Trump’s tariff bombshell and a red-hot ADP jobs report despatched shockwaves by means of the markets, flipping danger sentiment and jolting main property.

From gold’s report surge to the greenback’s wild trip, right here’s what moved and why it issues.

Headlines:

- Australia constructing approvals for February: -0.3% m/m (-1.4% forecast, 6.9% earlier)

- Bloomberg reported that China has taken steps to limit native corporations from investing within the U.S. amid commerce tensions

- Speculations that Trump’s “Liberation Day” tariffs are ceilings that may very well be negotiated downward helped help danger sentiment early Wednesday

- RBA to boost costs of recent OMO repos by 5 – 10bps above money charge goal, signaling a small shift towards tighter funding situations

- U.S. ADP report for March: 155.0k (60.0k forecast; 77.0k earlier)

- U.S. Manufacturing unit orders for February: 0.6% m/m (0.3% forecast; 1.7% earlier)

- U.S. EIA Crude Oil Shares Change for March 28: 6.17M (-3.34M earlier)

- ECB member Robert Holzmann stated he didn’t see a cause to chop rates of interest additional

- U.S. President Trump unveiled a ten% minimal tariff on most imports, with a lot greater duties on merchandise from dozens of nations

Broad Market Worth Motion:

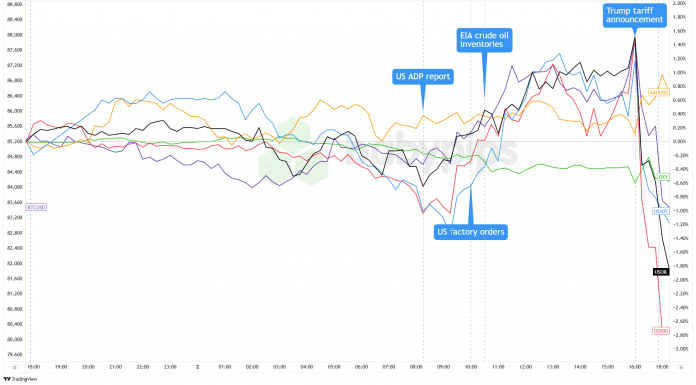

Greenback Index, Gold, S&P 500, Oil, U.S. 10-yr Yield, Bitcoin Overlay Chart by TradingView

The most important property didn’t decide to directional strikes early Wednesday as merchants braced for the anticipated U.S. “Liberation Day” tariffs. Shares managed to shake off early jitters and closed greater, however futures tanked after Trump’s speech. Tech took the most important hit given its deep ties to Asian manufacturing. Over in Europe, markets slipped as traders stayed cautious.

Listed below are key factors from Trump’s tariff announcement:

- Baseline 10% tariff on all imports to the U.S.

- China hit hardest with 34% tariff (whole efficient charge: 54%)

- Elimination of de minimis exemption for low-value shipments from China

- Manufacturing hubs in Taiwan dealing with tariffs above 30%

- No point out of serious tariffs on Canadian and Mexican items

- Mexican President said they might not impose retaliatory tariffs

- Tariffs described as a “cap” that nations may scale back by means of negotiations

In response, gold surged to a report excessive of $3,140 as traders sought security. WTI crude oil costs jumped to $72.20 regardless of a shock 6.2 million barrel construct in U.S. inventories, however later pulled again to round $70.65 as demand worries crept in.

10-year Treasury yields fell sharply following sturdy ADP employment knowledge (155K vs 105K anticipated) and manufacturing facility orders, however reversed to 4.13% on tariff fears. Bitcoin demonstrated relative stability, buying and selling within the $83,000-$85,000 vary, whereas Asia-focused ETFs noticed important outflows.

FX Market Habits: U.S. Greenback vs. Majors:

Overlay of USD vs. Main Currencies Chart by TradingView

The greenback had a blended begin to the day, slipping in opposition to the Aussie and Kiwi after Tuesday’s upbeat Chinese language manufacturing knowledge gave danger urge for food a carry. That development held by means of the European session, with the dollar broadly regular however nonetheless shedding floor to the yen and antipodean currencies as merchants stayed cautious forward of Trump’s large tariff reveal.

Within the U.S., stronger-than-expected knowledge gave the greenback a brief carry. ADP employment got here in at 155K vs 105K anticipated, pushing yields greater and boosting the greenback. Manufacturing unit orders additionally shocked to the upside, however USD/JPY stayed caught beneath 149 as demand for secure havens held agency.

Issues bought risky heading into Trump’s speech, and USD strikes turned erratic within the ultimate hour of buying and selling. As soon as the tariffs have been introduced – and turned out to be more durable than anticipated, particularly the 34% hit on China – the greenback spiked, then shortly reversed decrease in opposition to conventional secure havens.

In the meantime, the greenback concurrently strengthened in opposition to rising market currencies uncovered to commerce disruption, highlighting the advanced market response to what one analyst known as “the very best US tariff ranges in over a century.”

Upcoming Potential Catalysts on the Financial Calendar:

- Switzerland CPI at 6:30 am GMT

- French ultimate providers PMI at 7:50 am GMT

- German ultimate providers PMI at 7:55 am GMT

- Euro Space ultimate providers PMI at 8:00 am GMT

- SNB member Tschudin to present a speech at 8:30 am GMT

- U.Ok. ultimate providers PMI at 8:30 am GMT

- Euro Space PPI at 9:00 am GMT

- ECB assembly minutes at 11:30 am GMT

- U.S. Challenger job cuts at 11:30 am GMT

- Canada commerce stability at 12:30 pm GMT

- U.S. preliminary jobless claims at 12:30 pm GMT

- U.S. commerce stability at 12:30 pm GMT

- U.S. ultimate providers PMI at 1:45 pm GMT

- U.S. ISM providers PMI at 2:00 pm GMT

- FOMC Member Jefferson to present a speech at 4:30 pm GMT

- FOMC Member Cook dinner to present a speech at 6:00 pm GMT

- Japan family spending at 11:30 pm GMT

The European session kicks off with Swiss CPI and a wave of ultimate PMIs from France, Germany, and the Eurozone, whereas ECB minutes and a speech from SNB’s Tschudin may stir motion in EUR and CHF pairs.

Over within the US, jobless claims, commerce knowledge, and the ISM providers PMI headline a packed schedule, with Fed audio system Jefferson and Cook dinner lined as much as doubtlessly shake charge expectations. In the meantime, markets are treading rigorously after Trump floated new tariffs, elevating recent issues about commerce tensions and inflation dangers.

Don’t overlook to take a look at our model new Foreign exchange Correlation Calculator when taking any trades!