A Doji is a sort of candlestick sample in buying and selling that signifies that neither bulls nor bears prevail out there. The sample resembles a bar chart sample. It may possibly typically be present in any monetary market, together with Foreign exchange, commodities, cryptocurrencies, and shares.

The principle characteristic of a Doji candlestick is that opening and shutting costs are virtually on the identical degree, so the candle has a tiny and even no physique. Typically, a Doji candlestick has a small physique and lengthy higher or decrease shadows.

This text supplies an in depth overview of what a Doji candlestick sample is, how it may be interpreted, and the best way to use it in buying and selling.

The article covers the next topics:

Main Takeaways

-

Doji is a candlestick sample characterised by virtually similar opening and shutting costs, leading to a physique that resembles a skinny line. The Doji candle reveals a interval of uncertainty out there.

-

The Doji sample encompasses a small or no candlestick physique and lengthy wicks or shadows, hinting at value volatility through the formation interval, but with the value closing virtually on the opening degree.

-

A number of the most typical varieties of Doji embody Impartial Doji, Lengthy-Legged Doji, Dragonfly Doji, Headstone Doji, and Star Doji candlesticks. Every kind has its distinctive interpretation.

-

The looks of a Doji candlestick signifies a steadiness of energy between consumers and sellers, the place neither aspect can set up management over the market.

-

When buying and selling a Doji candle, it must be confirmed by the next candlesticks. A stop-loss order is often positioned past the Doji’s excessive or low, relying on the commerce course.

-

On account of the truth that there are various kinds of Doji candlesticks, the sample is utilized in pattern following and pattern reversal methods, in addition to with different indicators to extend the accuracy of indicators.

-

The benefit of the candlestick sample is that it supplies correct reversal indicators, whereas its drawbacks are the necessity for affirmation and the danger of false indicators if the sample is misinterpreted.

-

Doji candlestick patterns could be discovered on any timeframe and market. Most frequently, they seem on every day and weekly charts, in addition to in extremely unstable markets akin to Foreign exchange.

What Is a Doji Candle?

A Doji Japanese candlestick is a big candlestick sample that seems on a candlestick chart, indicating that the value is struggling to discover a clear course and that there’s a steadiness between the 2 market forces. The sample means that the market is hesitant. On the identical time, it implies {that a} pattern reversal is looming, signaling the onset of a brand new upward or downward pattern.

What Does the Doji Candle Imply for Merchants?

The Doji candlestick provides merchants priceless indicators, particularly if the sample seems on the every day timeframe on the peak of the uptrend or the underside of the downtrend. Its look tells market contributors {that a} bearish pattern reversal is impending or a correction is imminent.

Within the traditional Doji sample, the opening value ought to match the closing value, however generally there’s a minor distinction of some ticks. Due to this fact, when buying and selling this sample, it’s needed to attend for affirmation utilizing different candlestick evaluation patterns or technical indicators.

How Does the Doji Candle Forming?

A Doji candlestick sample is well-known on this planet of buying and selling. It helps merchants determine the height of an uptrend on the chart, notably when the sample emerges after an extended inexperienced candlestick. When there’s a extended rally out there and the asset is overbought, the looks of a Doji warns consumers that demand is fading, and bears are gaining the higher hand and are about to reverse the prevailing uptrend.

Nonetheless, in downtrends, a Doji loses its magic as a result of the sample signifies that the forces out there are equal, that means that the draw back potential is similar because the upside potential, so the decline may proceed inertially.

Due to this fact, it’s important to verify a value reversal and a brand new pattern utilizing different candlestick patterns in addition to a Doji. Such affirmation could be offered, for instance, by the Morning Star Doji sample, which consists of three candlesticks.

