-25 neurons – common historical past

-

L2: 12-15 neurons – balanced processing

-

L3: 0 – will be added if mandatory

-

L4: 5-6 neurons – medium time period prognosis

3. Day by day timeframes (H4)

-

L1: 30-35 neurons – prolonged historical past

-

L2: 16-20 neurons – deep processing

-

L3: 8-10 neurons – further hidden layer

-

L4: 8-10 neurons – long-term prognosis

4. Weekly and month-to-month timeframes

-

L1: 40-50 neurons – most historical past

-

L2: 20-25 neurons – excessive capability

-

L3: 12-15 neurons – deep structure

-

L4: 10-12 neurons – prolonged prognosis

Technique-specific settings:

For T1Dif and T4 (evaluation of value variations)

For T3Bin and T4Bin (binary classification)

-

Simplify structure: L3 = 0

-

Cut back L2 by 2-3 neurons (minimal 6)

-

Optimum for quick studying and clear indicators

For T2 and T2Dif (context-sensitive evaluation)

-

Enhance L2 by 2-3 neurons for higher context

-

If L3 is current, enhance by 2 neurons

-

Improves sample and stage recognition

Adaptation to instrument volatility:Extremely unstable devices (crypto, commodities)

-

Enhance L1 by 3-5 neurons

-

Enhance L2 by 2-3 neurons

-

Improves the community’s skill to deal with sudden actions

Low volatility devices (main pairs)

APPENDIX F – Gradient Limiting Suggestions for Every Activation Preset:

- Customary (Tanh-Tanh) GradientLimiting = false; // Tanh is proof against gradient explosion

- Basic (Sigma-Sigma) GradientLimiting = false; // Sigmoid is self-limiting

- Lrelu_Linear (LReLU-Linear) GradientLimiting = true; max_grad = 0.1; // Default worth for LReLU

- Bin_Momentum (ReLU-Sigma) GradientLimiting = true; max_grad = 0.08; // Stricter limitation for binary classification

- Asym_Output (Tanh-Tanh uneven) GradientLimiting = false; // Tanh is protected

- Relu_Network (ReLU-ReLU) GradientLimiting = true; max_grad = 0.1; // Required for pure ReLU

- Regression (Tanh-Linear) GradientLimiting = false; // Tanh + Linear are normally secure

- Mixed_Asym (Tanh-Sigma) GradientLimiting = false; // Each features are protected

- Standard_Alt (Tanh-Tanh various) GradientLimiting = false; // Tanh is protected

- Relu_Regression (ReLU-Linear) GradientLimiting = true; max_grad = 0.12; // ReLU requires limiting

- LRelu_Network (LReLU-LReLU) GradientLimiting = true; max_grad = 0.1; // LReLU is best with limiting

- Full_Linear (Linear-Linear) GradientLimiting = true; max_grad = 0.15; // Linear activations are liable to exploding gradients

- Hybrid (Sigma-Tanh) GradientLimiting = false; // Each features are protected

- Relu_Sigmoid (ReLU-Sigmoid) GradientLimiting = true; max_grad = 0.1; // ReLU requires limiting

- Combo_Relu_Tanh (ReLU-Tanh) GradientLimiting = true; max_grad = 0.1; // ReLU requires limiting

- Experimental (Sigma-Linear) GradientLimiting = false; // Sigmoid is protected

- Combo_LRelu_Tanh (LReLU-Tanh) GradientLimiting = true; max_grad = 0.1; // LReLU is best with limiting

- Combo_Tanh_Sigm (Tanh-Sigm) GradientLimiting = false; // Each features are protected

Keep in mind that these suggestions are normal. At all times take a look at methods on historic information of a particular instrument earlier than utilizing!

Word: The indicator makes use of historic information to make predictions. Previous efficiency doesn’t assure future earnings. Commerce responsibly.