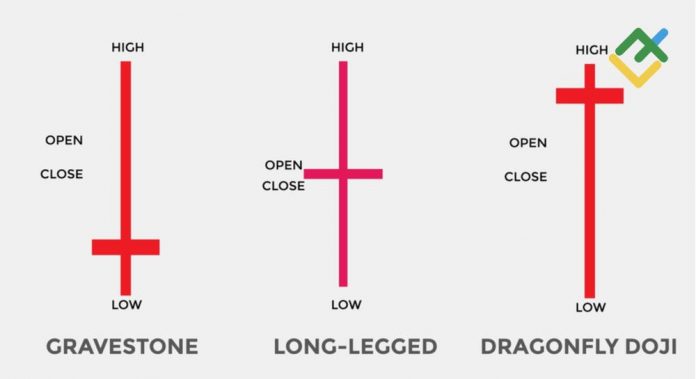

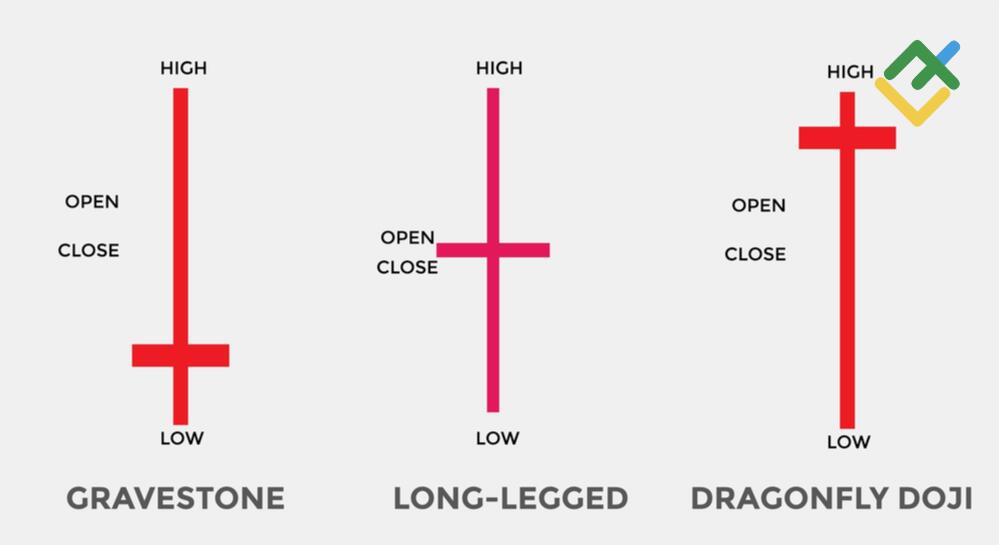

Doji Candlestick Sorts

Whereas the Doji candlestick is undoubtedly a robust sample, its significance can differ relying on its kind. On this part, we are going to study the various kinds of Doji candlesticks and what every kind of the sample signifies.

Lengthy-Legged Doji

A Lengthy-Legged Doji has lengthy higher and/or decrease shadows. This Doji sample is especially vital on the prime of the bullish pattern, because it signifies indecision out there, and that bears are gaining energy.

Throughout the candlestick formation interval, the value rises sharply, then falls, and by the top of the interval returns to or approaches its opening value, pointing to a looming pattern reversal.

If the value is in the midst of the candlestick’s vary and the size of the shadows is similar, this formation is named a Rickshaw Man.

As well as, there’s a kind of candlestick with a small physique and lengthy higher and/or decrease shadows, which is named a Excessive Wave. The Japanese name such candlesticks “lack of sense of course.”

Dragonfly Doji

The Dragonfly Doji sample has a T-shaped formation and resembles a Dragonfly, therefore its identify. As a rule, this Bullish Doji seems in a downtrend, signaling a pattern reversal. In some circumstances, the Dragonfly Doji bullish candlestick can also seem in an uptrend. Nonetheless, when it seems in an uptrend, it requires extra affirmation from different candlestick patterns. This candlestick has an extended decrease shadow and no higher shadow or a really quick one, which is why it’s extra bullish in nature.

Headstone Doji

The Headstone Doji has such a formidable identify as a result of it symbolizes a bearish pattern reversal and the “burial” of an uptrend.

The precept behind this determine is that the value opens on the lows, soars, after which rolls again to the opening value. The sample provides a very vital sign in an uptrend, giving a warning to bulls about elevated bearish exercise. Nonetheless, generally this bearish candlestick may also be discovered on the backside of the downtrend, the place it requires extra affirmation. As a rule, the longer the higher shadow of the Headstone Doji, the stronger the reversal sign.

Impartial Doji

A Impartial Doji candle shows the identical traits as a Rickshaw Doji. The worth on the finish of the formation interval finishes its motion near the opening value. Nonetheless, the space lined throughout the value vary is similar in each instructions, and the opening and shutting costs are in the midst of the buying and selling vary. In different phrases, neither market pressure prevailed, which creates indecision out there.

Customary Doji

A Customary or Traditional Doji happens when the opening and shutting costs of an asset are virtually equal, and the physique of the candlestick appears to be like like a really skinny line.

Lengthy higher and decrease shadows point out vital volatility through the buying and selling interval, pointing to uncertainty concerning the course of the value motion.

On a value chart, the sample displays a steadiness between consumers and sellers. It may possibly sign a possible bullish or bearish reversal, particularly if the Doji seems after an extended upward or downward motion.

Nonetheless, a traditional Doji also needs to be confirmed by indicators acquired from technical indicators and candlestick patterns. Notably, a Doji alone most frequently doesn’t generate a dependable sign; reasonably, it serves as a harbinger of potential shifts in market sentiment.

4-Value Doji

A 4-Value Doji is a particular kind of Doji sample on a chart the place the opening, closing, excessive, and low costs are the identical. This Doji candlestick indicators full indecision out there and appears like a horizontal line.

In essence, it reveals that neither consumers nor sellers have been capable of considerably affect the value through the buying and selling interval. A 4-Value Doji signifies excessive stagnation and an absence of volatility. Such candlesticks are often present in markets with very low buying and selling volumes or on massive time frames the place the value generally stays nearly unchanged.

What’s the Distinction between a Doji and a Spinning High?

The Doji sample is a candlestick characterised by its shadows and virtually no physique, indicating that the closing value is similar because the opening value. Spinning Tops are candlestick patterns with a small physique and, as a rule, lengthy shadows. That is the primary distinction between the 2 candlestick patterns.

Basically, Impartial Doji and Spinning High candlesticks level to uncertainty out there, which is confirmed by their wicks. That’s, the market is crowded with each bulls and bears.

In each circumstances, the looks of those candlesticks might sign a reversal, however it’s needed to attend for added indicators for affirmation.

Find out how to Commerce Doji Candlesticks?

Doji candlesticks carry out extra effectively when buying and selling on an H1 timeframe or increased. On decrease time frames, it seems too typically to be thought of a robust sign for a particular motion. As well as, there’s market noise on these time frames, which may deceive merchants.

Right here is an instance of a step-by-step buying and selling technique based mostly on the Doji sample utilizing the Walt Disney Firm inventory:

1. First, it is very important decide the time-frame, in addition to the assist and resistance ranges. On the 4-hour timeframe beneath, you possibly can see the assist and resistance ranges, in addition to the purpose the place the value reached a swing excessive.

2. The subsequent step after figuring out the descending pattern line is to research the candlestick chart at level 3. Right here, we will see that after an upward correction, the asset fashioned a Darkish Cloud Cowl reversal sample, adopted by a Headstone Doji. These patterns recommend that the market is bearish. As well as, after an try to interrupt by the resistance line, bears pushed the value again down throughout the identical interval.

3. By the top of the buying and selling session, it’s clear that the asset will proceed to say no additional, due to this fact, it was attainable to open a place through the formation of the Headstone Doji, i.e., nearer to the top of the session.

4. As illustrated, the next day exhibited a considerable downward hole, and bulls have been unable to fill it. Within the context of short-term buying and selling, it’s higher to take earnings on the nearest assist degree. Extra affected person merchants might wish to wait till the quotes take a look at the pattern resistance line once more. This strategy will permit them to see how the asset will behave additional. Because of this, merchants may pocket their earnings in three completely different areas.

Execs and Cons of Buying and selling Doji Candlestick

On this part, you possibly can briefly familiarize your self with the benefits and drawbacks of buying and selling with Doji candlesticks.

|

Benefits |

Disadvantages |

|

It’s a robust reversal sign on the peak |

False actions in the wrong way are attainable, resulting in the formation of bull and bear traps |

|

It indicators uncertainty out there |

In a downtrend, a Doji might not sign a reversal, however reasonably a continuation of the pattern, as market forces are equal |

|

It reveals a pattern’s peak, which supplies a extra favorable entry level |

Affirmation by different candlestick patterns is critical |

|

It really works finest on the Foreign exchange and inventory markets |

There are a lot of sorts of this candlestick, together with Headstone Doji, Lengthy-Legged Doji, Dragonfly Doji, and Doji after an extended inexperienced candlestick, amongst others |

|

It’s efficient on hourly or increased time frames, permitting you to achieve earnings from a single commerce |

It isn’t very efficient on decrease time frames of as much as 1 hour, as these durations are extra delicate to market noise |

Doji Chart Sample Examples

Let’s take a look at an instance of reside buying and selling on the USD/CHF foreign money pair on a 4-hour chart. The screenshot beneath reveals a Double High value sample. Since Capturing Star, Hanging Man, and Lengthy-Legged Doji candlesticks are pink close to the second prime, we will decide that the value hit a robust resistance space and failed to interrupt by it.

Subsequent, we see a rebound and the beginning of a brand new downward motion to the neckline of the Double High value sample, the place the value discovered assist. On the degree of 0.9746, one other Lengthy-Legged Doji candlestick fashioned, which indicated uncertainty and emphasised robust assist from consumers.

We are able to see a brief upward correction, through which the asset fashioned one other Doji candle and a Spinning High sample. That’s, the pair was nonetheless below bearish strain. Subsequent, we see the formation of a giant pink candlestick, which gave a confirming sign to open a brief place.

As you possibly can see on the chart, a brief commerce of 0.01 lot was opened at this degree. A stop-loss order was set at 0.9827. No take-profit was positioned as a result of it was a short-term intraday commerce, and earnings have been taken manually.

After seven hours, the commerce was closed manually at 0.9678, with a revenue of $7.76, which is a wonderful end result for intraday buying and selling.

Ideas for Buying and selling Doji Chart

It is very important contemplate the next standards when analyzing and buying and selling Doji candlesticks:

-

When performing technical evaluation, use bigger time frames.

-

You’ll want to set stop-loss orders to manage dangers and keep away from falling into market traps.

-

Open trades after you might be positive that the value is transferring in keeping with your forecast. To do that, look forward to affirmation utilizing different candlestick evaluation patterns or technical indicators.

-

It’s higher to depend on Doji candlesticks forming close to assist and resistance ranges.

-

Use a extra optimum 4-hour timeframe.

-

Earlier than opening a place, test the information and financial calendar.

Conclusion

A Doji candlestick sample can take numerous kinds, offering merchants with a wealth of knowledge and enabling them to determine optimum entry factors.

Some varieties of Doji are sometimes thought of reversal patterns. Their look within the space of low or excessive costs signifies, initially, uncertainty out there. Normally, it might point out a attainable pattern reversal.

The Doji sample is barely a small a part of all of the candlestick patterns that exist on this planet of buying and selling. You possibly can check out your new data on a free and multifunctional demo account with LiteFinance.

The content material of this text displays the creator’s opinion and doesn’t essentially replicate the official place of LiteFinance dealer. The fabric revealed on this web page is offered for informational functions solely and shouldn’t be thought of as the availability of funding recommendation for the needs of Directive 2014/65/EU.

In accordance with copyright legislation, this text is taken into account mental property, which features a prohibition on copying and distributing it with out consent.